| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Pressure Sensor Market Size 2024 |

USD 5,706.93 Million |

| U.S. Pressure Sensor Market, CAGR |

4.41% |

| U.S. Pressure Sensor Market Size 2032 |

USD 8,062.14 Million |

Market Overview

The U.S. Pressure Sensor Market is projected to grow from USD 5,706.93 million in 2024 to an estimated USD 8,062.14 million by 2032, with a compound annual growth rate (CAGR) of 4.41% from 2025 to 2032. This growth is driven by the increasing demand for pressure sensors across various industries, including automotive, healthcare, oil & gas, and manufacturing.

Key drivers of the U.S. Pressure Sensor Market include the growing need for efficient monitoring and control systems, the rising adoption of industrial automation, and the increasing implementation of pressure sensors in automotive safety systems and healthcare applications. Trends such as miniaturization, the integration of sensors with IoT devices, and innovations in wireless sensor technologies are contributing to the market’s growth. The increasing emphasis on energy efficiency and environmental sustainability is also driving the demand for pressure sensors in various sectors.

Geographically, the U.S. dominates the North American Pressure Sensor Market, with a strong presence of key players across multiple industries. The market is highly competitive, with major companies such as Honeywell International Inc., Emerson Electric Co., and Bosch Sensortec leading the way. These companies continue to focus on innovation, product development, and strategic partnerships to maintain their market leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Pressure Sensor Market is projected to grow from USD 5,706.93 million in 2024 to USD 8,062.14 million by 2032, with a CAGR of 4.41% from 2025 to 2032.

- Increasing industrial automation, demand for efficient monitoring systems, and the adoption of pressure sensors in automotive safety and healthcare are major market drivers.

- Innovations such as miniaturization, IoT integration, and wireless sensor technologies are fueling market expansion across various industries.

- High production costs for advanced sensors and integration complexities with existing systems pose challenges to market growth.

- Pressure sensors are increasingly used in automotive applications, including tire pressure monitoring and battery management, particularly in electric and autonomous vehicles.

- The rising adoption of wearable medical devices and remote monitoring systems is driving the demand for pressure sensors in healthcare applications.

- California, Texas, and Michigan are key regions in the U.S., driven by strong automotive, energy, and industrial sectors. California leads with 25% market share due to technological advancements.

Market Drivers

Growth in Healthcare and Medical Applications

Another important driver of the U.S. pressure sensor market is the increasing adoption of pressure sensors in healthcare and medical devices. Pressure measurement plays a crucial role in several medical applications, including respiratory devices, dialysis machines, blood pressure monitoring, and infusion pumps. These sensors provide accurate data to monitor the physiological conditions of patients, ensure the proper functioning of medical devices, and support timely medical interventions. The growing prevalence of chronic diseases, the aging population, and the increasing need for home healthcare are major factors driving the demand for pressure sensors in medical equipment. Additionally, with the advent of wearable medical devices and continuous health monitoring systems, the need for miniaturized, high-precision pressure sensors has intensified. These sensors help provide real-time monitoring of blood pressure, oxygen levels, and other critical health metrics, enhancing the quality of patient care and improving outcomes.

Growing Demand for Energy Efficiency and Environmental Sustainability

The need for energy efficiency and environmental sustainability is another significant driver of the U.S. pressure sensor market. As industries, municipalities, and consumers become more conscious of energy consumption and its impact on the environment, there is a growing emphasis on implementing energy-efficient technologies. Pressure sensors play a vital role in energy-efficient applications by optimizing the performance of heating, ventilation, and air conditioning (HVAC) systems, industrial boilers, and pumps. In the energy sector, pressure sensors are used to monitor the pressure levels of natural gas pipelines, which ensures proper operation and reduces the risk of leaks and accidents. Additionally, pressure sensors in renewable energy systems, such as solar power plants and wind turbines, help monitor system pressures and enable proactive maintenance to improve energy output. In the oil and gas industry, pressure sensors are used for accurate monitoring of pressure in pipelines, production rigs, and other critical infrastructure to prevent equipment failures, optimize resource extraction, and improve operational efficiency, all of which contribute to more sustainable practices.

Increased Demand for Industrial Automation and Control Systems

The U.S. pressure sensor market is experiencing significant growth due to the rising demand for industrial automation and process control systems. Industries across sectors such as manufacturing, automotive, oil & gas, and chemical processing are increasingly relying on automated solutions to enhance operational efficiency and minimize human error. Pressure sensors play a critical role in ensuring accurate measurement and monitoring of pressure within automated systems, contributing to precise control over machinery and processes. As industries continue to adopt automated technologies for their production lines and machinery, the demand for pressure sensors will grow steadily. For instance, in manufacturing plants that rely on compressed air systems, pressure sensors monitor air pressure to ensure consistent performance and energy efficiency. If the pressure falls outside a preset range, the sensor triggers an alarm or activates corrective actions such as adjusting the compressor speed or diverting air to maintain stability. This real-time monitoring and control are crucial for maintaining operational efficiency and safety in automated systems. Additionally, the integration of pressure sensors with smart technologies, such as the Internet of Things (IoT) and Industry 4.0, is expected to further drive the market. These sensors enable real-time monitoring and data analytics, facilitating proactive decision-making, predictive maintenance, and system optimization, all of which are essential for modern industrial operations.

Rising Adoption of Pressure Sensors in the Automotive Sector

The automotive industry has been a key driver of the U.S. pressure sensor market, with a growing demand for these devices in various vehicle applications. As vehicle technology becomes more advanced, pressure sensors are being increasingly utilized in areas such as tire pressure monitoring systems (TPMS), engine management systems, brake systems, and HVAC systems. The rising focus on vehicle safety, fuel efficiency, and environmental regulations is pushing automakers to adopt more sophisticated pressure sensing technologies. For instance, in safety-critical applications like airbags, brake systems, and fuel delivery systems, accurate pressure measurement is vital to ensuring proper system functionality and vehicle safety. The widespread implementation of electric vehicles (EVs) and hybrid vehicles also calls for specialized pressure sensors to manage battery pressure, fluid systems, and other components, further boosting the market for pressure sensors in the automotive sector. For instance, in the automotive sector, pressure sensors are being increasingly utilized in various applications such as tire pressure monitoring systems (TPMS), engine management systems, brake systems, and HVAC systems. These sensors play a crucial role in ensuring vehicle safety, fuel efficiency, and compliance with environmental regulations. Additionally, the adoption of pressure sensors in electric and hybrid vehicles for managing battery pressure and fluid systems further contributes to market growth.

Market Trends

Growing Demand for Pressure Sensors in Healthcare and Medical Devices

The healthcare sector has become an important driver of growth in the U.S. pressure sensor market, with increasing demand for pressure sensors in medical devices and healthcare applications. Pressure sensors are essential in a wide range of medical equipment, including blood pressure monitors, respiratory devices, dialysis machines, infusion pumps, and ventilators. They are used to accurately monitor pressure in blood vessels, airways, and fluid systems, enabling medical professionals to provide better patient care.In particular, the use of pressure sensors in wearable medical devices is gaining momentum. With the increasing focus on personalized healthcare and remote patient monitoring, wearable devices that track blood pressure, oxygen levels, and other critical health metrics are becoming more common. These devices rely on miniaturized pressure sensors that can deliver real-time data to healthcare providers, allowing for more effective treatment plans and interventions. The growing trend of telemedicine and remote healthcare monitoring, especially in the wake of the COVID-19 pandemic, is also contributing to the demand for advanced pressure sensors in medical applications. As the aging population and prevalence of chronic diseases continue to rise, the healthcare industry’s need for precise and reliable pressure sensors will remain a key trend in the U.S. market.

Adoption of Pressure Sensors in Renewable Energy Systems

With the global emphasis on sustainability and reducing carbon emissions, the U.S. pressure sensor market is witnessing increased adoption in renewable energy systems. Pressure sensors play a vital role in monitoring and optimizing the performance of various renewable energy technologies, including wind turbines, solar power plants, and geothermal systems. In wind energy, pressure sensors are used to monitor the pressure within hydraulic systems that control the pitch and yaw of turbine blades, ensuring optimal energy production and preventing equipment failures. Similarly, in solar power plants, pressure sensors are used to monitor the performance of cooling systems and ensure the safe operation of solar panels and other infrastructure.In geothermal energy systems, pressure sensors are crucial for monitoring the pressure within the wells and fluid systems, ensuring that the system operates efficiently and safely. As the renewable energy sector continues to expand in the U.S., pressure sensors are becoming more sophisticated, with advancements in sensor technology improving their accuracy, reliability, and durability in harsh environmental conditions. This trend is expected to grow as the renewable energy sector gains momentum and more investments are made in clean energy infrastructure. The push for energy efficiency and environmental sustainability is thus driving the demand for pressure sensors in renewable energy applications, solidifying their role in the future of energy production.

Miniaturization and Integration with IoT and Smart Technologies

The U.S. pressure sensor market is experiencing a significant trend towards miniaturization and integration with IoT and smart technologies. This shift is driven by the need for space-saving solutions across various industries, including automotive, medical devices, and industrial automation. Miniaturized pressure sensors offer high performance in compact sizes, making them ideal for consumer electronics and wearable devices. For instance, in the automotive industry, miniaturized wireless sensors with an edge length of 6 mm are being developed for tire pressure monitoring systems, allowing for efficient solutions that reduce out-of-balance forces and mechanical stress on electronic devices. These sensors can be integrated into various automotive applications, such as monitoring blind angles and parking distance control systems.The integration of pressure sensors with IoT systems is revolutionizing data collection, transmission, and analysis. IoT-enabled pressure sensors with wireless capabilities are gaining popularity, enabling seamless integration into remote monitoring systems and smart devices. These sensors transmit real-time data to cloud platforms, where advanced analytics and machine learning algorithms provide insights to improve operational efficiency, reduce downtime, and predict maintenance needs. This trend is expected to accelerate as industries move towards automation and real-time data becomes critical for decision-making processes.

Increased Use of Pressure Sensors in Electric Vehicles (EVs) and Autonomous Vehicles

The U.S. pressure sensor market is witnessing a rising adoption of pressure sensors in electric vehicles (EVs) and autonomous vehicles. As the automotive industry undergoes a major transformation with growing demand for EVs and investments in autonomous vehicle technologies, pressure sensors are becoming crucial for various applications. These include battery pressure monitoring, hydraulic systems, tire pressure monitoring systems (TPMS), and brake system optimization. In EVs, pressure sensors are critical for monitoring battery system pressure to ensure safe operation and prevent damage. Similarly, in autonomous vehicles, pressure sensors are essential for systems like braking, suspension, and lane-keeping assistance, ensuring optimal performance and safety.For instance, ceramic pressure sensors play a crucial role in Anti-lock Braking Systems (ABS) of electric vehicles, offering high accuracy, durability, and resistance to harsh conditions. These sensors measure hydraulic pressure within brake lines, allowing the ABS system to adjust pressure rapidly and prevent wheel lock-up. Additionally, pressure sensors are being used in EV cooling systems to provide feedback for regulation and optimization, as well as to detect pressure changes in complex fluid systems. As the electric and autonomous vehicle market continues to grow, pressure sensors are becoming more advanced, with innovations such as wireless sensors and smart sensors that integrate seamlessly into vehicle control systems.

Market Challenges

Integration Complexities and Compatibility Issues

Another significant challenge is the integration complexity of pressure sensors into existing systems, particularly in industries like automotive, healthcare, and industrial automation. As more industries adopt smart, IoT-enabled systems, ensuring the seamless integration of pressure sensors with these systems becomes more complex. Compatibility issues may arise due to the wide range of communication protocols, power requirements, and data processing methods used in different devices and networks. Additionally, older infrastructure and legacy systems may not be equipped to support the advanced sensor technologies that are increasingly in demand, creating barriers to their adoption. The need for continuous system upgrades, employee training, and potential operational disruptions during the integration process can delay the widespread adoption of new pressure sensing solutions. These integration challenges can also increase the total cost of ownership and create hurdles for companies seeking to implement pressure sensors on a large scale.

High Cost of Advanced Pressure Sensors: A Market Challenge

One of the primary challenges facing the U.S. pressure sensor market is the high cost associated with advanced pressure sensor technologies. While pressure sensors are integral in industries such as automotive, healthcare, and industrial automation, the development and manufacturing of highly accurate, reliable, and miniaturized sensors often require advanced materials, intricate designs, and sophisticated production processes. These factors contribute to the elevated cost of sensors, especially in high-performance applications.For instance, in the automotive sector, pressure sensors used in advanced driver-assistance systems (ADAS) and electric vehicle battery management systems require high precision and sophisticated materials, driving up production costs. Similarly, in the healthcare industry, pressure sensors utilized in critical medical devices like ventilators and infusion pumps demand stringent quality control and specialized manufacturing processes, contributing to their elevated prices. In industrial automation, pressure sensors designed for harsh environments or extreme conditions necessitate advanced packaging and materials, further increasing their cost.For industries operating on tight budgets or in price-sensitive markets, the cost of implementing advanced pressure sensor systems can be prohibitive, limiting adoption, particularly in small and medium-sized enterprises (SMEs). Additionally, the need for continuous innovation and adherence to stringent quality standards increases R&D expenses, further driving up the overall cost. This challenge is exacerbated by the pressure to balance sensor quality with affordability, making it a critical issue for market players striving to capture larger market shares while maintaining competitiveness.

Market Opportunities

Expansion in the Electric Vehicle (EV) and Autonomous Vehicle Sectors

The growing adoption of electric vehicles (EVs) and autonomous vehicles presents a significant market opportunity for pressure sensors in the U.S. automotive industry. As the demand for EVs continues to rise, pressure sensors play a crucial role in ensuring the safe operation of critical systems such as battery pressure monitoring, tire pressure monitoring, and hydraulic systems. Additionally, with autonomous vehicles requiring advanced sensor technologies for various applications like braking systems, suspension systems, and safety features, there is an increasing demand for precise and reliable pressure sensors. This evolving automotive landscape provides an opportunity for manufacturers to innovate and develop new pressure sensor solutions tailored for electric and self-driving vehicles, driving growth in this market segment.

Increasing Adoption of Pressure Sensors in Healthcare and Medical Devices

The healthcare industry represents another significant opportunity for the U.S. pressure sensor market. With the growing demand for wearable medical devices, remote monitoring systems, and home healthcare solutions, pressure sensors are becoming essential in a wide range of medical applications. These include blood pressure monitoring, infusion pumps, and ventilators, where accurate pressure measurement is critical for patient care. The increasing prevalence of chronic diseases and the aging population in the U.S. are further amplifying the need for advanced medical devices. This shift toward personalized healthcare and telemedicine offers a substantial opportunity for pressure sensor manufacturers to expand their presence in the healthcare sector by providing miniaturized, high-precision sensors that can seamlessly integrate into wearable and home-based medical devices.

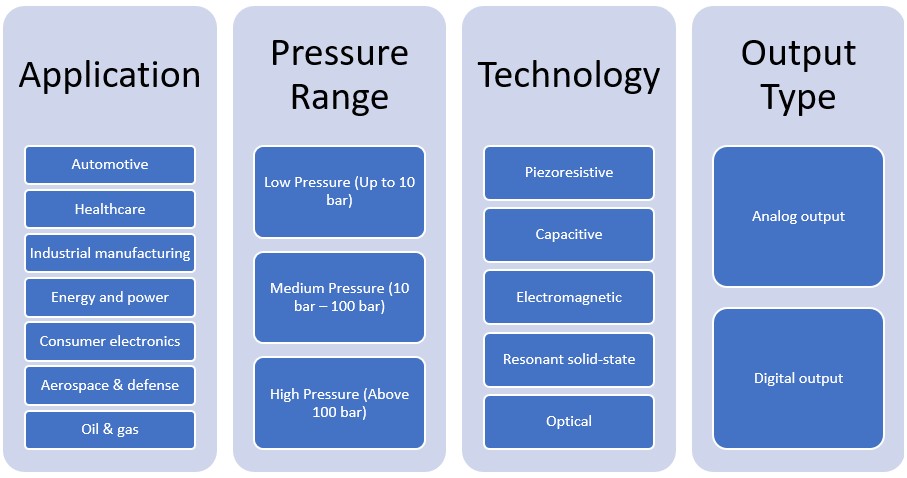

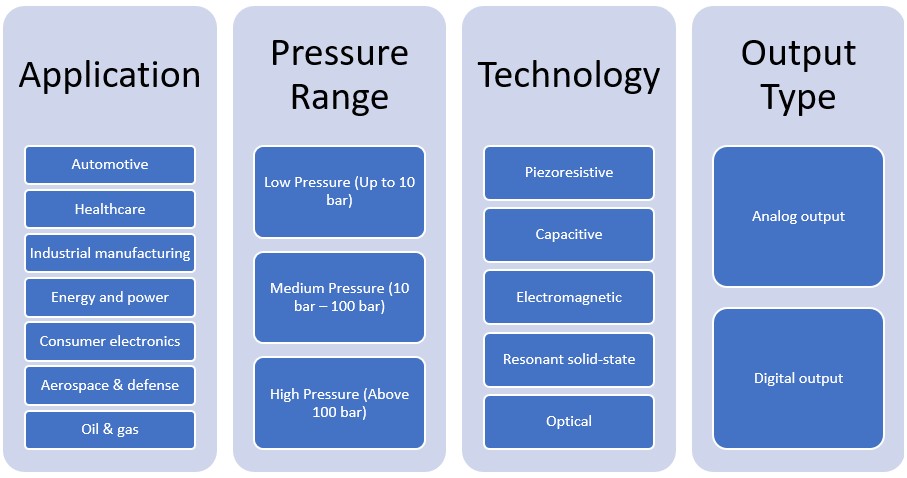

Market Segmentation Analysis

By Application

The U.S. pressure sensor market spans several industries, with key segments including automotive, healthcare, industrial manufacturing, energy and power, consumer electronics, aerospace & defense, and oil & gas. The automotive sector is a major driver, with pressure sensors utilized in tire pressure monitoring systems (TPMS), brake systems, and battery management in electric vehicles. The healthcare sector also represents significant growth potential due to the increasing use of pressure sensors in medical devices such as blood pressure monitors, ventilators, and infusion pumps. Industrial manufacturing continues to grow with the need for precise pressure control in manufacturing equipment, HVAC systems, and automated processes. The energy and power sector, especially in oil & gas, utilizes pressure sensors in monitoring pipeline pressure, hydraulic systems, and drilling operations. The consumer electronics segment is seeing increased demand for miniaturized pressure sensors in wearables and portable devices, while the aerospace & defense sector requires highly reliable pressure sensors for critical applications like flight control and engine monitoring.

By Pressure Range

Pressure sensors in the U.S. market are categorized into three ranges: low pressure (up to 10 bar), medium pressure (10 bar – 100 bar), and high pressure (above 100 bar). Low-pressure sensors are widely used in medical devices and HVAC systems, while medium-pressure sensors are prominent in industrial automation, automotive applications, and manufacturing processes. High-pressure sensors are typically used in oil & gas, aerospace, and energy sectors, where extreme pressure conditions need to be monitored for safety and efficiency.

Segments

Based on Application

- Automotive

- Healthcare

- Industrial manufacturing

- Energy and power

- Consumer electronics

- Aerospace & defenseOil & gas

Based on pressure Range

- Low Pressure (Up to 10 bar)

- Medium Pressure (10 bar – 100 bar)

- High Pressure (Above 100 bar)

Based on Technology

- Piezoresistive

- Capacitivem

- Electromagnetic

- Resonant solid-state

- Optical

Based on Output Type

- Analog output

- Digital output

Based on Region

- Michigan

- Texas

- California

Regional Analysis

California (25%)

California is a major contributor to the U.S. Pressure Sensor Market, accounting for approximately 25% of the market share. This is primarily driven by the state’s leadership in the technology sector, including the automotive, aerospace, and semiconductor industries. Silicon Valley’s focus on technological innovation boosts the demand for advanced pressure sensors used in automotive systems, IoT applications, and aerospace technologies. The growing electric vehicle (EV) market and emphasis on autonomous driving further enhance the demand for pressure sensors in California.

Texas (20%)

Texas holds about 20% of the market share, primarily due to its significant role in the energy sector, particularly oil and gas. The state’s extensive exploration, drilling, and energy production activities heavily rely on high-precision pressure sensors for pipeline monitoring, hydraulic systems, and safety applications. Additionally, Texas’ industrial manufacturing sector, especially in petrochemical processing, further drives the demand for pressure sensors in various applications such as HVAC systems, machinery, and automation.

Key players

- Emerson Electric Co.

- Texas Instruments Inc.

- Druck

- Micro Sensor Corp.

- Bosch Sensortec

Competitive Analysis

The U.S. pressure sensor market is highly competitive, with key players such as Emerson Electric Co., Texas Instruments Inc., Druck, Micro Sensor Corp., and Bosch Sensortec leading the industry. These companies maintain a strong presence through advanced technology, extensive product portfolios, and robust business strategies. Emerson Electric Co. stands out with its wide range of pressure sensors and innovative solutions tailored to industries like manufacturing and energy. Texas Instruments focuses on precision sensors, offering high-performance solutions for automotive and industrial applications. Druck, a subsidiary of Baker Hughes, specializes in high-accuracy sensors for aerospace and industrial markets, while Micro Sensor Corp. and Bosch Sensortec are known for their miniaturized and IoT-enabled pressure sensors, catering to automotive, healthcare, and consumer electronics sectors. The market is driven by these companies’ investments in R&D, strategic partnerships, and an emphasis on product innovation to capture growing demand across various industrial applications.

Recent Developments

- In March 2025, Honeywell International Inc launched the TruStability NSC Series pressure sensors, offering uncompensated and unamplified options for customers to perform their own calibration while benefiting from industry-leading stability, accuracy, and repeatability.

- In August 2024, Bosch Sensortec introduced the BMP581 barometric pressure sensor, utilizing capacitive technology instead of piezoresistive, resulting in 85% lower current consumption (1.3 µA), 80% reduced noise (0.08 Pa), and 33% improved temperature coefficient offset (± 0.5 Pa/K).

- In July 2024, Analog Devices Inc. released the MAX40109 low-power precision sensor interface SoC for pressure sensor applications, featuring a high-precision programmable analog front-end and digital signal processing capabilities.

- In November 2023, IFM Electronic released a series of wireless pressure sensors designed specifically for remote monitoring in oil and gas applications.

Market Concentration and Characteristics

The U.S. Pressure Sensor Market exhibits moderate market concentration, with a mix of large multinational corporations and specialized companies driving competition. Major players like Emerson Electric Co., Texas Instruments Inc., Druck, Micro Sensor Corp., and Bosch Sensortec dominate the market with their extensive product portfolios, technological expertise, and global presence. While these companies capture a significant share of the market through innovation, strategic partnerships, and acquisitions, the market also features smaller players focusing on niche applications and customized solutions, particularly in emerging sectors like healthcare, automotive, and renewable energy. The market is characterized by rapid technological advancements, including the integration of sensors with IoT, miniaturization, and increasing demand for wireless solutions. As industries seek more precise, reliable, and energy-efficient solutions, market players are increasingly emphasizing R&D to offer advanced, high-performance pressure sensors for diverse applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Pressure Range, Technology, Output Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for pressure sensors in automotive applications will continue to rise, driven by advancements in electric vehicles and autonomous driving technologies. These sensors will be integral for systems like tire pressure monitoring, brake systems, and battery management.

- With increasing reliance on wearable medical devices and home healthcare, pressure sensors will play a critical role in monitoring vital signs such as blood pressure and respiratory conditions. The aging population and rising chronic diseases will drive this demand.

- The integration of pressure sensors with IoT systems will grow as industries adopt smart devices for real-time monitoring and predictive maintenance. This trend will enhance operational efficiency across sectors such as manufacturing and energy.

- The trend toward miniaturization will continue, with smaller and more efficient sensors becoming essential for applications in consumer electronics, wearables, and healthcare devices. These compact sensors will offer greater functionality while saving space.

- As manufacturing industries increasingly adopt automation, the demand for pressure sensors will expand. These sensors will play a key role in process control, machine monitoring, and ensuring safety in automated systems.

- With the push for sustainable energy, pressure sensors will be critical in monitoring systems like wind turbines, solar power plants, and geothermal energy facilities. Their role in optimizing energy efficiency will increase.

- The aerospace and defense sectors will continue to drive the need for high-precision pressure sensors for flight control, engine monitoring, and safety systems. These sectors require sensors that can operate in extreme conditions.

- Technological innovations, including optical and resonant solid-state sensors, will enhance the capabilities of pressure sensors, offering greater accuracy, durability, and resistance to harsh environments.

- The growing emphasis on energy-efficient systems across industries will fuel the demand for pressure sensors, which are key to optimizing HVAC systems, hydraulic systems, and energy production processes.

- As regulatory frameworks for safety and environmental standards evolve, pressure sensors will become integral in meeting compliance requirements. This will particularly impact industries like oil & gas, automotive, and healthcare, where sensor accuracy and reliability are critical.