Market Overview

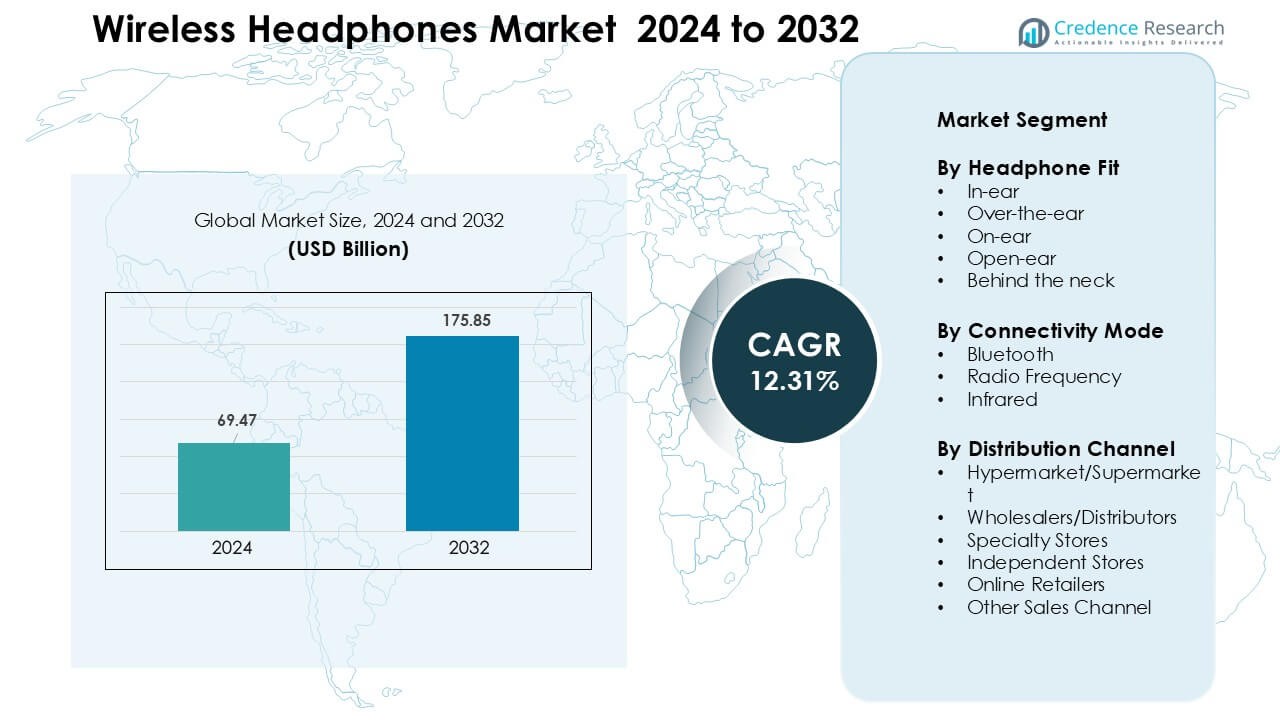

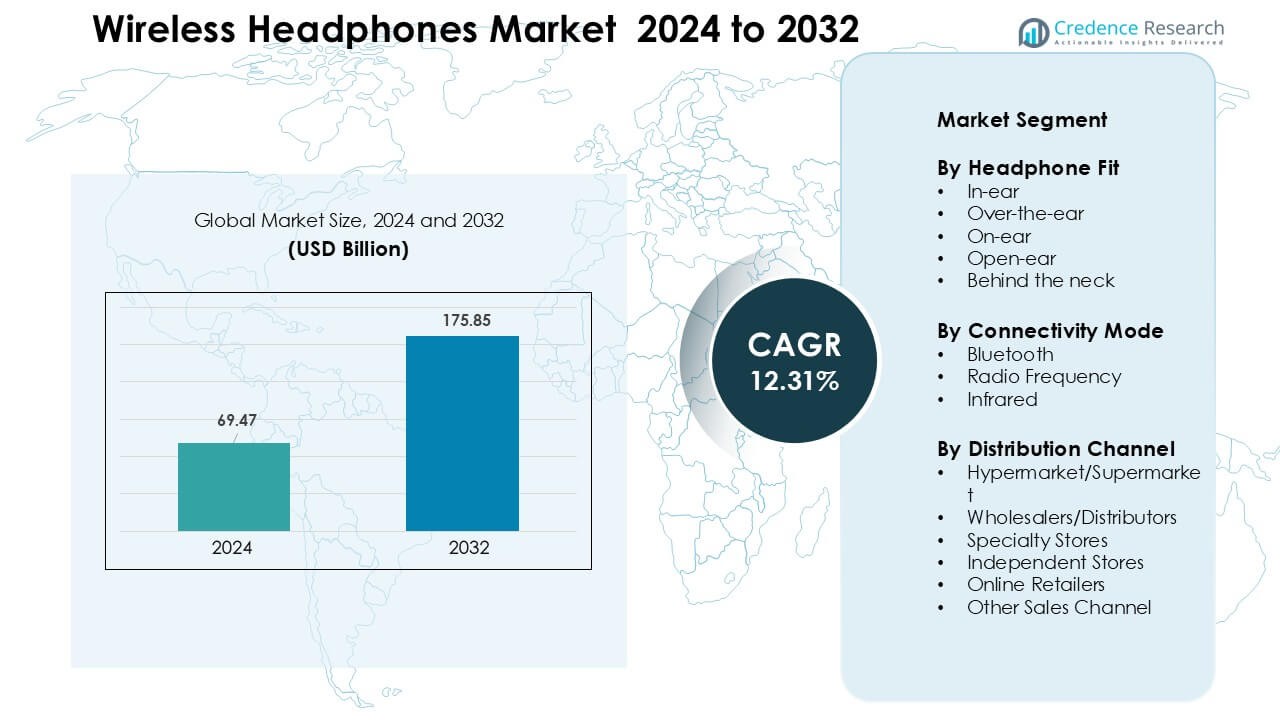

Wireless Headphones Market was valued at USD 69.47 billion in 2024 and is anticipated to reach USD 175.85 billion by 2032, growing at a CAGR of 12.31 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless Headphones Market Size 2024 |

USD 69.47 Billion |

| Wireless Headphones Market, CAGR |

12.31 % |

| Wireless Headphones Market Size 2032 |

USD 175.85 Billion |

The Wireless Headphones Market is shaped by leading companies such as Zevva Electronics Pvt. Ltd., Skullcandy Inc., Sony Corporation, U&I, Bose Corporation, The Samsung Group, Shure Incorporated, Philips Koninklijke N.V., Apple Inc., and Sennheiser electronic GmbH & Co. KG. These brands compete through advancements in ANC performance, spatial audio, multi-device connectivity, and long-battery designs that appeal to fitness users, commuters, gamers, and hybrid-work professionals. Product ecosystems, strong audio engineering, and premium build quality help major players defend their market position while regional brands drive volume growth through affordable TWS models. North America remained the leading region in 2024 with about 34% share, supported by high disposable income, strong adoption of premium headphones, and large-scale use of wireless audio across work and entertainment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Wireless Headphones Market reached USD 69.47 billion in 2024 and is projected to grow to USD 175.85 billion by 2032, advancing at a CAGR of 12.31% during the forecast period.

- Demand rises due to strong adoption of true wireless earbuds, which held about 61% share in 2024, driven by ANC performance, compact design, and ecosystem integration across smartphones and wearables.

- Key trends include fast growth in spatial audio, AI-based noise control, and sustainable designs, supported by rising use in fitness, gaming, streaming, and hybrid-work environments.

- Competition remains intense among Apple, Sony, Bose, Samsung, Sennheiser, Philips, Shure, Skullcandy, U&I, and Zevva Electronics, all focused on battery efficiency, premium sound, and low-latency modes.

- North America led the market with 34% share, followed by Asia Pacific at 29% and Europe at 27%, while Latin America and Middle East & Africa expanded steadily due to growing smartphone penetration and online retail access.

Market Segmentation Analysis:

By Product Type

In 2024, true wireless earbuds dominated the product type segment with about 61% share, driven by rising demand for compact designs and seamless device pairing. Consumers preferred these earbuds because they support improved battery life, enhanced noise cancellation, and strong compatibility with smartphones. Over-ear headphones held a moderate share due to their use in gaming and studio monitoring, while on-ear models trailed with lower adoption. Growth across all subsegments was shaped by stronger Bluetooth chipsets and wider use of ANC features in mass-market models.

- For instance, Sennheiser’s “Momentum True Wireless 4” earbuds deliver about 7 hours of playback per charge (and roughly 28-30 hours total with the charging case), illustrating improved battery life and user convenience.

By Application

The personal use segment led this category in 2024 with nearly 68% share, supported by heavy use for music streaming, fitness, calls, and online learning. Buyers selected wireless headphones for daily use because they offer improved comfort, portable charging cases, and longer playtime. The commercial segment grew in offices, call centers, and content-production spaces as teams shifted toward wireless communication tools. Gaming applications increased steadily as brands launched low-latency models, but personal consumption remained the primary growth engine.

- For instance, users engaged in work-from-home or remote-learning increasingly use wireless models with stable Bluetooth connectivity (e.g. Bluetooth 5.0 or later) and reliable mic/audio quality enabling comfortable long-duration video calls or online learning without the cable tangles or movement constraints of wired devices.

By Distribution Channel

Online retail dominated this segment in 2024 with around 54% share, driven by strong discounts, wide brand options, and fast delivery services. Shoppers favored e-commerce platforms because they allow easy comparison of battery life, drivers, codecs, and ANC performance. Offline stores-maintained relevance through experiential testing and premium model upselling, especially in urban malls. Brand outlets and electronic specialty stores continued to attract buyers who sought product trials and quick replacements, yet digital channels remained the strongest growth driver globally.

Key Growth Drivers

Rising Consumer Shift Toward Wireless Audio Ecosystems

Growing demand for wireless audio ecosystems drives large adoption of wireless headphones across global markets. Users prefer wire-free designs because smartphones are steadily removing 3.5-mm jacks, forcing a shift toward Bluetooth-enabled models. This shift strengthens demand for true wireless stereo (TWS) earbuds, which now dominate retail shelves due to compact form factors and rapid pairing features. Brands push ecosystem integration through auto-sync, device-switching, and advanced codec support, giving buyers smoother experiences across phones, tablets, and wearables. Fitness enthusiasts drive further growth as wireless headphones support sweat resistance, motion tracking, and hands-free controls. Online learning and hybrid work have also boosted daily audio use, which expands replacement cycles. As users consume more streaming content through platforms such as Spotify and YouTube Music, the need for wireless audio convenience increases, shaping strong long-term demand.

- For instance, many premium smartphone models have indeed dropped the 3.5mm headphone jack, and this change encourages users to adopt Bluetooth-based or USB-C/Lightning-based audio solutions.

Growing Demand for ANC and Premium Audio Performance

Active noise cancellation (ANC) has become a major purchase driver because consumers want distraction-free listening in crowded travel and work environments. Strong improvements in chipsets, microphones, and signal processing enable mid-range models to offer ANC once limited to premium devices. Adoption rose sharply among commuters, students, and office workers seeking isolation from ambient noise. Premium audio features such as spatial sound, high-resolution codecs, and adaptive EQ attract music lovers and gamers. These enhancements raise average selling prices and push brands to invest in R&D for better sound quality. As hybrid work expands, clear voice pickup, multi-device pairing, and AI-based noise suppression support high-quality online meetings. This combination of improved audio output and enhanced convenience keeps ANC-equipped wireless headphones in high demand across consumer segments.

- For instance, the Sony WH‑1000XM4 Wireless Noise-Canceling Over-Ear Headphones a widely used over-ear ANC model delivers strong ANC performance and high-fidelity sound, demonstrating how advances in signal-processing and driver tuning let users achieve near-flight-cabin quiet even in noisy commutes, making ANC accessible beyond premium niche.

Expanding Use Cases Across Fitness, Gaming, and Work

Growth accelerates as wireless headphones serve multiple use cases across fitness, gaming, and remote work scenarios. Sports users prefer lightweight TWS earbuds with strong water resistance, stable fit, and long battery life during workouts. Gaming users adopt low-latency headphones for smooth audio response in competitive environments, supported by surround-sound modes and long-wear comfort. The professional segment grows as remote workers rely on premium microphones, AI noise filtering, and multi-device switching for seamless meetings. Educational institutions create added demand as students use wireless audio for online classes. These expanding use cases raise overall penetration and drive repeated upgrades. Continuous expansion of apps, entertainment platforms, and cloud gaming also strengthens daily reliance on wireless audio products.

Key Trend & Opportunity

AI-Driven Audio Features and Smart Integration

AI integration creates a major opportunity as brands embed intelligent features across wireless headphones. AI-powered noise suppression, adaptive sound profiles, and smart equalization enhance audio quality based on environment and user preference. Voice recognition systems support hands-free commands for music, calls, and device switching. AI allows real-time tracking of battery health, hearing profiles, and personalized volume safety, improving user experience and safety compliance. Integration with smart home systems, AR/VR devices, and wearables expands cross-platform use. Companies explore AI-based conversational assistants for premium models, which raises product value. As AI ecosystems expand across electronics, wireless headphones become a key access point for smart interactions, creating new opportunities for hardware and software innovation.

- For instance, the Bose QuietComfort Ultra Noise Cancelling Earbuds offer intelligent noise reduction and seamless multi-device switching (between phone, tablet, laptop), demonstrating smart integration across devices: a feature that appeals to users working on calls, streaming media, or switching tasks highlighting how headphones have become central nodes in a broader device ecosystem.

Growth of Sustainable, Repairable, and Eco-Friendly Designs

Sustainability shapes new product development as buyers prefer eco-friendly and repairable wireless headphones. Brands introduce recyclable plastics, plant-based materials, and modular components to reduce e-waste. Long-life batteries, replaceable ear tips, and repair kits increase product lifespan and support environmental goals. Regulatory pressure in Europe and North America pushes companies to comply with repairability and recycling guidelines. Green packaging and carbon-neutral production programs improve brand perception among younger consumers who value environmental responsibility. As sustainability becomes a competitive differentiator, companies gain opportunities to attract premium buyers who prioritize responsible consumption. This shift supports long-term product loyalty and creates space for green-focused headphone brands.

- For instance, House of Marley uses responsibly sourced bamboo, FSC-certified wood, recycled aluminium and recycled plastics for many of its headphone designs replacing conventional virgin plastics and reducing reliance on non-renewable resources.

Expansion of Spatial Audio and Immersive Entertainment

Spatial audio adoption rises as entertainment platforms, gaming services, and streaming apps integrate immersive sound experiences. Wireless headphones now support head-tracking, 3D audio formats, and dynamic surround sound that enhance music, movies, and gaming. This trend creates strong demand for premium TWS models with advanced codecs and high-precision drivers. Growth in VR and AR applications increases use of spatial audio for more engaging virtual environments. Content creators and studios push 3D audio content, further boosting headphone sales. As immersive entertainment rises, brands gain opportunities to differentiate through new sound technologies and performance upgrades.

Key Challenge

Intense Price Competition and Market Saturation

The wireless headphones market faces strong price pressure as hundreds of global and regional brands compete across online and offline channels. Entry-level TWS models from low-cost manufacturers reduce margins for established brands. Heavy discounting during e-commerce sales events accelerates commoditization, limiting differentiation in lower price tiers. Market saturation increases customer churn, as users switch brands frequently based on short-term deals. Companies must invest more in R&D, marketing, and design to stand out, raising operational costs. These pressures make long-term profitability difficult for mid-sized and new entrants.

Short Product Lifecycles and High Replacement Pressure

Wireless headphones have shorter lifecycles due to rapid technological upgrades and heavy daily usage. Batteries degrade within two to three years, leading to early replacement or disposal. Constant updates to Bluetooth standards, codecs, and ANC performance push consumers to expect frequent improvements, creating pressure on manufacturers to release new models quickly. This cycle increases production costs and contributes to e-waste. Limited repairability further reduces lifespan, causing environmental and regulatory concerns. Managing this fast upgrade cycle remains a key challenge for brands aiming for sustainable profitability.

Regional Analysis

North America

North America led the Wireless Headphones Market in 2024 with about 34% share, supported by high adoption of true wireless earbuds and strong presence of premium brands. Consumers in the US and Canada favored models with ANC, spatial audio, and multi-device pairing due to widespread use across work, travel, fitness, and entertainment. E-commerce platforms boosted sales through fast delivery and wide model availability. Growth also came from hybrid work setups, which increased demand for clear-mic and noise-filtering features. Strong tech ecosystems and higher disposable income continued to sustain regional leadership.

Europe

Europe held nearly 27% share in 2024, driven by strong adoption in Germany, the UK, France, and the Nordics. Buyers in the region preferred high-fidelity audio and sustainable headphone designs, supporting demand for premium and repairable models. Strict environmental regulations pushed brands toward recyclable materials and modular components, shaping consumer preference. Fitness and travel users boosted demand for lightweight TWS earbuds with long battery life. Retail electronics chains and digital platforms supported steady growth across urban markets. The region continued to shift from wired to wireless formats due to rising smartphone integration and improved Bluetooth standards.

Asia Pacific

Asia Pacific captured around 29% share in 2024, growing rapidly due to large-scale adoption across China, India, South Korea, and Japan. Expanding smartphone penetration and rising youth demand for affordable TWS earbuds drove strong volume sales. Regional brands offered competitive pricing and frequent upgrades, pushing faster replacement cycles. Gaming, streaming, and fitness trends supported high daily usage, while premium models gained traction in major cities. E-commerce platforms played a major role through flash sales and broad assortments. Asia Pacific’s fast-growing middle class and expanding digital services made it the strongest growth engine globally.

Latin America

Latin America accounted for nearly 6% share in 2024, supported by growing smartphone ownership and increased interest in TWS earbuds among young consumers. Brazil and Mexico led demand as buyers preferred budget-friendly models with stable Bluetooth connectivity. Online marketplaces expanded adoption by offering EMI options and competitive pricing. Music streaming culture and mobile gaming further pushed headphone usage across urban regions. Despite economic pressures in parts of the region, steady demand from mid-income consumers supported moderate growth. Brands with durable designs and longer battery life gained strong traction in local retail networks.

Middle East & Africa

Middle East & Africa held about 4% share in 2024, with rising adoption across the UAE, Saudi Arabia, South Africa, and Nigeria. Urban consumers favored wireless headphones for streaming, travel, and work communication, supported by growing 4G and 5G networks. Retail electronics stores and online platforms expanded access to mid-range and premium products. Price-sensitive buyers preferred durable models with long playtime and basic ANC features. Although overall penetration remained lower than other regions, rising youth populations and expanding digital entertainment supported steady market growth across key countries.

Market Segmentations:

By Headphone Fit

- In-ear

- Over-the-ear

- On-ear

- Open-ear

- Behind the neck

By Connectivity Mode

- Bluetooth

- Radio Frequency

- Infrared

By Distribution Channel

- Hypermarket/Supermarket

- Wholesalers/Distributors

- Specialty Stores

- Independent Stores

- Online Retailers

- Other Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Wireless Headphones Market features strong competition led by Zevva Electronics Pvt. Ltd., Skullcandy Inc., Sony Corporation, U&I, Bose Corporation, The Samsung Group, Shure Incorporated, Philips Koninklijke N.V., Apple Inc., and Sennheiser electronic GmbH & Co. KG. These companies compete through advancements in active noise cancellation, spatial audio, low-latency gaming modes, and longer battery life. Premium brands focus on superior sound quality and ecosystem integration, while regional brands drive volume growth with affordable true wireless stereo models. Marketing efforts highlight comfort, durability, and seamless connectivity to attract fitness, gaming, and hybrid-work users. Many brands leverage online retail dominance through flash sales and exclusive launches, expanding customer reach across emerging markets. Growing demand for AI-enhanced sound profiles, sustainable materials, and multi-device pairing prompts companies to increase R&D investments. Continuous product refresh cycles and expanding after-sales support networks strengthen competitiveness and accelerate innovation in the global wireless audio industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zevva Electronics Pvt. Ltd.

- Skullcandy Inc.

- Sony Corporation

- U&I

- Bose Corporation

- The Samsung Group

- Shure Incorporated

- Philips Koninklijke N.V.

- Apple Inc.

- Sennheiser electronic GmbH & Co. KG

Recent Developments

- In October 2025, Sennheiser electronic GmbH & Co. KG Sennheiser introduced the HDB 630 wireless over-ear headphones with 42 mm drivers, Bluetooth 5.2, adaptive noise cancellation, bundled USB-C aptX Adaptive dongle for 24-bit/96 kHz hi-res audio, and up to 60 hours battery life with fast charge.

- In September 2025, Apple Inc. announced AirPods Pro 3, adding a built-in heart-rate sensor, enhanced active noise cancellation up to 2x stronger than the previous Pro, Live Translation, and around 8 hours of listening with ANC

- In July 2025, Skullcandy (India): Skullcandy launched Crusher wireless headphones and Sesh ANC active earbuds in India (press release dated July 9, 2025).

Report Coverage

The research report offers an in-depth analysis based on Headphone Fit, Connectivity Mode, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Wireless headphones will see steady demand as consumers shift fully to Bluetooth-based audio.

- True wireless earbuds will remain the fastest-growing category due to compact design and strong feature upgrades.

- ANC, spatial audio, and adaptive sound profiles will become standard in mid-range models.

- AI-driven audio enhancement will improve personalization and strengthen premium product adoption.

- Gaming and AR/VR ecosystems will boost demand for low-latency and immersive audio headphones.

- Sustainability will shape future designs, with more brands using recyclable and repairable components.

- Battery life will improve through efficient chipsets and better power management systems.

- Hybrid work and virtual meetings will sustain demand for clear-mic and noise-filtering headphones.

- Regional brands will expand market share with affordable models targeted at emerging markets.

- Competition will intensify as global and regional players accelerate innovation and shorten product refresh cycles.