Market Overview:

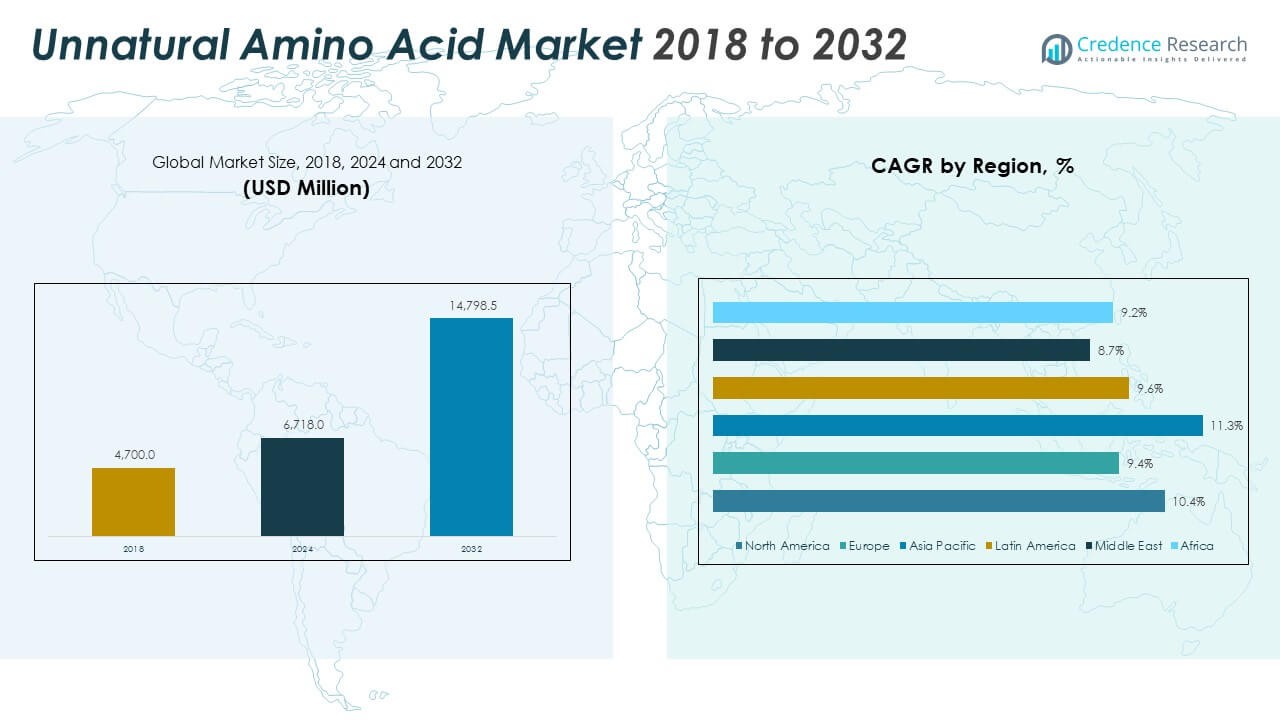

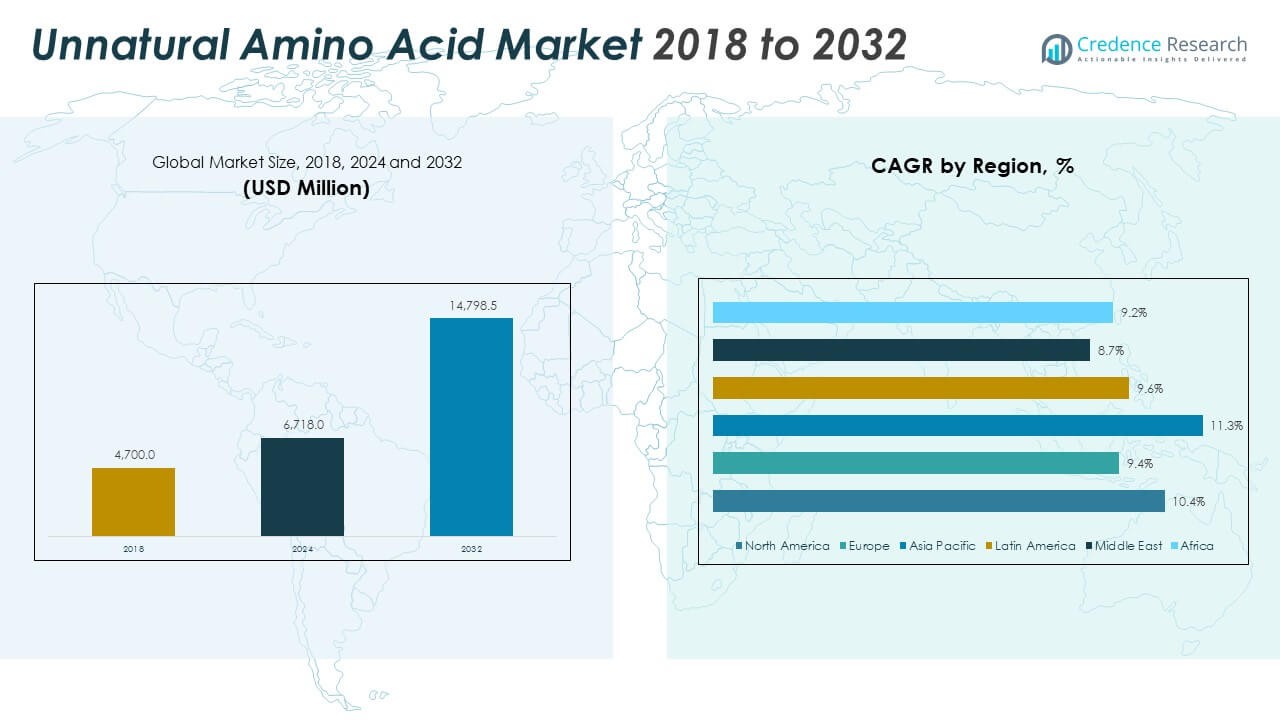

The Global Unnatural Amino Acid Market size was valued at USD 4,700.0 million in 2018 to USD 6,718.0 million in 2024 and is anticipated to reach USD 14,798.5 million by 2032, at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Unnatural Amino Acid Market Size 2024 |

USD 6,718.0 Million |

| Unnatural Amino Acid Market, CAGR |

10.5% |

| Unnatural Amino Acid Market Size 2032 |

USD 14,798.5 Million |

The market is driven by the rising adoption of unnatural amino acids in drug discovery, protein engineering, and therapeutic development. Increasing demand for precision medicines, coupled with advancements in biotechnology and genetic engineering, is strengthening growth. Expanding applications in diagnostic tools, enzyme design, and novel protein synthesis are further fueling market expansion. Additionally, rising R&D investments from pharmaceutical companies and academic institutions are supporting innovation in this field.

Geographically, North America leads due to strong biotechnology infrastructure, robust research funding, and extensive pharmaceutical activities. Europe follows with significant contributions from academic research and industrial adoption of advanced protein engineering. Asia-Pacific is emerging as a key growth hub, driven by expanding pharmaceutical manufacturing, increasing healthcare investments, and rising interest in synthetic biology. Countries such as China, India, and Japan are particularly advancing the adoption of unnatural amino acids to strengthen regional competitiveness in life sciences and biotechnology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Unnatural Amino Acid Market was valued at USD 4,700.0 million in 2018, grew to USD 6,718.0 million in 2024, and is projected to reach USD 14,798.5 million by 2032, expanding at a CAGR of 10.5%.

- Asia Pacific held the largest share at 39.4% in 2024, driven by strong pharmaceutical manufacturing and government investments, followed by North America at 29.2% with advanced research infrastructure, and Europe at 18.5% supported by regulatory alignment and biotechnology leadership.

- Asia Pacific emerged as the fastest-growing region with its share supported by rising healthcare expenditure, expanding biotech clusters, and favorable cost advantages.

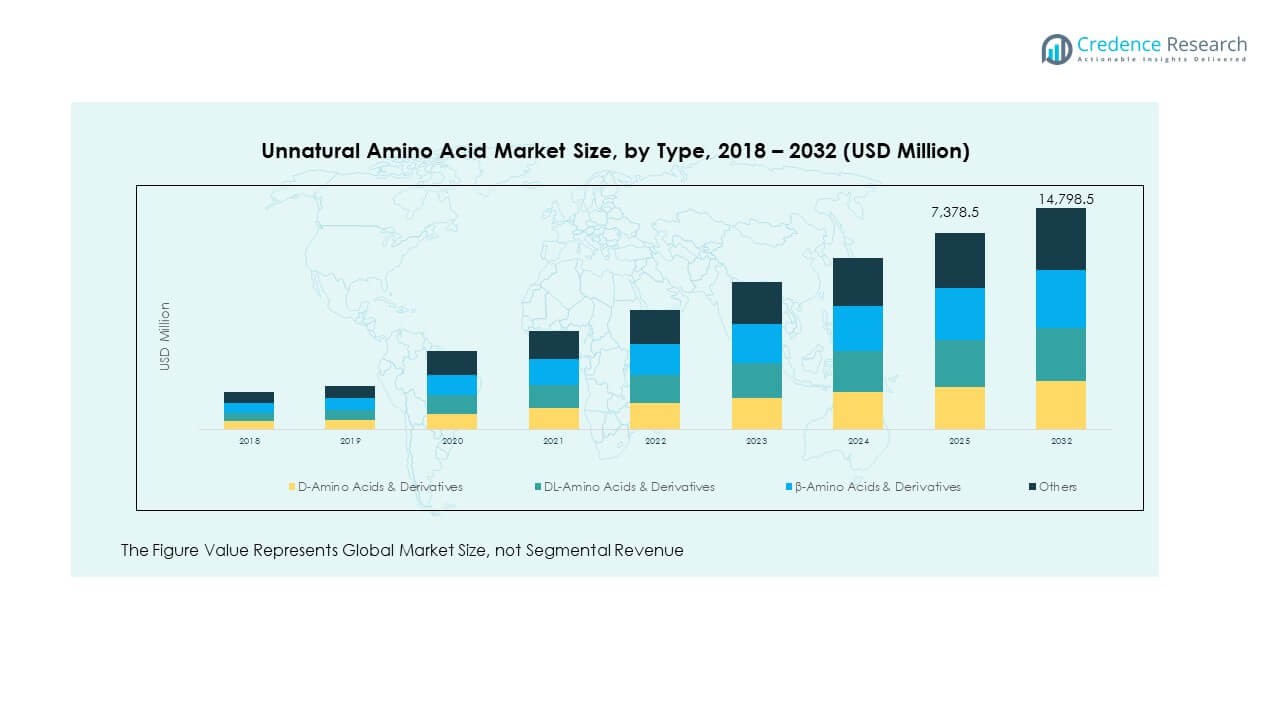

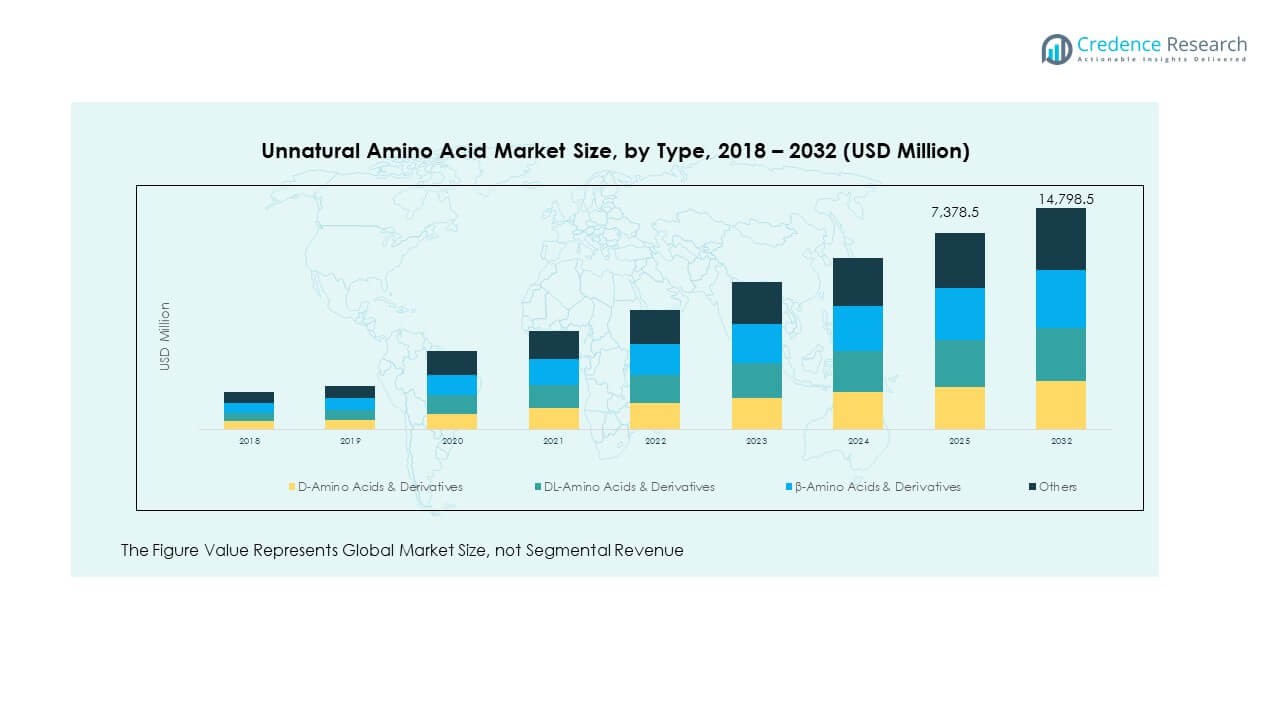

- D-Amino Acids & Derivatives accounted for the largest segment share at 34.5% in 2024, reflecting their critical role in therapeutic applications.

- DL-Amino Acids & Derivatives followed with 27.3% share, supported by their broad application in biochemical research and enzyme modification.

Market Drivers:

Expanding Role of Unnatural Amino Acids in Drug Development

The Global Unnatural Amino Acid Market is driven by the growing adoption of these compounds in advanced drug development. Pharmaceutical companies are focusing on creating therapies with higher precision and fewer side effects. It supports the design of molecules that cannot be synthesized with traditional amino acids. Enhanced stability and binding properties offered by unnatural amino acids increase their use in next-generation biologics. Rising investments from biotechnology firms further strengthen their adoption in research. Increasing emphasis on protein engineering expands the demand across therapeutic pipelines. Academic collaborations with pharmaceutical manufacturers accelerate the commercialization of novel solutions. These factors together make drug development a primary driver of market growth.

- For instance, Ambrx Biopharma has developed an expanded genetic code technology that incorporates unnatural amino acids into proteins, leading to antibody-drug conjugates (ADCs) with controlled drug-to-antibody ratios. Its lead candidate ARX788, designed using this platform, demonstrated a median progression-free survival of 11.3 months in HER2-positive breast cancer patients during Phase 2 trials.

Growing Importance of Protein Engineering and Synthetic Biology

Protein engineering is emerging as a strong growth driver for the Global Unnatural Amino Acid Market. Unnatural amino acids provide structural diversity and functionality that natural ones cannot achieve. It enables scientists to design proteins with unique catalytic abilities and improved performance. This expands their role in enzyme design, biocatalysis, and industrial biotechnology. Synthetic biology research is using these molecules to create novel biological pathways. The demand for tailored proteins in diagnostics and industrial processes is increasing steadily. Biotechnology firms and academic institutions are allocating more resources to accelerate breakthroughs. This momentum ensures that protein engineering remains a critical driver for market expansion.

Rising Demand for Personalized and Precision Medicine

The Global Unnatural Amino Acid Market benefits from the shift toward personalized and precision medicine. Physicians and researchers are seeking targeted therapies that match individual genetic profiles. It creates opportunities to integrate unnatural amino acids into therapeutic designs. These compounds improve the selectivity and activity of engineered drugs. Pharmaceutical companies are expanding clinical research to leverage this advantage. The focus on reducing adverse effects drives investment in custom-designed proteins. Hospitals and specialty clinics are adopting advanced therapeutics at a rapid pace. Personalized medicine, supported by unnatural amino acids, continues to be a major growth catalyst.

- For instance, Sutro Biopharma uses its proprietary cell-free protein synthesis platform, XpressCF+, which incorporates non-natural amino acids into drug candidates. Its personalized oncology therapeutic, STRO-002, demonstrated an objective response rate of 37% in patients with ovarian cancer in Phase 1 trials, underscoring the clinical potential of site-specific protein engineering.

Increased Research Investments and Industrial Applications

Research institutions and private players are steadily increasing their funding for unnatural amino acid innovations, strengthening the Global Unnatural Amino Acid Market. These investments accelerate discovery in healthcare, diagnostics, and biopharmaceutical production. It also expands into industrial applications such as specialty chemicals and food biotechnology. The flexibility of unnatural amino acids makes them valuable for designing advanced enzymes. Governments across regions are funding biotechnology programs that incorporate these compounds. Partnerships between industry and academia further drive translational research. Demand from multiple sectors ensures a strong and diverse application base. This continuous funding creates a stable and sustainable market growth path.

Market Trends:

Expansion of Biopharmaceutical Pipelines with Novel Therapeutics

The Global Unnatural Amino Acid Market is witnessing strong momentum through the expansion of biopharmaceutical pipelines. Pharmaceutical developers are integrating these compounds into monoclonal antibodies and peptide drugs. It enhances therapeutic efficacy and provides improved pharmacokinetics. The trend reflects a shift toward therapies that combine innovation with functional stability. Rising demand for chronic disease treatments amplifies this direction. Biotechnology companies are securing patents for advanced unnatural amino acid formulations. Clinical trials are also expanding, signaling increasing adoption in regulated markets. This trend highlights how biopharma pipelines are reshaping future treatment landscapes.

Integration into Advanced Diagnostic Tools and Imaging Solutions

Diagnostics is becoming a significant growth area within the Global Unnatural Amino Acid Market. Researchers are embedding these compounds into imaging probes and biomarker detection systems. It strengthens early disease detection by offering enhanced sensitivity and specificity. Advanced diagnostic solutions are gaining acceptance in cancer and infectious disease monitoring. Hospitals are relying more on innovative imaging for timely patient outcomes. Companies are investing in creating diagnostic kits using modified amino acid markers. This trend expands their scope beyond therapeutics into preventive healthcare. The integration into diagnostic tools ensures long-term demand across medical fields.

Adoption in Sustainable Biomanufacturing and Industrial Biotechnology

Sustainable biomanufacturing is driving new opportunities within the Global Unnatural Amino Acid Market. Industrial biotechnology firms are adopting these molecules for greener enzyme production. It reduces dependency on harmful chemicals and supports eco-friendly processes. Unnatural amino acids are enabling biocatalysts with higher efficiency and durability. This expands their use in producing biofuels, specialty chemicals, and biodegradable plastics. Industries are focusing on reducing environmental footprints, and this trend aligns well. Governments are also encouraging sustainable biotechnologies through funding programs. Industrial adoption strengthens the market’s relevance outside healthcare applications.

- For instance, studies incorporating fluorinated amino acids such as 3-fluorotyrosine into ω-transaminase increased its half-life by more than two-fold compared to the natural enzyme, supporting advances in biocatalysis for pharmaceutical applications.

Emerging Role in Academic Collaborations and Cutting-Edge Research

Academic research is contributing significantly to the Global Unnatural Amino Acid Market. Universities and research institutes are exploring advanced applications in molecular biology. It provides a foundation for designing experimental models and breakthrough therapies. Joint projects between academia and industry are delivering faster innovation. Research funding is increasing, particularly in the United States, Europe, and Asia. This is fueling the development of new protein designs and bio-based solutions. Collaborative platforms are also helping to standardize research outputs for commercialization. The trend underlines how academic progress supports the long-term expansion of the market.

- For example, researchers at the Massachusetts Institute of Technology have advanced methods for protein synthesis and genetic code expansion, enabling the incorporation of unnatural amino acids into engineered proteins. Their work in synthetic biology has demonstrated reliable site-specific incorporation using orthogonal tRNA/synthetase systems, supporting applications in protein labeling and translational research.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

The Global Unnatural Amino Acid Market faces challenges due to high production costs and complex manufacturing techniques. Creating these compounds requires advanced synthesis methods that are resource-intensive. It often demands specialized equipment and highly skilled personnel. This increases the overall cost of development and restricts scalability. Smaller biotechnology firms face difficulty in competing with larger players. Limited standardization in manufacturing processes adds to the challenge. Pharmaceutical companies are cautious in adoption when costs outweigh benefits. Such barriers slow the pace of commercialization despite strong scientific interest.

Regulatory Complexity and Limited Commercialization Pathways

Regulatory approvals present another significant challenge for the Global Unnatural Amino Acid Market. Strict compliance requirements delay the introduction of new therapeutics. It restricts market entry and limits faster adoption of innovative compounds. Pharmaceutical companies must conduct extensive trials to meet safety benchmarks. Complex approval processes discourage small firms from pursuing commercialization. Limited guidelines also create uncertainty for industrial applications. Regulatory inconsistencies between regions further complicate market expansion. The lack of harmonized standards slows global product deployment. This environment makes regulatory navigation a persistent challenge for growth.

Market Opportunities:

Expansion into Industrial Biotechnology and Specialty Sectors

Opportunities for the Global Unnatural Amino Acid Market lie in expanding applications beyond healthcare. Industrial biotechnology is increasingly adopting these molecules for enzyme development. It enhances production efficiency in chemicals, biofuels, and sustainable materials. Specialty food and beverage industries are also exploring innovative uses. The versatility of unnatural amino acids ensures adaptability to non-medical sectors. Rising demand for sustainable industrial processes creates favorable conditions. This broadens the revenue base and reduces dependency on pharmaceutical demand. New opportunities are expected to strengthen long-term industry resilience.

Strong Potential in Emerging Economies with Growing R&D Investment

Emerging economies offer substantial growth opportunities for the Global Unnatural Amino Acid Market. Governments in Asia-Pacific and Latin America are investing in biotechnology infrastructure. It encourages domestic companies to innovate in drug discovery and industrial applications. Local universities are building research collaborations to strengthen scientific output. Rising healthcare expenditure also supports the adoption of advanced therapeutics. Pharmaceutical outsourcing is expanding in these regions, offering additional opportunities. The combination of cost advantages and large patient pools strengthens market appeal. These economies are expected to shape the next phase of market growth.

Market Segmentation Analysis:

By type

The Global Unnatural Amino Acid Market is segmented into D-amino acids & derivatives, DL-amino acids & derivatives, β-amino acids & derivatives, and others. D-amino acids & derivatives dominate due to their critical role in pharmaceuticals and peptide-based drugs. It provides higher structural stability and supports therapeutic innovations. DL-amino acids & derivatives contribute steadily with broad use in biochemical research and enzyme modification. β-amino acids & derivatives gain traction in specialty applications, particularly in advanced polymers and drug design. The others category, including rare variants, finds niche demand in academic research and specialty chemicals.

- For example, a study incorporated diverse non-canonical amino acids (DL-variants) at 13 different positions within the active site of the enzyme N-acetylneuraminate lyase (NAL), resulting in modified enzymes capable of processing new substrates.

By application

The market is divided into liver disease, inflammatory disease, and others such as genetic disease and cancer. The liver disease segment accounts for a significant share owing to strong adoption of amino acid therapies in managing hepatic conditions. Inflammatory disease applications are expanding, supported by research into targeted treatments. The others segment shows high potential, with cancer and genetic disorders emerging as promising growth areas. It continues to attract investment from pharmaceutical and biotechnology companies.

- For example, nonproteinic aminobutyric acids, identified in human samples, are explored as clinical biomarkers for diseases such as osteoporosis and colorectal cancer, with chiral techniques providing high diagnostic sensitivity.

By end-use

The market is segmented into pharmaceutical and others including biotechnological companies, research laboratories, and academic institutes. The pharmaceutical sector dominates due to consistent demand for novel therapeutics and protein engineering. It remains the primary driver for commercialization and large-scale applications. The others segment supports growth through early-stage research, experimental applications, and industrial biotechnology initiatives. Together, these segments highlight the market’s balanced demand from both commercial and research-driven stakeholders.

Segmentation:

By Type

- D-Amino Acids & Derivatives

- DL-Amino Acids & Derivatives

- β-Amino Acids & Derivatives

- Others

By Application

- Liver Disease

- Inflammatory Disease

- Others (Genetic Disease, Cancer, and Others)

By End-Use

- Pharmaceutical

- Others (Biotechnological Companies, Research Laboratories, and Academic Institutes)

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Unnatural Amino Acid Market size was valued at USD 1,393.6 million in 2018 to USD 1,962.3 million in 2024 and is anticipated to reach USD 4,304.4 million by 2032, at a CAGR of 10.4% during the forecast period. North America accounted for 29.2% market share in 2024. Strong biotechnology infrastructure and advanced pharmaceutical research anchor its leadership. It benefits from significant R&D funding and robust clinical trial networks. Pharmaceutical companies in the U.S. dominate adoption through drug discovery and precision medicine. Universities and research institutes also support market expansion with high innovation levels. It shows consistent growth through collaborations between industry and academia. North America’s regulatory framework, though complex, ensures reliable commercialization pathways.

Europe

The Europe Global Unnatural Amino Acid Market size was valued at USD 915.1 million in 2018 to USD 1,239.3 million in 2024 and is anticipated to reach USD 2,519.8 million by 2032, at a CAGR of 9.4% during the forecast period. Europe represented 18.5% market share in 2024. Strong contributions from Germany, France, and the UK drive the region’s performance. It benefits from unified regulatory frameworks and advanced healthcare adoption. Pharmaceutical industries in Europe are adopting amino acid technologies to expand biologics portfolios. Academic institutions and biotech startups add strength to the market ecosystem. It faces competitive growth due to high demand in therapeutic and diagnostic innovations. Europe’s emphasis on sustainable biotechnology practices also drives adoption.

Asia Pacific

The Asia Pacific Global Unnatural Amino Acid Market size was valued at USD 1,802.9 million in 2018 to USD 2,649.9 million in 2024 and is anticipated to reach USD 6,211.4 million by 2032, at a CAGR of 11.3% during the forecast period. Asia Pacific accounted for 39.4% market share in 2024. It leads global expansion with strong contributions from China, Japan, and India. Rapid pharmaceutical manufacturing and rising healthcare spending create strong opportunities. Biotechnology hubs in South Korea and Australia add momentum. It benefits from lower production costs, making it attractive for outsourcing. Governments across the region invest heavily in life sciences infrastructure. Growing demand for targeted therapies and synthetic biology enhances adoption. Asia Pacific is expected to remain the fastest-growing region during the forecast period.

Latin America

The Latin America Global Unnatural Amino Acid Market size was valued at USD 341.2 million in 2018 to USD 483.6 million in 2024 and is anticipated to reach USD 998.6 million by 2032, at a CAGR of 9.6% during the forecast period. Latin America represented 7.2% market share in 2024. Brazil dominates regional adoption due to expanding pharmaceutical industries. Mexico and Argentina show steady research activities supporting the market. It benefits from rising government investment in healthcare and biotechnology. Pharmaceutical outsourcing in the region strengthens opportunities. Limited infrastructure compared to North America and Europe restricts faster expansion. Local collaborations with global companies improve market access. Latin America remains a growing contributor with gradual adoption of advanced therapies.

Middle East

The Middle East Global Unnatural Amino Acid Market size was valued at USD 145.7 million in 2018 to USD 192.1 million in 2024 and is anticipated to reach USD 371.5 million by 2032, at a CAGR of 8.7% during the forecast period. The Middle East held 2.9% market share in 2024. GCC countries lead regional adoption with investments in biotechnology and healthcare. Israel shows strong progress in research-focused applications. It benefits from partnerships with global pharmaceutical firms. However, limited domestic production restricts faster scaling. Governments are prioritizing healthcare diversification beyond oil-based economies. The region is strengthening biotechnology clusters to attract foreign investments. The Middle East shows steady, though moderate, growth potential in advanced therapeutics.

Africa

The Africa Global Unnatural Amino Acid Market size was valued at USD 101.5 million in 2018 to USD 190.8 million in 2024 and is anticipated to reach USD 392.8 million by 2032, at a CAGR of 9.2% during the forecast period. Africa accounted for 2.8% market share in 2024. South Africa leads adoption due to advanced research infrastructure. Egypt and Nigeria are emerging contributors with growing healthcare investments. It faces constraints from limited biotechnology capacity and research funding. International collaborations help overcome local infrastructure challenges. Rising demand for improved healthcare access supports adoption. The region is gradually building its position through academic and industrial partnerships. Africa shows long-term potential, though short-term growth remains slower compared to other regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bayer AG

- BASF SE

- Aminologics Co.

- AnaSpec Inc.

- AstraZeneca

- Pfizer

- Enzo Life Sciences, Inc.

- Miat S.P.A.

- Yoneyama Yakuhin Kogyo

- Nagase & Co. Ltd.

- Nippon Rika

- Senn Chemicals

- Fufeng Group

- Hanhong Group

Competitive Analysis:

The Global Unnatural Amino Acid Market features a competitive landscape shaped by multinational pharmaceutical companies, biotechnology firms, and specialty chemical manufacturers. Leading players such as Bayer AG, BASF SE, Pfizer, AstraZeneca, and Enzo Life Sciences dominate with established product portfolios and robust research investments. It emphasizes innovation through protein engineering, precision medicine, and biopharmaceutical applications. Companies like AnaSpec Inc., Aminologics, and Miat S.P.A. strengthen their positions by focusing on niche markets and collaborative research. Asian firms including Fufeng Group and Hanhong Group enhance competitiveness with cost-effective production and expanding global reach. Strategic partnerships, mergers, and acquisitions remain central to growth strategies. It reflects a market where established leaders consolidate positions while regional companies leverage specialized expertise and manufacturing advantages.

Recent Developments:

- In September 2025, Enlaza Therapeutics entered a collaboration with Vertex Pharmaceuticals, centered on its War-Lock platform that incorporates non-natural amino acids to create covalent-acting protein drugs. The partnership aims to develop immune therapies for autoimmune diseases and improve treatment conditioning for sickle cell disease and thalassemia, with USD 45 million upfront and up to USD 2 billion in potential milestones.

- In June 2025, Argenx partnered with Unnatural Products, agreeing on a collaboration worth up to USD 1.5 billion to develop oral macrocyclic peptides targeting inflammatory and immunological diseases. The deal aims to deliver once-daily oral alternatives to current infused antibody treatments, leveraging the advantages of macrocyclic peptides such as stability without cold storage and resistance to protease degradation.

- In August 2025, Bayer AG entered into a landmark partnership with Kumquat Biosciences, valued at up to $1.3 billion, to co-develop Kumquat’s novel KRAS G12D inhibitor for oncology applications, enhancing Bayer’s precision oncology portfolio. This alliance aims to advance the drug candidate through early clinical trials and ultimately commercialize it for the treatment of cancers with high unmet needs, such as pancreatic, colorectal, and lung cancers.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Unnatural Amino Acid Market is set to expand with strong adoption in drug discovery.

- Advances in protein engineering will strengthen demand for tailored therapeutic and diagnostic applications.

- Precision medicine will accelerate usage, creating opportunities for patient-specific drug development.

- Expanding applications in industrial biotechnology will diversify revenue sources beyond pharmaceuticals.

- Regional growth will be led by Asia Pacific due to strong manufacturing and R&D infrastructure.

- North America will sustain dominance through advanced clinical research and biopharmaceutical pipelines.

- Europe will contribute with sustainable biotechnology practices and strong academic collaborations.

- Partnerships and mergers among global firms will reshape competition and broaden innovation capacity.

- Regulatory clarity and harmonized standards will play a vital role in supporting commercialization.

- Emerging economies will provide new opportunities through expanding healthcare investments and outsourcing.