| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Incinerators Market Size 2024 |

USD 18,111.06 million |

| Incinerators Market, CAGR |

2.97% |

| Incinerators Market Size 2032 |

USD 22,798.36 million |

Market Overview

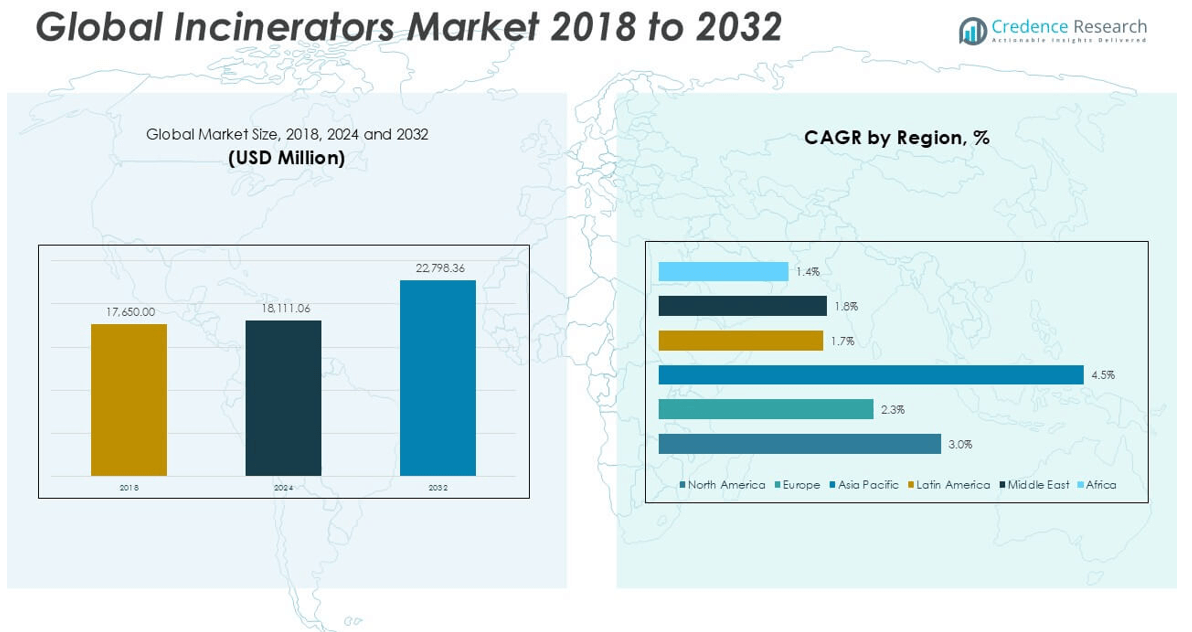

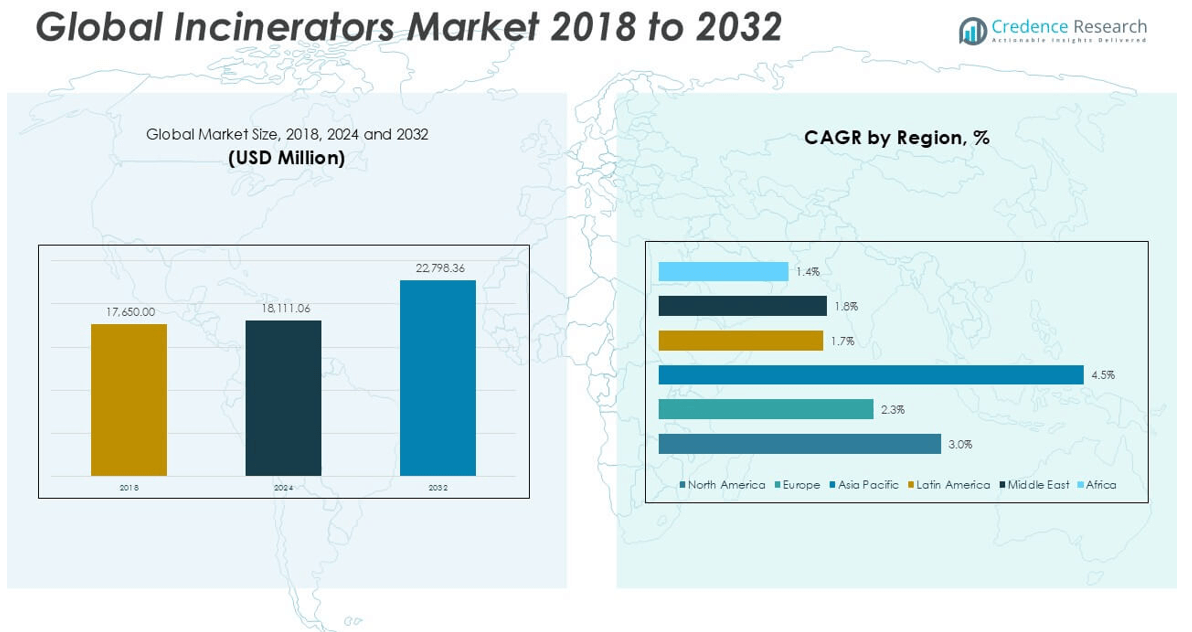

The Incinerators market size was valued at USD 17,650.00 million in 2018, increased to USD 18,111.06 million in 2024, and is anticipated to reach USD 22,798.36 million by 2032, at a CAGR of 2.97% during the forecast period.

The incinerators market is driven by key players such as Babcock & Wilcox, Mitsubishi Heavy Industries, Keppel Seghers, Atlas Incinerators, Dutch Incinerators, and Haat Incinerator India. These companies lead the market through advanced technologies, strategic partnerships, and strong global networks, focusing on energy-efficient and environmentally compliant solutions. North America dominates the global incinerators market, holding the largest share of 38.05% in 2024, supported by stringent waste management regulations and significant investments in waste-to-energy infrastructure. Europe follows, driven by strict environmental policies and the widespread adoption of advanced incineration systems, while Asia Pacific emerges as the fastest-growing region, propelled by rapid urbanization, increasing waste volumes, and expanding government initiatives to modernize waste management practices.

Market Insights

- The global incinerators market was valued at USD 18,111.06 million in 2024 and is projected to reach USD 22,798.36 million by 2032, growing at a CAGR of 2.97% during the forecast period.

- Increasing municipal solid waste generation and the rising need for effective hazardous waste management are key drivers accelerating the demand for incinerators globally.

- The market is witnessing a growing trend toward waste-to-energy technologies, with rotary kiln incinerators dominating the product segment due to their versatility and high efficiency.

- Key players such as Babcock & Wilcox, Mitsubishi Heavy Industries, and Keppel Seghers are focusing on strategic partnerships, product innovation, and expanding their global footprint to strengthen their competitive position.

- High capital investment, operational costs, and public concerns over emissions are major restraints, while North America holds the largest regional share at 38.05%, followed by Europe at 25.75% and Asia Pacific at 22.27%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The incinerators market, segmented by product, is led by the rotary kiln sub-segment, which holds the largest market share due to its versatility in handling a wide range of waste types, including hazardous, medical, and municipal waste. Rotary kilns are favored for their high-temperature operations, continuous processing capability, and adaptability to various waste streams. Additionally, the growing need for efficient hazardous waste management and stricter environmental regulations worldwide are driving the demand for rotary kiln incinerators. Their ability to achieve complete combustion with minimal emissions further strengthens their dominance in the global market.

- For instance, Babcock & Wilcox’s rotary kiln system at the Dülmen Hazardous Waste Incineration Plant in Germany processes up to 55,000 tonnes of hazardous waste annually, achieving combustion chamber temperatures exceeding 1,100°C with over 99.99% destruction efficiency.

By End Use:

Among end-use segments, the municipal sector dominates the incinerators market, accounting for the largest market share. This dominance is driven by the rapid urbanization and growing population that contribute to increasing municipal solid waste volumes globally. Municipalities are increasingly adopting incineration as an effective solution to manage waste and reduce landfill dependence, particularly in urban areas where space constraints are critical. The rising focus on energy recovery from waste and stringent government policies promoting sustainable waste management practices further support the significant adoption of incinerators in the municipal sector.

- For instance, the Keppel Seghers Tuas Waste-to-Energy Plant in Singapore processes approximately 800 tonnes of municipal waste per day, generating up to 22 MW of electricity, which is sufficient to power around 45,000 households.

Market Overview

Rising Municipal Solid Waste Generation

The increasing generation of municipal solid waste (MSW) due to rapid urbanization and population growth is a major driver for the incinerators market. Many urban areas face space constraints for landfilling, prompting municipalities to adopt incineration as an efficient waste management solution. Incinerators offer a practical method to significantly reduce waste volume while enabling energy recovery through waste-to-energy (WTE) systems. Governments worldwide are investing in waste incineration infrastructure to mitigate landfill pressure and improve sustainable waste management, further fueling market expansion.

- For instance, the Spittelau Waste Incineration Plant in Vienna, operated by Wien Energie, processes approximately 250,000 tonnes of waste annually, reducing waste volume by 90% while supplying heating to over 60,000 households.

Stringent Environmental Regulations

Stringent environmental policies aimed at reducing landfill use and minimizing greenhouse gas emissions are driving the adoption of advanced incineration technologies. Regulatory bodies in developed and developing countries are enforcing stricter guidelines on waste disposal and emissions control, encouraging industries and municipalities to opt for modern, eco-friendly incinerators. These advanced systems are equipped with sophisticated air pollution control mechanisms that comply with international emission standards, promoting their widespread deployment. This regulatory pressure significantly boosts the demand for efficient and sustainable incineration solutions.

- For instance, the Amager Bakke Waste-to-Energy Plant in Copenhagen, operated by ARC, is equipped with state-of-the-art flue gas cleaning systems that reduce nitrogen oxide emissions to as low as 30 mg/Nm³, significantly below the EU emission limit of 200 mg/Nm³.

Growing Industrial Waste and Hazardous Disposal Needs

Industrialization across sectors such as pharmaceuticals, chemicals, and manufacturing is contributing to the rising volume of hazardous and non-recyclable waste. Industries are increasingly relying on incinerators to manage toxic by-products safely and comply with stringent disposal regulations. The demand for specialized incinerators capable of handling industrial waste streams is growing rapidly, particularly in emerging economies. This trend is reinforced by the rising focus on workplace safety, environmental protection, and the proper handling of hazardous materials, which collectively stimulate market growth.

Key Trends & Opportunities

Advancements in Waste-to-Energy Technologies

The integration of waste-to-energy (WTE) technologies in modern incinerators presents a significant growth opportunity. Innovations in energy recovery systems allow incinerators to efficiently convert waste into electricity and heat, offering both environmental and economic benefits. The shift toward energy-positive waste treatment is particularly attractive to municipalities and industrial operators seeking sustainable and cost-effective solutions. As governments increasingly promote renewable energy initiatives, the development and deployment of advanced WTE-incinerators are expected to gain momentum.

- For instance, Mitsubishi Heavy Industries Environmental & Chemical Engineering Co. successfully developed the Naka Waste-to-Energy Plant in Japan, which generates 13 MW of electricity by processing 396 tonnes of waste per day, utilizing high-efficiency combustion and energy recovery systems.

Expansion in Emerging Economies

Emerging economies, particularly in Asia-Pacific and Latin America, are witnessing rapid infrastructure development and urban population growth, creating substantial opportunities for incinerator market expansion. These regions face mounting waste management challenges, limited landfill capacity, and growing public health concerns. Governments are focusing on adopting modern waste treatment technologies, including incineration, to address these issues efficiently. Investments in new waste management facilities and supportive regulatory frameworks are opening new markets for incinerator manufacturers and service providers.

- For instance, in India, the Okhla Waste-to-Energy Plant operated by Jindal Urban Infrastructure processes 2,000 tonnes of municipal solid waste daily, generating approximately 16 MW of electricity, significantly contributing to New Delhi’s waste management capacity.

Key Challenges

High Capital and Operational Costs

One of the primary challenges in the incinerators market is the high initial investment required for building and installing incineration facilities. Additionally, operating costs can be significant, particularly for systems that must meet stringent emission standards through advanced pollution control technologies. These financial barriers may limit adoption, especially in developing countries where budget constraints and competing infrastructure priorities exist. As a result, market penetration in cost-sensitive regions may be slower despite the pressing need for waste management solutions.

Public Opposition and Environmental Concerns

Public resistance to incineration projects, often driven by concerns over air pollution, toxic emissions, and potential health risks, poses a major challenge. Communities sometimes oppose the establishment of incineration plants near residential areas, fearing long-term environmental impacts. Negative perceptions regarding the safety and sustainability of incinerators can delay project approvals and hinder market growth. Overcoming these concerns requires continuous technological improvements, transparent communication, and strict adherence to emission regulations to build public trust.

Competition from Alternative Waste Management Methods

The growing emphasis on recycling, composting, and circular economy practices presents competition to incinerators as waste treatment solutions. Governments and environmental organizations increasingly promote waste reduction and material recovery strategies that prioritize recycling over incineration. In some regions, financial incentives and regulatory support are more favorable toward recycling and biodegradable waste management methods. This competitive pressure may limit the demand for incinerators, especially for waste streams that can be efficiently recycled or repurposed.

Regional Analysis

North America

North America dominated the incinerators market in 2024, accounting for approximately 38.05% of the global market. The market size in the region was valued at USD 6,795.25 million in 2018, which increased to USD 6,892.96 million in 2024, and is projected to reach USD 8,665.70 million by 2032 at a CAGR of 3.0%. The region’s strong waste-to-energy infrastructure and stringent waste management regulations continue to drive market growth. Additionally, increasing investments in modern incineration technologies, especially in the United States and Canada, are supporting the market’s expansion across both municipal and industrial sectors.

Europe

Europe held a 25.75% share of the global incinerators market in 2024, with a market size of USD 4,730.20 million in 2018, declining slightly to USD 4,668.54 million in 2024 but projected to recover and reach USD 5,557.16 million by 2032 at a CAGR of 2.3%. The European market is driven by stringent environmental policies, particularly in countries like Germany, France, and the UK, which prioritize emission control and waste minimization. The region’s commitment to sustainable waste management practices, along with advanced incineration technologies, continues to support stable market demand despite growing competition from recycling initiatives.

Asia Pacific

Asia Pacific is the fastest-growing regional market, capturing a 22.27% share in 2024. The market was valued at USD 3,741.80 million in 2018, expanded to USD 4,035.97 million in 2024, and is expected to reach USD 5,710.67 million by 2032, growing at the highest CAGR of 4.5%. Rapid industrialization, urbanization, and increasing municipal solid waste generation in countries like China, India, and Japan are key growth drivers. Additionally, rising government investments in modern waste treatment solutions and the increasing adoption of waste-to-energy systems significantly contribute to the region’s accelerating market growth.

Latin America

Latin America accounted for 4.82% of the global incinerators market in 2024, with a market size of USD 863.09 million in 2018, increasing modestly to USD 874.58 million in 2024, and projected to reach USD 997.88 million by 2032 at a CAGR of 1.7%. The region’s market growth is supported by gradual improvements in waste management infrastructure, particularly in Brazil, Mexico, and Argentina. However, limited government budgets and competing waste management methods such as landfilling and recycling may constrain rapid growth. Increasing awareness of sustainable waste treatment and environmental concerns is expected to slowly strengthen market development.

Middle East

The Middle East represented 3.86% of the global incinerators market in 2024, with the market valued at USD 723.65 million in 2018, decreasing slightly to USD 698.97 million in 2024, but projected to grow to USD 800.35 million by 2032 at a CAGR of 1.8%. The region’s growth is supported by rising urbanization, population growth, and a growing need for efficient waste management solutions in countries such as Saudi Arabia, the UAE, and Qatar. However, the market faces challenges due to the dominance of landfill-based waste management and relatively slow adoption of advanced incineration technologies.

Africa

Africa accounted for 5.19% of the global incinerators market in 2024, with a market size of USD 796.02 million in 2018, growing to USD 940.04 million in 2024, and anticipated to reach USD 1,066.60 million by 2032 at a CAGR of 1.4%. The region’s market expansion is driven by the increasing need for proper waste disposal systems amid rising urban populations and public health concerns. Growth is particularly notable in countries like South Africa, Nigeria, and Egypt. However, limited technological infrastructure and financial constraints may continue to restrict the pace of large-scale incinerator adoption across the continent.

Market Segmentations:

By Product:

- Rotary Kiln

- Fluidized Bed

- Grate

- Static Hearth

- Multiple Hearth

- Others

By End Use:

- Municipal

- Industrial

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The incinerators market is moderately fragmented, with the presence of several regional and international players competing on technology, efficiency, and environmental compliance. Key companies such as Babcock & Wilcox, Mitsubishi Heavy Industries, Keppel Seghers, and Atlas Incinerators hold significant market shares due to their advanced product offerings and strong global presence. These players focus on continuous innovation, strategic partnerships, and mergers to expand their market reach and enhance technological capabilities. Regional companies like Haat Incinerator India and Dutch Incinerators are strengthening their positions by providing cost-effective, customized solutions to local markets. Additionally, growing regulatory pressure on emissions and waste management is prompting companies to invest in eco-friendly and energy-efficient incineration technologies. The competitive landscape is also shaped by increasing demand for waste-to-energy systems, encouraging players to diversify their portfolios with integrated energy recovery solutions. Continuous innovation, environmental performance, and competitive pricing remain critical factors for sustaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Alfatherm

- Atlas Incinerators

- Babcock & Wilcox

- CHUWASTAR

- Dutch Incinerators

- Gershman, Brickner & Bratton

- Haat Incinerator India

- Incinco

- Keller Manufacturing

- Keppel Seghers

- Ketek Group

- MARTIN

- Maximus Envirotech

- Mitsubishi Heavy Industries

- Vikas Engineering

Recent Developments

- In December 2024, Atlas Incinerators launched the X10 Titan range, starting with the X610 Titan model. This new incinerator allows for the simultaneous incineration of solid waste and oil sludge without preheating the sludge oil, significantly reducing energy consumption, installation complexity, and operational costs. It also boasts an upgraded control system with advanced HMI technology and has received MED-type approval from DNV GL.

- In November 2024, Babcock & Wilcox (B&W) was awarded a contract to conduct a full-scale feasibility study of its SolveBright™ carbon capture technology at Mälarenergi AB’s waste-to-energy plant in Västerås, Sweden. The goal is to capture 400,000 tonnes of CO₂ annually and achieve carbon neutrality by 2035. The study will focus on integrating B&W’s carbon capture system with the plant’s existing waste-to-energy and district heating operations.

- In 2024, Alfatherm supplied a new incinerator to Al Fujairah Municipal Corporation (UAE) for the treatment of bio-medical waste. The incinerator was specifically designed for this purpose, reflecting a focus on tailored solutions for hazardous waste streams.

Market Concentration & Characteristics

The Incinerators Market shows a moderate level of concentration, with several established players holding significant shares across key regions. It features both global companies and strong regional participants competing on technology, efficiency, and regulatory compliance. The market focuses on delivering solutions that meet strict emission standards and support waste-to-energy initiatives. Leading companies prioritize product innovation, strategic partnerships, and capacity expansion to strengthen their competitive positions. It presents a diverse product landscape, including rotary kiln, fluidized bed, and grate-type incinerators, each addressing specific waste treatment needs. The market demonstrates steady demand from municipal and industrial sectors, driven by the increasing need for effective waste management and the growing preference for energy recovery from waste. Companies in this space face cost challenges related to capital investment and system maintenance while striving to improve operational efficiency and environmental performance. Competition remains dynamic, with companies continuously seeking technological improvements to enhance system lifespan and reduce emissions. The Incinerators Market evolves through regulatory shifts, infrastructure upgrades, and changing waste management strategies across different regions.

Report Coverage

The research report offers an in-depth analysis based on Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The incinerators market is expected to grow steadily, driven by increasing municipal and industrial waste volumes worldwide.

- Advancements in waste-to-energy technologies will enhance energy recovery efficiency from incineration processes.

- Governments will continue to implement stricter environmental regulations, pushing the adoption of modern, low-emission incinerators.

- Public-private partnerships are likely to increase, supporting the development of large-scale waste treatment facilities.

- Asia Pacific will emerge as the fastest-growing region due to rapid urbanization and infrastructure expansion.

- Investment in portable and small-scale incinerators will rise to meet the needs of remote and specialized waste treatment.

- Companies will focus on integrating air pollution control systems to meet global emission standards.

- Competition will intensify as more players introduce cost-effective and energy-efficient incinerator models.

- Waste management companies will prioritize incineration solutions that offer long-term sustainability and operational safety.

- Growing awareness about environmental safety will drive the demand for advanced incineration technologies across all sectors.