Market Overview

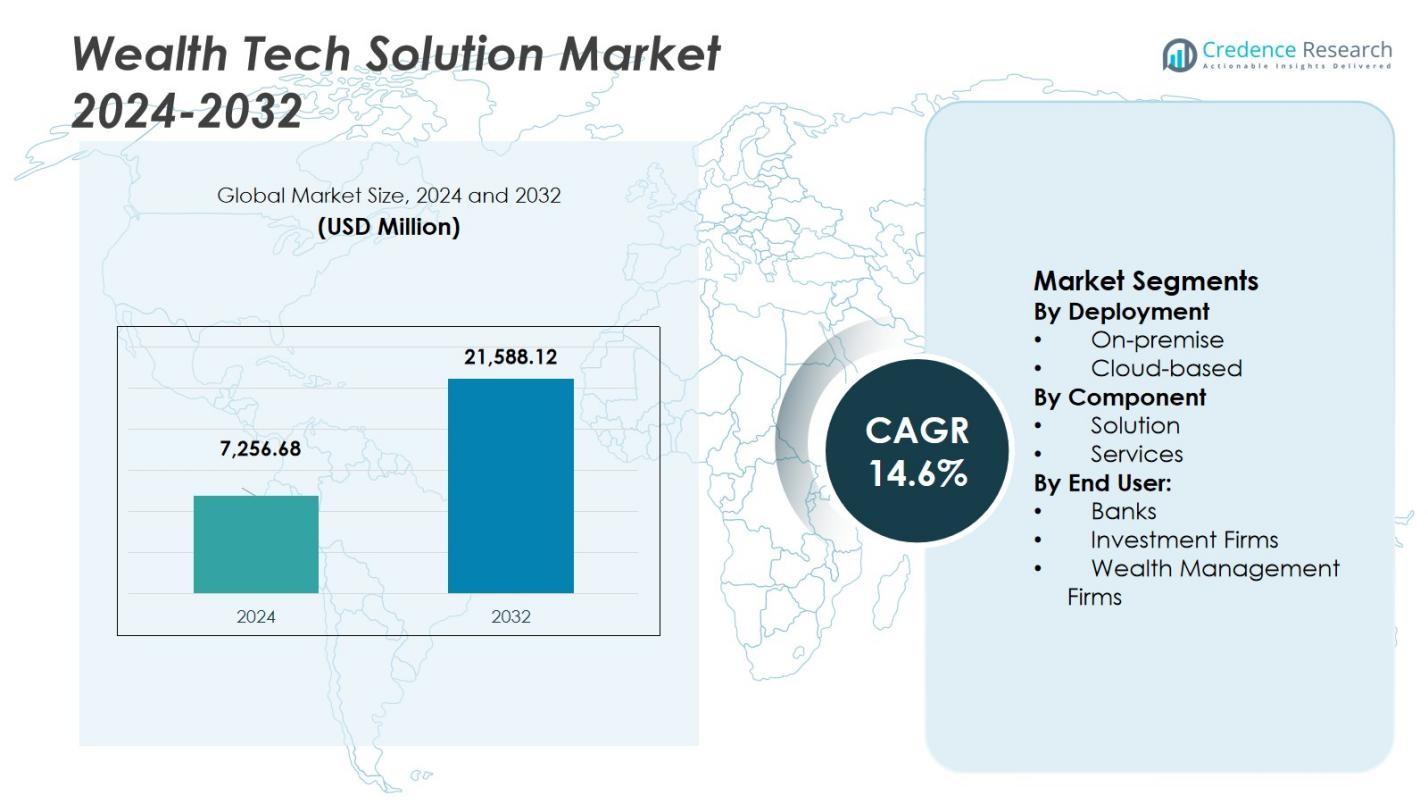

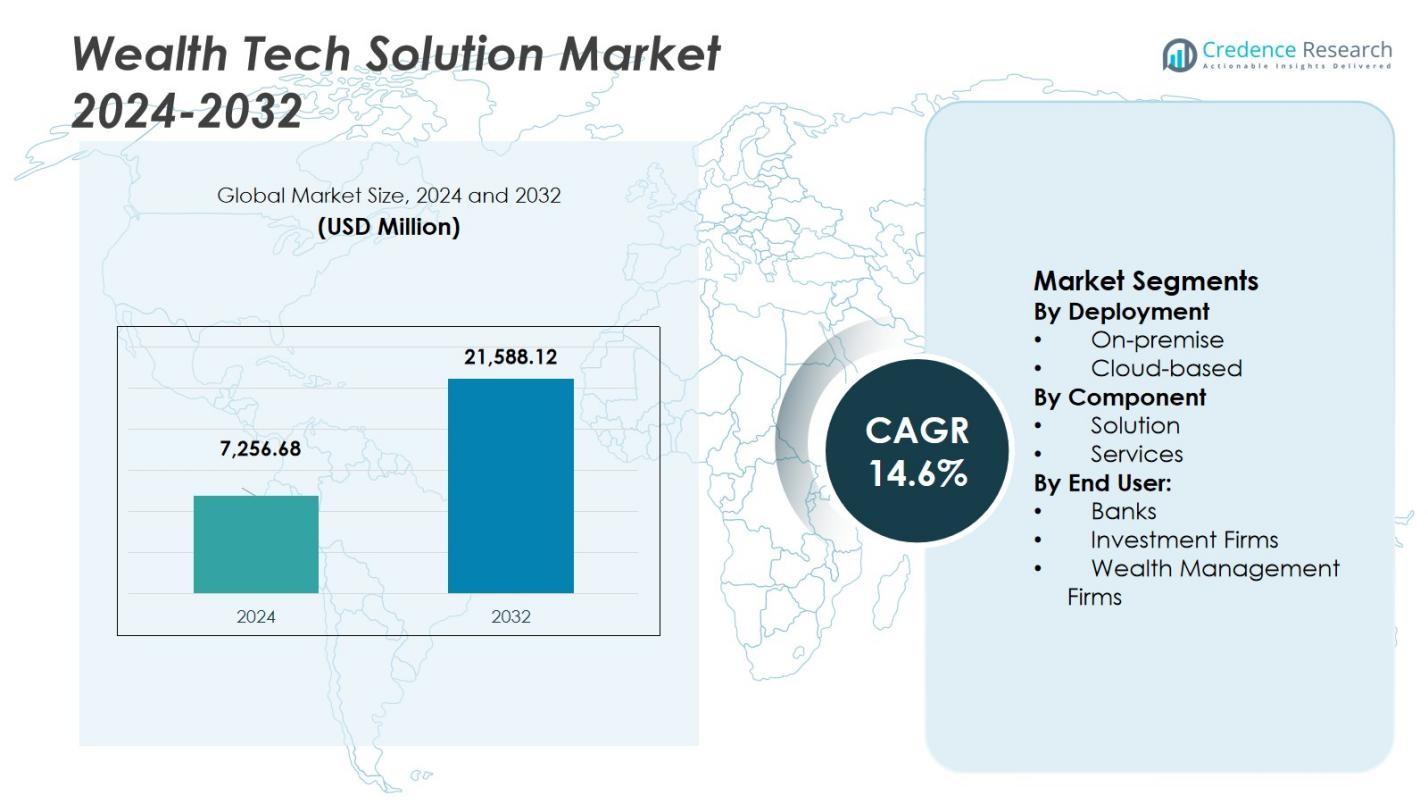

Wealth Tech Solution Market size was valued at USD 7,256.68 Million in 2024 and is anticipated to reach USD 21,588.12 Million by 2032, at a CAGR of 14.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wealth Tech Solution Market Size 2024 |

USD 7,256.68 Million |

| Wealth Tech Solution Market , CAGR |

14.6% |

| Wealth Tech Solution Market Size 2032 |

USD 21,588.12 Million |

Wealth Tech Solution Market is driven by major players such as BlackRock, Inc., InvestCloud, Aixigo AG, Synechron, Wealthfront Corporation, InvestSuite, Valuefy, WealthTechs Inc., BME Inntech, and 3rd-eyes analytics, each advancing digital advisory capabilities through AI-driven portfolio tools, automated onboarding systems, and cloud-based wealth platforms. These companies focus on enhancing real-time analytics, personalization engines, and scalable digital ecosystems for banks, investment firms, and wealth managers. Regionally, North America leads the market with a 37% share, supported by strong fintech maturity, rapid adoption of automated advisory tools, and significant investment in cloud-enabled wealth management infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Wealth Tech Solution Market is valued at USD 7,256.68 Million in 2024 and is projected to reach USD 21,588.12 Million by 2032, registering a CAGR of 14.6%.

- Rising demand for digital advisory tools, AI-enabled analytics, automated onboarding, and scalable cloud-based platforms is driving strong market expansion across banks, investment firms, and wealth managers.

- Key trends include rapid adoption of open-API architectures, growing interest in ESG-integrated investment technologies, and increasing shift toward hybrid advisory models that blend human expertise with automation.

- Leading players such as BlackRock, Inc., InvestCloud, Aixigo AG, Synechron, Wealthfront Corporation, and InvestSuite strengthen market growth through advanced portfolio engines, enhanced client-engagement solutions, and platform modernization.

- Regionally, North America holds a 37% share, followed by Europe at 28% and Asia-Pacific at 24%, while cloud-based deployment leads with a 64% segment share, positioning the market for continued expansion across global financial ecosystems.

Market Segmentation Analysis:

By Deployment

The Wealth Tech Solution Market by deployment is led by cloud-based platforms, holding 64% share in 2024, driven by their scalability, lower upfront costs, and faster integration with evolving digital wealth ecosystems. Cloud deployments enable real-time portfolio analytics, automated advisory workflows, and seamless API connectivity with third-party financial data providers, making them the preferred choice for institutions modernizing legacy infrastructure. On-premise solutions maintain a 36% share, supported by demand from firms with strict data governance, but adoption continues to shift rapidly toward cloud-driven architectures due to enhanced security, flexibility, and cost efficiency.

- For instance, d1g1t platform provides real-time portfolio analytics across diverse asset classes, delivering institutional-grade investment insights instantly.

By Component

Within the component segment, solutions dominate the Wealth Tech Solution Market with a 58% share in 2024, propelled by rising adoption of robo-advisory platforms, portfolio risk engines, client onboarding tools, and digital investment dashboards. Firms prioritize integrated wealth management suites that streamline advisory workflows and improve client engagement, accelerating demand for advanced analytics, automation, and AI-enabled decision engines. Services account for a 42% share, driven by implementation, consulting, and managed services, yet the growing push for self-service digital tools and scalable software ecosystems continues to strengthen the dominance of solutions.

- For instance, BlackRock’s Aladdin Wealth platform now offers a GenAI-based “Auto Commentary” feature that Morgan Stanley Wealth Management is the first to implement, transforming complex risk analytics into personalized client-ready insights at scale for U.S. advisors.

By End User

Banks lead the end-user segment of the Wealth Tech Solution Market with a 46% share in 2024, supported by extensive digital transformation initiatives aimed at enhancing retail and private banking experiences. Their adoption is driven by the need to modernize advisory operations, comply with regulatory reporting, and offer personalized investment products through automated platforms. Investment firms hold a 31% share as they expand digital portfolio management and risk analytics, while wealth management firms represent 23%, leveraging wealth tech to improve client engagement, optimize financial planning, and deliver data-driven insights across diversified client portfolios.

Key Growth Drivers

Rapid Digital Transformation in Financial Services

The Wealth Tech Solution Market is expanding rapidly as financial institutions accelerate digital transformation to modernize advisory and investment operations. Banks, investment firms, and wealth managers increasingly adopt automated portfolio tools, digital onboarding, AI-driven recommendations, and real-time analytics to enhance client engagement. The shift from manual processes to technology-enabled workflows also reduces operational costs and improves regulatory compliance. Growing demand for seamless omnichannel advisory experiences and personalized financial planning further strengthens the adoption of wealth tech platforms across global financial ecosystems.

- For instance, Charles Schwab improved its digital onboarding by enabling advisors to open and fund multiple client accounts simultaneously through a streamlined digital process, reducing onboarding time and increasing advisor efficiency.

Rising Adoption of AI, Automation, and Predictive Analytics

Advanced technologies such as artificial intelligence, machine learning, and predictive analytics serve as major drivers by enabling faster, more accurate decision-making in wealth management. These solutions empower advisors with real-time insights, risk profiling, behavior forecasting, and automated rebalancing, improving portfolio performance and client satisfaction. Robo-advisors and intelligent workflow engines also support mass personalization at scale, allowing firms to serve a wider client base efficiently. As financial institutions seek greater precision, automation, and operational agility, the demand for AI-centric wealth tech continues to intensify.

- For instance, at BlackRock, the Aladdin® platform is used to dynamically assess risk and adjust portfolios with AI‑driven analytics across public and private markets.

Growing Demand for Personalized and Hybrid Advisory Models

The industry is witnessing a strong push toward personalized wealth solutions that blend human expertise with digital capabilities. Clients increasingly expect tailored investment recommendations, contextual insights, and proactive financial planning delivered through intuitive platforms. Hybrid advisory models address this demand by integrating robo-advisory efficiency with advisor-led relationship depth. Wealth tech providers are introducing advanced goal-based planning tools, behavioral analytics, and customizable dashboards, enabling firms to differentiate their offerings. This shift toward hyper-personalization drives substantial investment in digital wealth ecosystems.

Key Trends & Opportunities

Expansion of Open Banking and API-Driven Wealth Ecosystems

A major trend reshaping the Wealth Tech Solution Market is the rapid adoption of open banking frameworks, which allow secure data sharing between banks, fintechs, and third-party providers. API-driven architectures enable seamless integration of portfolio tools, KYC modules, risk engines, and external market data, fostering highly connected digital wealth ecosystems. This interoperability unlocks new opportunities for personalized advisory services, cross-platform financial planning, and consolidated client insights. As regulatory support for open finance increases globally, wealth tech vendors gain strong opportunities to expand modular and connected digital solutions.

- For instance, BBVA launched its Open Platform, a BaaS solution that enables third-party developers to build innovative digital wealth products using API access to bank services.

Growing Shift Toward ESG-Integrated Investment Technologies

Wealth management platforms increasingly incorporate environmental, social, and governance (ESG) analytics as investors demand greater visibility into sustainable portfolios. Advanced tools capable of monitoring carbon exposure, ethical scores, and impact insights present a major opportunity for wealth tech vendors. Financial institutions use these ESG engines to create differentiated advisory offerings and attract socially conscious investors. Platforms that integrate real-time ESG data feeds, customizable scoring models, and regulatory reporting capabilities are particularly well-positioned to capitalize on the accelerating shift toward ethical and sustainable investing.

- For instance, Morningstar’s Direct ESG offers comprehensive analytics including impact insights and automated sustainability ratings that financial institutions use to build differentiated advisory offerings and attract socially conscious investors

Key Challenges

Data Privacy, Cybersecurity, and Regulatory Compliance Risks

The Wealth Tech Solution Market faces significant challenges related to safeguarding sensitive financial data amid rising cyber threats and evolving regulatory frameworks. Financial institutions must comply with stringent requirements such as GDPR, data-protection mandates, and cybersecurity norms while maintaining seamless digital operations. Ensuring secure API connections, implementing strong authentication systems, and maintaining audit-ready data trails add operational complexity. Vendors must continually invest in advanced security architectures, encryption models, and compliance automation to mitigate risks while preserving user trust and platform integrity.

Integration Complexity and Legacy System Constraints

Many financial institutions struggle with integrating advanced wealth tech solutions into legacy infrastructures, resulting in extended deployment timelines and high modernization costs. Older core banking systems often lack compatibility with modern API-based platforms, slowing digital transformation. Fragmented data environments, manual workflows, and outdated IT architectures add further barriers. Wealth tech providers must offer scalable, flexible, and interoperable systems to overcome these constraints. Institutions that fail to resolve integration challenges risk reduced operational efficiency and limited ability to deliver modern digital advisory experiences.

Regional Analysis

North America

North America leads the Wealth Tech Solution Market with a 37% share in 2024, driven by strong digital adoption among banks, investment firms, and wealth managers. The region benefits from a mature fintech ecosystem, high investor awareness, and rapid integration of AI-driven advisory tools. U.S. institutions continue investing in cloud-based wealth platforms, predictive analytics, and hybrid advisory models to enhance client experience. Regulatory clarity around digital finance further supports market expansion. Growing demand for personalized portfolio tools and sophisticated risk engines strengthens North America’s position as the core hub for wealth tech innovation and deployment.

Europe

Europe holds a 28% share of the Wealth Tech Solution Market, supported by the expanding implementation of open banking frameworks and strong regulatory focus on transparency and investor protection. Wealth management firms across the U.K., Germany, Switzerland, and the Nordics are increasingly adopting API-enabled platforms and ESG-centric investment tools. The region’s rising digital wealth penetration, combined with demand for automated compliance and client onboarding solutions, accelerates platform modernization. Financial institutions are also embracing hybrid advisory models to enhance relationship-led services, driving steady investment in advanced portfolio analytics, risk engines, and digital planning tools.

Asia-Pacific

Asia-Pacific captures a 24% share of the Wealth Tech Solution Market, fueled by rising affluence, expanding investor participation, and rapid digitization across banking and financial services. Countries such as China, India, Singapore, and Australia are accelerating the adoption of AI-driven advisory platforms, mobile wealth apps, and digital investment ecosystems. Strong government support for fintech innovation and growing interest in low-cost robo-advisory services further strengthen market penetration. As wealth creation accelerates among mass affluent and high-net-worth segments, regional institutions increasingly rely on wealth tech solutions to scale advisory capabilities and deliver tailored investment experiences.

Latin America

Latin America holds a 6% share of the Wealth Tech Solution Market, supported by improving digital-financial infrastructure and rising demand for cost-efficient investment solutions. Brazil, Mexico, and Chile lead adoption as financial institutions modernize legacy systems and introduce digital advisory platforms for a growing middle-income population. Wealth tech solutions offering automated onboarding, goal-based planning, and digital portfolio management are gaining traction. Economic diversification and expanding fintech ecosystems also contribute to technology uptake. However, market growth remains moderate due to regulatory fragmentation and slower digital transformation among traditional financial institutions.

Middle East & Africa

The Middle East & Africa region accounts for a 5% share of the Wealth Tech Solution Market, driven by expanding private wealth, rising fintech investments, and strong digital transformation agendas led by GCC countries. Institutions in the UAE, Saudi Arabia, and South Africa are adopting cloud-based advisory platforms, digital onboarding tools, and portfolio analytics to enhance service delivery. Growing interest in Sharia-compliant investment technologies and cross-border wealth management further supports uptake. Despite increasing modernization, broader market expansion is limited by uneven financial infrastructure, though ongoing economic diversification initiatives continue to boost digital wealth adoption across the region.

Market Segmentations:

By Deployment

By Component

By End User:

- Banks

- Investment Firms

- Wealth Management Firms

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Wealth Tech Solution Market features prominent players such as BlackRock, Inc., Aixigo AG, InvestCloud, Inc., Wealthfront Corporation, Synechron, Valuefy, InvestSuite, WealthTechs Inc., BME Inntech, and 3rd-eyes analytics, each contributing to rapid digital transformation in global wealth management. These companies compete by offering advanced portfolio management tools, AI-powered advisory engines, robo-advisory platforms, and integrated client-engagement solutions. The market is defined by continuous innovation in automation, predictive analytics, ESG scoring, and API-driven interoperability, enabling institutions to deliver personalized advisory experiences at scale. Vendors increasingly focus on cloud-based architectures, cybersecurity enhancements, and hybrid advisory enablement to meet the evolving needs of banks, investment firms, and wealth managers. Strategic partnerships, product enhancements, and regional expansion remain central to strengthening market presence, while firms with strong technological depth and scalable platforms gain a competitive advantage in addressing the rising demand for digital-first wealth ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Citigroup partnered with Palantir Technologies to modernise its wealth‑management technology platform.

- In April 2025, UBS agreed to sell its Indian on‑shore wealth business to 360 ONE WAM and take a 4.95 % stake in the company as part of a strategic partnership.

- In May 2025, iCapital announced that it would acquire Citi Global Alternatives, a subsidiary of Citigroup representing 180+ alternative‑investment funds, for an end‑to‑end technology integration and platform operation.

Report Coverage

The research report offers an in-depth analysis based on Deployment, Component, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong expansion as financial institutions accelerate digital transformation across advisory and investment operations.

- AI-driven analytics, automation, and predictive engines will become central to delivering personalized and efficient wealth management services.

- Cloud-based platforms will continue to gain dominance as firms prioritize scalability, security, and seamless integration with digital ecosystems.

- Hybrid advisory models will rise as clients seek the combined value of human expertise and robo-advisory efficiency.

- ESG-integrated investment tools will see increasing adoption as demand grows for sustainable and impact-driven portfolios.

- Open banking and API-enabled architectures will enable deeper interoperability between banks, fintechs, and data providers.

- Wealth platforms will expand their offerings to include goal-based planning, behavioral finance tools, and advanced risk engines.

- Cybersecurity and data privacy technologies will become critical investment priorities for digital wealth providers.

- Emerging markets will accelerate adoption as affluence rises and digital financial inclusion strengthens.

- Strategic partnerships between fintechs, banks, and technology providers will play a major role in shaping competitive positioning.