Market Overview:

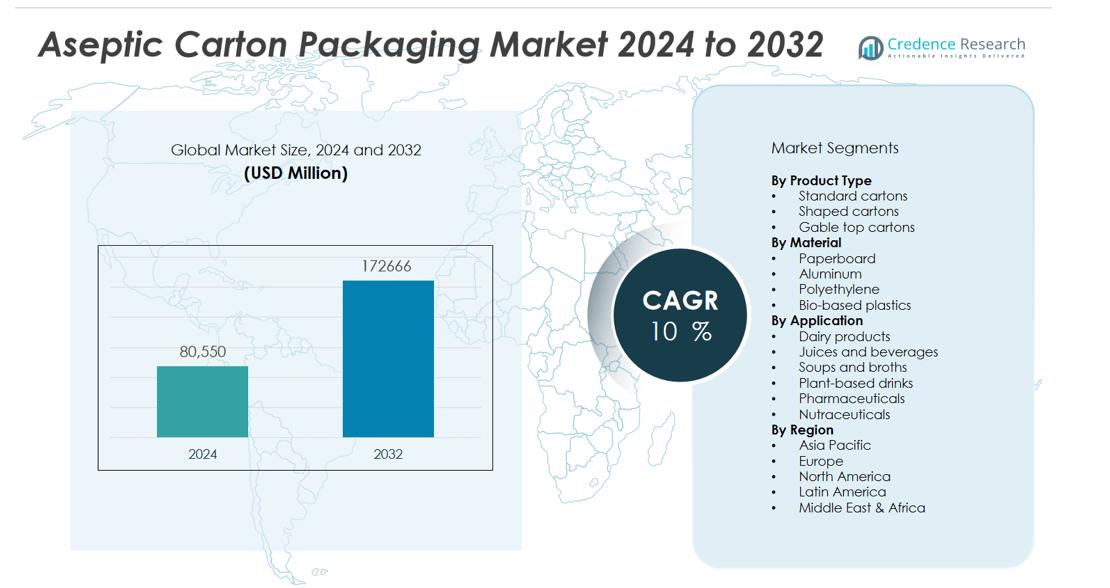

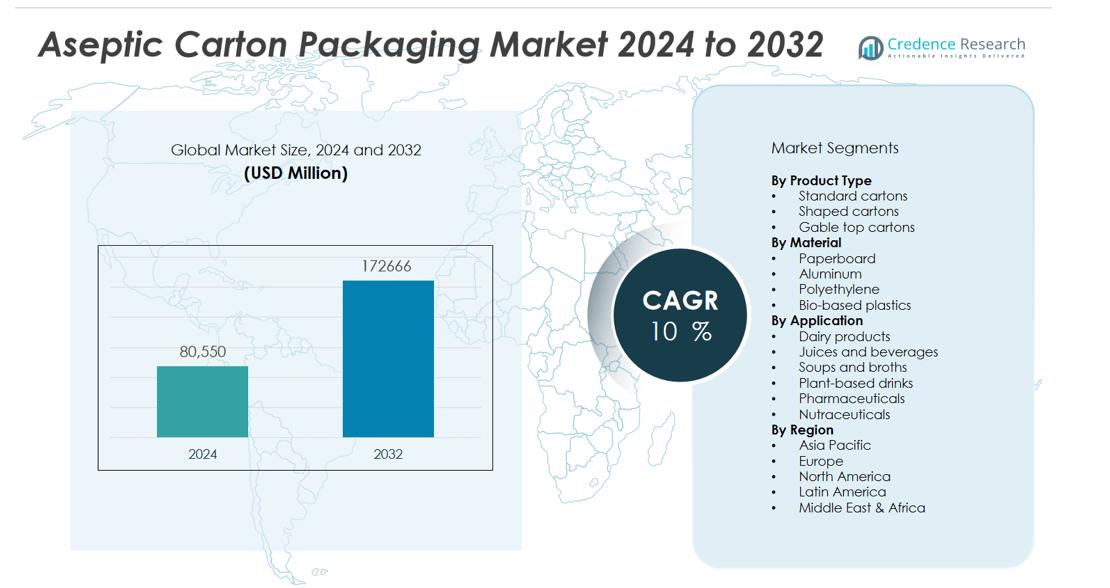

The aseptic carton packaging market size was valued at USD 80,550 million in 2024 and is anticipated to reach USD 172666 million by 2032, at a CAGR of 10 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aseptic Carton Packaging Market Size 2024 |

USD 80,550 million |

| Aseptic Carton Packaging Market , CAGR |

10% |

| Aseptic Carton Packaging Market Size 2032 |

USD 172666 million |

Key drivers fueling the aseptic carton packaging market include rising consumer preference for convenient, ready-to-consume food and beverages, alongside heightened awareness regarding food safety and hygiene. The industry is also propelled by a growing emphasis on eco-friendly and recyclable materials, as both consumers and regulatory bodies push for reduced environmental impact. Technological advancements in aseptic processing and packaging machinery have led to improved efficiency, product quality, and packaging design versatility. In addition, the rapid expansion of e-commerce and urbanization has increased the demand for lightweight, tamper-evident, and cost-effective packaging solutions, further supporting market expansion.

Regionally, Asia Pacific dominates the aseptic carton packaging market, led by a large consumer base, urbanization, and investments in food processing infrastructure. Key players include Robert Bosch GmbH and Reynolds Group Holdings Limited. Europe follows, supported by strict food safety regulations and sustainable packaging adoption, with Becton, Dickinson and Company and IMA S.P.A active in the region. North America shows steady growth, driven by demand for organic beverages and technology advancements from Schott AG. Latin America and the Middle East & Africa are emerging markets, fueled by changing diets and a growing middle class.

Market Insights:

- The aseptic carton packaging market was valued at USD 80,550 million in 2024 and will reach USD 172,666 million by 2032.

- Consumer preference for convenient, ready-to-consume foods and beverages is driving rapid market expansion.

- Growing focus on food safety and hygiene supports adoption across dairy, juice, and liquid food segments.

- Sustainability and recyclable materials play a crucial role, with regulators and consumers seeking eco-friendly solutions.

- Technological advancements in aseptic processing and packaging machinery boost efficiency and product quality.

- Asia Pacific leads with a 41% market share, followed by Europe at 29% and North America at 18%.

- Key players such as Robert Bosch GmbH, Reynolds Group Holdings Limited, Becton, Dickinson and Company, IMA S.P.A, and Schott AG shape the competitive landscape across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Extended Shelf Life and Safe Food Packaging:

Consumer demand for food and beverages with longer shelf life continues to drive the aseptic carton packaging market. Ready-to-drink dairy, juices, and liquid foods require packaging that prevents microbial contamination and preserves product freshness. The aseptic process allows products to remain stable without refrigeration, reducing the need for preservatives. It supports the distribution of perishable products to remote and urban areas alike. Food safety regulations across global markets further reinforce the need for aseptic packaging. Manufacturers and brands benefit from reduced food spoilage and waste. This trend positions the aseptic carton packaging market as a critical enabler of modern food logistics.

- For instance, Tetra Pak’s aseptic packaging technology enables products to stay fresh for up to 12 months without refrigeration, as demonstrated by the Tetra Brik Aseptic, which has surpassed more than 4 billion units sold worldwide due to its capability to safely extend shelf life and facilitate distribution over long distances.

Increasing Consumer Preference for Sustainable and Recyclable Packaging:

The shift toward sustainable lifestyles and eco-friendly products significantly boosts the aseptic carton packaging market. Consumers are choosing packaging that minimizes environmental impact and supports recycling. Aseptic cartons, often composed of renewable resources such as paperboard, are easier to recycle compared to multi-material plastic or glass containers. It aligns with global sustainability initiatives and legislative mandates on packaging waste reduction. Brand owners leverage recyclable cartons to strengthen their environmental credentials. Governments worldwide are implementing regulations that encourage the use of renewable materials. This drive for sustainability directly impacts packaging choices in the food and beverage sector.

- For instance, Tetra Pak sold 17.6billion plant-based packages and 10.8billion plant-based caps in 2021, which resulted in saving 96 kilotonnes of CO₂ compared to fossil-based plastics.

Technological Advancements in Aseptic Processing and Packaging Machinery:

Ongoing innovation in processing technology supports the growth of the aseptic carton packaging market. Advances in aseptic filling equipment improve operational efficiency and ensure higher standards of hygiene. Modern machinery enables rapid changeovers, precise filling, and reduced risk of contamination. Automation and digital monitoring systems streamline production lines and support compliance with international food safety standards. It allows manufacturers to scale operations quickly in response to shifting consumer demands. Technological improvements have led to more compact, lightweight, and versatile carton designs. Enhanced production capabilities contribute to cost savings and greater product differentiation.

Expansion of E-Commerce, Urbanization, and Changing Lifestyles:

The expansion of e-commerce channels and rising urbanization trends are transforming the aseptic carton packaging market. Urban consumers prefer portable, single-serve packaging formats that offer convenience and easy storage. Aseptic cartons are ideal for busy lifestyles, requiring minimal handling and ensuring product integrity during transit. E-commerce retailers benefit from lightweight cartons that reduce shipping costs and product damage. It enables food and beverage brands to reach new consumer segments and increase market penetration. Shifting dietary habits and growing health consciousness are also influencing packaging design. The adoption of aseptic carton packaging keeps pace with the evolving expectations of modern consumers.

Market Trends:

Integration of Smart and Interactive Packaging Solutions:

Brands are integrating smart and interactive technologies into the aseptic carton packaging market to enhance product safety, traceability, and consumer engagement. Features such as QR codes, near-field communication (NFC), and tamper-evident seals allow consumers to verify product authenticity and access detailed product information. These solutions help brands combat counterfeiting and improve supply chain transparency. It allows manufacturers to gather valuable consumer data and deliver targeted marketing campaigns directly through the packaging. Smart packaging supports traceability initiatives and compliance with food safety regulations in global markets. Increased adoption of digital technologies signals a shift toward intelligent packaging that extends beyond traditional protective functions.

- For Instances, Kezzler provided serialized QR code traceability for global food producers, with more than six billion uniquely coded products worldwide as of 2019, and their technology recorded over 500,000 consumer scan interactions in a single day, demonstrating large-scale engagement and traceability.

Adoption of Minimalist Design and Customization to Boost Shelf Appeal:

The aseptic carton packaging market is witnessing a strong trend toward minimalist designs, clean graphics, and premium aesthetics. Brand owners focus on packaging that communicates product purity, simplicity, and environmental values. Customizable carton formats and high-quality printing technologies allow for distinctive branding and product differentiation on crowded retail shelves. It appeals to both established and emerging brands aiming to capture consumer attention and foster brand loyalty. The trend toward minimalist, eco-friendly packaging aligns with changing consumer preferences and supports sustainability messaging. Enhanced visual appeal and personalization drive higher product visibility and influence purchase decisions in competitive markets.

- For instance, SIG has implemented digital printing technology for aseptic cartons, enabling flexible design customization and accommodating small orders at speeds up to 270 meters per minute, supporting agile branding for its clients.

Market Challenges Analysis:

Complex Supply Chain and High Initial Investment Requirements:

The aseptic carton packaging market faces challenges due to the complexity of its supply chain and the need for significant upfront capital investment. Setting up aseptic filling and packaging lines demands advanced machinery, specialized expertise, and compliance with stringent hygiene standards. Small and mid-sized manufacturers may struggle to afford the high costs associated with equipment installation and maintenance. It leads to longer payback periods and potential barriers to market entry for new players. Coordinating raw material sourcing, logistics, and quality control across a global supply chain further increases operational complexity. Delays or disruptions in any part of the chain can impact product availability and profitability.

Limited Recycling Infrastructure and Regulatory Pressure:

Regulatory requirements for food safety and packaging sustainability continue to evolve, posing ongoing challenges for the aseptic carton packaging market. The multi-layer structure of many cartons complicates recycling and limits the availability of recycling infrastructure in several regions. It can create obstacles for brands aiming to achieve environmental targets or comply with stricter regulations on packaging waste. Meeting diverse regulatory standards across different countries increases compliance costs and operational complexity. Growing pressure from both consumers and governments requires continuous investment in sustainable materials and innovative recycling solutions to remain competitive.

Market Opportunities:

Expansion in Emerging Markets and Diversification of Product Applications:

The aseptic carton packaging market presents significant growth opportunities in emerging markets where urbanization, income levels, and demand for packaged food and beverages are rising. Rapid development in countries across Asia Pacific, Latin America, and Africa creates new avenues for brands to introduce aseptic packaging solutions tailored to local preferences. It enables manufacturers to offer innovative products such as flavored milk, plant-based beverages, and ready-to-eat soups in user-friendly cartons. Growth in healthcare and pharmaceutical packaging also drives adoption of aseptic cartons for liquid medicines and nutritional supplements. Companies that customize products and packaging formats to meet regional demands can achieve a competitive advantage.

Innovation in Sustainable Materials and Circular Economy Initiatives:

Growing focus on sustainability and resource efficiency generates opportunities for innovation in the aseptic carton packaging market. Investment in bio-based, compostable, and recyclable materials allows companies to address regulatory requirements and consumer preferences for eco-friendly solutions. Collaboration with recycling firms and adoption of closed-loop systems support the development of a circular economy in the packaging sector. It positions brands as leaders in environmental stewardship while meeting customer demand for sustainable packaging options. Companies investing in next-generation materials and green manufacturing processes will capture emerging opportunities in both established and developing markets.

Market Segmentation Analysis:

By Material:

Paperboard dominates the aseptic carton packaging market due to its renewable nature, printability, and compatibility with food safety standards. It accounts for the majority of carton structures and supports the industry’s push for sustainability. Aluminum foil acts as an essential barrier layer, ensuring product integrity by blocking light, oxygen, and contaminants. Polyethylene remains crucial for inner and outer layers, providing sealing and moisture resistance. Manufacturers are exploring bio-based plastics to replace conventional polymers and enhance environmental performance.

- For instance, Tetra Pak’s Brik Aseptic 1000 Edge package uses more than 80% renewable bio-based materials, which contributed to achieving the highest four-star certification from Vinçotte and led to a 17% reduction in carbon footprint compared to standard cartons.

By Product:

Standard cartons lead the market, widely used for milk, juices, and liquid foods. Shaped cartons, offering ergonomic designs and improved shelf appeal, see increasing adoption in premium and single-serve segments. Gable top cartons find favor in chilled product applications, including fresh milk and certain juices. It benefits from consumer preferences for easy-to-pour, resealable features and attractive branding options.

- For instance, FrieslandCampina’s Chocomel brand became the first chocolate milk packaged in a 1-liter cardboard pack made of 80% plant-based material sourced from FSC-certified forests and sugarcane by-products, reflecting commitment to circular packaging.

By Application:

The aseptic carton packaging market primarily serves the dairy industry, followed closely by juice and beverage manufacturers. Ready-to-drink soups, broths, and plant-based beverages represent fast-growing applications, driven by evolving consumer tastes. Pharmaceutical and nutraceutical sectors are adopting aseptic cartons for liquid medicines and dietary supplements, recognizing the value in sterile, tamper-evident, and lightweight packaging. It supports both large-volume and single-serve applications, catering to a broad range of consumer and industrial needs.

Segmentations:

By Material:

- Paperboard

- Aluminum

- Polyethylene

- Bio-based plastics

By Product:

- Standard cartons

- Shaped cartons

- Gable top cartons

By Application:

- Dairy products

- Juices and beverages

- Soups and broths

- Plant-based drinks

- Pharmaceuticals

- Nutraceuticals

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific :

Asia Pacific accounts for 41% share of the aseptic carton packaging market, establishing itself as the dominant region. Strong demand from China, India, and Southeast Asia drives sustained growth in both food and beverage sectors. Urbanization, rising disposable incomes, and expansion of modern retail formats support market expansion. Government focus on food safety and increased investments in cold chain infrastructure further accelerate adoption. It benefits from a rapidly growing middle class seeking convenience and quality in packaged products. Key multinational brands and local players continue to invest in product innovation and packaging technology tailored to regional tastes.

Europe:

Europe represents 29% share of the aseptic carton packaging market, with leading demand in countries such as Germany, France, and the United Kingdom. The region is characterized by strong regulatory frameworks for food safety and packaging sustainability. High adoption of renewable and recyclable packaging aligns with the European Union’s circular economy targets. It is home to major packaging technology providers and global beverage brands that prioritize eco-friendly solutions. Stringent requirements on extended shelf life and product traceability also drive preference for aseptic cartons. Local consumers show a clear preference for responsible consumption and premium quality.

North America:

North America holds 18% share of the aseptic carton packaging market, supported by robust demand in the United States and Canada. The market benefits from rising consumer interest in healthy, organic, and functional beverages packaged in safe and convenient formats. Strong presence of food and beverage manufacturers, combined with expanding e-commerce channels, sustains market growth. It faces a dynamic regulatory landscape focused on food safety and environmental performance. Innovation in product formats, including single-serve and family-size cartons, appeals to diverse consumer segments. Ongoing investments in packaging automation and sustainable materials reinforce the region’s competitive position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Robert Bosch GmbH

- Reynolds Group Holdings Limited

- Becton,Dickinson and Company

- IMA S.P.A

- Schott AG

- Amcor

- Greatview Aseptic Packaging Co. Ltd

- IPI SRL (Coesia Group)

- Tetra Pak International SA

- SIG Combibloc Group

- DS Smith PLC

Competitive Analysis:

The aseptic carton packaging market features a competitive landscape shaped by global and regional players leveraging technology, sustainability, and strategic alliances. Key participants such as Robert Bosch GmbH, Reynolds Group Holdings Limited, Becton, Dickinson and Company, IMA S.P.A, and Schott AG lead market innovation through advanced packaging machinery, eco-friendly materials, and automation solutions. It prioritizes long-term partnerships with food and beverage producers to secure consistent demand and reinforce brand presence. Companies invest in research and development to enhance carton barrier properties, recyclability, and filling efficiencies. Competitive differentiation centers on quality, speed to market, and compliance with evolving regulatory standards. Market leaders expand their reach through acquisitions, regional expansions, and collaboration with local suppliers to strengthen distribution networks and address emerging customer needs.

Recent Developments:

- In June 2025, PowerCell Group deepened its strategic partnership with Bosch to accelerate fuel cell adoption in China, reflecting enhanced collaborative work in Q2 2025.

- In April 2025, Bosch premiered Hybrion PEM electrolysis stacks for green hydrogen production at Hannover Messe, marking a first market entry and unveiling partnerships with key players in European energy and manufacturing sectors.

- In January 2025, BD and Biosero initiated a collaboration to enable robotic integration with BD’s flow cytometers in drug discovery and development.

Market Concentration & Characteristics:

The aseptic carton packaging market demonstrates moderate to high concentration, with a few leading global players controlling a significant portion of total market revenue. It features established companies with strong brand portfolios, extensive distribution networks, and advanced technological capabilities. Intense competition drives continuous innovation in packaging design, sustainable materials, and production efficiency. Barriers to entry include high capital requirements and stringent regulatory standards. The market is characterized by long-term supply contracts with major food and beverage producers, creating stable demand. Strategic partnerships, mergers, and regional expansions remain common strategies for companies seeking to strengthen their market position.

Report Coverage:

The research report offers an in-depth analysis based on Material, Product, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Continued emphasis on renewable and recyclable materials will drive innovation in aseptic carton packaging, aligning industry practices with global sustainability goals.

- Companies will invest in bio-based barrier coatings to enhance product protection while reducing reliance on fossil-fuel‑derived components.

- Adoption of digital traceability features, such as QR codes and NFC, will increase, helping brands improve supply‑chain transparency and consumer engagement.

- Suppliers will prioritize lightweight carton formats to reduce transportation costs and carbon emissions during distribution.

- Packaging manufacturers will expand into pharmaceutical and nutraceutical sectors, leveraging aseptic technology for liquid medicines and nutritional supplements.

- Customizable, single‑serve and portion-controlled formats will gain traction among health-conscious and on-the-go consumers.

- Collaboration between packaging firms and recycling infrastructure developers will accelerate circular economy initiatives and improve end‑of‑life recyclability.

- Manufacturers will deploy automation, robotics, and predictive maintenance in filling lines to boost operational efficiency and maintain quality.

- Market participants will explore partnerships in emerging regions to capitalize on growing demand for packaged beverages and dairy products.

- Regulatory alignment on packaging waste reduction and food‑safety standards will drive standardization and innovation across the industry.