Market Overview

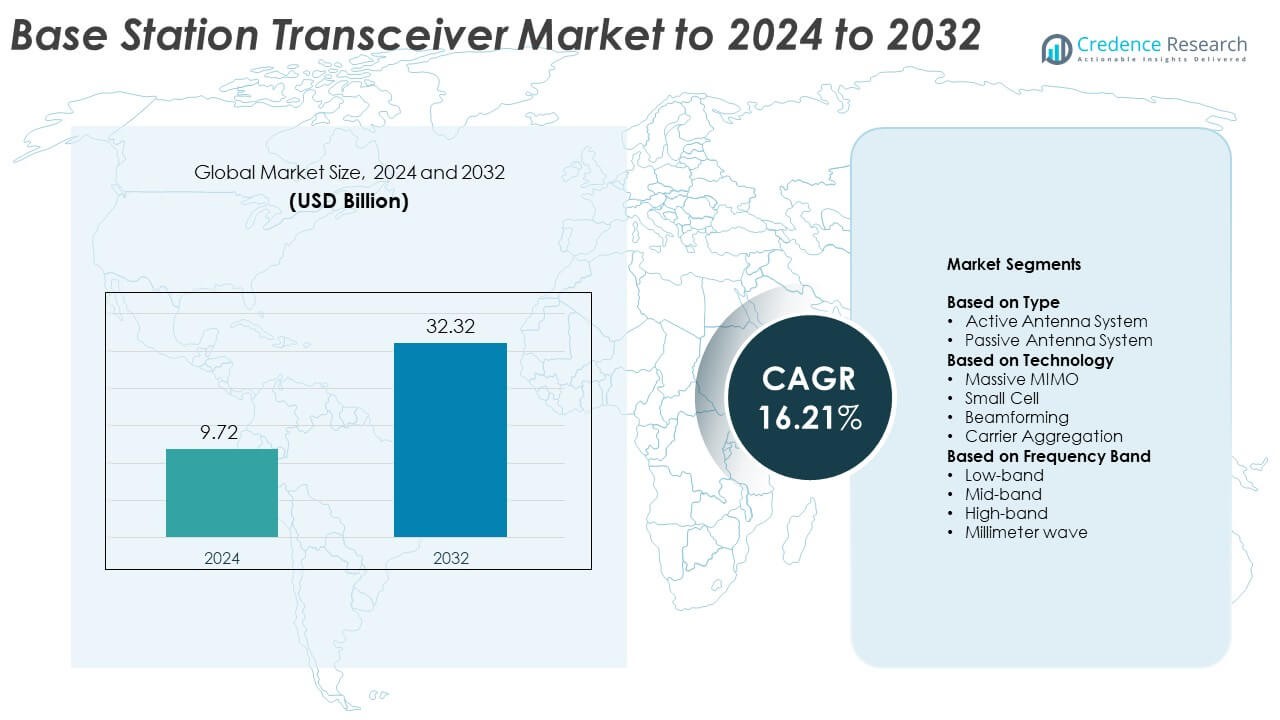

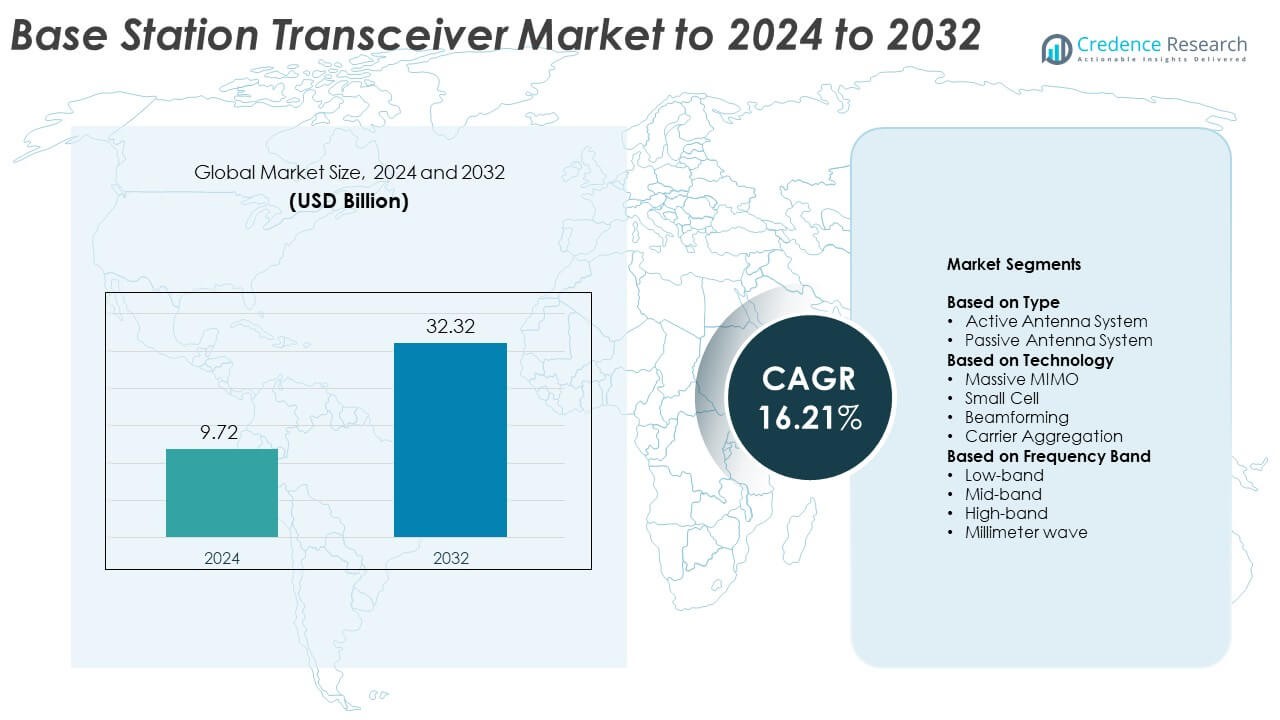

Base Station Transceiver Market size was valued USD 9.72 Billion in 2024 and is anticipated to reach USD 32.32 Billion by 2032, at a CAGR of 16.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Base Station Transceiver Market Size 2024 |

USD 9.72 Billion |

| Base Station Transceiver Market, CAGR |

16.21% |

| Base Station Transceiver Market Size 2032 |

USD 32.32 Billion |

The base station transceiver market is shaped by leading companies such as Tongyu Communication Inc., Cisco Systems Inc., Rosenberger Group, Huawei Technologies Co. Ltd., NEC Corporation, ZTE Corporation, Radio Frequency Systems (RFS), Amphenol Corporation, Kathrein SE, and Nokia Corporation. These vendors compete through advanced antenna technologies, multi-band systems, and strong support for 5G rollout. They focus on massive MIMO, active antenna units, and compact designs that improve coverage and capacity for operators. North America remained the leading region in 2024 with 34% share, supported by rapid network modernization. Europe followed with 28%, while Asia Pacific held 30%, driven by large-scale 5G expansion across major economies.

Market Insights

- The base station transceiver market reached USD 9.72 Billion in 2024 and is projected to hit USD 32.32 Billion by 2032, growing at a CAGR of 16.21% during the forecast period.

- Growth is driven by rapid 5G deployment, rising data usage, and strong demand for massive MIMO and active antenna systems that boost spectral efficiency across dense urban networks.

- Key trends include fast adoption of small cells for indoor coverage, expansion of virtual RAN, and rising investment in multi-band and energy-efficient transceiver designs to support large-scale modernization.

- Competition intensifies as major vendors enhance integrated antenna solutions, improve software-driven features, and strengthen partnerships with telecom operators to support large rollout programs.

- North America led the market with 34% share, followed by Europe at 28% and Asia Pacific at 30%, while mid-band dominated the frequency segment with 52% share due to balanced speed and coverage advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Active antenna system led the base station transceiver market in 2024 with about 57% share. Mobile operators preferred active antennas because these units combine radio elements and antenna structures in one compact design, which improves energy use and network coverage. Rising 5G rollouts increased demand for these systems due to their beam control and fast installation needs. Passive antenna systems kept stable use in cost-sensitive networks, but active designs stayed ahead as operators targeted higher capacity and better user experience in dense urban areas.

- For instance, Ericsson’s AIR 6419 active antenna unit supports 200 MHz instantaneous bandwidth with 64 transmit and 64 receive paths (64T64R).

By Technology

Massive MIMO dominated the technology segment in 2024 with nearly 46% share. Network providers adopted massive MIMO to support higher data loads and maintain strong signal quality across busy zones. The technology helps operators increase spectral efficiency and handle rising video use and connected devices across cities. Small cells expanded with growing indoor coverage needs, while beamforming and carrier aggregation improved performance in mixed spectrum zones. Massive MIMO held the lead because it delivers strong throughput and meets strict 5G performance targets.

- For instance, Nokia’s Habrok AirScale Massive MIMO 64TRX radio (Band n78) supports up to 400 MHz instantaneous bandwidth (IBW) and 200 MHz occupied bandwidth (OBW), according to official Nokia product specifications and press releases.

By Frequency Band

Mid-band held the largest share in 2024 with about 52% of the base station transceiver market. Operators favored mid-band because it provides a balanced mix of wide coverage and high data speed, making the band central to nationwide 5G plans. Low-band supported broad rural reach, while high-band and millimeter-wave delivered very high speed in dense city clusters. The rise of urban smart zones and enterprise 5G pushed mid-band demand higher, as this band ensures stable performance for both consumer and industrial networks.

Key Growth Drivers

Rising 5G Deployment Worldwide

Global 5G expansion drives strong demand for base station transceivers as operators upgrade networks for higher speed and low-latency service. Nations accelerate spectrum release and support dense site installation for urban and industrial needs. The shift toward cloud-native cores and virtualized RAN further boosts transceiver integration. Growing mobile data use and device penetration push operators to expand capacity, making 5G rollout the leading growth driver.

- For instance, China Mobile confirmed deployment of approximately 360,000 new 5G base stations in a single year during 2023, bringing its total 5G base stations to 1.945 million by the end of that year, as reported in its official 2023 network operations disclosure.

High Demand for Enhanced Network Capacity

Soaring data traffic from video streaming, connected devices, and enterprise mobility pushes operators to upgrade radio infrastructure. Telecom networks require transceivers that support greater throughput, better spectral efficiency, and stable service in crowded zones. Massive MIMO and advanced antenna systems strengthen network capacity and attract investment. This rise in heavy data consumption makes capacity enhancement a major growth catalyst.

- For instance, Verizon reported that its customers used a total of 47.8 terabytes of data in and around State Farm Stadium during Super Bowl LVII in 2023, representing the total data consumed over the event, according to official press releases and network performance reporting.

Expansion of IoT and Industrial Connectivity

Increasing IoT deployment across manufacturing, logistics, and smart city projects boosts need for strong and reliable cellular coverage. Transceivers support dense device clusters and enable automation, remote control, and sensor communication. Industries adopt private 5G networks, increasing demand for high-performance mid-band and millimeter-wave units. This expanding digital ecosystem positions IoT-driven connectivity as another vital market driver.

Key Trends & Opportunities

Shift Toward Massive MIMO and Active Antenna Units

Operators adopt massive MIMO and active antennas to improve spectrum output, extend coverage, and support dense urban use. These technologies offer strong performance gains and reduce energy consumption through advanced signal shaping. Wider availability of mid-band and millimeter-wave spectrum accelerates this trend. The shift creates opportunities for vendors offering integrated and compact transceiver designs.

- For instance, the Ericsson AIR 6419 active antenna unit supports 200 MHz instantaneous bandwidthwith 64 transmit and 64 receive paths (64T64R). While its weight varies by frequency band, certain lightweight variants (e.g., Band 42) weigh approximately 20 kilograms, which has been highlighted in official press releases.

Growing Adoption of Small Cells for Urban Densification

Cities face rising congestion as mobile users grow, pushing operators to deploy small cells for targeted capacity boosts. Small cells support indoor coverage and meet traffic demands in stadiums, stations, and enterprise sites. The move toward neutral-host models and shared infrastructure expands adoption further. This trend strengthens opportunities in compact transceivers designed for flexible urban placement.

- For instance, Huawei’s LampSite small-cell system supports up to 8 remote units (pRRUs) per Radio Hub (RHUB), and later versions like LampSite 2.0 enable user speeds of up to 1 Gbps, according to various technical overview documents and press releases.

Advancement in Software-Defined and Virtualized RAN

Telecom networks move toward virtual RAN to cut cost and improve scalability. Software-defined control helps operators manage spectrum efficiently and deploy new services faster. Vendors offering programmable transceivers gain strong opportunities as operators seek future-ready network functions. This shift supports long-term modernization strategies.

Key Challenges

High Deployment and Upgrade Costs

Operators face heavy capital needs for upgrading to 5G-ready infrastructure, installing new antennas, and expanding backhaul. Dense site rollout increases tower lease, power, and fiber expenses. These high costs slow deployment in developing regions and pressure operator margins. Vendors must offer cost-optimized and energy-efficient transceiver solutions to ease spending challenges.

Spectrum Availability and Regulatory Barriers

Limited spectrum release and strict licensing rules delay network expansion across many countries. Slow regulatory approvals hinder installation of new sites and advanced antenna systems. Fragmented spectrum bands create complexity in equipment design and limit global standardization. These barriers challenge transceiver adoption and slow broad-scale upgrades.

Regional Analysis

North America

North America held about 34% share of the base station transceiver market in 2024, driven by rapid 5G deployments and strong investment from major operators. The region expanded network density across urban clusters, enterprise campuses, and transport corridors. Demand rose for massive MIMO and mid-band solutions to support growing data traffic and device adoption. The United States led activity with aggressive spectrum releases and modernization programs, while Canada strengthened rural connectivity. Steady upgrades across private 5G and industrial sites further pushed regional growth and maintained North America’s leading position.

Europe

Europe captured nearly 28% share in 2024, supported by coordinated 5G rollout plans across major economies. Governments encouraged spectrum harmonization to improve cross-border network efficiency, while telecom operators upgraded sites with active antenna systems and small cells. Urban regions focused on improving service quality for high-density zones, including business districts and transport hubs. Demand also grew in manufacturing clusters adopting private 5G for automation. Eastern Europe saw rising infrastructure investment, helping the region maintain stable growth and a strong share in the global market.

Asia Pacific

Asia Pacific accounted for about 30% share in 2024, driven by large-scale network deployments across China, South Korea, Japan, and emerging Southeast Asian markets. Heavy data consumption and rapid mobile subscriber growth pushed operators to adopt massive MIMO, mid-band, and millimeter-wave solutions. Countries expanded both urban and rural coverage, targeting smart city programs and industrial automation. Competitive pricing and domestic manufacturing strength supported fast equipment adoption. The region’s strong digital ecosystem kept Asia Pacific one of the fastest-growing markets with significant long-term potential.

Latin America

Latin America held around 5% share in 2024 as operators gradually upgraded networks to support 5G services. Countries prioritized mid-band deployment for cost-efficient coverage and adopted small cells in dense metropolitan areas. Economic constraints slowed widespread rollout, but targeted investments by major carriers strengthened connectivity in business districts and industrial zones. Nations like Brazil and Mexico led regional adoption with early spectrum allocation. Growing interest in enterprise digitalization and improved regulatory clarity helped the region expand at a steady pace.

Middle East and Africa

Middle East and Africa captured about 3% share in 2024, with deployment levels varying across countries. Gulf nations accelerated 5G rollout in smart city projects, airports, and logistics hubs, creating strong demand for high-band and millimeter-wave transceivers. Africa progressed at a slower rate due to high infrastructure cost, focusing mainly on low-band and mid-band upgrades to expand coverage. Government initiatives to improve digital inclusion and attract foreign investment supported gradual market progress. The region continued to evolve with selective high-value deployments and long-term expansion plans.

Market Segmentations:

By Type

- Active Antenna System

- Passive Antenna System

By Technology

- Massive MIMO

- Small Cell

- Beamforming

- Carrier Aggregation

By Frequency Band

- Low-band

- Mid-band

- High-band

- Millimeter wave

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The base station transceiver market features key players such as Tongyu Communication Inc., Cisco Systems Inc., Rosenberger Group, Huawei Technologies Co. Ltd., NEC Corporation, ZTE Corporation, Radio Frequency Systems (RFS), Amphenol Corporation, Kathrein SE, and Nokia Corporation. Companies in this space focus on advanced antenna design, improved spectral efficiency, and strong network reliability to meet rising 5G demands. Vendors invest in massive MIMO, compact active antennas, and multi-band systems to support dense city coverage and high-capacity sites. Many suppliers expand manufacturing strength and streamline supply chains to handle growing global deployment. Firms also enhance software-driven features that support virtual RAN, network automation, and energy-efficient operation. Strategic partnerships with telecom operators help accelerate new technology adoption in large markets. Growing interest in private 5G and industrial automation drives suppliers to offer flexible and scalable transceiver solutions suited for enterprise use.

Key Player Analysis

- Tongyu Communication Inc.

- Cisco Systems Inc.

- Rosenberger Group

- Huawei Technologies Co. Ltd.

- NEC Corporation

- ZTE Corporation

- Radio Frequency Systems (RFS)

- Amphenol Corporation

- Kathrein SE

- Nokia Corporation

Recent Developments

- In 2025, ZTE launched the industry’s first intelligent 400GE base station router, the ZXCTN 6120H-SE, aimed at addressing rising data traffic and powering future digital networks with efficiency and flexibility.

- In 2025, Cisco collaborated with SoftBank for deploying all-optical metro networks, enhancing the efficiency and scalability of base station network components.

- In 2025, Tongyu Communication unveiled a revolutionary Macro WiFi product at MWC 2025 in Barcelona.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Frequency Band and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with continued global 5G deployment across urban and rural zones.

- Operators will invest more in active antenna systems to improve network efficiency.

- Massive MIMO adoption will rise as data traffic grows across consumer and enterprise segments.

- Demand for small cells will increase to support indoor coverage and dense city use.

- Mid-band spectrum will remain the preferred choice for balanced performance and wide rollout.

- Virtual RAN and software-defined functions will reshape transceiver integration within networks.

- Private 5G networks will boost industrial demand for high-performance transceiver units.

- Energy-efficient designs will become a priority as operators seek to reduce operating costs.

- Multi-band and compact transceivers will gain traction for flexible deployment across locations.

- Emerging markets will accelerate upgrades as spectrum access improves and device adoption rises.