Market Overview

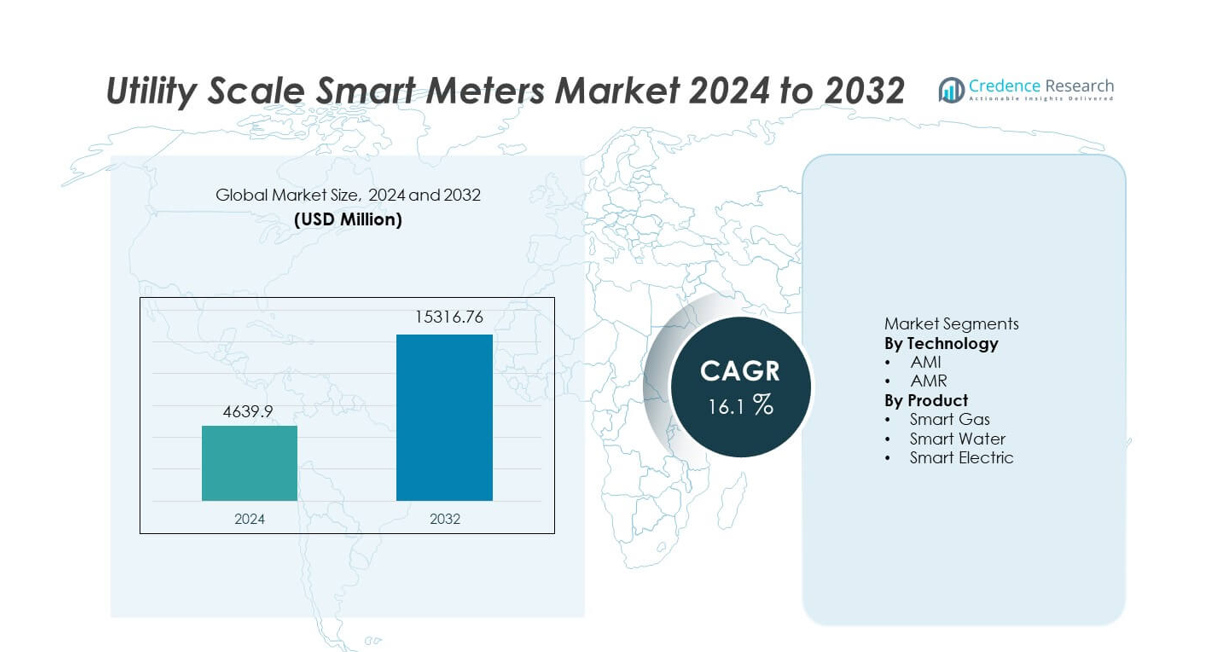

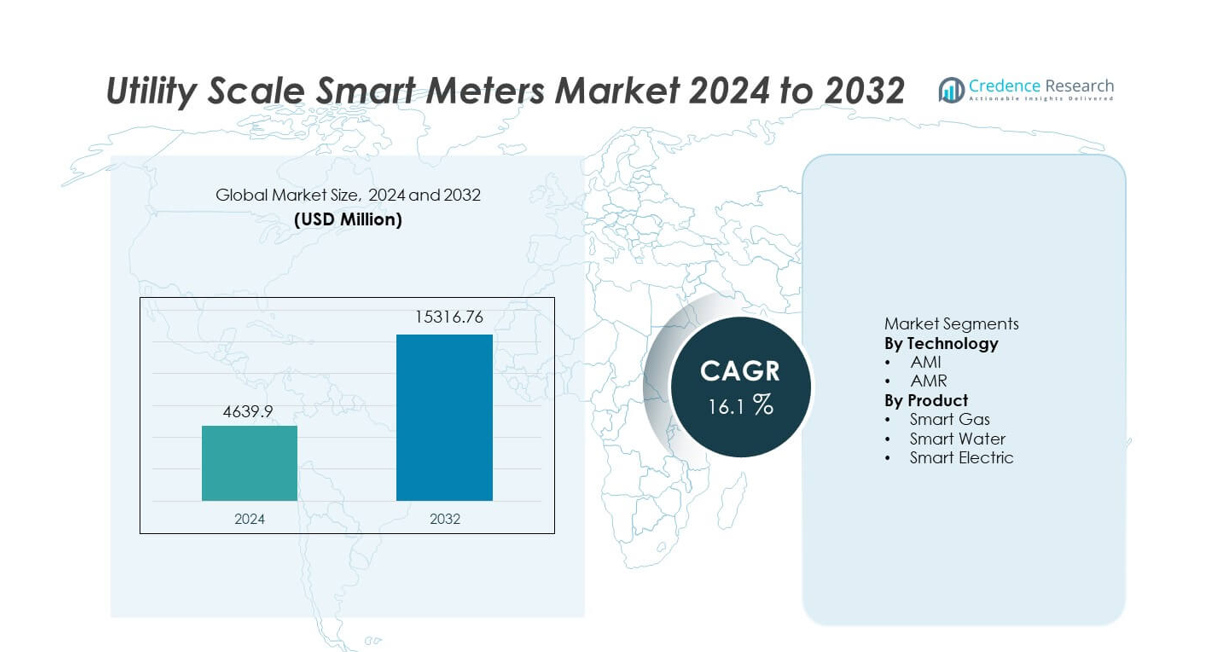

The Utility Scale Smart Meters market was valued at USD 4,639.9 million in 2024 and is projected to reach USD 15,316.76 million by 2032, registering a CAGR of 16.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Utility Scale Smart Meters Market Size 2024 |

USD 4,639.9 million |

| Utility Scale Smart Meters Market, CAGR |

16.1% |

| Utility Scale Smart Meters Market Size 2032 |

USD 15,316.76 million |

The Utility Scale Smart Meters market features leading players such as Itron, Landis+Gyr, Siemens AG, Schneider Electric, Honeywell International, ABB Ltd., Kamstrup, Aclara Technologies, Sensus (Xylem), and Badger Meter. These companies compete through large-scale AMI deployments, advanced communication platforms, and strong utility partnerships. Asia Pacific leads the market with an exact share of 34.6%, driven by national smart grid programs, urbanization, and large rollout initiatives in China and India. North America follows with a 28.4% share, supported by early adoption, grid modernization, and replacement of legacy meters. Europe holds a 25.1% share, driven by regulatory mandates, energy efficiency goals, and widespread AMI implementation. Competitive focus remains on scalability, data analytics, cybersecurity, and long-term utility service contracts.

Market Insights

- The Utility Scale Smart Meters market was valued at USD 4,639.9 million in 2024 and is projected to grow at a CAGR of 16.1% during the forecast period.

- Strong growth is driven by government mandates, smart grid programs, rising energy efficiency targets, and the need to reduce technical and non-technical losses across utility networks.

- AMI technology dominates the technology segment with a market share of 68.9%, while smart electric meters lead the product segment with a share of 61.4%, supported by large-scale electricity metering rollouts.

- Competitive activity remains intense, with leading players focusing on AMI platforms, data analytics, cybersecurity, and long-term utility contracts, while regional players compete through cost efficiency and localized deployment.

- Asia Pacific leads regional demand with a 34.6% market share, followed by North America at 28.4% and Europe at 25.1%, driven by national rollout programs, grid modernization, and replacement of legacy meters.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The Utility Scale Smart Meters market, by technology, includes AMI and AMR, with AMI dominating with a market share of 68.9%. Utilities increasingly deploy Advanced Metering Infrastructure due to two-way communication, real-time data access, and remote control capabilities. AMI supports outage management, demand response, and dynamic pricing, which strengthens grid efficiency. Government mandates for smart grid deployment and rising investments in digital utility infrastructure further accelerate adoption. AMR remains relevant in basic meter reading applications, but limited functionality and lack of real-time interaction restrict growth. Strong focus on grid automation and data-driven operations continues to position AMI as the leading technology.

- For instance, Landis+Gyr’s AMR solutions support daily automated reads exceeding 24 read cycles per meter, which limits advanced grid applications.

By Product

By product type, the market segments into smart gas, smart water, and smart electric meters, with smart electric meters holding the largest share at 61.4%. Electric utilities prioritize smart electric meters to manage peak loads, reduce losses, and support renewable energy integration. Rising electricity consumption and large-scale rollout programs drive installations across urban and rural regions. Smart gas and smart water meters gain adoption for resource efficiency and leakage detection, but deployment volumes remain lower. Expansion of smart grid initiatives and regulatory support continue to anchor smart electric meters as the dominant product segment.

- For instance, Badger Meter’s smart water meters enable leak detection at flow rates as low as 0.03 gallons per minute, supporting early fault identification in distribution systems.

Key Growth Drivers

Government Mandates and Smart Grid Programs

Government mandates strongly drive adoption of utility scale smart meters. Many countries require utilities to replace legacy meters with digital systems. These programs support accurate billing, energy efficiency, and grid transparency. Utilities deploy smart meters to comply with regulatory timelines and reporting standards. Public funding and incentive schemes further accelerate rollout. Large-scale national smart grid projects increase installation volumes. Regulatory pressure remains a core growth driver for sustained market expansion.

- For instance, Itron delivered utility-scale AMI deployments supporting more than 10,000,000 smart meters, with systems capable of collecting interval data every 15 minutes and enabling remote connect and disconnect within seconds.

Rising Demand for Energy Efficiency and Loss Reduction

Utilities face growing pressure to reduce technical and non-technical losses. Smart meters enable real-time monitoring of consumption and grid performance. Utilities use advanced data to detect theft, outages, and inefficiencies. Improved demand forecasting supports better load management. These capabilities reduce operational costs and improve service reliability. Rising electricity consumption increases the need for efficient energy management. This efficiency-driven focus supports strong smart meter adoption.

- For instance, Schneider Electric deployed advanced smart meters equipped with high-precision current and voltage monitoring capabilities, enabling utilities to accurately identify and reduce technical losses across their distribution feeders.

Integration of Renewable Energy and Distributed Resources

Renewable energy integration increases grid complexity and variability. Smart meters support two-way communication and real-time data flow. Utilities use this data to manage distributed generation and demand response programs. Smart meters improve visibility across low-voltage networks. Expansion of solar and storage systems strengthens deployment needs. Grid flexibility requirements continue to drive market growth.

Key Trends and Opportunities

Shift Toward Advanced Metering Infrastructure Solutions

Utilities increasingly replace AMR systems with AMI platforms. AMI enables remote monitoring, outage detection, and dynamic pricing. Utilities benefit from improved customer engagement and grid automation. Integration with analytics platforms enhances decision-making. Large-scale AMI rollouts create long-term growth opportunities. This transition supports higher-value smart meter deployments.

- For instance, Aclara Technologies deployed AMI systems supporting more than 6,000,000 electric meters, with two-way communication latency below 5 seconds and interval data capture at 15-minute granularity.

Expansion of Multi-Utility Smart Meter Deployments

Utilities deploy smart meters across electricity, gas, and water networks. Integrated platforms improve resource management and billing efficiency. Urban infrastructure projects support multi-utility installations. Smart cities initiatives increase adoption across services. Vendors offering interoperable solutions gain competitive advantage. This trend expands addressable market scope.

- For instance, Kamstrup implemented multi-utility smart metering platforms supporting electricity meters rated up to 100 amperes, gas meters with hourly consumption logging, and water meters detecting flow changes as low as 0.02 cubic meters per hour.

Key Challenges

High Initial Deployment and Infrastructure Costs

Utility scale smart meter deployment requires high upfront investment. Costs include devices, communication networks, and IT systems. Budget constraints delay projects in developing regions. Long payback periods impact investment decisions. Utilities must justify capital expenditure through efficiency gains. Cost sensitivity remains a key adoption barrier.

Data Security and Privacy Concerns

Smart meters generate large volumes of consumer data. Utilities face increasing cybersecurity and privacy risks. Data breaches damage trust and regulatory compliance. Secure communication and storage increase system complexity. Compliance with data protection laws adds operational burden. Security concerns continue to challenge widespread deployment.

Regional Analysis

North America

North America holds a market share of 28.4% in the Utility Scale Smart Meters market. Strong adoption comes from the United States and Canada due to early smart grid investments and regulatory support. Utilities focus on AMI deployments to improve outage management, billing accuracy, and demand response. Replacement of aging metering infrastructure supports steady installations. High penetration of renewable energy and electric vehicles increases the need for real-time consumption data. Federal and state-level funding programs further accelerate rollout. Advanced communication infrastructure supports large-scale smart meter integration across utility networks.

Europe

Europe accounts for 25.1% of the global Utility Scale Smart Meters market share. Mandatory rollout programs across countries such as the United Kingdom, France, Italy, and Germany drive adoption. Utilities deploy smart meters to meet energy efficiency targets and consumer transparency requirements. Strong focus on decarbonization and dynamic pricing supports AMI penetration. Integration with smart home and demand-side management systems strengthens value. Replacement of legacy meters remains a key driver. Harmonized regulatory frameworks and cross-border energy initiatives sustain regional market growth.

Asia Pacific

Asia Pacific leads the market with a share of 34.6%. Rapid urbanization, population growth, and rising electricity demand drive large-scale smart meter deployments. China, India, Japan, and South Korea lead installations through national digital grid programs. Utilities focus on reducing losses and improving billing efficiency. Government-backed smart city initiatives support multi-utility meter adoption. Expansion of renewable energy further increases demand for real-time monitoring. Strong manufacturing capacity and public investment position Asia Pacific as the fastest-growing regional market.

Latin America

Latin America holds a market share of 7.2% in the Utility Scale Smart Meters market. Countries such as Brazil, Mexico, and Chile invest in smart metering to reduce electricity theft and improve revenue collection. Utilities deploy smart meters to enhance grid visibility and operational control. Renewable energy expansion increases the need for advanced metering. Budget constraints slow rapid rollout, but pilot projects continue to expand. Regulatory reforms and digital utility strategies support gradual market growth across the region.

Middle East & Africa

The Middle East & Africa region accounts for 4.7% of the global market share. Smart meter adoption is driven by utility modernization programs in Gulf countries. Utilities deploy advanced meters to manage peak demand and support smart city projects. High electricity consumption and infrastructure upgrades support installations. In Africa, rollout remains limited but growing due to electrification initiatives. Focus on reducing losses and improving billing accuracy supports demand. Long-term infrastructure development underpins steady regional expansion.

Market Segmentations:

By Technology

By Product

- Smart Gas

- Smart Water

- Smart Electric

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights a highly competitive and innovation-driven market led by Itron, Landis+Gyr, Siemens AG, Schneider Electric, Honeywell International, ABB Ltd., Kamstrup, Aclara Technologies, Sensus (Xylem), and Badger Meter. These players compete through large-scale AMI deployments, advanced communication technologies, and strong utility partnerships. Leading companies focus on end-to-end smart metering platforms that integrate data analytics, outage management, and demand response. Investments in cybersecurity, interoperability, and cloud-based meter data management strengthen differentiation. Global vendors benefit from established regulatory compliance experience and long-term utility contracts, while regional players compete through cost efficiency and localized customization. Continuous upgrades in communication standards and meter accuracy support competitive positioning. Strategic collaborations with telecom providers and smart grid integrators further enhance market reach. Innovation, scalability, and service reliability remain central to competition in the Utility Scale Smart Meters market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Itron, Inc.

- Landis+Gyr

- Siemens AG

- Schneider Electric

- Honeywell International Inc.

- ABB Ltd.

- Kamstrup A/S

- Aclara Technologies LLC

- Sensus (Xylem Inc.)

- Badger Meter, Inc.

Recent Developments

- In March 2025, Honeywell International, Inc. introduced the NXU Residential Smart Gas Meter, designed to help protect gas customers and utilities across North America through automation and remote operability.

- In March 2025, Itron and CHINT Global introduced the first residential electric smart meter based on the DLMS User Association’s AC Electricity Smart Meter (ACESM) Generic Companion Profile (GCP) standard.

- In November 2024, Landis+Gyr announced a five-year agreement with Horizon Energy Infrastructure to support the UK’s smart meter rollout beyond 2026

Report Coverage

The research report offers an in-depth analysis based on Technology, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Large-scale smart meter rollouts will continue across utility networks.

- AMI platforms will replace legacy metering technologies.

- Utilities will expand demand response and dynamic pricing programs.

- Renewable energy integration will increase real-time monitoring needs.

- Data analytics will play a larger role in grid decision-making.

- Cybersecurity investment will remain a priority for utilities.

- Asia Pacific will sustain the highest deployment growth.

- Multi-utility metering solutions will gain wider adoption.

- Smart city initiatives will accelerate meter installations.

- Competition will intensify through innovation, scale, and service reliability.