Table of Content

1. Preface

1.1. Report Description

1.1.1. Purpose of the Report

1.1.2. Target Audience

1.1.3. USP and Key Offerings

1.2. Research Scope

1.3. Market Introduction

2. Executive Summary

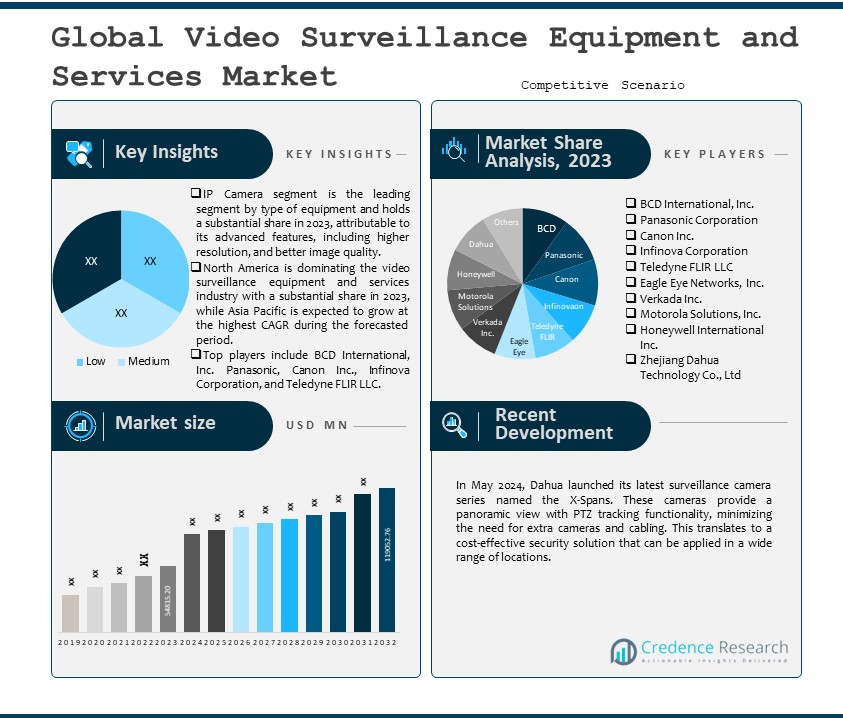

2.1. Market Snapshot: Global Video Surveillance Equipment and Services Market

2.1.1. Global Video Surveillance Equipment and Services Market, By Type of Equipment

2.1.2. Global Video Surveillance Equipment and Services Market, By Service Offerings

2.1.3. Global Video Surveillance Equipment and Services Market, By End-User Industries

2.1.4. Global Video Surveillance Equipment and Services Market, By Region

2.2. Insights from Primary Respondents

3. Market Dynamics & Factors Analysis

3.1. Introduction

3.1.1. Global Video Surveillance Equipment and Services Market Value, 2019-2032, (US$ Mn)

3.1.2. Y-o-Y Growth Trend Analysis

3.2. Market Dynamics

3.2.1. Video Surveillance Equipment and Services Market Drivers

3.2.2. Video Surveillance Equipment and Services Market Restraints

3.2.3. Video Surveillance Equipment and Services Market Opportunities

3.2.4. Major Video Surveillance Equipment and Services Industry Challenges

3.3. Growth and Development Patterns

3.4. Investment Feasibility Analysis

3.5. Market Opportunity Analysis

3.5.1. Type of Equipment

3.5.2. Service Offerings

3.5.3. End-User Industries

3.5.4. Geography

4. Market Competitive Landscape Analysis

4.1. Company Market Share Analysis, 2023

4.1.1. Global Video Surveillance Equipment and Services Market: Company Market Share, Value 2023

4.1.2. Global Video Surveillance Equipment and Services Market: Top 6 Company Market Share, Value 2023

4.1.3. Global Video Surveillance Equipment and Services Market: Top 3 Company Market Share, Value 2023

4.2. Global Video Surveillance Equipment and Services Market: Company Revenue Share Analysis, 2023

4.3. Company Assessment Metrics, 2023

4.3.1. Stars

4.3.2. Emerging Leaders

4.3.3. Pervasive Players

4.3.4. Participants

4.4. Startups/ SMEs Assessment Metrics, 2023

4.4.1. Progressive Companies

4.4.2. Responsive Companies

4.4.3. Dynamic Companies

4.4.4. Starting Blocks

4.5. Strategic Development

4.5.1. Acquisition and Mergers

4.5.2. New Product Launch

4.5.3. Regional Expansion

4.5.4. Partnerships

4.6. Key Player Product Matrix

4.7. Potential for New Players in the Global Video Surveillance Equipment and Services Market

5. Premium Insights

5.1. STAR (Situation, Task, Action, Results) Analysis

5.2. Porter’s Five Forces Analysis

5.2.1. Threat of New Entrants

5.2.2. Bargaining Power of Buyers/Consumers

5.2.3. Bargaining Power of Suppliers

5.2.4. Threat of Substitute Types

5.2.5. Intensity of Competitive Rivalry

5.3. PESTEL Analysis

5.3.1. Political Factors

5.3.2. Economic Factors

5.3.3. Social Factors

5.3.4. Technological Factors

5.3.5. Environmental Factors

5.3.6. Legal Factors

5.4. Key Market Trends

5.4.1. Demand Side Trends

5.4.2. Supply Side Trends

5.5. Value Chain Analysis

5.6. Technology Analysis

5.6.1. Research and development in the global market

5.6.2. Patent Analysis

5.6.3. Emerging technologies and their potential disruption to the market

5.7. Consumer Behaviour Analysis

5.7.1. Consumer Preferences and Expectations

5.7.2. Factors Influencing Consumer Buying Decisions

5.7.2.1. North America

5.7.2.2. Europe

5.7.2.3. Asia Pacific

5.7.2.4. Latin America

5.7.2.5. Middle East and Africa

5.7.3. Consumer Pain Points

5.8. Analysis and Recommendations

5.9. Adjacent Market Analysis

6. Market Positioning of Key Players, 2023

6.1. Company market share of key players, 2023

6.2. Competitive Benchmarking

6.3. Market Positioning of Key Vendors

6.4. Geographical Presence Analysis

6.5. Major Strategies Adopted by Key Players

6.5.1. Key Strategies Analysis

6.5.2. Mergers and Acquisitions

6.5.3. Partnerships

6.5.4. Product Launch

6.5.5. Geographical Expansion

6.5.6. Others

7. Impact Analysis of COVID 19 and Russia – Ukraine War on Video Surveillance Equipment and Services Market

7.1. Ukraine-Russia War Impact

7.1.1. Uncertainty and Economic Instability

7.1.2. Supply chain disruptions

7.1.3. Regional market shifts

7.1.4. Shift in government priorities

7.2. COVID-19 Impact Analysis

7.2.1. Supply Chain Disruptions

7.2.2. Demand Fluctuations

7.2.3. Shift in Product Mix

7.2.4. Reduced Industrial Activity

7.2.5. Regional Impact Analysis

7.2.5.1. North America

7.2.5.2. Europe

7.2.5.3. Asia Pacific

7.2.5.4. Latin America

7.2.5.5. Middle East and Africa

8. Global Video Surveillance Equipment and Services Market, By Type of Equipment

8.1. Global Video Surveillance Equipment and Services Market Overview, by Type of Equipment

8.1.1. Global Video Surveillance Equipment and Services Market Revenue Share, By Type of Equipment, 2023 Vs 2032 (in %)

8.2. Cameras

8.2.1. Global Video Surveillance Equipment and Services Market, By Cameras, By Region, 2019-2032 (US$ Mn)

8.2.2. Market Dynamics for Cameras

8.2.2.1. Drivers

8.2.2.2. Restraints

8.2.2.3. Opportunities

8.2.2.4. Trends

8.3. Analog Cameras

8.3.1. Global Video Surveillance Equipment and Services Market, By Analog Cameras, By Region, 2019-2032 (US$ Mn)

8.3.2. Market Dynamics for Analog Cameras

8.3.2.1. Drivers

8.3.2.2. Restraints

8.3.2.3. Opportunities

8.3.2.4. Trends

8.4. IP Cameras (Network Cameras)

8.4.1. Global Video Surveillance Equipment and Services Market, By IP Cameras (Network Cameras), By Region, 2019-2032 (US$ Mn)

8.4.2. Market Dynamics for IP Cameras (Network Cameras)

8.4.2.1. Drivers

8.4.2.2. Restraints

8.4.2.3. Opportunities

8.4.2.4. Trends

8.5. HD and Ultra HD Cameras

8.5.1. Global Video Surveillance Equipment and Services Market, By HD and Ultra HD Cameras, By Region, 2019-2032 (US$ Mn)

8.5.2. Market Dynamics for HD and Ultra HD Cameras

8.5.2.1. Drivers

8.5.2.2. Restraints

8.5.2.3. Opportunities

8.5.2.4. Trends

8.6. PTZ Cameras (Pan-Tilt-Zoom)

8.6.1. Global Video Surveillance Equipment and Services Market, By PTZ Cameras (Pan-Tilt-Zoom), By Region, 2019-2032 (US$ Mn)

8.6.2. Market Dynamics for PTZ Cameras (Pan-Tilt-Zoom)

8.6.2.1. Drivers

8.6.2.2. Restraints

8.6.2.3. Opportunities

8.6.2.4. Trends

8.7. Video Management Systems (VMS)

8.7.1. Global Video Surveillance Equipment and Services Market, By Video Management Systems (VMS), By Region, 2019-2032 (US$ Mn)

8.7.2. Market Dynamics for Video Management Systems (VMS)

8.7.2.1. Drivers

8.7.2.2. Restraints

8.7.2.3. Opportunities

8.7.2.4. Trends

8.8. Storage Solutions

8.8.1. Global Video Surveillance Equipment and Services Market, By Storage Solutions, By Region, 2019-2032 (US$ Mn)

8.8.2. Market Dynamics for Storage Solutions

8.8.2.1. Drivers

8.8.2.2. Restraints

8.8.2.3. Opportunities

8.8.2.4. Trends

8.9. DVRs (Digital Video Recorders)

8.9.1. Global Video Surveillance Equipment and Services Market, By DVRs (Digital Video Recorders), By Region, 2019-2032 (US$ Mn)

8.9.2. Market Dynamics for DVRs (Digital Video Recorders)

8.9.2.1. Drivers

8.9.2.2. Restraints

8.9.2.3. Opportunities

8.9.2.4. Trends

8.10. NVRs (Network Video Recorders)

8.10.1. Global Video Surveillance Equipment and Services Market, By NVRs (Network Video Recorders), By Region, 2019-2032 (US$ Mn)

8.10.2. Market Dynamics for NVRs (Network Video Recorders)

8.10.2.1. Drivers

8.10.2.2. Restraints

8.10.2.3. Opportunities

8.10.2.4. Trends

8.11. Cloud Storage

8.11.1. Global Video Surveillance Equipment and Services Market, By Cloud Storage, By Region, 2019-2032 (US$ Mn)

8.11.2. Market Dynamics for Cloud Storage

8.11.2.1. Drivers

8.11.2.2. Restraints

8.11.2.3. Opportunities

8.11.2.4. Trends

8.12. Video Analytics

8.12.1. Global Video Surveillance Equipment and Services Market, By Video Analytics, By Region, 2019-2032 (US$ Mn)

8.12.2. Market Dynamics for Video Analytics

8.12.2.1. Drivers

8.12.2.2. Restraints

8.12.2.3. Opportunities

8.12.2.4. Trends

8.13. Accessories

8.13.1. Global Video Surveillance Equipment and Services Market, By Accessories, By Region, 2019-2032 (US$ Mn)

8.13.2. Market Dynamics for Accessories

8.13.2.1. Drivers

8.13.2.2. Restraints

8.13.2.3. Opportunities

8.13.2.4. Trends

9. Global Video Surveillance Equipment and Services Market, By Service Offerings

9.1. Global Video Surveillance Equipment and Services Market Overview, by Service Offerings

9.1.1. Global Video Surveillance Equipment and Services Market Revenue Share, By Service Offerings, 2023 Vs 2032 (in %)

9.2. Installation and Integration Services

9.2.1. Global Video Surveillance Equipment and Services Market, By Installation and Integration Services, By Region, 2019-2032 (US$ Mn)

9.2.2. Market Dynamics for Installation and Integration Services

9.2.2.1. Drivers

9.2.2.2. Restraints

9.2.2.3. Opportunities

9.2.2.4. Trends

9.3. Maintenance and Support Services

9.3.1. Global Video Surveillance Equipment and Services Market, By Maintenance and Support Services, By Region, 2019-2032 (US$ Mn)

9.3.2. Market Dynamics for Maintenance and Support Services

9.3.2.1. Drivers

9.3.2.2. Restraints

9.3.2.3. Opportunities

9.3.2.4. Trends

9.4. Monitoring Services

9.4.1. Global Video Surveillance Equipment and Services Market, By Monitoring Services, By Region, 2019-2032 (US$ Mn)

9.4.2. Market Dynamics for Monitoring Services

9.4.2.1. Drivers

9.4.2.2. Restraints

9.4.2.3. Opportunities

9.4.2.4. Trends

9.5. Managed Services

9.5.1. Global Video Surveillance Equipment and Services Market, By Managed Services, By Region, 2019-2032 (US$ Mn)

9.5.2. Market Dynamics for Managed Services

9.5.2.1. Drivers

9.5.2.2. Restraints

9.5.2.3. Opportunities

9.5.2.4. Trends

10. Global Video Surveillance Equipment and Services Market, By End-User Industries

10.1. Global Video Surveillance Equipment and Services Market Overview, by End-User Industries

10.1.1. Global Video Surveillance Equipment and Services Market Revenue Share, By End-User Industries, 2023 Vs 2032 (in %)

10.2. Commercial

10.2.1. Global Video Surveillance Equipment and Services Market, By Commercial, By Region, 2019-2032 (US$ Mn)

10.2.2. Market Dynamics for Commercial

10.2.2.1. Drivers

10.2.2.2. Restraints

10.2.2.3. Opportunities

10.2.2.4. Trends

10.3. Government & Public Sector

10.3.1. Global Video Surveillance Equipment and Services Market, By Government & Public Sector, By Region, 2019-2032 (US$ Mn)

10.3.2. Market Dynamics for Government & Public Sector

10.3.2.1. Drivers

10.3.2.2. Restraints

10.3.2.3. Opportunities

10.3.2.4. Trends

10.4. Industrial

10.4.1. Global Video Surveillance Equipment and Services Market, By Industrial, By Region, 2019-2032 (US$ Mn)

10.4.2. Market Dynamics for Industrial

10.4.2.1. Drivers

10.4.2.2. Restraints

10.4.2.3. Opportunities

10.4.2.4. Trends

10.5. Residential

10.5.1. Global Video Surveillance Equipment and Services Market, By Residential, By Region, 2019-2032 (US$ Mn)

10.5.2. Market Dynamics for Residential

10.5.2.1. Drivers

10.5.2.2. Restraints

10.5.2.3. Opportunities

10.5.2.4. Trends

10.6. Healthcare & Education

10.6.1. Global Video Surveillance Equipment and Services Market, By Healthcare & Education, By Region, 2019-2032 (US$ Mn)

10.6.2. Market Dynamics for Healthcare & Education

10.6.2.1. Drivers

10.6.2.2. Restraints

10.6.2.3. Opportunities

10.6.2.4. Trends

11. Global Video Surveillance Equipment and Services Market, By Region

11.1. Global Video Surveillance Equipment and Services Market Overview, by Region

11.1.1. Global Video Surveillance Equipment and Services Market, By Region, 2023 vs 2032 (in%)

11.2. Type of Equipment

11.2.1. Global Video Surveillance Equipment and Services Market, By Type of Equipment, 2019-2032 (US$ Mn)

11.3. Service Offerings

11.3.1. Global Video Surveillance Equipment and Services Market, By Service Offerings, 2019-2032 (US$ Mn)

11.4. End-User Industries

11.4.1. Global Video Surveillance Equipment and Services Market, By End-User Industries, 2019-2032 (US$ Mn)

12. North America Video Surveillance Equipment and Services Market Analysis

12.1. Overview

12.1.1. Market Dynamics for North America

12.1.1.1. Drivers

12.1.1.2. Restraints

12.1.1.3. Opportunities

12.1.1.4. Trends

12.2. North America Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2032(US$ Mn)

12.2.1. Overview

12.2.2. SRC Analysis

12.3. North America Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2032(US$ Mn)

12.3.1. Overview

12.3.2. SRC Analysis

12.4. North America Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2032(US$ Mn)

12.4.1. Overview

12.4.2. SRC Analysis

12.5. North America Video Surveillance Equipment and Services Market, by Country, 2019-2032 (US$ Mn)

12.5.1. North America Video Surveillance Equipment and Services Market, by Country, 2023 Vs 2032 (in%)

12.5.2. U.S.

12.5.3. Canada

12.5.4. Mexico

13. Europe Video Surveillance Equipment and Services Market Analysis

13.1. Overview

13.1.1. Market Dynamics for Europe

13.1.1.1. Drivers

13.1.1.2. Restraints

13.1.1.3. Opportunities

13.1.1.4. Trends

13.2. Europe Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2032(US$ Mn)

13.2.1. Overview

13.2.2. SRC Analysis

13.3. Europe Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2032(US$ Mn)

13.3.1. Overview

13.3.2. SRC Analysis

13.4. Europe Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2032(US$ Mn)

13.4.1. Overview

13.4.2. SRC Analysis

13.5. Europe Video Surveillance Equipment and Services Market, by Country, 2019-2032 (US$ Mn)

13.5.1. Europe Video Surveillance Equipment and Services Market, by Country, 2023 Vs 2032 (in%)

13.5.2. Germany

13.5.3. French

13.5.4. UK

13.5.5. Italy

13.5.6. Spain

13.5.7. Benelux

13.5.8. Russia

13.5.9. Rest of Europe

14. Asia Pacific Video Surveillance Equipment and Services Market Analysis

14.1. Overview

14.1.1. Market Dynamics for Asia Pacific

14.1.1.1. Drivers

14.1.1.2. Restraints

14.1.1.3. Opportunities

14.1.1.4. Trends

14.2. Asia Pacific Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2032(US$ Mn)

14.2.1. Overview

14.2.2. SRC Analysis

14.3. Asia Pacific Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2032(US$ Mn)

14.3.1. Overview

14.3.2. SRC Analysis

14.4. Asia Pacific Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2032(US$ Mn)

14.4.1. Overview

14.4.2. SRC Analysis

14.5. Asia Pacific Video Surveillance Equipment and Services Market, by Country, 2019-2032 (US$ Mn)

14.5.1. Asia Pacific Video Surveillance Equipment and Services Market, by Country, 2023 Vs 2032 (in%)

14.5.2. China

14.5.3. Japan

14.5.4. India

14.5.5. South Korea

14.5.6. South East Asia

14.5.7. Rest of Asia Pacific

15. Latin America Video Surveillance Equipment and Services Market Analysis

15.1. Overview

15.1.1. Market Dynamics for Latin America

15.1.1.1. Drivers

15.1.1.2. Restraints

15.1.1.3. Opportunities

15.1.1.4. Trends

15.2. Latin America Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2032(US$ Mn)

15.2.1. Overview

15.2.2. SRC Analysis

15.3. Latin America Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2032(US$ Mn)

15.3.1. Overview

15.3.2. SRC Analysis

15.4. Latin America Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2032(US$ Mn)

15.4.1. Overview

15.4.2. SRC Analysis

15.5. Latin America Video Surveillance Equipment and Services Market, by Country, 2019-2032 (US$ Mn)

15.5.1. Latin America Video Surveillance Equipment and Services Market, by Country, 2023 Vs 2032 (in%)

15.5.2. Brazil

15.5.3. Argentina

15.5.4. Rest of Latin America

16. Middle East Video Surveillance Equipment and Services Market Analysis

16.1. Overview

16.1.1. Market Dynamics for Middle East

16.1.1.1. Drivers

16.1.1.2. Restraints

16.1.1.3. Opportunities

16.1.1.4. Trends

16.2. Middle East Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2032(US$ Mn)

16.2.1. Overview

16.2.2. SRC Analysis

16.3. Middle East Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2032(US$ Mn)

16.3.1. Overview

16.3.2. SRC Analysis

16.4. Middle East Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2032(US$ Mn)

16.4.1. Overview

16.4.2. SRC Analysis

16.5. Middle East Video Surveillance Equipment and Services Market, by Country, 2019-2032 (US$ Mn)

16.5.1. Middle East Video Surveillance Equipment and Services Market, by Country, 2023 Vs 2032 (in%)

16.5.2. UAE

16.5.3. Saudi Arabia

16.5.4. Rest of Middle East

17. Africa Video Surveillance Equipment and Services Market Analysis

17.1. Overview

17.1.1. Market Dynamics for Africa

17.1.1.1. Drivers

17.1.1.2. Restraints

17.1.1.3. Opportunities

17.1.1.4. Trends

17.2. Africa Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2032(US$ Mn)

17.2.1. Overview

17.2.2. SRC Analysis

17.3. Africa Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2032(US$ Mn)

17.3.1. Overview

17.3.2. SRC Analysis

17.4. Africa Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2032(US$ Mn)

17.4.1. Overview

17.4.2. SRC Analysis

17.5. Africa Video Surveillance Equipment and Services Market, by Country, 2019-2032 (US$ Mn)

17.5.1. Middle East Video Surveillance Equipment and Services Market, by Country, 2023 Vs 2032 (in%)

17.5.2. South Africa

17.5.3. Egypt

17.5.4. Rest of Africa

18. Company Profiles

18.1. BCD International, Inc.

18.1.1. Company Overview

18.1.2. Products/Services Portfolio

18.1.3. Geographical Presence

18.1.4. SWOT Analysis

18.1.5. Financial Summary

18.1.5.1. Market Revenue and Net Profit (2019-2023)

18.1.5.2. Business Segment Revenue Analysis

18.1.5.3. Geographical Revenue Analysis

18.2. Panasonic Corporation

18.3. Canon Inc.

18.4. Infinova Corporation

18.5. Teledyne FLIR LLC

18.6. Eagle Eye Networks, Inc.

18.7. Verkada Inc.

18.8. Motorola Solutions, Inc.

18.9. Honeywell International Inc.

18.10. Zhejiang Dahua Technology Co., Ltd.

19. Research Methodology

19.1. Research Methodology

19.2. Phase I – Secondary Research

19.3. Phase II – Data Modelling

19.3.1. Company Share Analysis Model

19.3.2. Revenue Based Modelling

19.4. Phase III – Primary Research

19.5. Research Limitations

19.5.1. Assumptions

List of Figures

FIG. 1 Global Video Surveillance Equipment and Services Market: Research Methodology

FIG. 2 Market Size Estimation – Top Down & Bottom up Approach

FIG. 3 Global Video Surveillance Equipment and Services Market Segmentation

FIG. 4 Global Video Surveillance Equipment and Services Market, by Type of Equipment, 2023 (US$ Mn)

FIG. 5 Global Video Surveillance Equipment and Services Market, by Service Offerings, 2023 (US$ Mn)

FIG. 6 Global Video Surveillance Equipment and Services Market, by End-User Industries, 2023 (US$ Mn)

FIG. 7 Global Video Surveillance Equipment and Services Market, by Geography, 2023 (US$ Mn)

FIG. 8 Attractive Investment Proposition, by Type of Equipment, 2023

FIG. 9 Attractive Investment Proposition, by Service Offerings, 2023

FIG. 10 Attractive Investment Proposition, by End-User Industries, 2023

FIG. 11 Attractive Investment Proposition, by Geography, 2023

FIG. 12 Global Market Share Analysis of Key Video Surveillance Equipment and Services Market Manufacturers, 2023

FIG. 13 Global Market Positioning of Key Video Surveillance Equipment and Services Market Manufacturers, 2023

FIG. 14 Global Video Surveillance Equipment and Services Market Value Contribution, By Type of Equipment, 2023 & 2032 (Value %)

FIG. 15 Global Video Surveillance Equipment and Services Market, by Cameras, Value, 2019-2032 (US$ Mn)

FIG. 16 Global Video Surveillance Equipment and Services Market, by Analog Cameras, Value, 2019-2032 (US$ Mn)

FIG. 17 Global Video Surveillance Equipment and Services Market, by IP Cameras (Network Cameras), Value, 2019-2032 (US$ Mn)

FIG. 18 Global Video Surveillance Equipment and Services Market, by HD and Ultra HD Cameras, Value, 2019-2032 (US$ Mn)

FIG. 19 Global Video Surveillance Equipment and Services Market, by PTZ Cameras (Pan-Tilt-Zoom), Value, 2019-2032 (US$ Mn)

FIG. 20 Global Video Surveillance Equipment and Services Market, by Video Management Systems (VMS), Value, 2019-2032 (US$ Mn)

FIG. 21 Global Video Surveillance Equipment and Services Market, by Storage Solutions, Value, 2019-2032 (US$ Mn)

FIG. 22 Global Video Surveillance Equipment and Services Market, by DVRs (Digital Video Recorders), Value, 2019-2032 (US$ Mn)

FIG. 23 Global Video Surveillance Equipment and Services Market, by NVRs (Network Video Recorders), Value, 2019-2032 (US$ Mn)

FIG. 24 Global Video Surveillance Equipment and Services Market, by Cloud Storage, Value, 2019-2032 (US$ Mn)

FIG. 25 Global Video Surveillance Equipment and Services Market, by Video Analytics, Value, 2019-2032 (US$ Mn)

FIG. 26 Global Video Surveillance Equipment and Services Market, by Accessories, Value, 2019-2032 (US$ Mn)

FIG. 27 Global Video Surveillance Equipment and Services Market Value Contribution, By Service Offerings, 2023 & 2032 (Value %)

FIG. 28 Global Video Surveillance Equipment and Services Market, by Installation and Integration Services, Value, 2019-2032 (US$ Mn)

FIG. 29 Global Video Surveillance Equipment and Services Market, by Maintenance and Support Services, Value, 2019-2032 (US$ Mn)

FIG. 30 Global Video Surveillance Equipment and Services Market, by Monitoring Services, Value, 2019-2032 (US$ Mn)

FIG. 31 Global Video Surveillance Equipment and Services Market, by Managed Services, Value, 2019-2032 (US$ Mn)

FIG. 32 Global Video Surveillance Equipment and Services Market Value Contribution, By End-User Industries, 2023 & 2032 (Value %)

FIG. 33 Global Video Surveillance Equipment and Services Market, by Commercial, Value, 2019-2032 (US$ Mn)

FIG. 34 Global Video Surveillance Equipment and Services Market, by Government & Public Sector, Value, 2019-2032 (US$ Mn)

FIG. 35 Global Video Surveillance Equipment and Services Market, by Industrial, Value, 2019-2032 (US$ Mn)

FIG. 36 Global Video Surveillance Equipment and Services Market, by Residential, Value, 2019-2032 (US$ Mn)

FIG. 37 Global Video Surveillance Equipment and Services Market, by Healthcare & Education, Value, 2019-2032 (US$ Mn)

FIG. 38 North America Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 39 U.S. Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 40 Canada Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 41 Mexico Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 42 Europe Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 43 Germany Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 44 France Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 45 U.K. Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 46 Italy Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 47 Spain Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 48 Benelux Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 49 Russia Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 50 Rest of Europe Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 51 Asia Pacific Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 52 China Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 53 Japan Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 54 India Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 55 South Korea Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 56 South-East Asia Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 57 Rest of Asia Pacific Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 58 Latin America Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 59 Brazil Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 60 Argentina Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 61 Rest of Latin America Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 62 Middle East Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 63 UAE Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 64 Saudi Arabia Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 65 Rest of Middle East Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 66 Africa Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 67 South Africa Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 68 Egypt Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

FIG. 69 Rest of Africa Video Surveillance Equipment and Services Market, 2019-2032 (US$ Mn)

List of Tables

TABLE 1 Market Snapshot: Global Video Surveillance Equipment and Services Market

TABLE 2 Global Video Surveillance Equipment and Services Market: Market Drivers Impact Analysis

TABLE 3 Global Video Surveillance Equipment and Services Market: Market Restraints Impact Analysis

TABLE 4 Global Video Surveillance Equipment and Services Market, by Competitive Benchmarking, 2023

TABLE 5 Global Video Surveillance Equipment and Services Market, by Geographical Presence Analysis, 2023

TABLE 6 Global Video Surveillance Equipment and Services Market, by Key Strategies Analysis, 2023

TABLE 7 Global Video Surveillance Equipment and Services Market, by Cameras, By Region, 2019-2023 (US$ Mn)

TABLE 8 Global Video Surveillance Equipment and Services Market, by Cameras, By Region, 2024-2032 (US$ Mn)

TABLE 9 Global Video Surveillance Equipment and Services Market, by Analog Cameras, By Region, 2019-2023 (US$ Mn)

TABLE 10 Global Video Surveillance Equipment and Services Market, by Analog Cameras, By Region, 2024-2032 (US$ Mn)

TABLE 11 Global Video Surveillance Equipment and Services Market, by IP Cameras (Network Cameras), By Region, 2019-2023 (US$ Mn)

TABLE 12 Global Video Surveillance Equipment and Services Market, by IP Cameras (Network Cameras), By Region, 2024-2032 (US$ Mn)

TABLE 13 Global Video Surveillance Equipment and Services Market, by HD and Ultra HD Cameras, By Region, 2019-2023 (US$ Mn)

TABLE 14 Global Video Surveillance Equipment and Services Market, by HD and Ultra HD Cameras, By Region, 2024-2032 (US$ Mn)

TABLE 15 Global Video Surveillance Equipment and Services Market, by PTZ Cameras (Pan-Tilt-Zoom), By Region, 2019-2023 (US$ Mn)

TABLE 16 Global Video Surveillance Equipment and Services Market, by PTZ Cameras (Pan-Tilt-Zoom), By Region, 2024-2032 (US$ Mn)

TABLE 17 Global Video Surveillance Equipment and Services Market, by Video Management Systems (VMS), By Region, 2019-2023 (US$ Mn)

TABLE 18 Global Video Surveillance Equipment and Services Market, by Video Management Systems (VMS), By Region, 2024-2032 (US$ Mn)

TABLE 19 Global Video Surveillance Equipment and Services Market, by Storage Solutions, By Region, 2019-2023 (US$ Mn)

TABLE 20 Global Video Surveillance Equipment and Services Market, by Storage Solutions, By Region, 2024-2032 (US$ Mn)

TABLE 21 Global Video Surveillance Equipment and Services Market, by DVRs (Digital Video Recorders), By Region, 2019-2023 (US$ Mn)

TABLE 22 Global Video Surveillance Equipment and Services Market, by DVRs (Digital Video Recorders), By Region, 2024-2032 (US$ Mn)

TABLE 23 Global Video Surveillance Equipment and Services Market, by NVRs (Network Video Recorders), By Region, 2019-2023 (US$ Mn)

TABLE 24 Global Video Surveillance Equipment and Services Market, by NVRs (Network Video Recorders), By Region, 2024-2032 (US$ Mn)

TABLE 25 Global Video Surveillance Equipment and Services Market, by Cloud Storage, By Region, 2019-2023 (US$ Mn)

TABLE 26 Global Video Surveillance Equipment and Services Market, by Cloud Storage, By Region, 2024-2032 (US$ Mn)

TABLE 27 Global Video Surveillance Equipment and Services Market, by Video Analytics, By Region, 2019-2023 (US$ Mn)

TABLE 28 Global Video Surveillance Equipment and Services Market, by Video Analytics, By Region, 2024-2032 (US$ Mn)

TABLE 29 Global Video Surveillance Equipment and Services Market, by Accessories, By Region, 2019-2023 (US$ Mn)

TABLE 30 Global Video Surveillance Equipment and Services Market, by Accessories, By Region, 2024-2032 (US$ Mn)

TABLE 31 Global Video Surveillance Equipment and Services Market, by Installation and Integration Services, By Region, 2019-2023 (US$ Mn)

TABLE 32 Global Video Surveillance Equipment and Services Market, by Installation and Integration Services, By Region, 2024-2032 (US$ Mn)

TABLE 33 Global Video Surveillance Equipment and Services Market, by Maintenance and Support Services, By Region, 2019-2023 (US$ Mn)

TABLE 34 Global Video Surveillance Equipment and Services Market, by Maintenance and Support Services, By Region, 2024-2032 (US$ Mn)

TABLE 35 Global Video Surveillance Equipment and Services Market, by Monitoring Services, By Region, 2019-2023 (US$ Mn)

TABLE 36 Global Video Surveillance Equipment and Services Market, by Monitoring Services, By Region, 2024-2032 (US$ Mn)

TABLE 37 Global Video Surveillance Equipment and Services Market, by Managed Services, By Region, 2019-2023 (US$ Mn)

TABLE 38 Global Video Surveillance Equipment and Services Market, by Managed Services, By Region, 2024-2032 (US$ Mn)

TABLE 39 Global Video Surveillance Equipment and Services Market, by Commercial, By Region, 2019-2023 (US$ Mn)

TABLE 40 Global Video Surveillance Equipment and Services Market, by Commercial, By Region, 2024-2032 (US$ Mn)

TABLE 41 Global Video Surveillance Equipment and Services Market, by Government & Public Sector, By Region, 2019-2023 (US$ Mn)

TABLE 42 Global Video Surveillance Equipment and Services Market, by Government & Public Sector, By Region, 2024-2032 (US$ Mn)

TABLE 43 Global Video Surveillance Equipment and Services Market, by Industrial, By Region, 2019-2023 (US$ Mn)

TABLE 44 Global Video Surveillance Equipment and Services Market, by Industrial, By Region, 2024-2032 (US$ Mn)

TABLE 45 Global Video Surveillance Equipment and Services Market, by Residential, By Region, 2019-2023 (US$ Mn)

TABLE 46 Global Video Surveillance Equipment and Services Market, by Residential, By Region, 2024-2032 (US$ Mn)

TABLE 47 Global Video Surveillance Equipment and Services Market, by Healthcare & Education, By Region, 2019-2023 (US$ Mn)

TABLE 48 Global Video Surveillance Equipment and Services Market, by Healthcare & Education, By Region, 2024-2032 (US$ Mn)

TABLE 49 Global Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 50 Global Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 51 Global Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 52 Global Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 53 Global Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 54 Global Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 55 Global Video Surveillance Equipment and Services Market, by Region, 2019-2023 (US$ Mn)

TABLE 56 Global Video Surveillance Equipment and Services Market, by Region, 2024-2032 (US$ Mn)

TABLE 57 North America Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 58 North America Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 59 North America Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 60 North America Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 61 North America Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 62 North America Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 63 North America Video Surveillance Equipment and Services Market, by Country, 2019-2023 (US$ Mn)

TABLE 64 North America Video Surveillance Equipment and Services Market, by Country, 2024-2032 (US$ Mn)

TABLE 65 United States Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 66 United States Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 67 United States Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 68 United States Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 69 United States Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 70 United States Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 71 Canada Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 72 Canada Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 73 Canada Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 74 Canada Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 75 Canada Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 76 Canada Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 77 Mexico Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 78 Mexico Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 79 Mexico Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 80 Mexico Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 81 Mexico Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 82 Mexico Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 83 Europe Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 84 Europe Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 85 Europe Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 86 Europe Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 87 Europe Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 88 Europe Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 89 Europe Video Surveillance Equipment and Services Market, by Country, 2019-2023 (US$ Mn)

TABLE 90 Europe Video Surveillance Equipment and Services Market, by Country, 2024-2032 (US$ Mn)

TABLE 91 Germany Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 92 Germany Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 93 Germany Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 94 Germany Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 95 Germany Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 96 Germany Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 97 France Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 98 France Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 99 France Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 100 France Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 101 France Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 102 France Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 103 United Kingdom Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 104 United Kingdom Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 105 United Kingdom Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 106 United Kingdom Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 107 United Kingdom Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 108 United Kingdom Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 109 Italy Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 110 Italy Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 111 Italy Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 112 Italy Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 113 Italy Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 114 Italy Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 115 Spain Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 116 Spain Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 117 Spain Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 118 Spain Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 119 Spain Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 120 Spain Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 121 Benelux Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 122 Benelux Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 123 Benelux Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 124 Benelux Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 125 Benelux Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 126 Benelux Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 127 Russia Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 128 Russia Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 129 Russia Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 130 Russia Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 131 Russia Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 132 Russia Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 133 Rest of Europe Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 134 Rest of Europe Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 135 Rest of Europe Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 136 Rest of Europe Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 137 Rest of Europe Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 138 Rest of Europe Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 139 Asia Pacific Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 140 Asia Pacific Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 141 Asia Pacific Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 142 Asia Pacific Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 143 Asia Pacific Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 144 Asia Pacific Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 145 China Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 146 China Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 147 China Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 148 China Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 149 China Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 150 China Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 151 Japan Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 152 Japan Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 153 Japan Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 154 Japan Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 155 Japan Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 156 Japan Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 157 India Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 158 India Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 159 India Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 160 India Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 161 India Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 162 India Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 163 South Korea Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 164 South Korea Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 165 South Korea Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 166 South Korea Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 167 South Korea Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 168 South Korea Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 169 South-East Asia Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 170 South-East Asia Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 171 South-East Asia Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 172 South-East Asia Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 173 South-East Asia Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 174 South-East Asia Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 175 Rest of Asia Pacific Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 176 Rest of Asia Pacific Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 177 Rest of Asia Pacific Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 178 Rest of Asia Pacific Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 179 Rest of Asia Pacific Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 180 Rest of Asia Pacific Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 181 Latin America Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 182 Latin America Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 183 Latin America Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 184 Latin America Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 185 Latin America Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 186 Latin America Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 187 Brazil Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 188 Brazil Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 189 Brazil Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 190 Brazil Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 191 Brazil Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 192 Brazil Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 193 Argentina Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 194 Argentina Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 195 Argentina Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 196 Argentina Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 197 Argentina Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 198 Argentina Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 199 Rest of Latin America Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 200 Rest of Latin America Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 201 Rest of Latin America Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 202 Rest of Latin America Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 203 Rest of Latin America Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 204 Rest of Latin America Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 205 Middle East Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 206 Middle East Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 207 Middle East Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 208 Middle East Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 209 Middle East Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 210 Middle East Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 211 UAE Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 212 UAE Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 213 UAE Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 214 UAE Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 215 UAE Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 216 UAE Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 217 Saudi Arabia Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 218 Saudi Arabia Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 219 Saudi Arabia Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 220 Saudi Arabia Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 221 Saudi Arabia Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 222 Saudi Arabia Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 223 Rest of Middle East Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 224 Rest of Middle East Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 225 Rest of Middle East Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 226 Rest of Middle East Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 227 Rest of Middle East Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 228 Rest of Middle East Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 229 Africa Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 230 Africa Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 231 Africa Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 232 Africa Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 233 Africa Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 234 Africa Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 235 South Africa Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 236 South Africa Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 237 South Africa Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 238 South Africa Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 239 South Africa Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 240 South Africa Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 241 Egypt Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 242 Egypt Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 243 Egypt Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 244 Egypt Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 245 Egypt Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 246 Egypt Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)

TABLE 247 Rest of Africa Video Surveillance Equipment and Services Market, by Type of Equipment, 2019-2023 (US$ Mn)

TABLE 248 Rest of Africa Video Surveillance Equipment and Services Market, by Type of Equipment, 2024-2032 (US$ Mn)

TABLE 249 Rest of Africa Video Surveillance Equipment and Services Market, by Service Offerings, 2019-2023 (US$ Mn)

TABLE 250 Rest of Africa Video Surveillance Equipment and Services Market, by Service Offerings, 2024-2032 (US$ Mn)

TABLE 251 Rest of Africa Video Surveillance Equipment and Services Market, by End-User Industries, 2019-2023 (US$ Mn)

TABLE 252 Rest of Africa Video Surveillance Equipment and Services Market, by End-User Industries, 2024-2032 (US$ Mn)