Market Overview

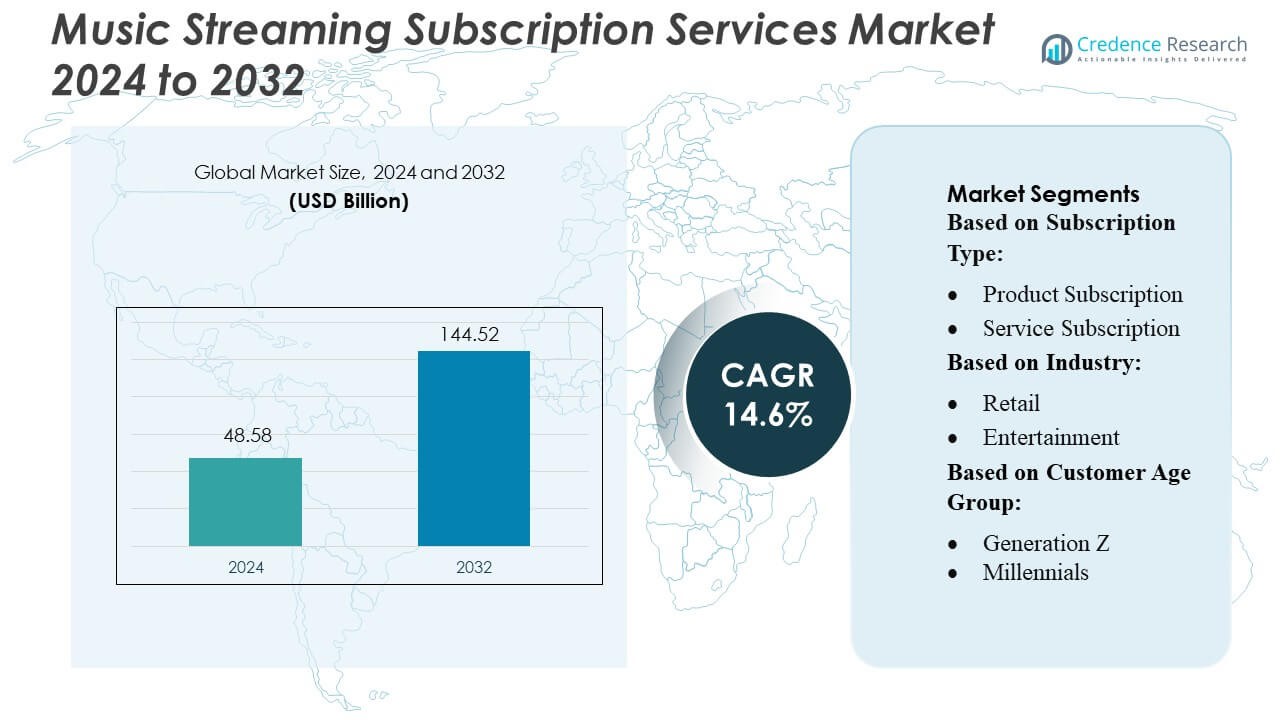

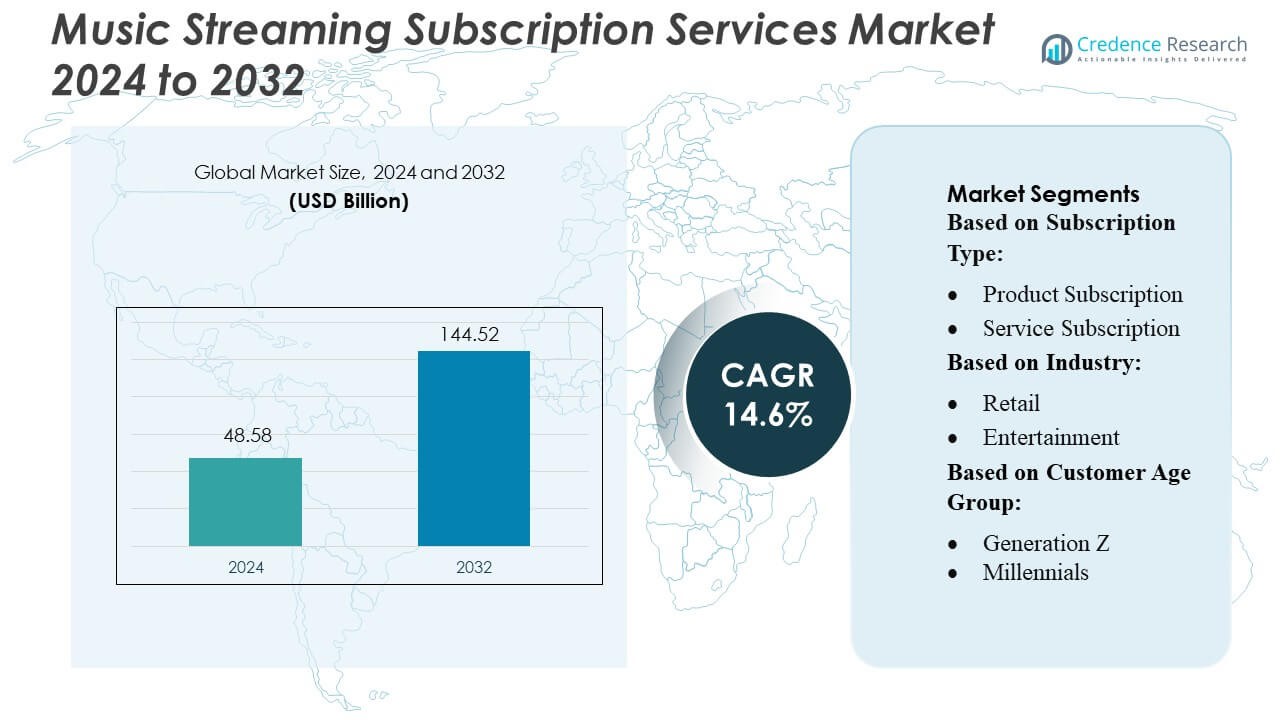

Music Streaming Subscription Services Market size was valued USD 48.58 billion in 2024 and is anticipated to reach USD 144.52 billion by 2032, at a CAGR of 14.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Music Streaming Subscription Services Market Size 2024 |

USD 48.58 Billion |

| Music Streaming Subscription Services Market, CAGR |

14.6% |

| Music Streaming Subscription Services Market Size 2032 |

USD 144.52 Billion |

The global music streaming subscription services market remains highly competitive as leading platforms aggressively innovate and expand their offerings. Major services invest in exclusive content, algorithm-driven personalization, and high-fidelity audio across devices, aiming to attract and retain paying subscribers. Regional players and emerging-market platforms increasingly challenge incumbents by offering localized content, flexible pricing, and mobile-first experiences tailored to younger audiences. Meanwhile, the dominant region continues to be North America, which accounts for roughly 37% of global market share, driven by high subscription penetration, strong internet infrastructure, and widespread adoption of premium and bundled streaming plans.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Music Streaming Subscription Services Market was valued at USD 48.58 billion in 2024 and is projected to reach USD 144.52 billion by 2032, registering a 14.6% CAGR, driven by rising adoption of premium, ad-free listening and expanding digital ecosystems.

- Growing demand for exclusive content, AI-powered personalization, and high-fidelity audio continues to drive market growth, with the premium subscription segment contributing the largest share of overall revenue.

- Trends such as podcast integration, social listening features, and mobile-first consumption in emerging markets strengthen platform engagement and broaden user bases.

- Competition intensifies as global and regional players expand localized content, flexible pricing, and device-agnostic streaming experiences, challenging traditional segment leaders.

- North America leads the market with a 37% share, supported by strong digital infrastructure, while Asia-Pacific emerges as the fastest-growing region due to rising smartphone penetration and youth-driven demand.

Market Segmentation Analysis:

By Subscription Type

Product Subscription dominates the music streaming subscription market, holding the largest share due to strong demand for bundled premium features such as offline access, ad-free streaming, and high-resolution audio. Service Subscription also grows steadily as platforms integrate AI-powered recommendations and multi-device syncing. Digital Subscription gains traction among users seeking flexible, app-based music access without long-term commitments, while Membership Subscription expands through ecosystem-based offerings that combine music, video, and cloud storage benefits. The dominance of Product Subscription is driven by higher perceived value and strong adoption among frequent streamers.

- For instance, Tidal supports lossless playback up to 24-bit/192 kHz across its premium tier. Service Subscription grows steadily with platforms enhancing AI-driven recommendations and device integration.

By Industry

Entertainment remains the dominant industry segment, accounting for the largest share as streaming platforms partner with record labels, production houses, and gaming companies to enhance content diversity and exclusivity. Retail increasingly leverages music subscriptions for in-store ambience optimization, while Food and Beverage outlets adopt curated playlists to enhance customer engagement. Health and Wellness emerges as a fast-growing segment with rising usage of mood-based and therapy-focused music collections. The Entertainment segment’s leadership is driven by high consumption volumes, rapid digital integration, and wide content licensing networks.

- For instance, SoundCloud supports a mix of free and paid memberships: its “Pro” subscription tier offers unlimited uploads (as opposed to the 1-hour or 2-hour upload caps on free/basic accounts).

By Customer Age Group

Millennials lead the market, holding the largest share due to high adoption of paid streaming plans, multi-device usage, and preference for curated and algorithmic playlists. Generation Z follows closely, driven by affordability options, social media-integrated music discovery, and strong engagement with short-form audio-visual platforms. Generation X maintains steady demand, especially for premium plans with family-sharing options, while Baby Boomers show growing interest in simplified user interfaces and classic-genre libraries. Millennials dominate primarily because of sustained digital spending habits and continuous engagement with both mainstream and niche music content.

Key Growth Drivers

- Expansion of Personalized and Algorithmic Recommendations

The market grows as platforms invest in advanced AI-driven recommendation engines that improve content discovery and user retention. Services analyze listening behavior, mood patterns, and contextual data to deliver hyper-personalized playlists that enhance engagement. This capability boosts subscription upgrades and reduces churn, particularly among younger demographics seeking curated, real-time music experiences. As algorithms become more precise, platforms strengthen customer loyalty and differentiate themselves in a competitive landscape, driving sustained subscriber growth across global markets.

- For instance, Amazon, customers using Alexa+ explored music three times more than with the earlier Alexa, and those who requested recommendations listened to nearly 70% more music.

- Rising Adoption of Multi-Device and Cross-Platform Streaming

Growing consumer demand for seamless access across smartphones, smart speakers, smart TVs, and wearables significantly drives subscription adoption. Music streaming services optimize interoperability, allowing users to switch devices without interrupting playback. This technological convenience increases daily usage time and encourages households to adopt family plans. The expansion of connected ecosystems—combined with high-speed internet availability—further reinforces the shift toward subscription-based audio consumption, enabling platforms to offer richer features and enhance user satisfaction.

- For instance, iHeartRadio reports having more than 188 million registered users. The service is available on over 500 platforms and supports more than 2,000 distinct types of connected devices, enabling listeners to begin playback on one device and continue it on another without interruption.

- Increasing Demand for Ad-Free and High-Fidelity Streaming

The rising preference for premium, ad-free music listening experiences accelerates subscription growth. Consumers show strong willingness to pay for enhanced audio quality, such as HD, Ultra HD, and lossless formats, along with offline playback capabilities. As more users invest in high-end headphones and home audio systems, the value proposition of high-fidelity streaming strengthens. This shift pushes platforms to expand premium tiers, integrate immersive formats like spatial audio, and improve sound engineering, thereby driving higher revenue per subscriber.

Key Trends & Opportunities

- Growth of Social Listening and Collaborative Features

A major trend emerges as platforms integrate real-time social listening, group sessions, and playlist collaboration features. These tools enable users to co-create content, share music experiences, and engage across social networks. The rise of creator-driven audio formats and shareable content generates new monetization opportunities. Services that leverage social integration enhance user stickiness, attract younger demographics, and transform streaming from a solo to a community-driven experience, unlocking long-term engagement potential.

- For instance, Deezer’s “Shaker” feature (launched in November 2023) enables users to form a collaborative playlist group with up to 14 people, even if some members don’t have a Deezer account.

- Expansion into Podcasts and Audio-Based Services

Music streaming platforms increasingly diversify into podcasts, live audio sessions, and exclusive talk shows, creating significant revenue and engagement opportunities. Original podcast content and exclusive licensing deals strengthen platform differentiation while expanding listening time beyond music. This trend supports cross-selling strategies, increases subscription value, and attracts new user segments. As audiences adopt audio for learning, entertainment, and wellness, platforms gain opportunities to become comprehensive audio hubs.

- For instance, Spotify’s official investor relations and newsroom information, the platform offers over 100 million tracks, nearly 7 million podcast titles, and 350,000 audiobooks for individual purchase (or access via monthly listening hours for Premium subscribers).

- Integration of AI-Generated and Immersive Audio Experiences

Platforms explore AI-generated soundscapes, personalized mixes, and adaptive listening experiences as emerging opportunities. Immersive formats like Dolby Atmos and spatial audio enhance user satisfaction and provide premium upgrade pathways. AI-assisted creation tools enable users to craft customized audio environments, expanding engagement and opening new content verticals. These advancements offer differentiation and support the transition toward more interactive, experience-driven streaming services.

Key Challenges

- High Licensing Costs and Content Acquisition Pressures

The market faces rising operational costs due to expensive licensing agreements with music labels, artists, and publishers. Ensuring access to diverse and exclusive content requires substantial investment, placing financial pressure on streaming platforms—especially emerging and regional players. As licensor negotiations become more complex and demand for fair artist compensation grows, platforms struggle to balance profitability with competitive pricing, limiting their ability to innovate or expand aggressively.

- Intense Competition and Subscriber Retention Issues

The industry experiences strong competition from global streaming giants, regional services, and alternative entertainment formats such as short-form video and social media platforms. With similar content libraries across competitors, differentiation becomes challenging, leading to frequent price-based competition. Users often switch platforms due to promotional discounts, content preferences, or bundled service offerings. Maintaining long-term retention requires continuous investment in personalization, exclusive content, and value-added features, making sustained growth more difficult.

Regional Analysis

North America

North America holds the largest share of the music streaming subscription services market, accounting for around 38%. The region benefits from mature digital ecosystems, high smartphone adoption, and strong demand for premium, ad-free streaming. Users show consistent willingness to pay for enhanced audio quality and exclusive content. The presence of major global platforms strengthens market leadership, supported by widespread use of smart speakers and connected home devices. Growth continues steadily as personalized recommendations, podcast integration, and bundled subscription offerings increase user engagement and retention.

Europe

Europe represents approximately 27% of the global market, driven by strong digital infrastructure and high acceptance of subscription-based audio services. The region benefits from diverse language preferences, robust licensing frameworks, and rising demand for high-fidelity streaming. Consumers increasingly shift from free to paid tiers due to better sound quality and wider content libraries. Local and international platforms both maintain strong presence, supported by steady adoption across Western and Northern Europe. Although growth is moderate, Europe remains a stable and significant contributor to global revenue.

Asia-Pacific

Asia-Pacific holds nearly 28% of the market and remains the fastest-growing region. Expanding smartphone usage, affordable mobile data plans, and large youth populations fuel rapid adoption of music streaming services. Local-language content and mobile-first subscription models make streaming accessible across urban and rural areas. Countries like India, China, and Indonesia drive significant user growth due to strong digital engagement and rising disposable incomes. As platforms integrate more regional content and flexible pricing, Asia-Pacific continues to offer substantial long-term growth potential.

Latin America

Latin America accounts for around 6% of the global market but shows strong year-on-year growth. Rising internet penetration, wider availability of low-cost mobile plans, and increasing interest in regional music genres support subscription adoption. Countries such as Brazil and Mexico lead consumption, driven by young digital-native populations. Local playlists and culturally relevant content help platforms increase user engagement. Although its market share is smaller compared to other regions, Latin America remains a high-growth region with expanding opportunities for premium subscription offerings.

Middle East & Africa

The Middle East & Africa region holds roughly 5% of the market and is in an early but fast-growing stage. Growth is supported by rising smartphone ownership, urbanization, and greater availability of digital payment methods. Telecom partnerships offering bundled subscriptions help expand user bases. Increasing demand for local-language music also boosts streaming adoption. While subscription rates are lower than in mature markets, the region offers strong long-term potential as digital access improves and more consumers shift from traditional media to streaming platforms.

Market Segmentations:

By Subscription Type:

- Product Subscription

- Service Subscription

By Industry:

By Customer Age Group:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the music streaming subscription services market features leading players such as Tidal, SoundCloud Global Limited & Co. KG, Amazon.com, Inc. (Amazon Music), iHeartMedia, Inc., Deezer SA, Tencent Music Entertainment Group, Spotify AB, YouTube Music, Pandora Media, Inc., and Apple, Inc. (Apple Music). The music streaming subscription services market continues to intensify as platforms invest heavily in personalization technologies, exclusive content partnerships, and improved audio quality to strengthen user engagement. Companies focus on expanding premium tiers, offering high-fidelity and spatial audio formats, and integrating podcasts, live sessions, and creator-driven content to broaden their appeal. Cross-platform accessibility, smart-device compatibility, and bundled subscription ecosystems have become key differentiators, enabling services to retain subscribers in a crowded market. Regional platforms compete effectively through localized catalogues and flexible pricing, while global providers leverage large libraries and advanced recommendation systems. Overall, rising consumer expectations for seamless, high-quality listening experiences drive continuous innovation and strategic expansion across the industry.

Key Player Analysis

- Tidal

- SoundCloud Global Limited & Co. KG

- com, Inc. (Amazon Music)

- iHeartMedia, Inc.

- Deezer SA

- Tencent Music Entertainment Group

- Spotify AB

- YouTube Music

- Pandora Media, Inc.

- Apple, Inc. (Apple Music)

Recent Developments

- In May 2025, Naver Corp. is considering adding Spotify to its shopping membership to compete with Coupang, following a previous partnership with Netflix. This move would expand Naver’s global content partnerships to attract more users to its services.

- In February 2025, Spotify launched “Mi Primer Escenario” in Argentina, a new music contest aimed at supporting emerging artists by giving them a chance to perform at the Quilmes Rock festival. The competition allows up-and-coming Argentine musicians to showcase their talent and connect with listeners, with the grand prize being a performance slot at the festival alongside established artists.

- In December 2024, Apple Music added three new live global radio stations—Apple Música Uno, Apple Music Club, and Apple Music Chill—to its existing lineup of Apple Music 1, Hits, and Country. These stations offer exclusive content and are available for free without a subscription.

- In September 2024, YouTube and Shopee launched a new online shopping service in Indonesia that allows users to buy products directly from YouTube videos, with plans to expand to other Southeast Asian countries. This move is a response to increasing competition from rivals like TikTok, which has also strengthened its e-commerce presence in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Subscription Type, Industry, Customer Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as more users shift from ad-supported listening to premium, subscription-based models.

- Platforms will invest further in AI-driven personalization to enhance discovery and improve user retention.

- High-fidelity, lossless, and spatial audio formats will gain wider adoption across premium tiers.

- Podcasts, audiobooks, and live audio sessions will strengthen platform diversification and engagement.

- Local-language content will grow significantly as services target regional audiences more effectively.

- Cross-platform integration with smart devices and connected ecosystems will increase subscription value.

- Creator-focused tools and fan-engagement features will open new monetization opportunities.

- Telecom partnerships and bundled services will support subscriber growth in emerging markets.

- Social listening, shared playlists, and collaborative features will enhance community-based streaming.

- Continuous competition will drive innovation in pricing models, exclusive content, and user experience enhancements.