| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Off The Road Tire Market Size 2023 |

USD 5,316.59 Million |

| U.S. Off The Road Tire Market, CAGR |

4.6% |

| U.S. Off The Road Tire Market Size 2032 |

USD 7,969.39 Million |

Market Overview:

U.S. Off The Road Tire Market size was valued at USD 5,316.59 million in 2023 and is anticipated to reach USD 7,969.39 million by 2032, at a CAGR of 4.6% during the forecast period (2023-2032).

Key drivers propelling the U.S. OTR tire market include the rapid expansion of infrastructure projects, such as road construction, railways, and airports, which necessitate the use of heavy machinery equipped with durable OTR tires. Additionally, the growing mechanization in agriculture, with increased adoption of tractors and harvesters, further fuels the demand for specialized tires. Technological advancements, including the integration of sensors for tire condition monitoring, are also enhancing tire performance and safety, contributing to market growth. Furthermore, the rising demand for eco-friendly and fuel-efficient tire solutions is pushing tire manufacturers to innovate and develop more sustainable OTR tire options. The adoption of OTR tires with improved fuel efficiency is also gaining traction in industries focused on reducing operational costs and environmental impact.

North America, with the U.S. at its core, dominates the global OTR tire market. The region is expected to hold a significant market share due to its robust construction and mining sectors. The prevalence of off-road vehicles for both recreational and commercial purposes, coupled with a strong aftermarket demand, positions the U.S. as a pivotal market for OTR tires. The presence of major tire manufacturers and a competitive landscape further bolster the market’s growth prospects in the region. Additionally, rising consumer awareness about the importance of tire performance and safety, especially in hazardous environments, is fostering increased investments in high-quality OTR tires. The market is further supported by favorable government policies that promote the expansion of infrastructure, enhancing the demand for heavy machinery and subsequently, OTR tires.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Off-the-Road (OTR) tire market was valued at USD 5,316.59 million in 2023 and is projected to reach USD 7,969.39 million by 2032, growing at a CAGR of 4.6% during the forecast period.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Key drivers include the rapid expansion of infrastructure projects like road construction, railways, and airports, requiring durable OTR tires for heavy machinery.

- The agricultural sector’s mechanization is fueling demand for specialized OTR tires for tractors, harvesters, and other farming equipment.

- Technological advancements, such as tire pressure monitoring systems (TPMS), are improving tire performance, safety, and cost-efficiency, boosting market growth.

- Increasing demand for eco-friendly and fuel-efficient tires is pushing manufacturers to innovate with low rolling resistance and sustainable materials.

- North America, especially the U.S., dominates the global OTR tire market due to its strong construction and mining sectors.

- The market faces challenges such as high production costs, supply chain disruptions, and barriers to technological innovation, limiting growth for smaller manufacturers.

Market Drivers:

Increasing Demand for Infrastructure Development

The U.S. Off-the-Road (OTR) tire market is significantly driven by the ongoing expansion and development of infrastructure across the country. Large-scale construction projects, including roads, bridges, airports, and railways, require heavy machinery that operates in challenging off-road conditions. These machines, such as bulldozers, cranes, and excavators, rely heavily on durable and high-performance OTR tires. As the U.S. continues to invest in infrastructure growth, the demand for OTR tires is expected to rise steadily. Major infrastructure initiatives, including public-private partnerships and government-funded construction, provide a robust foundation for the market’s expansion.

Growth in the Agricultural Sector

The agricultural sector is another key driver of the U.S. OTR tire market. Increasing mechanization in farming practices has led to higher demand for specialized tires designed for agricultural vehicles. Tractors, harvesters, and other farming equipment require OTR tires that can handle the harsh terrains and provide superior traction for agricultural tasks. As the U.S. agricultural industry continues to modernize with advanced machinery and equipment to improve efficiency and output, the demand for OTR tires will rise in parallel. Furthermore, the need for tires capable of supporting precision agriculture technologies is also fueling the growth of the market.

Technological Advancements in Tire Design

Technological innovation is playing an important role in shaping the U.S. OTR tire market. Manufacturers are continuously introducing advanced tire technologies aimed at improving durability, safety, and fuel efficiency. These advancements include the integration of tire pressure monitoring systems (TPMS), which help in maintaining optimal tire conditions, and the development of more robust tire compounds that enhance performance in extreme off-road environments. For example, Bridgestone introduced smart tire technology with real-time pressure and wear tracking in 2024, allowing for predictive maintenance and reduced downtime. Additionally, the ongoing focus on tire longevity and load-bearing capacity has prompted manufacturers to design tires that reduce the frequency of replacement and maintenance, thus improving the overall cost-efficiency for end-users. As these technologies become more prevalent, the market for high-quality, technologically advanced OTR tires continues to expand.

Growing Emphasis on Sustainability and Fuel Efficiency

Sustainability is becoming an increasingly important factor in the U.S. OTR tire market. As industries such as construction and agriculture focus on reducing their carbon footprints, the demand for eco-friendly and fuel-efficient OTR tires is growing. Tires that are designed to minimize fuel consumption, reduce emissions, and provide longer service life are gaining traction in the market. For instance, Michelin’s sustainable OTR tire range incorporates 60% recycled materials, while Goodyear has partnered with mining firms to test ultra-durable tire solutions that also focus on environmental impact. Manufacturers are now producing tires with low rolling resistance, which improve fuel efficiency in off-road vehicles, and using sustainable materials to create environmentally friendly tire solutions. The growing emphasis on sustainability is not only aligning with regulatory requirements but also meeting the rising consumer and industry demand for greener alternatives in heavy-duty equipment. This shift towards sustainability is likely to continue driving the market as businesses and governments prioritize eco-conscious decisions in their purchasing and operational practices.

Market Trends:

Expansion of Electric and Hybrid Off-Road Vehicles

One of the emerging trends in the U.S. Off-the-Road (OTR) tire market is the increasing adoption of electric and hybrid off-road vehicles. As industries such as construction and mining seek to reduce their environmental impact, electric and hybrid heavy-duty vehicles are becoming more prevalent. These vehicles require specialized OTR tires designed to handle the specific demands of electric powertrains, including the need for enhanced durability and load-bearing capacity due to heavier battery systems. The shift toward electric and hybrid machinery is driving tire manufacturers to develop innovative solutions that cater to the unique performance requirements of these vehicles, creating new opportunities within the OTR tire market.

Shift Toward Radial Tires for Improved Performance

Another notable trend in the U.S. OTR tire market is the growing preference for radial tires over bias-ply tires. Radial tires, which are designed with a stronger and more flexible structure, offer superior performance in terms of fuel efficiency, durability, and traction. In the construction and mining industries, where vehicles face rough and unpredictable terrains, radial tires are increasingly becoming the preferred option. Their ability to provide longer tire life, better heat dissipation, and improved fuel economy is making them highly sought after in off-road applications. As the market continues to evolve, the trend towards radial tires is expected to gain momentum, further solidifying their role in the OTR tire market.

Integration of Smart Tire Technology

The integration of smart tire technology is becoming a significant trend in the U.S. OTR tire market. Manufacturers are increasingly embedding sensors and other digital technologies into OTR tires, allowing for real-time monitoring of tire performance. These smart tires are equipped with sensors that track parameters such as tire pressure, temperature, and wear, enabling operators to make timely adjustments and reduce the risk of tire failure. For instance, Goodyear, for instance, has introduced its SightLine technology, which integrates sensors directly into tires to monitor road conditions and tire performance; this system is designed to support both traditional and autonomous vehicles by providing critical operational data. This technology is particularly beneficial in industries like mining and construction, where equipment downtime can result in costly delays. As more OTR tire manufacturers invest in smart tire solutions, the market is witnessing the growing adoption of these high-tech products, which enhance both safety and operational efficiency.

Increased Demand for Sustainable Materials

The demand for sustainable materials in the production of OTR tires is another key trend shaping the market. With the growing emphasis on sustainability across industries, tire manufacturers are increasingly focusing on developing eco-friendly OTR tires that use renewable or recycled materials. For example, GRI launched its GREEN XLR EARTH series and ULTIMATE GREEN XT specialty tires in March 2024, featuring up to 93.5% sustainable material content, demonstrating a strong commitment to eco-friendly innovation. These sustainable tires are designed to reduce environmental impact by minimizing carbon emissions, improving recyclability, and lowering the use of non-renewable resources. For instance, manufacturers are incorporating sustainable compounds such as natural rubber and bio-based oils to replace traditional petroleum-based materials. As the push for sustainability intensifies, this trend is likely to continue to influence the design and production of OTR tires in the U.S. market.

Market Challenges Analysis:

High Production Costs

One of the key restraints in the U.S. Off-the-Road (OTR) tire market is the high production costs associated with manufacturing OTR tires. The complex design, use of high-quality materials, and the need for specialized technologies contribute to the elevated cost of production. For instance, manufacturing an Off-the-Road (OTR) tire in the U.S. costs about $17.37 per unit, with rubber and steel cord as the major components. Manufacturers often face challenges in sourcing the raw materials, such as natural rubber and steel, which are subject to price volatility. These higher production costs ultimately result in higher prices for end-users, making it difficult for small and mid-sized businesses to invest in premium OTR tires. As a result, some companies opt for lower-cost alternatives, which may not offer the same performance or durability, potentially impacting the market’s growth.

Supply Chain Disruptions

Supply chain disruptions represent another challenge for the U.S. OTR tire market. The industry relies heavily on a complex network of global suppliers for raw materials and components. Any disruptions in the supply chain—due to factors such as geopolitical tensions, natural disasters, or trade restrictions—can lead to delays in production and delivery. Additionally, the COVID-19 pandemic highlighted the vulnerability of global supply chains, with tire manufacturers facing challenges in securing components and materials on time. Such disruptions not only lead to production delays but can also increase operational costs, further hindering market growth.

Technological Barriers to Innovation

While technological advancements are driving growth in the OTR tire market, there are significant barriers to innovation. Developing new tire technologies, such as smart tire systems or sustainable materials, requires substantial investment in research and development. Smaller tire manufacturers, in particular, may struggle to allocate the necessary resources for innovation. This technological gap can limit the ability of some companies to compete in a market that increasingly demands high-performance and eco-friendly tire solutions. The challenge lies in balancing innovation with cost-effectiveness, particularly in an industry that operates on tight margins.

Market Opportunities:

The growing adoption of electric and hybrid off-road vehicles presents a significant opportunity for the U.S. Off-the-Road (OTR) tire market. As industries such as construction and mining continue to prioritize sustainability and reduce their carbon footprint, the shift towards electric-powered heavy machinery is gaining momentum. Electric and hybrid vehicles require specialized tires that can support the unique demands of electric powertrains, including handling the additional weight of batteries and providing better energy efficiency. This shift is creating a new market for OTR tire manufacturers, who can innovate by developing tires that cater to these evolving requirements. With major infrastructure projects underway and the increasing demand for eco-friendlier alternatives in heavy machinery, the U.S. OTR tire market stands to benefit from this growing trend.

Another promising opportunity lies in the integration of smart tire technology and the growing focus on sustainability. With increasing demand for data-driven tire performance and monitoring, smart tire technology is becoming more essential for industries that rely on off-road machinery. Tires equipped with sensors to monitor tire pressure, temperature, and wear can help prevent failures, improve safety, and reduce maintenance costs. Additionally, the rising emphasis on sustainability provides tire manufacturers with the opportunity to develop eco-friendly solutions. Tires made from recycled materials or those designed to reduce fuel consumption can attract businesses seeking to align with environmental goals. Both of these trends offer significant growth potential for OTR tire manufacturers, positioning them to capture a larger share of the market through innovation and sustainability efforts.

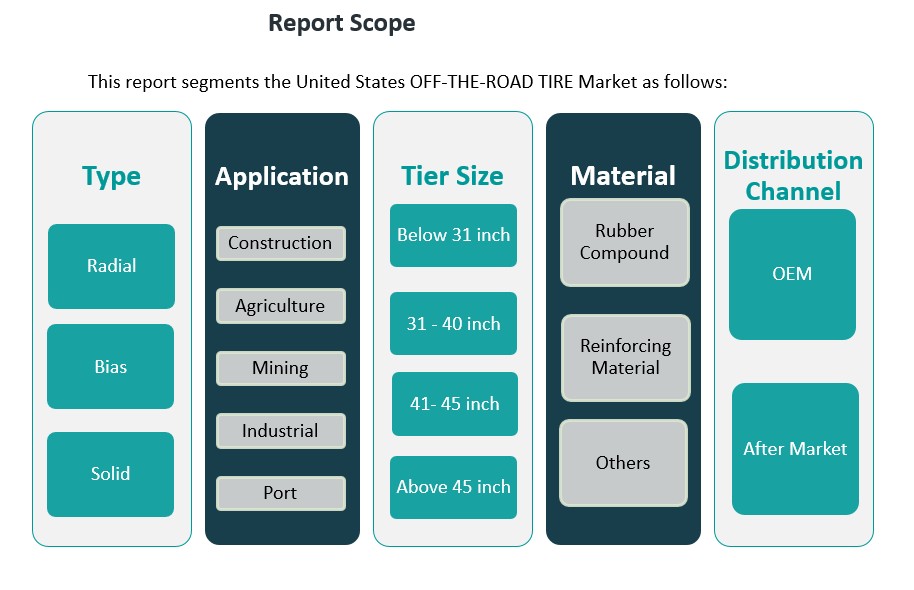

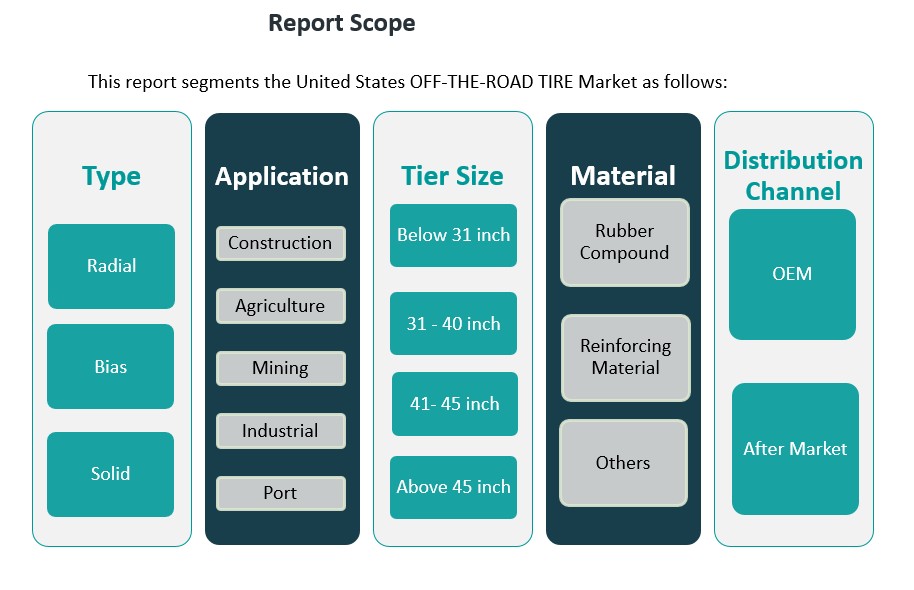

Market Segmentation Analysis:

By Type Segment

The U.S. Off-the-Road (OTR) tire market is divided into three main types: radial, bias, and solid tires. Radial tires dominate the market due to their superior performance in terms of durability, fuel efficiency, and heat dissipation, making them the preferred choice for industries such as construction and mining. Bias tires, although less commonly used, still hold a significant share due to their cost-effectiveness and reliability in certain applications. Solid tires, known for their durability and ability to withstand extreme conditions, are widely used in industrial and port operations, where the risk of punctures is high.

By Application Segment

The market is segmented by application into construction, agriculture, mining, industrial, and port sectors. The construction sector is a major contributor, driving demand for heavy-duty OTR tires used in bulldozers, cranes, and excavators. The agriculture segment benefits from the mechanization of farming, with tires required for tractors and harvesters. The mining sector also demands robust OTR tires capable of handling rough terrain and heavy loads, while the industrial segment primarily requires tires for material handling equipment. The port sector also represents a niche application, with solid tires being the preferred option for equipment used in handling containers.

By Tire Size Segment

Tires are available in various sizes, including below 31 inches, 31-40 inches, 41-45 inches, and above 45 inches. Larger tires, particularly those above 45 inches, are typically used in construction and mining vehicles that need to support heavy loads and navigate rough terrain. Smaller tires, such as those below 31 inches, are commonly used in agricultural equipment, where maneuverability is key.

By Material Segment

The materials used in OTR tire production include rubber compounds, reinforcing materials, and other specialized components. Rubber compounds provide flexibility and durability, while reinforcing materials such as steel offer strength and support for heavy-duty applications. The choice of material directly influences the tire’s performance, longevity, and cost.

By Distribution Channel Segment

The distribution of OTR tires occurs through two primary channels: OEM (Original Equipment Manufacturer) and aftermarket. OEM tires are supplied directly to manufacturers of heavy machinery and equipment, while aftermarket tires are sold to end-users for replacement and maintenance. The aftermarket segment is growing as industries seek to replace worn-out tires, ensuring continuous operations without equipment downtime.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The U.S. Off-the-Road (OTR) tire market exhibits regional variations in demand, driven by factors such as industry concentration, infrastructure development, and agricultural activity. The major regions in the U.S. include the Northeast, Midwest, South, and West, each contributing to the overall growth and diversification of the market.

Northeast Region

The Northeast region of the U.S. holds a significant portion of the OTR tire market, contributing to approximately 20% of the market share. This region is heavily influenced by urbanization, with substantial construction projects driving the demand for heavy machinery, and consequently, OTR tires. The presence of large metropolitan areas, coupled with ongoing infrastructure development and expansion, fosters demand for durable and high-performance tires. Additionally, the agriculture and mining industries, although less concentrated here compared to other regions, still contribute to the market share through specialized off-road equipment.

Midwest Region

The Midwest is another key player in the U.S. OTR tire market, accounting for around 25% of the market share. The region’s strong agricultural presence makes it a major consumer of OTR tires, particularly for tractors, harvesters, and other farming equipment. The Midwest is also home to a growing number of mining operations, where heavy-duty OTR tires are critical for machinery handling rough and rocky terrains. The region’s industrial activities, including manufacturing and material handling, further increase the demand for reliable OTR tire solutions, especially in sectors like steel production and automotive manufacturing.

South Region

The South region leads the U.S. OTR tire market with the largest share, contributing approximately 30%. The extensive agricultural activities across states like Texas, Florida, and Georgia ensure a continuous demand for OTR tires, especially in the agricultural sector. Furthermore, the South has witnessed significant infrastructure projects, including highways, ports, and rail networks, further stimulating demand for OTR tires. The construction sector in the South is particularly robust, with numerous urban development projects driving the use of construction machinery requiring durable OTR tires. Additionally, the mining sector in the Appalachian Mountains and other areas further bolsters the demand for OTR tires in this region.

West Region

The West region accounts for roughly 25% of the market share and is characterized by its diverse industries, including construction, agriculture, and mining. California, in particular, is a major hub for agriculture, where tractors and harvesters are essential for large-scale crop production. The construction industry, driven by urban expansion and infrastructure upgrades, fuels the demand for OTR tires as well. The mining sector in Western states, particularly in Nevada, further contributes to the region’s demand for heavy-duty OTR tires capable of withstanding harsh conditions.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Hankook Tire

Competitive Analysis:

The U.S. Off-the-Road (OTR) tire market is highly competitive, with key players including global tire manufacturers such as Michelin, Bridgestone, Goodyear, Continental, and Titan International. These companies dominate the market through their extensive product portfolios, which cater to various off-road applications, including construction, mining, agriculture, and industrial sectors. Innovation in tire technology, such as the development of smart tires with integrated sensors for real-time performance monitoring, is a critical competitive factor. Additionally, manufacturers are increasingly focusing on sustainability, offering eco-friendly and fuel-efficient tire solutions to meet environmental regulations and market demands. Strong distribution networks and partnerships with original equipment manufacturers (OEMs) further strengthen the market presence of these players. The competitive landscape also sees smaller, regional players vying for market share by offering specialized tires that meet the unique demands of specific industries or geographic regions.

Recent Developments:

- In February 2025, Yokohama Rubber completed its acquisition of Goodyear’s Off-the-Road (OTR) tire business, which specializes in mining and construction tires. This strategic move, announced in July 2024 and finalized on February 4, 2025, allows Yokohama to expand its OTR product lineup and production capabilities, while Goodyear continues to focus on its core operations and transformation strategy.

- In March 2024, Goodyear launched the RL-5K OTR tire, a new product designed for heavy-duty loaders and wheel dozers. This tire features a three-star load capacity rating, enhancing durability and performance for demanding operations. The RL-5K showcases Goodyear’s commitment to innovation in OTR tire technology, focusing on efficiency, durability, and operational performance to meet the needs of mining and construction industries.

Market Concentration & Characteristics:

The U.S. Off-the-Road (OTR) tire market is moderately concentrated, with a few dominant global players commanding a significant share of the market. Key companies like Michelin, Bridgestone, Goodyear, and Continental hold the majority of the market share, benefiting from their established brand reputation, wide distribution networks, and extensive product offerings. These companies lead through innovation, offering high-performance tires designed for various off-road applications, including construction, mining, and agriculture. However, the market also features a number of smaller, regional manufacturers that focus on specialized tires to meet specific customer needs, such as enhanced durability or eco-friendly options. The market is characterized by a high level of competition, with players focusing on technological advancements, tire longevity, and cost-efficiency to differentiate themselves. Ongoing trends like the shift to electric vehicles and the growing demand for smart tire technology are shaping the competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Off-the-Road (OTR) tire market is expected to grow steadily, driven by increased infrastructure and construction activities.

- Advancements in tire technology, such as smart tires with embedded sensors, will enhance safety and efficiency.

- The demand for eco-friendly and fuel-efficient OTR tires will rise as industries prioritize sustainability.

- The shift towards electric and hybrid off-road vehicles will create new opportunities for specialized tire solutions.

- Strong growth in the agricultural sector, fueled by mechanization, will increase the need for durable OTR tires.

- The mining industry’s expansion, particularly in remote locations, will drive demand for high-performance tires.

- The port and industrial sectors will continue to rely on solid tires for their durability and performance in heavy-duty applications.

- Regional disparities will remain, with the South contributing the largest share due to its strong agricultural and construction sectors.

- Tire manufacturers will focus on improving cost-efficiency and tire longevity to meet customer demands for lower operational costs.

- The competitive landscape will evolve, with smaller players capitalizing on niche markets and specialized products.