| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Autonomous Off-Road Vehicles And Machinery Market Size 2023 |

USD 6,793.71 Million |

| U.S. Autonomous Off-Road Vehicles And Machinery Market, CAGR |

12.91% |

| U.S. Autonomous Off-Road Vehicles And Machinery Market Size 2032 |

USD 20,259.75 Million |

Market Overview:

U.S. Autonomous Off-Road Vehicles And Machinery Market size was valued at USD 6,793.71 million in 2023 and is anticipated to reach USD 20,259.75 million by 2032, at a CAGR of 12.91% during the forecast period (2023-2032).

Several factors are propelling the growth of autonomous off-road vehicles and machinery in the U.S. Technological advancements in artificial intelligence, machine learning, and sensor technologies have enhanced the capabilities of autonomous systems, enabling them to operate effectively in challenging terrains. These advancements are helping vehicles make real-time decisions that improve operational efficiency. Additionally, the rising costs of labor and the shortage of skilled workers are encouraging industries to adopt automation to maintain productivity and reduce operational costs. This is particularly evident in sectors like agriculture and construction, where the demand for skilled labor often outpaces supply. Moreover, the growing emphasis on safety and environmental sustainability is prompting the adoption of autonomous solutions that can operate in hazardous environments, thereby minimizing human exposure to risks and reducing emissions, aligning with regulatory pressures for greener operations.

North America, particularly the United States, leads the global market for autonomous off-road vehicles and machinery, accounting for nearly 40% of the global share in 2023. The region’s dominance is attributed to its robust technological infrastructure, significant investments in research and development, and the early adoption of autonomous technologies in sectors such as agriculture, construction, and mining. This strong foundation has enabled U.S. companies to implement advanced autonomous systems in real-world applications, further driving market growth. For instance, companies like Deere & Co. have introduced autonomous tractors and industrial equipment to address labor shortages and enhance operational efficiency. Similarly, autonomous trucks are being tested and deployed for tasks like frac sand deliveries in West Texas, showcasing the practical applications of autonomous systems in off-road environments. This trend is expected to continue as industries seek innovative solutions to meet operational challenges, improve productivity, and gain a competitive edge in the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Autonomous Off-road Vehicles and Machinery market is valued at USD 6,793.71 million in 2023 and is projected to reach USD 20,259.75 million by 2032, with a CAGR of 12.91%.

- Global Autonomous Off-road Vehicles and Machinery size was valued at USD 23,300.00 million in 2023 and is anticipated to reach USD 68,887.09 million by 2032, at a CAGR of 12.80% during the forecast period (2023-2032).

- Technological advancements in AI, machine learning, and sensors have greatly enhanced autonomous systems, enabling them to operate efficiently in complex, hazardous environments.

- Labor shortages in sectors like agriculture, construction, and mining are driving the adoption of autonomous machinery to maintain productivity and address workforce challenges.

- Autonomous systems provide significant cost-saving benefits, reducing operational costs through increased efficiency, better resource management, and the elimination of manual labor.

- The demand for environmentally sustainable and safer operations is accelerating the adoption of autonomous machinery, as it reduces emissions and minimizes human exposure to hazardous conditions.

- Despite their long-term benefits, high initial investment costs remain a significant barrier, particularly for small and medium-sized enterprises (SMEs) with limited budgets.

- The U.S. market leads the global sector, accounting for nearly 40% of the share in 2023, with significant investments in research, development, and the early adoption of autonomous technologies in agriculture, construction, and mining.

Market Drivers:

Technological Advancements in Automation

The rapid progression of automation technologies is one of the primary drivers for the growth of autonomous off-road vehicles and machinery in the U.S. Artificial intelligence (AI), machine learning (ML), and advanced sensor technologies have dramatically enhanced the performance and reliability of autonomous systems. For instance, Applied Intuition, a leading vehicle software supplier, has launched an off-road autonomy stack that integrates the latest AI and ML advances with robust sensor modules, enabling vehicles to safely navigate complex, unstructured terrains. These innovations enable vehicles and machinery to operate in complex and hazardous terrains with minimal human intervention. AI and ML algorithms allow these systems to process real-time data, make intelligent decisions, and navigate obstacles efficiently. Additionally, advancements in sensor technologies, such as LiDAR and radar, improve the precision of autonomous machines, ensuring they can detect and respond to environmental changes in real-time. This technological evolution has made autonomous off-road machinery more reliable and adaptable, fostering its adoption in industries like agriculture, construction, and mining.

Labor Shortages and Increased Operational Efficiency

Another key factor driving the adoption of autonomous off-road vehicles in the U.S. is the ongoing labor shortage in sectors such as agriculture, construction, and mining. As these industries face a growing demand for skilled labor, the scarcity of qualified workers has become a significant challenge. Autonomous machinery provides an effective solution by reducing the dependence on human labor. This not only addresses labor shortages but also improves operational efficiency. Autonomous systems can work continuously without the constraints of human fatigue, enabling 24/7 operations. This results in higher productivity, reduced operational downtime, and more consistent output, which is particularly beneficial in industries like agriculture, where tasks like planting, harvesting, and field maintenance require frequent, repetitive action. The ability to operate autonomously also reduces the risk of human errors, contributing to more reliable and accurate operations.

Cost Reduction and Profitability Enhancement

The economic benefits of autonomous off-road vehicles are a significant driver of their growth in the U.S. As industries increasingly seek ways to reduce costs and improve profitability, autonomous systems offer a clear solution. By minimizing the need for manual labor, businesses can reduce overhead costs associated with wages, training, and employee benefits. For example, the autonomous trucking industry could save an estimate range from $85 billion to $125 billion annually in labor costs once full adoption is achieved. Moreover, autonomous machines can perform tasks more efficiently, resulting in fewer delays and better resource management. For example, autonomous haul trucks in mining can transport materials faster and more safely, leading to lower operational costs and higher throughput. Additionally, autonomous systems can be integrated into existing infrastructure, often with a lower upfront investment compared to traditional machinery, further improving the return on investment for companies in various industries.

Environmental Sustainability and Safety Regulations

The growing focus on environmental sustainability and stringent safety regulations is also fueling the demand for autonomous off-road vehicles and machinery in the U.S. As industries face increasing pressure to meet sustainability goals, autonomous machinery offers the potential to reduce fuel consumption, lower emissions, and minimize environmental impact. For instance, autonomous vehicles can optimize routes and operations to ensure more efficient fuel usage, contributing to reduced greenhouse gas emissions. Furthermore, autonomous systems can operate in hazardous environments where human exposure is risky, such as in mining or construction sites. These machines can navigate dangerous terrain or conditions, reducing the risk of accidents and improving worker safety. As regulatory agencies continue to enforce stricter environmental and safety standards, businesses are increasingly turning to autonomous technologies to comply with these requirements and maintain competitiveness in the market.

Market Trends:

Integration of Electrification in Autonomous Systems

A notable trend in the U.S. autonomous off-road vehicle and machinery market is the increasing integration of electrification with autonomous systems. For instance, New Holland Agriculture launched the T4 Electric Power in August 2023, an all-electric utility tractor equipped with autonomous functionalities, designed for a variety of field tasks such as mixed farming and specialty crops. Electric autonomous vehicles are gaining traction across industries like agriculture and construction due to their lower operating costs and reduced environmental impact. Electrification offers benefits such as reduced fuel consumption, lower maintenance costs, and less reliance on fossil fuels, aligning with sustainability goals set by both government regulations and companies. Electric-powered autonomous machinery, including tractors and excavators, can work longer hours with fewer energy requirements, contributing to enhanced operational efficiency. As electric technology continues to evolve, its integration into autonomous machinery will play a crucial role in shaping the future of off-road vehicle operations in the U.S.

Enhanced Connectivity through IoT and 5G

The adoption of IoT (Internet of Things) technology and the deployment of 5G networks are transforming the U.S. autonomous off-road vehicles and machinery market. For example, Miller Electric, in partnership with T-Mobile, is deploying a 5G private network to support a fleet of autonomous vehicles in Jacksonville, Florida, enabling real-time telemetry, video surveillance, and two-way audio/video communications between vehicles and a central control center. IoT sensors and devices enable real-time monitoring and data collection from autonomous machines, allowing operators to track performance, predict maintenance needs, and enhance operational efficiency. The integration of 5G technology further accelerates this trend by providing faster and more reliable communication networks, which are essential for the seamless operation of autonomous systems in remote and expansive terrains. With low-latency, high-speed communication, 5G enables more precise control of autonomous vehicles and machinery, supporting critical functions such as remote diagnostics, autonomous navigation, and data exchange between machinery and central systems. This enhanced connectivity will significantly improve the automation and management of off-road vehicles in the coming years.

Expansion into New Applications and Markets

Autonomous off-road vehicles and machinery are expanding beyond traditional applications in agriculture and construction into new markets such as mining, forestry, and logistics. In particular, autonomous systems are increasingly being deployed in remote and difficult-to-access areas like mines and forestry operations, where they offer significant advantages in terms of safety and efficiency. For example, autonomous mining trucks are now being used to transport materials in challenging environments, reducing the need for human labor and minimizing safety risks. Similarly, autonomous vehicles are being tested in warehouse logistics, streamlining material handling and transportation within large industrial sites. This diversification into new industries will drive market growth by creating new opportunities and applications for autonomous technology.

Focus on Data Analytics and Predictive Maintenance

Another significant trend in the U.S. autonomous off-road vehicle and machinery market is the increasing reliance on data analytics and predictive maintenance solutions. Autonomous vehicles generate vast amounts of data, which can be analyzed to gain insights into their performance and efficiency. By leveraging data analytics, companies can optimize the use of their machinery, forecast potential issues, and schedule proactive maintenance before a breakdown occurs. This trend is not only improving the operational lifespan of autonomous systems but also reducing downtime and maintenance costs. Predictive maintenance tools are being integrated with autonomous vehicles to ensure their optimal performance, reducing both unplanned maintenance and operational disruptions, which are crucial for industries that rely on continuous operation. This growing focus on data-driven management strategies will further enhance the value proposition of autonomous machinery across various sectors.

Market Challenges Analysis:

High Initial Investment Costs

One of the primary restraints in the U.S. autonomous off-road vehicles and machinery market is the high initial investment required for adopting these advanced systems. For instance, equipping a commercial truck with autonomous vehicle (AV) technology costs between $50,000 and $200,000 per vehicle, depending on the level of automation. While autonomous technologies offer long-term cost savings, the upfront cost of purchasing and implementing autonomous machinery remains a significant barrier for many businesses, especially small and medium-sized enterprises (SMEs). The high costs associated with automation, including the price of sensors, AI systems, and other specialized components, can deter companies from transitioning to autonomous operations. This financial hurdle may limit market penetration, particularly in industries with tight budget constraints or where ROI timelines may be lengthy.

Regulatory and Safety Concerns

The evolving regulatory landscape presents another challenge for the growth of autonomous off-road vehicles and machinery in the U.S. While the technology is advancing rapidly, regulatory frameworks surrounding autonomous systems in off-road environments are still under development. The lack of standardized regulations regarding safety, operational guidelines, and liability issues creates uncertainty for businesses looking to invest in autonomous machinery. Companies must navigate complex federal, state, and local regulations, which can vary across jurisdictions. Moreover, ensuring compliance with strict safety standards and mitigating potential risks associated with autonomous system failures are critical issues that require attention from both regulators and industry stakeholders.

Technology Integration and Interoperability

Another significant challenge is the integration of autonomous technology with existing machinery and infrastructure. Many companies are already operating a fleet of non-autonomous vehicles and equipment, and transitioning to fully autonomous systems can be complex and costly. Ensuring interoperability between new autonomous systems and legacy machinery poses a technical challenge. The integration process may require extensive modifications to existing operations, which can result in disruptions and inefficiencies during the transition phase. Furthermore, autonomous systems must also seamlessly interact with other technologies, such as fleet management software and real-time data analytics platforms, to maximize their efficiency and utility.

Public Perception and Workforce Resistance

Public perception and workforce resistance also present challenges to the widespread adoption of autonomous off-road vehicles and machinery. While autonomous systems offer significant operational advantages, there are concerns about their potential impact on jobs, especially in industries heavily reliant on manual labor. Labor unions and employees in sectors like agriculture and construction may resist the adoption of autonomous technology due to fears of job displacement. Additionally, public skepticism regarding the safety and reliability of autonomous machinery could slow its acceptance, even as technological advancements continue. Overcoming these social and cultural barriers will require effective communication and demonstration of the long-term benefits of automation.

Market Opportunities:

The U.S. autonomous off-road vehicles and machinery market presents significant opportunities driven by the increasing demand for efficiency, safety, and cost reduction across industries such as agriculture, construction, and mining. As labor shortages continue to challenge these sectors, autonomous technology offers a viable solution by minimizing human intervention and enhancing operational efficiency. Autonomous machinery can operate 24/7, leading to higher productivity and faster task completion. Additionally, the ability to perform in hazardous and difficult-to-reach environments—such as remote agricultural fields and mining sites—further boosts its appeal. This capability aligns with the growing emphasis on safety and sustainability, making autonomous off-road vehicles an attractive option for businesses aiming to reduce both operational risks and environmental impact.

Moreover, the ongoing advancements in electric vehicle (EV) technology present new opportunities for the U.S. autonomous off-road vehicle market. The integration of electric powertrains in autonomous machinery can significantly reduce operational costs, particularly in terms of fuel consumption and maintenance. With the growing focus on sustainability and stricter emissions regulations, electric autonomous vehicles offer an eco-friendly alternative to traditional fossil fuel-powered machinery. The rise of 5G connectivity and IoT further enhances the potential of autonomous systems by enabling real-time data exchange and remote management. These technological advancements, coupled with government incentives for green technologies, create a favorable environment for the adoption of electric autonomous off-road vehicles. As industries seek to optimize operations while adhering to environmental standards, the market for these vehicles is expected to grow substantially in the coming years.

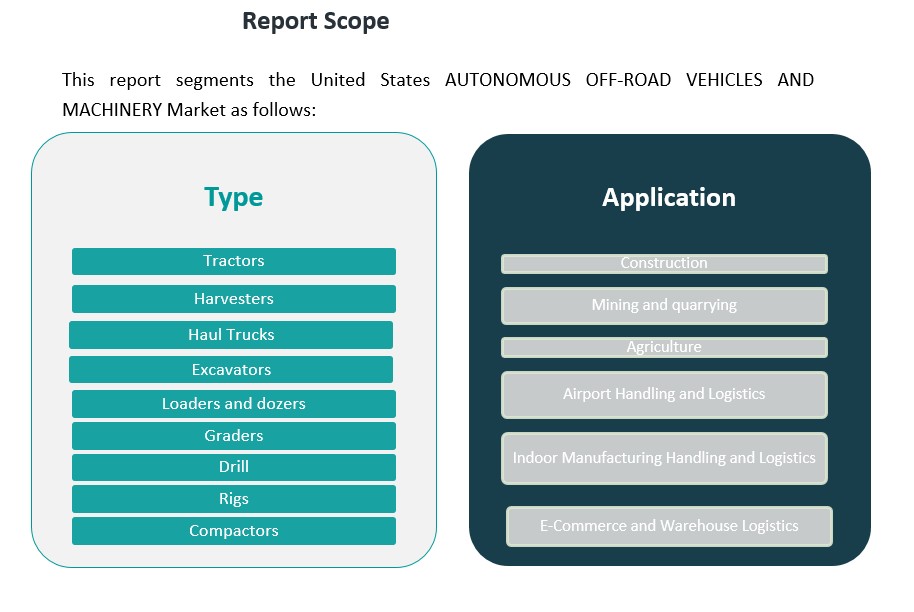

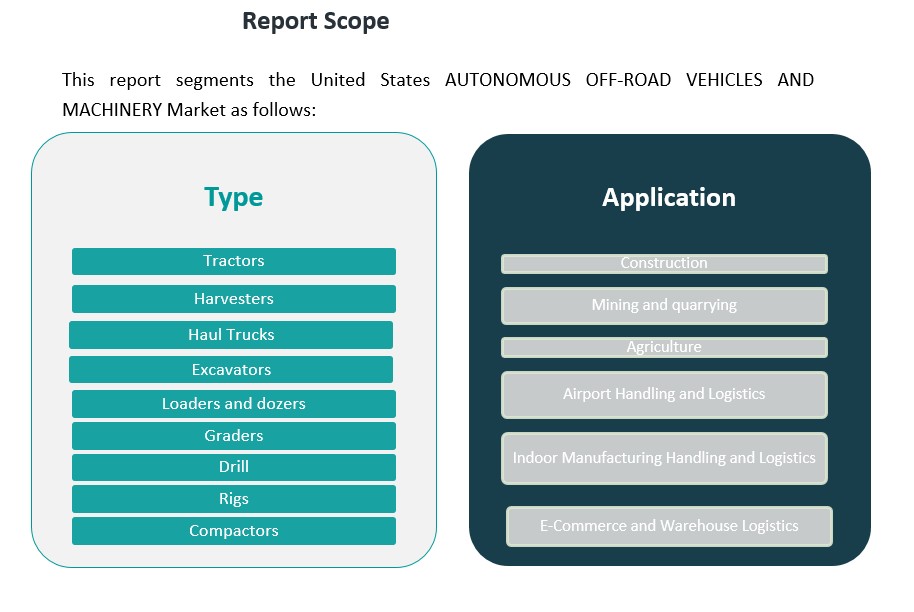

Market Segmentation Analysis:

The U.S. autonomous off-road vehicles and machinery market is segmented by type and application, each contributing to the market’s growth in unique ways.

By type, the market includes a variety of machinery, such as tractors, harvesters, haul trucks, excavators, loaders, dozers, graders, drills, rigs, and compactors. Tractors and harvesters dominate the agricultural sector, where autonomous technology is used for tasks like planting, harvesting, and field maintenance. Haul trucks, excavators, and loaders are widely used in mining and construction applications, where their ability to operate autonomously in harsh environments enhances productivity and safety. Autonomous compactors and graders are becoming increasingly popular in construction for tasks such as soil compaction and leveling, which require high precision and continuous operation.

By application, the market is primarily driven by sectors such as construction, mining, agriculture, and logistics. In construction, autonomous machinery streamlines operations, improving efficiency and reducing human error, particularly in tasks like excavation, grading, and material handling. Mining and quarrying are increasingly adopting autonomous vehicles and equipment to improve safety and operational efficiency in hazardous environments. In agriculture, autonomous tractors and harvesters enable more efficient crop management, addressing labor shortages and reducing operational costs. Autonomous vehicles are also gaining traction in airport handling, logistics, and e-commerce, where they are used for material handling, warehouse logistics, and inventory management, further enhancing the demand for autonomous solutions across these industries. The growing need for precision, safety, and operational efficiency across these diverse sectors ensures continued market expansion.

Segmentation:

By Type Segment:

- Tractors

- Harvesters

- Haul Trucks

- Excavators

- Loaders and Dozers

- Graders

- Drill

- Rigs

- Compactors

By Application Segment:

- Construction

- Mining and Quarrying

- Agriculture

- Airport Handling and Logistics

- Indoor Manufacturing Handling and Logistics

- E-Commerce and Warehouse Logistics

Regional Analysis:

The U.S. autonomous off-road vehicles and machinery market is predominantly driven by developments in North America, particularly the United States. In 2023, North America accounted for nearly 40% of the global market share in this sector. This dominance is attributed to the region’s advanced technological infrastructure, significant investments in research and development, and the early adoption of autonomous technologies across various industries. The presence of major manufacturers and tech firms further accelerates the deployment of autonomous systems in off-road applications.

Within the United States, regions such as the Midwest and West are leading the adoption of autonomous off-road vehicles. The Midwest, with its extensive agricultural activities, has seen increased use of autonomous tractors and harvesters, enhancing efficiency and addressing labor shortages. In the West, particularly in states like Texas, autonomous haul trucks are being utilized in mining operations, exemplified by Atlas Energy’s deployment of driverless trucks for frac sand deliveries in the Permian Basin. These regions benefit from favorable regulatory environments, vast open spaces suitable for testing and deployment, and a strong presence of industries that can leverage autonomous technologies to improve productivity and safety.

Key Player Analysis:

- Caterpillar Inc

- Komatsu Ltd

- Sandvik AB

- John Deere

- Liebherr Group

- Jungheinrich AG

- Daifuku Co. Ltd.

- KION Group

- NAVYA

- EasyMile

Competitive Analysis:

The U.S. autonomous off-road vehicles and machinery market is characterized by a dynamic competitive landscape, with several key players driving innovation and adoption across various sectors. Companies like Deere & Company, Caterpillar Inc., and Komatsu Ltd. are at the forefront, integrating advanced autonomous technologies into their machinery to enhance operational efficiency and safety in agriculture, construction, and mining applications. These industry giants leverage their extensive experience and established market presence to develop and deploy autonomous solutions that meet the evolving demands of their clients. In addition to traditional equipment manufacturers, technology firms such as Aurora Innovation and Kodiak Robotics are making significant strides in the autonomous off-road vehicle sector. Aurora, for instance, has partnered with Volvo and DHL Supply Chain to launch driverless freight trucks operating between Dallas and Houston, showcasing the potential of autonomous technology in logistics and transportation. Similarly, Kodiak Robotics has collaborated with Atlas Energy Solutions to introduce autonomous haul trucks for frac sand deliveries in the Permian Basin, highlighting the application of autonomous systems in resource extraction industries. This convergence of traditional heavy machinery manufacturers and innovative technology startups is fostering a competitive environment that accelerates the development and deployment of autonomous off-road vehicles and machinery in the U.S. market. As these entities continue to collaborate and compete, the industry is poised for significant advancements, offering enhanced productivity, safety, and sustainability across various applications.

Recent Developments:

- In April 2025, Kodiak Robotics, a leading U.S. provider of AI-powered autonomous vehicle technology, announced a significant milestone by entering into a definitive business combination agreement with Ares Acquisition Corporation II. This move will take Kodiak public, positioning the company for accelerated growth and expansion of its autonomous off-road and trucking solutions.

- In January 2025, John Deere unveiled several new autonomous machines and its second-generation autonomy kit at CES 2025, expanding its technology stack across agriculture, construction, and landscaping. The new kit leverages advanced AI and computer vision, enabling machines like the 9RX Tractor to operate autonomously with improved efficiency. Later that month, John Deere announced its 2025 Startup Collaborator cohort, partnering with startups focused on digital twins, advanced LiDAR, and automation to further drive innovation in autonomous machinery.

- In July 2024, Liebherr Groupand Fortescue formalized a partnership to develop and validate a fully integrated Autonomous Haulage Solution (AHS), including a fleet management system and machine guidance solution. This collaboration, building on their zero-emission haul truck project, aims to deliver the first AHS operating zero-emissions vehicles globally, with ongoing validation at Fortescue’s Christmas Creek mine in Australia.

- In April 2025, Aurrigo International plc announced the global launch of its Auto-Cargo® autonomous electric vehicle, marking a significant advancement in autonomous off-road and airside logistics in the UK. Developed in partnership with UPS, Innovate UK, the Centre for Connected and Autonomous Vehicles (CCAV), and East Midlands Airport, Auto-Cargo® is engineered to move heavy cargo loads—up to 16,500kg when towing a standard trailer—between aircraft and terminals.

Market Concentration & Characteristics:

The U.S. autonomous off-road vehicles and machinery market is characterized by moderate concentration, with a few major players leading the development and deployment of autonomous technologies. Companies such as Deere & Company, Caterpillar Inc., and Komatsu Ltd. dominate the market, leveraging their extensive industry experience and established infrastructure to integrate autonomous systems into their machinery. These firms are investing heavily in research and development to enhance automation capabilities across various equipment types, including tractors, harvesters, haul trucks, and excavators. In addition to traditional heavy machinery manufacturers, technology companies like Aurora Innovation and Kodiak Robotics are entering the market, focusing on the development of autonomous systems for off-road applications. These tech-driven entrants bring innovative approaches to automation, contributing to the diversification of the market. The competition between established equipment manufacturers and emerging technology firms fosters innovation and accelerates the adoption of autonomous technologies in off-road machinery. As a result, the market is witnessing rapid advancements in automation, leading to increased efficiency, safety, and productivity across sectors such as agriculture, construction, and mining.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type and Application It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. autonomous off-road vehicles and machinery market is expected to grow rapidly, driven by technological advancements in AI, machine learning, and sensor systems.

- Increased labor shortages across sectors like agriculture and mining will accelerate the adoption of autonomous machinery to improve productivity.

- Environmental sustainability regulations will push for greener, electric-powered autonomous vehicles, reducing emissions and operational costs.

- The integration of IoT and 5G connectivity will enable more precise control and real-time monitoring of autonomous systems, enhancing operational efficiency.

- Autonomous off-road vehicles will become more versatile, expanding into new industries such as forestry, logistics, and e-commerce.

- OEMs and tech companies will increasingly collaborate, combining machinery expertise with innovative automation technologies.

- Advancements in predictive maintenance will reduce downtime and maintenance costs, improving the ROI of autonomous machinery.

- Regulatory frameworks will evolve to support safe integration and deployment of autonomous vehicles across various sectors.

- Competitive pressure will drive continuous innovation, lowering costs and improving performance, making autonomous machinery more accessible to smaller enterprises.

- As autonomous systems prove their value, public perception will shift, leading to greater acceptance and widespread adoption across industries.