Market Overview:

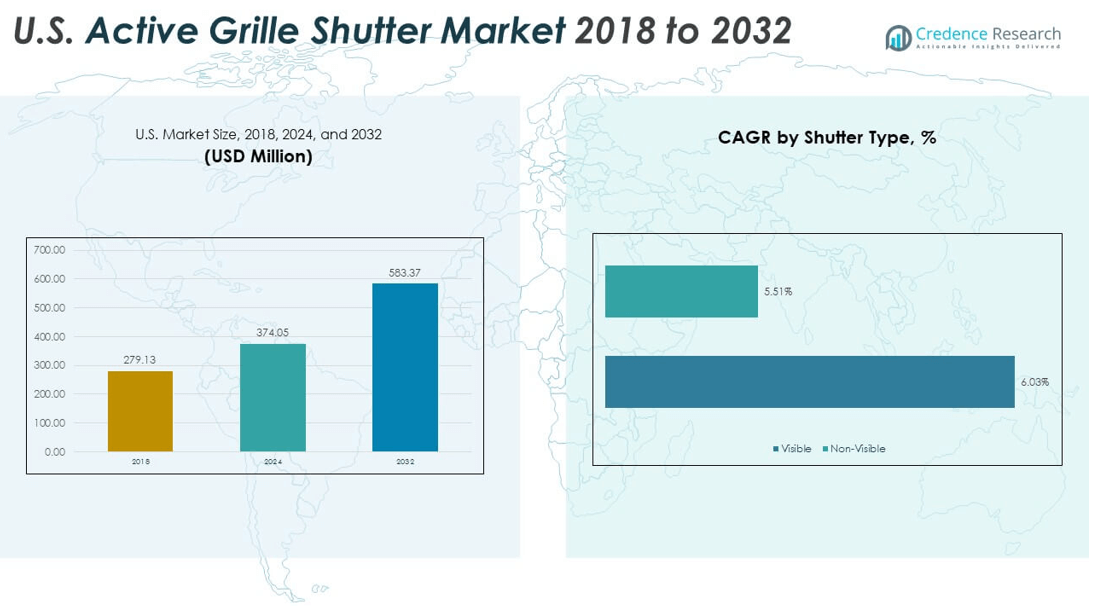

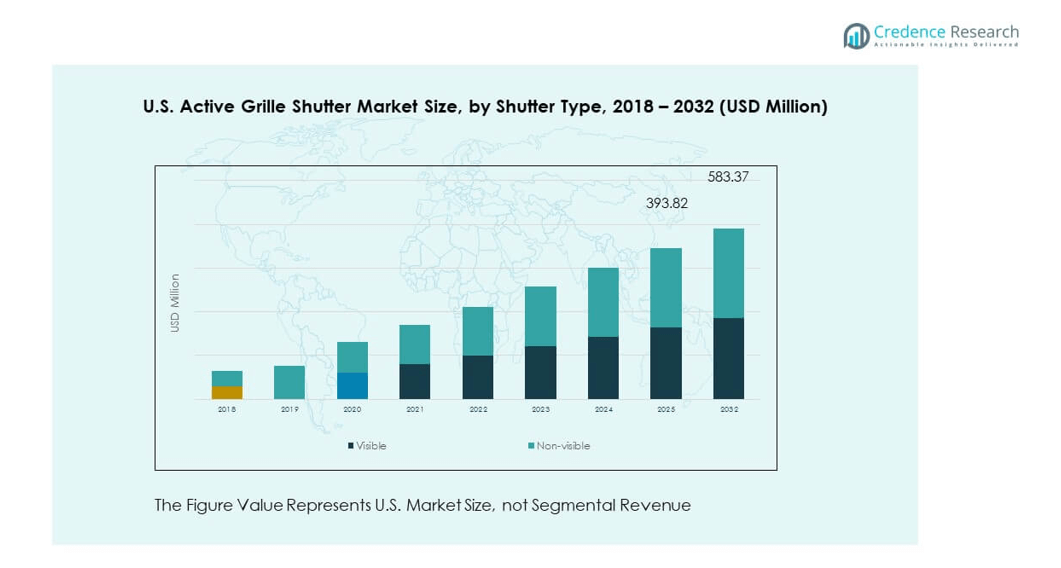

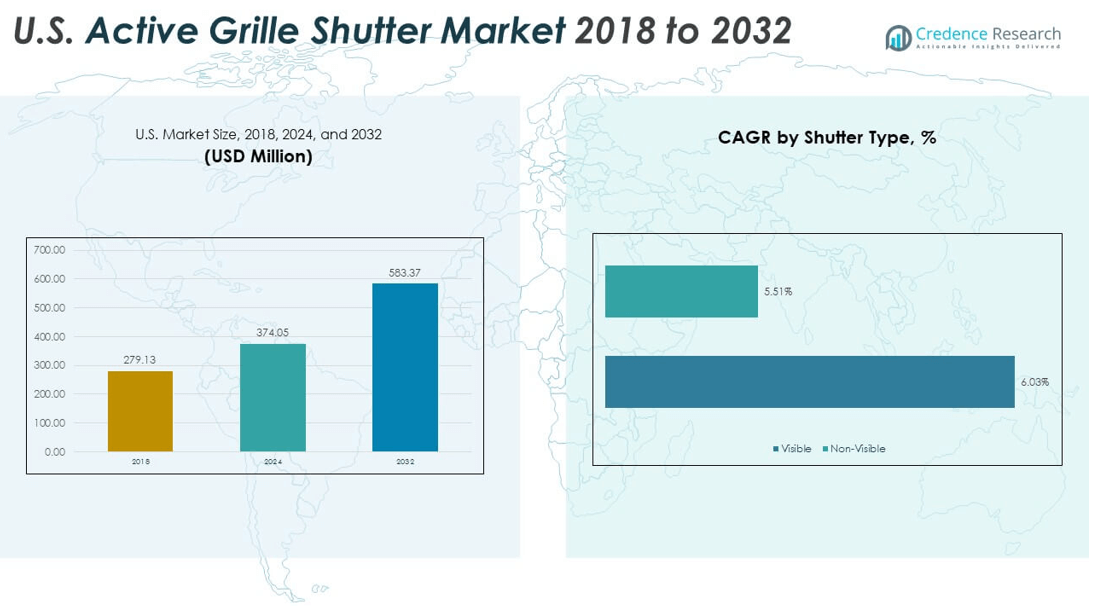

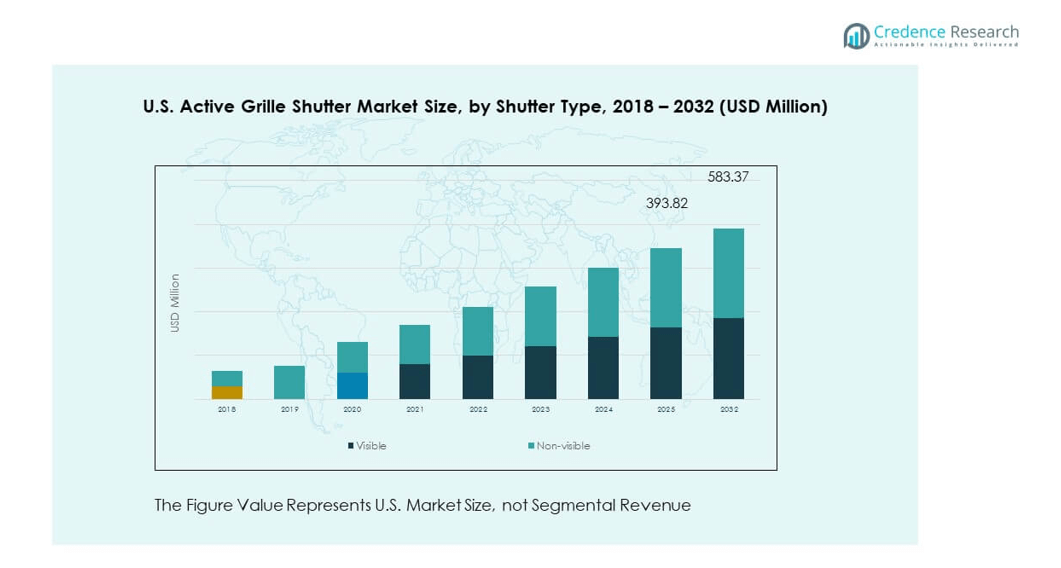

The U.S. Active Grille Shutter Market size was valued at USD 279.13 million in 2018 to USD 374.05 million in 2024 and is anticipated to reach USD 583.37 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Active Grille Shutter Market Size 2024 |

USD 374.05 million |

| U.S. Active Grille Shutter Market, CAGR |

5.7% |

| U.S. Active Grille Shutter Market Size 2032 |

USD 583.37 million |

The U.S. active grille shutter market is driven by the automotive industry’s focus on improving fuel efficiency, lowering carbon emissions, and meeting regulatory standards. Automakers are integrating grille shutter systems to optimize aerodynamics, reduce drag, and enhance vehicle performance. Consumer demand for premium vehicles with advanced technologies further supports adoption, as manufacturers use these systems to improve range in electric vehicles and efficiency in internal combustion models. Additionally, rising government pressure to comply with emission norms and the growing push for sustainable mobility solutions strengthen the demand for advanced aerodynamic components across passenger and commercial vehicles.

Regionally, the U.S. holds a dominant position due to its strong automotive manufacturing base, early adoption of energy-efficient technologies, and consumer preference for high-performance vehicles. States with large production hubs and R&D facilities act as key contributors to market growth. While established automotive centers lead in adoption, emerging regions within the U.S. are showing potential as electric vehicle infrastructure expands and OEMs target broader markets. The country’s emphasis on technological innovation and alignment with global sustainability goals ensures steady demand for active grille shutter systems in both traditional and next-generation vehicles.

Market Insights:

- The U.S. Active Grille Shutter Market was valued at USD 279.13 million in 2018, reached USD 374.05 million in 2024, and is projected to attain USD 583.37 million by 2032, expanding at a CAGR of 5.7%.

- The Midwest (36%), South and West combined (40%), and Northeast (24%) represent the top three regional shares, with dominance driven by manufacturing concentration, EV adoption, and consumer demand.

- The West region emerges as the fastest-growing subregion with strong electric vehicle penetration, supported by California’s regulatory environment and consumer preference for sustainable mobility.

- By shutter type, non-visible shutters account for 65% of the U.S. Active Grille Shutter Market in 2024, reflecting broad adoption in mainstream models.

- Visible shutters hold the remaining 35% share, driven by luxury and premium vehicles where design differentiation and aesthetics enhance adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Need for Aerodynamic Efficiency and Fuel Economy

The U.S. Active Grille Shutter Market benefits from rising demand for better fuel economy. Automakers deploy these systems to reduce drag and improve vehicle efficiency. Regulatory bodies enforce strict fuel economy standards, encouraging wide adoption. The shutters enhance aerodynamics by controlling airflow at different speeds. Consumers in the U.S. expect vehicles that combine performance with efficiency. Electric vehicle makers use shutters to extend driving range. Internal combustion vehicles also gain efficiency improvements from optimized airflow. This factor remains a central driver for overall market growth. Future innovations in shutter design will further improve efficiency outcomes.

Increasing Government Regulations and Emission Standards

Government policies play a major role in driving demand across the U.S. Active Grille Shutter Market. Federal and state emission norms force automakers to adopt efficient technologies. Stringent standards encourage manufacturers to integrate shutters as compliance tools. Companies invest heavily in R&D to meet evolving regulations. Consumers value brands that show commitment to sustainability. The systems also help OEMs reduce fleet-wide CO₂ emissions. It becomes critical for automakers targeting environmentally conscious buyers. This alignment with government policies secures long-term growth momentum. Future policy tightening will reinforce demand for compliant aerodynamic solutions.

- For instance, General Motors equipped the Chevrolet Malibu with active grille shutters, designed to improve aerodynamics and support compliance with Corporate Average Fuel Economy (CAFE) standards. The system helps enhance fuel efficiency by reducing drag during highway driving.

Strong Adoption in Premium and Luxury Vehicle Segments

Premium brands drive significant adoption in the U.S. Active Grille Shutter Market. Luxury vehicle makers integrate shutters to improve design and performance. Buyers in this segment expect advanced efficiency features. The shutters also enhance aesthetics, aligning with premium design language. EV luxury models gain extended range benefits from optimized aerodynamics. Internal combustion luxury models meet stringent standards without losing performance. It strengthens brand reputation among discerning customers. Strong demand in this category ensures continuous system adoption. Future luxury offerings will showcase shutters as standard aerodynamic technologies.

- For example, Mercedes-Benz unveiled the IAA (Intelligent Aerodynamic Automobile) Conceptat the 2015 Frankfurt Motor Show, demonstrating active grille shutters and movable body elements that shift the drag coefficient from 25 to 0.19 in aerodynamic mode. This innovation was officially reported by Mercedes-Benz and covered in global automotive media, attesting to authentic technological advancement in the luxury segment.

Expanding Role of Electric Vehicle Market Growth

The expansion of the EV sector provides another key driver for the U.S. Active Grille Shutter Market. EVs demand maximum efficiency to extend battery life and driving range. Shutters improve range by minimizing drag at high speeds. They also regulate cooling needs during battery operation. U.S. automakers prioritize EV adoption, making shutters essential in design. Consumers appreciate extended range without compromising comfort. It creates a competitive advantage for manufacturers. This driver aligns with broader industry electrification trends. Strong growth of EV infrastructure will further accelerate shutter adoption.

Market Trends

Integration with Advanced Vehicle Thermal Management Systems

The U.S. Active Grille Shutter Market is seeing integration with advanced thermal management. Automakers connect shutters with cooling and heating systems for precision. These connections ensure batteries and engines operate at optimal temperatures. The technology helps in both EVs and hybrid vehicles. OEMs highlight thermal benefits as key selling points. Integration supports future-ready platforms designed for efficiency. It positions shutters beyond aerodynamics into full vehicle management. This trend enhances the value proposition for manufacturers. Continuous refinement of these systems will drive long-term adoption across multiple vehicle categories.

Adoption of Smart Sensors and Digital Control Platforms

Smart sensors represent a growing trend across the U.S. Active Grille Shutter Market. Digital platforms now control airflow adjustments with high precision. Automakers employ algorithms that predict cooling needs in real time. Connected sensors allow systems to adapt instantly to conditions. The technology increases reliability and extends component life. OEMs present this as an advanced feature for modern buyers. It supports predictive maintenance and reduces downtime risks. This trend reinforces shutters as intelligent systems, not passive parts. Expanding use of AI-driven control will further strengthen system efficiency.

- For instance, Valeo’s active grille shutter systems, as detailed in their latest technical catalogue, link real-time airflow adjustment to vehicle ECUs via digital communication interfaces, enabling verified fuel savings of up to 2–5 grams CO₂/km and a specific drag coefficient reduction of 4.8% on recent vehicle models.

Growing Customization and Differentiation for Vehicle Aesthetics

The U.S. Active Grille Shutter Market includes a trend of using shutters for brand identity. Automakers design shutters that align with signature front-end aesthetics. Luxury models emphasize visible shutter designs that blend performance and style. Mainstream brands also use distinct shutter patterns to differentiate vehicles. Buyers appreciate features that enhance both form and function. It elevates shutters from technical components to design assets. OEMs highlight this in advertising strategies. This trend expands consumer perception of grille shutter value. Greater customization options will allow brands to reinforce unique positioning.

- For instance, Röchling Automotive supplies active grille shutter systems, including vertical configurations positioned behind radiator grilles, engineered to improve aerodynamics while aligning with individual OEM design requirements.

Rising Collaboration between Automakers and Tier-One Suppliers

The U.S. Active Grille Shutter Market features increasing collaboration with leading suppliers. Automakers depend on tier-one partners for advanced materials and designs. These suppliers innovate lightweight, durable shutter systems. Joint development accelerates adoption of new designs. It reduces costs for manufacturers while improving scalability. Suppliers also bring expertise in electronics integration. Automakers rely on these partnerships to meet strict timelines. This trend strengthens supply chains and ensures faster technology deployment. Stronger alliances are expected to drive faster rollout of next-generation shutter solutions.

Market Challenges Analysis

High System Costs and Complexity in Mass Adoption

The U.S. Active Grille Shutter Market faces cost-related challenges. Shutter systems add complexity and increase production expenses. Automakers balance costs with benefits when scaling adoption. Price-sensitive buyers resist additional costs in economy segments. Manufacturers find it difficult to justify shutters for low-margin vehicles. Complex integration also raises development time. Supply chain disruptions amplify cost challenges. It limits full-scale adoption across all vehicle categories. This challenge directly impacts growth potential for the market.

Reliability, Maintenance Concerns, and Harsh Environmental Conditions

Reliability concerns create another barrier for the U.S. Active Grille Shutter Market. Exposure to dust, ice, and debris affects system performance. Failure risks reduce consumer trust in long-term durability. Maintenance adds additional costs for owners. Automakers must guarantee performance under varied climates. Warranty claims increase if shutters fail prematurely. Complex electronics also require specialized servicing. It limits appeal among some consumer groups. Addressing these concerns is vital for market expansion.

Market Opportunities

Expansion Linked to Electric and Hybrid Vehicle Platforms

The U.S. Active Grille Shutter Market presents opportunities through EV and hybrid adoption. Growing consumer preference for clean vehicles accelerates integration of shutters. Automakers see it as an essential element for range optimization. New EV platforms include shutters as standard features. Rising hybrid adoption also strengthens demand. It creates opportunities for both OEMs and suppliers. The opportunity links directly to long-term electrification strategies. This ensures shutters remain a vital system in vehicle design.

Development of Lightweight Materials and Smart Automation Features

The U.S. Active Grille Shutter Market gains opportunities through material and automation advances. Lightweight composites reduce system weight while maintaining durability. Automation through sensors and AI improves shutter responsiveness. It supports predictive maintenance and greater efficiency. Automakers promote these as advanced safety and comfort features. Lightweight designs help OEMs meet efficiency targets. It ensures shutters can be scaled across multiple vehicle classes. These opportunities support long-term innovation and adoption.

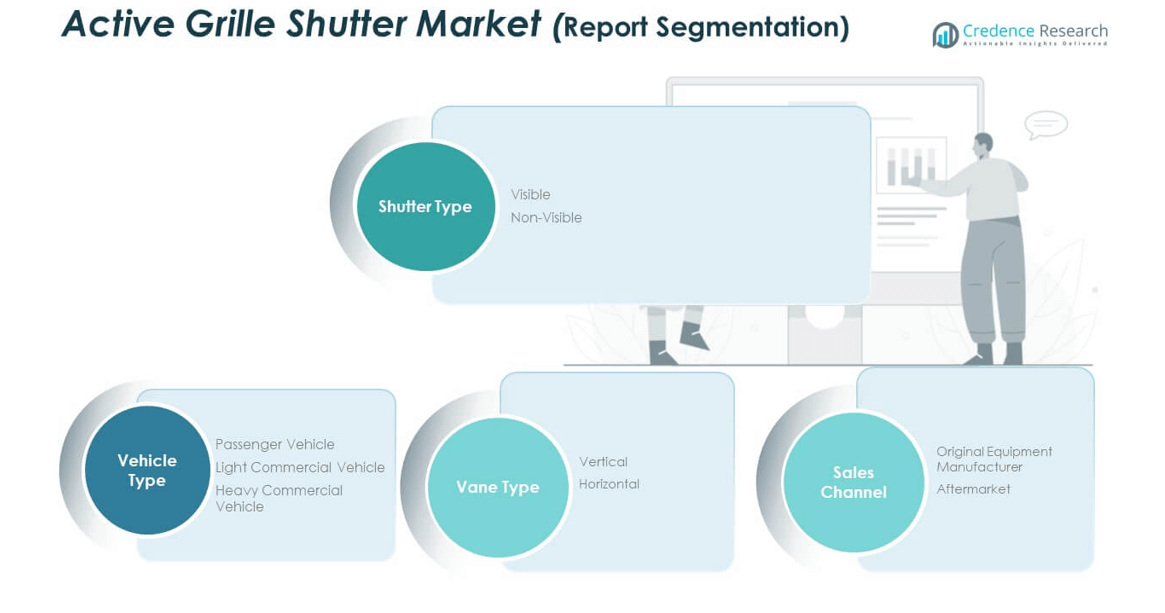

Market Segmentation Analysis:

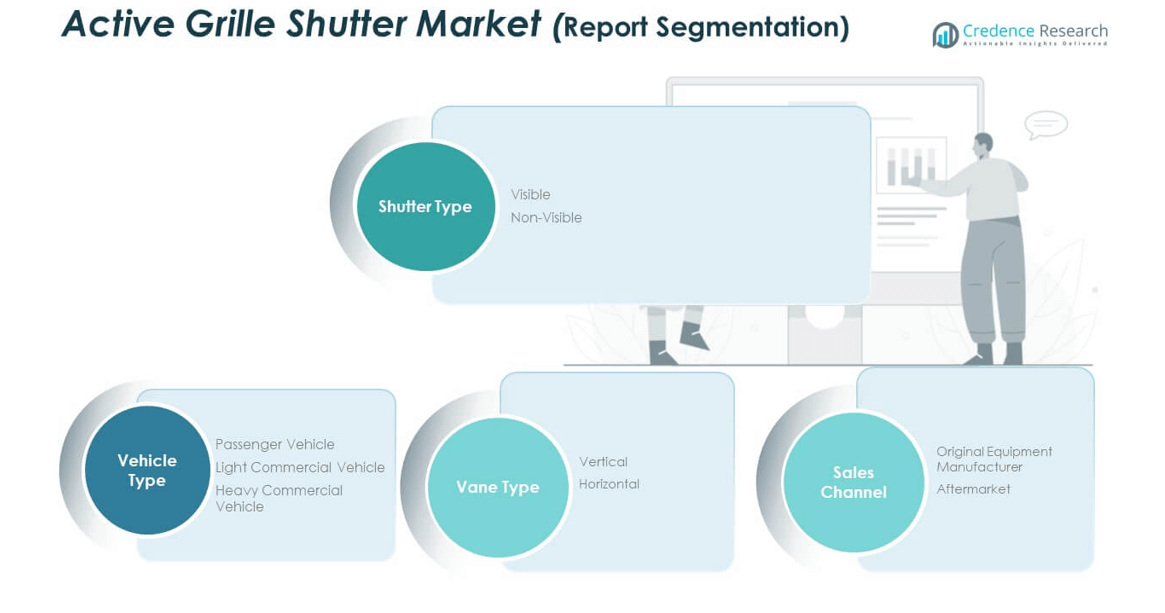

By shutter type, the U.S. Active Grille Shutter Market divides into visible and non-visible categories. Visible shutters gain traction in premium vehicles due to their aesthetic appeal and integration with design language. Non-visible shutters dominate mainstream models where functionality and cost efficiency remain critical. Automakers adopt both formats strategically to balance performance with consumer expectations, strengthening overall system penetration across diverse vehicle classes.

- For instance, the BMW 7 Series incorporates visible active grille shutters, which are designed for both premium aesthetics and aerodynamic optimization, as confirmed in BMW’s official literature and industry reviews.

By vehicle type, passenger vehicles account for a major share of the market, supported by strong consumer demand for efficiency and compliance with emission standards. Light commercial vehicles show rising adoption due to regulatory pressure and OEM emphasis on operational cost savings. Heavy commercial vehicles remain a smaller segment, yet integration grows steadily as fleet operators seek long-term efficiency and lower emissions. This structure demonstrates broadening adoption across multiple mobility categories.

- For instance, the Toyota Camry integrates active grille shutters as standard equipment on recent models, particularly hybrids, to improve aerodynamics and fuel efficiency.

By vane type, vertical and horizontal configurations shape system design and performance. Vertical vanes often feature in luxury vehicles for premium styling, while horizontal vanes dominate volume models where practicality and aerodynamic optimization are prioritized. It enables automakers to select vane orientation that aligns with both engineering requirements and brand identity.

By sales channel, original equipment manufacturers hold a dominant share, driven by integration of grille shutters during production. Aftermarket sales exist but remain limited, primarily targeting replacement and customization needs. The OEM-led structure reflects strong collaboration between automakers and suppliers to meet regulatory standards and consumer demand efficiently.

Segmentation:

By Shutter Type

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Vane Type

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Regional Analysis:

The Northeast region accounts for 24% share of the U.S. Active Grille Shutter Market. Strong automotive demand in states like New York, Pennsylvania, and Massachusetts supports adoption. Premium passenger vehicles dominate this subregion, driving demand for advanced aerodynamic systems. Consumers prioritize efficiency and sustainability, which encourages automakers to deploy shutters widely. OEM facilities in nearby regions also strengthen supply chain networks. It ensures reliable distribution and supports aftermarket availability across urban centers.

The Midwest holds the largest share at 36%, supported by its status as the country’s automotive manufacturing hub. States such as Michigan, Ohio, and Indiana lead production, creating high integration rates for grille shutters. Automakers in this subregion focus on compliance with emission norms and efficiency targets, pushing adoption across vehicle categories. The presence of leading OEMs and suppliers fosters innovation and accelerates system development. It benefits from established R&D infrastructure that ensures consistent technology upgrades. Growing demand for light commercial vehicles further strengthens market position in the Midwest.

The South and West together represent the remaining 40% share of the U.S. Active Grille Shutter Market. The South, including Texas and Georgia, shows rising adoption due to its expanding automotive assembly plants and strong consumer demand. It also benefits from fleet demand in commercial segments, boosting integration in light and heavy commercial vehicles. The West, led by California, prioritizes electric vehicle adoption, making it a significant growth contributor. Consumers in this subregion focus on range optimization and environmental performance, driving adoption in EV platforms. Both subregions demonstrate strong potential for future expansion supported by government regulations and consumer preference shifts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Röchling SE & Co. KG

- Valeo

- Magna International Inc.

- SRG U.S.

- Batz Group

- Standard Motor Products, Inc.

- Techniplas LLC

- Brose Fahrzeugteile GmbH & Co. KG, Coburg

- Yacenter Electric Co., Ltd.

- Keboda

- Starlite

- Aisin Corporation

Competitive Analysis:

The U.S. Active Grille Shutter Market features strong competition among global tier-one suppliers and domestic manufacturers. Key players such as Röchling SE & Co. KG, Valeo, Magna International Inc., and Brose Fahrzeugteile GmbH & Co. KG lead the market through innovation and OEM partnerships. It reflects a competitive environment driven by technology integration, cost efficiency, and design differentiation. Companies strengthen portfolios by introducing lightweight shutters and smart systems with advanced sensor controls. Domestic players, including Standard Motor Products, Inc. and Techniplas LLC, compete by targeting aftermarket opportunities and supplying niche segments. Asian suppliers such as Keboda and Yacenter Electric Co., Ltd. expand presence by providing cost-effective alternatives for OEM contracts. The competitive landscape emphasizes R&D investment, as automakers demand shutters that meet strict emission regulations while supporting electric vehicle efficiency. It encourages suppliers to balance reliability, scalability, and pricing strategies to maintain relevance. Partnerships, mergers, and regional expansions remain common strategies, shaping long-term positioning.

Recent Developments:

- In November 2024, Continental Automotive Systems Inc. released a new line of Active Grille Shutters for key Ford and Chrysler models. The launch covers popular vehicles like the Chrysler 200, Ford Focus, Escape, Mustang, Explorer, F-150, Fusion, and Lincoln MKZ. Designed to reduce aerodynamic drag and regulate engine cooling, these shutters remain closed during the engine warm-up phase to warm up quickly, then open at lower speeds for cooling and close again at higher speeds to lower drag.

Report Coverage:

The research report offers an in-depth analysis based on shutter type, vehicle type, vane type, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Active Grille Shutter Market will expand with rising focus on fuel efficiency and compliance with strict emission standards.

- Demand will grow steadily as automakers integrate shutters across passenger, light commercial, and electric vehicles.

- The market will benefit from increasing adoption of visible shutters in luxury and premium models to balance aesthetics with efficiency.

- Non-visible shutters will dominate mainstream applications due to their cost-effectiveness and performance advantages.

- Integration of advanced sensors and digital controls will transform shutters into intelligent components that optimize aerodynamics and thermal management.

- Lightweight material development will gain momentum, allowing suppliers to deliver durable yet efficient designs for mass adoption.

- Electric vehicles will emerge as the strongest growth driver, with shutters playing a critical role in extending driving range.

- OEM sales channels will continue to dominate, while aftermarket opportunities will develop in niche replacement and customization markets.

- Regional leaders such as the Midwest will maintain dominance through established production facilities, while the West will rise due to EV penetration.

- Competition will intensify as global suppliers and regional firms focus on innovation, partnerships, and cost leadership strategies.