Market Overview

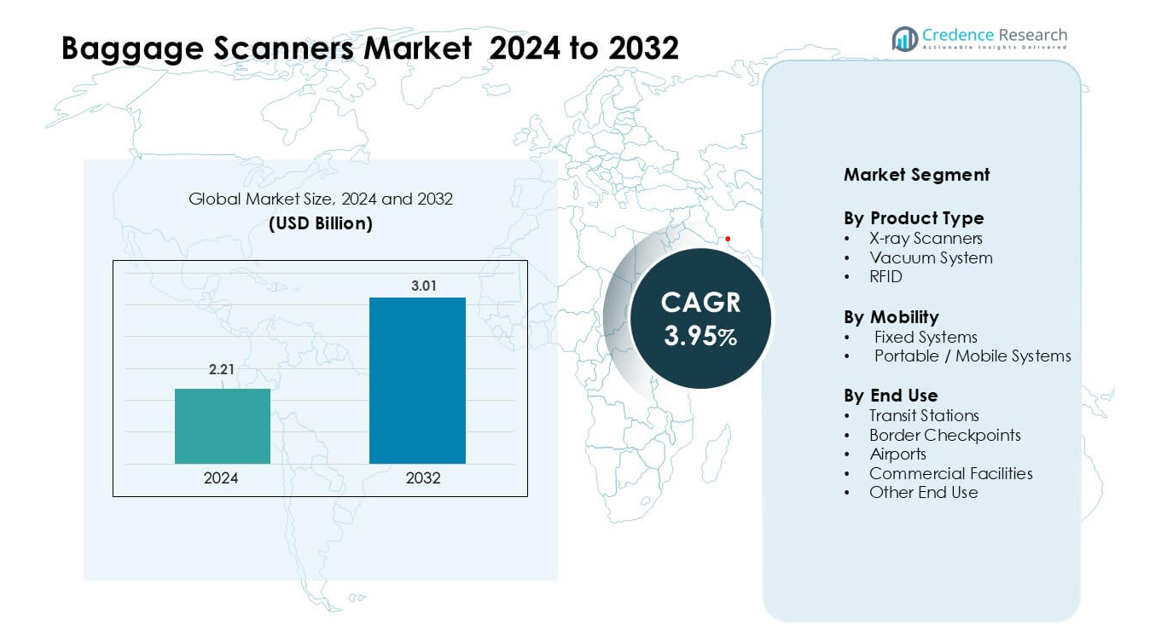

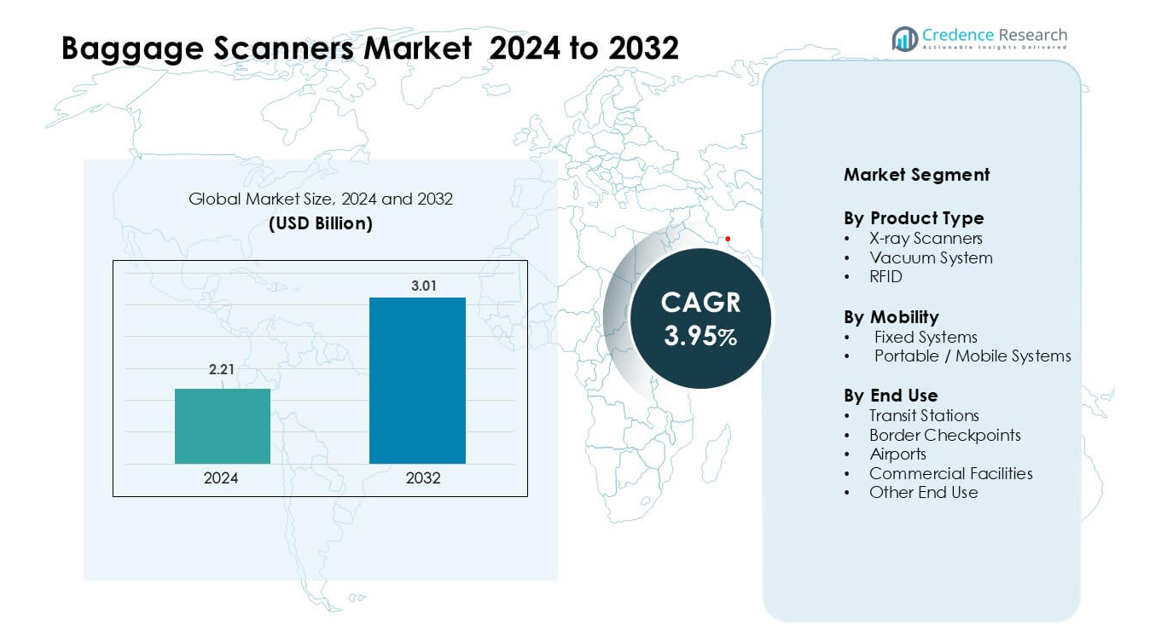

Baggage Scanners Market was valued at USD 2.21 billion in 2024 and is anticipated to reach USD 3.01 billion by 2032, growing at a CAGR of 3.95 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Baggage Scanners Market Size 2024 |

USD 2.21 billion |

| Baggage Scanners Market, CAGR |

3.95% |

| Baggage Scanners Market Size 2032 |

USD 3.01 billion |

The Baggage Scanners Market is shaped by key players such as CEIA SpA, Kromek Group plc, Teledyne ICM, Autoclear LLC, Gilardoni S.p.A., Astrophysics Inc., IDSS, Nikon Metrology, L3Harris Technologies’ legacy security units, and VOTI Detection Inc. These companies compete by offering advanced multi-view, dual-energy, and CT-based scanners that enhance detection accuracy and reduce screening time. Continuous upgrades in AI analytics, automated threat identification, and integrated security platforms further strengthen their market presence. North America remained the leading region in 2024 with a 37% share, supported by strict aviation security standards and rapid modernization of screening infrastructure.

Market Insights

- The Baggage Scanners Market was valued at USD 2.21 billion in 2024 and is expected to reach USD 3.01 billion by 2032, registering a CAGR of 3.95% during the forecast period.

- Growth is driven by rising global air travel, strict security regulations, and strong demand for advanced dual-energy and CT-based scanners across airports and border checkpoints.

- Major trends include rapid adoption of AI-driven detection, automation of screening lanes, and expansion of portable scanners for events and temporary checkpoints.

- Competition remains strong as CEIA SpA, Kromek Group plc, Teledyne ICM, Autoclear LLC, Gilardoni S.p.A., and other players enhance imaging quality, cybersecurity, and remote screening capabilities to strengthen market presence.

- North America led the market with 37% share in 2024, while airports dominated the end-use segment with about 58% share, supported by modernization of screening systems across major transit hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

X-ray scanners led the product type segment in 2024 with about 64% share. Their strong position came from high deployment across airports, rail stations, and secured buildings due to reliable threat detection. Demand grew as modern X-ray units offer dual-energy imaging, real-time alerts, and better material discrimination. Vacuum systems expanded in facilities that handle sensitive goods, while RFID gained traction for baggage tracking and workflow automation. Rising global travel volumes and strict security mandates continued to push X-ray scanner adoption across major transit hubs.

- For instance, Smiths Detection deployed CT-based baggage scanners with automated threat detection by 2023, enabling airports to reduce manual bag checks and increase screening throughput while maintaining regulatory compliance.

By Mobility

Fixed systems dominated the mobility segment in 2024 with nearly 71% share. These systems remained preferred in airports, border points, and metro stations because fixed installations offer higher throughput, stronger scanning performance, and durability for 24/7 operations. Portable and mobile scanners gained demand from events, rapid-response units, and small terminals requiring flexible screening. Growth in fixed systems was driven by infrastructure upgrades, government safety programs, and rising investment in integrated surveillance platforms designed to streamline large-scale passenger movement.

- For instance, Hawkberg offers portable X-ray baggage scanners designed for rapid setup and compact operation. These systems support temporary checkpoints, mobile security units, and remote screening needs where fixed infrastructure is limited.

By End Use

Airports led the end-use segment in 2024 with around 58% share. The dominance came from stringent aviation security standards and the need to manage rising passenger traffic. Airports invested in advanced scanners that detect explosives, contraband, and high-risk items with faster processing speeds. Transit stations and border checkpoints expanded as countries strengthened transportation security. Commercial facilities also adopted scanners to protect high-value assets and control access. Growth across all end uses aligned with tightening regulations and increased global focus on screening efficiency.

Key Growth Drivers

Rising Global Air Traffic and Security Mandates

Growing international travel and increasing cross-border movement continue to push airports, seaports, and transit hubs to expand screening capacity. Aviation agencies worldwide enforce strict rules on baggage inspection, which drives investments in advanced scanners with higher accuracy and faster throughput. Authorities adopt dual-energy, multi-view, and CT-based systems to meet emerging threats linked to explosives, weapons, and prohibited goods. Airports upgrade legacy systems to handle peak loads and reduce wait times during security checks. Rising tourism, expanding airline fleets, and new airport terminals further strengthen demand. This shift toward efficient and automated screening fuels sustained growth in the baggage scanners market.

- For instance, Smiths Detection deployed the HI-SCAN 6040 CTiX, a CT carry-on baggage scanner certified to ECAC EDS CB C3 and TSA APSS 6.2 Level 1 standards. The system supports screening without removing electronics or liquids, helping airports streamline passenger inspection workflows.

Growing Threat Landscape and Need for Advanced Detection

Threat patterns are evolving rapidly, increasing the need for scanners that detect a wide range of dangerous items. Security agencies seek systems capable of identifying concealed objects, powder-based substances, lithium batteries, narcotics, and chemically hazardous materials. AI-driven analysis, pattern recognition, and automated threat highlighting improve operator efficiency and reduce error rates. Countries also invest in integrated screening networks that link scanners with real-time intelligence platforms. These upgrades help authorities respond to smuggling attempts, terrorism risks, and contraband flow. The rising focus on national security and tightening border control measures makes high-performance detection technology a major growth driver.

- For instance, Smiths Detection’s HI-SCAN 10080 XCT is a high-speed CT-based explosives detection system for hold baggage and air cargo. The platform delivers 3D volumetric imaging and is designed to support high screening throughput at large airports while maintaining certified detection performance.

Infrastructure Modernization and Digital Transformation

Many nations are modernizing airports, railway hubs, and border facilities, creating strong demand for next-generation scanning systems. Public and private operators deploy high-speed scanners, robotics-assisted baggage handling, and automated inspection lanes to streamline passenger flow. Digital transformation fuels adoption of cloud-based monitoring, predictive maintenance, and centralized command systems that enhance operational visibility. Governments increasingly fund smart-security projects, especially in Asia-Pacific, the Middle East, and Europe. As infrastructure projects expand, operators replace outdated scanners with energy-efficient, networked, and high-resolution systems. This modernization wave accelerates procurement cycles and boosts long-term market growth.

Key Trends & Opportunities

AI Integration and Automation Across Screening Systems

AI plays a major role in shaping the future of baggage scanners by improving both accuracy and speed. Machine-learning algorithms help identify complex threats and automate routine decision-making, reducing operator fatigue and lowering false-alarm rates. Automated tray return systems, remote screening, and self-service security lanes improve passenger flow in busy terminals. Integration with airport data platforms supports risk-based screening and predictive threat mapping. These advancements create strong opportunities for manufacturers offering scalable, intelligent solutions.

- For instance, Smiths Detection’s iCMORE AI software integrates with CT baggage scanners to support automated threat recognition using machine-learning algorithms, improving image consistency and reducing operator workload across certified EDS screening systems.

Shift Toward Contactless and Touch-Free Security

Airports and commercial hubs are adopting touch-free and automated screening solutions to improve hygiene and efficiency. New scanners support remote viewing, mobile operator consoles, and automated scanning tunnels that reduce human contact. Contactless identification through RFID and automated tray handling also streamline movement. This shift opens opportunities for companies delivering systems optimized for speed, minimal contact, and improved passenger comfort.

- For instance, Rapiscan Systems’ Orion 920CT is a CT-based carry-on baggage scanner that supports screening without removing electronics or liquids under approved operating rules. The platform enables remote image analysis and centralized screening while meeting applicable ECAC and TSA certification requirements.

Expansion of Mobile and Portable Scanning Solutions

Demand for portable scanners is rising across border checkpoints, public events, and temporary security installations. Mobile units support fast deployment and flexible scanning where permanent systems cannot be installed. This trend creates opportunities for lightweight, rugged, and battery-efficient scanner designs.

Key Challenges

High Procurement and Maintenance Costs

Advanced scanners require significant capital investment, which limits adoption in smaller airports and commercial sites. CT-based and multi-view systems involve high installation, calibration, and maintenance expenses. Operators must also train staff and manage continuous software updates to maintain compliance. For developing regions with limited budgets, these costs slow procurement and extend replacement cycles. The financial burden remains a major challenge for wider market penetration.

Operational Complexity and Skill Gaps

Modern scanners rely on sophisticated imaging, software analytics, and integrated networks, requiring skilled operators. Many regions face shortages of trained personnel capable of interpreting images and managing automated systems. Poor training increases false alarms and reduces efficiency. Additionally, integrating scanners with existing security infrastructure often creates technical challenges. This skills gap slows full-scale adoption and impacts operational reliability.

Regional Analysis

North America

North America led the Baggage Scanners Market in 2024 with about 37% share. Strong federal aviation mandates, high international passenger traffic, and frequent upgrades to screening systems supported continued adoption. Airports expanded CT-based and multi-view scanners to improve detection accuracy and reduce congestion. Border checkpoints also strengthened procurement due to rising cross-border movement and advanced threat screening needs. Investments in AI-integrated scanning platforms and modernization of transportation hubs further boosted demand. The region’s mature infrastructure and strong security compliance requirements continued to drive sustained system replacement and technological upgrades.

Europe

Europe held nearly 31% share in 2024, supported by strict aviation security rules and continuous modernization across major airports. EU regulatory frameworks pushed operators to adopt advanced scanners that meet updated threat-detection standards. Nations such as the U.K., Germany, France, and the Netherlands upgraded systems to handle dense passenger flow and improve border security efficiency. The expansion of intra-EU travel and rising cargo screening needs further supported demand. Investments in automated screening lanes and AI-enabled inspection tools also accelerated adoption across transit hubs, seaports, and high-traffic commercial facilities.

Asia-Pacific

Asia-Pacific accounted for approximately 26% share in 2024, driven by rapid airport expansion, rising tourism, and growing airline fleets. Countries such as China, India, Japan, and South Korea invested heavily in next-generation scanners to support new terminals and high-traffic transit systems. Regional governments strengthened border security and cargo screening to manage increasing passenger volumes and trade flow. Growing interest in AI-enabled screening, automated baggage lanes, and integrated security management platforms also accelerated momentum. The region’s fast-growing aviation ecosystem positioned Asia-Pacific as one of the strongest future demand centers.

Latin America

Latin America captured around 4% share in 2024, supported by gradual upgrades in airport screening and growing emphasis on border security. Nations such as Brazil, Mexico, and Colombia invested in new imaging systems to improve threat detection and reduce operational bottlenecks. Rising tourism and expansion of regional airlines also encouraged scanning system adoption. Budget constraints slowed full-scale modernization, but international funding programs and private-sector investment improved deployment rates. The region’s need for enhanced security at public venues and transport hubs continued to create steady replacement opportunities.

Middle East & Africa

The Middle East & Africa region held nearly 2% share in 2024, yet showed rising long-term potential due to expanding airport infrastructure and tourism-driven travel growth. Gulf countries invested in advanced screening systems for large international hubs, focusing on CT-based scanners and automated lanes. African nations gradually adopted modern scanners to strengthen border control and improve cargo inspection. Security upgrades for major events and new construction projects also supported demand. Although investment levels vary widely, ongoing infrastructure development positions the region for steady adoption over the next decade.

Market Segmentations:

By Product Type

- X-ray Scanners

- Vacuum System

- RFID

By Mobility

- Fixed Systems

- Portable / Mobile Systems

By End Use

- Transit Stations

- Border Checkpoints

- Airports

- Commercial Facilities

- Other End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Baggage Scanners Market features strong competition among leading companies such as CEIA SpA, Kromek Group plc, Teledyne ICM, Autoclear LLC, Gilardoni S.p.A., Astrophysics Inc., IDSS, Nikon Metrology, L3Harris Technologies’ legacy security units, and VOTI Detection Inc. These manufacturers compete through advanced imaging technologies, AI-enabled threat detection, and multi-view or CT-based scanning platforms that enhance screening accuracy and throughput. Companies strengthen their positions by expanding product portfolios, improving cybersecurity features, and integrating scanners with automated lanes and centralized screening systems. Strategic partnerships with airports, government agencies, and border authorities help secure long-term contracts. Many players focus on developing energy-efficient, compact, and networked systems tailored to both high-traffic hubs and smaller facilities. Continuous R&D investment, regulatory compliance, and global service networks remain central to maintaining competitiveness in this evolving security market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CEIA SpA

- Kromek Group plc

- Teledyne ICM

- Autoclear LLC

- Gilardoni S.p.A.

- Astrophysics Inc.

- IDSS (Integrated Defense and Security Solutions)

- Nikon Metrology

- L3Harris Technologies (legacy security units)

- VOTI Detection Inc.

Recent Developments

- In March 2024, Kromek received a US$ 2.1 million order from a U.S.-based OEM serving the homeland security sector to supply radiation-detector components for advanced explosive detection systems. The contract, scheduled for delivery in the first half of FY 2025, highlights continued demand for Kromek’s detector technology within the security screening equipment supply chain.

Report Coverage

The research report offers an in-depth analysis based on ProductType, Mobility, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for CT-based scanners will rise as airports replace older X-ray systems.

- AI-driven threat detection will become standard to improve accuracy and reduce false alarms.

- Automated screening lanes will expand to speed up passenger flow in high-traffic terminals.

- Portable and mobile scanners will gain traction for rapid deployment in temporary security zones.

- Integration with centralized security command platforms will strengthen real-time monitoring.

- Manufacturers will focus on energy-efficient and low-maintenance scanners to reduce operating costs.

- Border checkpoints will increase adoption due to growing cross-border movement and smuggling concerns.

- Smart scanning systems will support touchless and remote screening to enhance operator safety.

- Governments will boost investments in modernization programs across airports and transport hubs.

- Hybrid imaging technologies will emerge to detect complex threats and improve screening precision.