Market Overview:

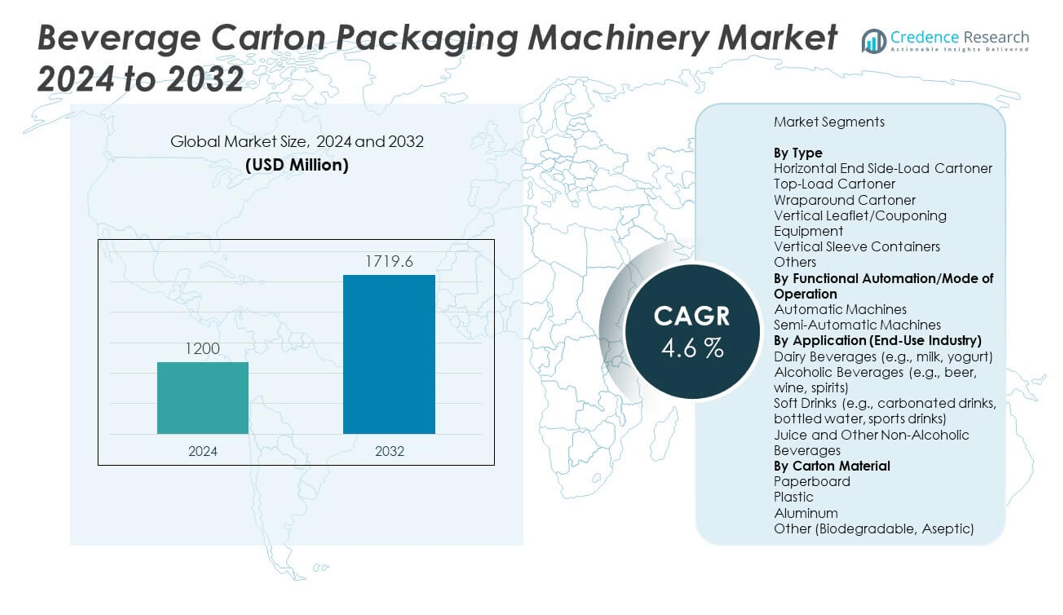

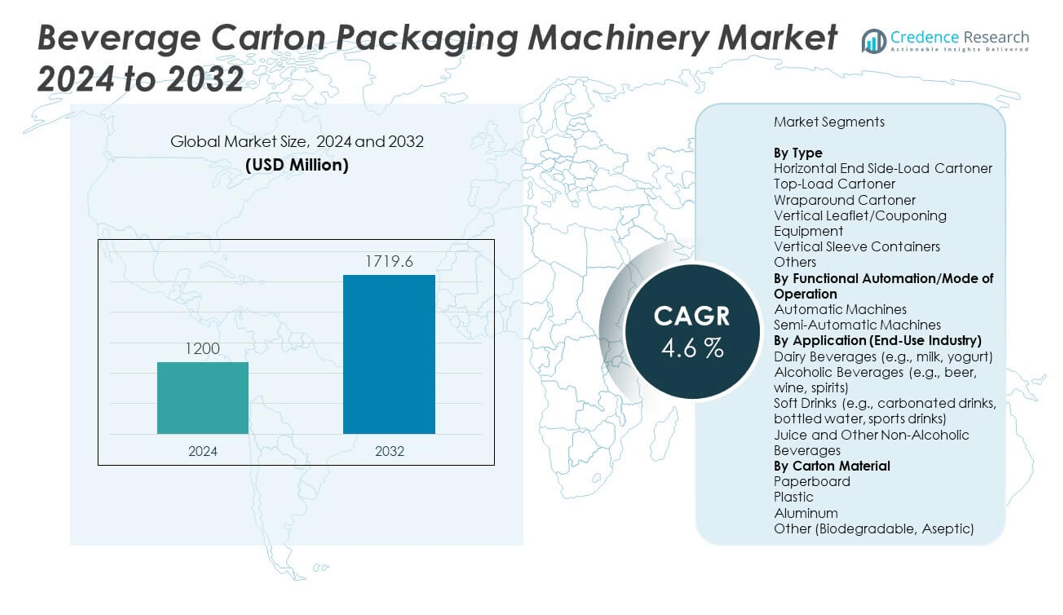

The Beverage Carton Packaging Machinery Market is projected to grow from USD 1,200 million in 2024 to an estimated USD 1,719.6 million by 2032, with a compound annual growth rate (CAGR) of 4.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Beverage Carton Packaging Machinery Market Size 2024 |

USD 1,200 million |

| Beverage Carton Packaging Machinery Market, CAGR |

4.6% |

| Beverage Carton Packaging Machinery Market Size 2032 |

USD 1,719.6 million |

Growth in the beverage carton packaging machinery market is driven by the rising global demand for sustainable and efficient packaging solutions. Manufacturers are increasingly adopting automation and advanced machinery to boost productivity and ensure precise filling and sealing. The growing consumption of dairy, juice, and plant-based beverages, especially in single-serve formats, is prompting producers to invest in faster and more flexible packaging lines. Additionally, regulatory pressures to reduce plastic usage are pushing beverage brands to shift toward carton-based formats, thereby supporting demand for specialized machinery.

Regionally, Europe leads the market due to its mature beverage industry, strong sustainability regulations, and early adoption of eco-friendly packaging solutions. North America follows closely, backed by technological innovations and established infrastructure. Meanwhile, Asia-Pacific is emerging rapidly as countries like China, India, and Indonesia experience rising urbanization, increased beverage consumption, and greater investments in food and beverage processing. Latin America and the Middle East & Africa are also witnessing steady growth due to expanding middle-class populations and shifting consumer preferences toward packaged drinks.

Market Insights:

- The Beverage Carton Packaging Machinery Market is valued at USD 1,200 million in 2024 and is expected to reach USD 1,719.6 million by 2032, growing at a CAGR of 4.6%.

- Rising demand for sustainable, recyclable, and lightweight packaging materials continues to drive the adoption of advanced carton packaging systems.

- Automation trends and demand for high-speed, efficient production lines are pushing manufacturers to invest in modern machinery.

- High capital investment requirements and limited access to technical expertise in developing regions restrict adoption among small and mid-sized producers.

- Europe leads the market with 34% share, supported by strong regulatory frameworks and advanced beverage processing infrastructure.

- Asia Pacific is emerging as a high-growth region due to rising urbanization, increased beverage consumption, and foreign direct investment in manufacturing.

- Market players increasingly focus on energy efficiency, modular design, and remote monitoring capabilities to meet industry demands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Sustainability Push from Global Beverage Brands Drives Demand for Eco-Friendly Carton Packaging Machinery

The Beverage Carton Packaging Machinery Market benefits from the global pivot toward sustainable packaging by leading beverage manufacturers. Companies seek alternatives to plastic and glass, and paper-based cartons offer a recyclable, lightweight solution. Regulatory frameworks across regions increasingly enforce environmental compliance, urging manufacturers to adopt carton formats. It supports this demand with machinery that accommodates renewable, biodegradable materials. Rising pressure to meet ESG goals accelerates investments in modern packaging systems. Machine makers are optimizing for minimal material wastage and low energy use.

High-Speed and Automated Filling Equipment Becomes Essential for Competitive Beverage Operations

Filling speed and operational accuracy play critical roles in beverage production, prompting machinery upgrades. The Beverage Carton Packaging Machinery Market aligns with these priorities through fully automated systems that reduce manual intervention. Manufacturers want to minimize downtime, improve throughput, and ensure sterility for perishable liquids. It enables faster line changeovers to suit varied product types and volumes. Demand for compact machines that save floor space and support modularity grows among producers in space-constrained facilities. Accurate fill levels and leak-proof sealing enhance shelf life and reduce spoilage. Integration of robotics and digital controls boosts efficiency and standardization.

- For instance, Laub/Hunt Packaging Systems’ rotary volumetric fillers feature up to 120 filling heads, delivering line speeds of up to 1,000 containers per minute for a range of viscosities and container shapes. Their machines include Clean-in-Place systems for quick product changeover and achieve high fill accuracy via patented positive stop piston technology, minimizing product loss and increasing hygiene.

Growing Health Beverage Segment Requires Flexible and Hygienic Packaging Lines

Consumer preference for functional drinks such as plant-based milks, juices, and nutraceutical beverages influences equipment design. The Beverage Carton Packaging Machinery Market addresses this demand with lines built for hygienic filling, aseptic sealing, and sterile handling. It ensures that sensitive products avoid contamination and retain nutritional integrity. Machine flexibility accommodates a wide range of viscosities, flavors, and carton formats. Equipment tailored for short production runs appeals to niche health brands and co-packers. The shift in consumption from carbonated soft drinks to wellness-oriented alternatives fuels machinery upgrades. Regulatory standards on cleanroom compliance tighten across markets.

- For instance, Krones’ Contipure AseptBloc DN aseptic system gained full FDA approval for low-acid, shelf-stable liquid foods. The system performs full automatic cleaning and sterilization in under 2.5 hours, maintaining sterile production for over a week without intervention.

Demand for Smaller SKUs and On-the-Go Packaging Spurs Machine Customization

Changing lifestyles and urbanization trends drive the need for single-serve and portable beverage formats. The Beverage Carton Packaging Machinery Market caters to this shift by offering systems compatible with compact SKUs and multi-pack configurations. It supports packaging designs that align with e-commerce distribution and retail shelf requirements. Retailers demand differentiated products with eye-catching formats and convenient openings. Equipment vendors respond by developing machinery with advanced cutting, shaping, and printing functions. Machine adaptability allows producers to meet specific marketing and branding goals. Customizable machines also help companies test new product variants faster.

Market Trends:

Digital Transformation Integrates Smart Sensors and Predictive Maintenance in Packaging Lines

The Beverage Carton Packaging Machinery Market reflects broader industry moves toward digitization and predictive analytics. Smart sensors now track real-time machine health, flagging potential failures before they cause downtime. It allows operators to schedule maintenance efficiently and avoid costly interruptions. Cloud-connected dashboards provide remote monitoring capabilities, reducing reliance on on-site technicians. Data-driven insights help manufacturers fine-tune packaging speed and consistency. Systems also monitor material flow, temperature, and seal integrity, enhancing quality assurance. These advancements improve machine uptime, reduce error rates, and support cost control. Industry 4.0 principles gain traction across beverage manufacturing facilities worldwide.

- For example, companies like Galdi have introduced digital platforms that aggregate real-time performance data directly from packaging equipment, including specific “meters” that log component usage—such as the number of doses, caps, or cartons processed.

Aseptic and Cold-Fill Technologies Gain Traction in Juice and Dairy Processing

Innovation in beverage processing fuels demand for advanced packaging technologies like aseptic and cold-fill systems. The Beverage Carton Packaging Machinery Market incorporates sterile enclosures and non-contact filling tools to maintain product integrity. It helps extend shelf life without requiring chemical preservatives. Demand for fresh-tasting, clean-label beverages accelerates this trend. Machinery with aseptic modules suits dairy-based, organic, and cold-pressed drinks. Cold-fill systems also enable packaging of heat-sensitive nutrients, ensuring flavor retention. Beverage companies use these technologies to differentiate in crowded markets. Food safety compliance improves through tighter hygiene control in the packaging stage.

- For instance, Tetra Pak’s A3/Speed aseptic package filling systemis FDA-approved for ambient and chilled products, delivering sterile food aseptically packaged for up to 24 months without refrigeration or preservatives. The system supports speeds up to 24,000 packages per hour and integrates a remote diagnostics system for real-time maintenance.

Customization and Personalization Features Become Critical for Branding Success

Packaging design becomes a powerful tool for brand storytelling and consumer engagement. The Beverage Carton Packaging Machinery Market evolves to support high-resolution printing and structural customization. It enables brands to experiment with unique shapes, colors, and digital interaction features. QR codes, AR labels, and serialized packaging formats enhance traceability and personalization. Brands test limited-edition campaigns with short production runs using digitally integrated machinery. Equipment flexibility allows fast design switches without major tooling costs. It provides beverage companies with the creative freedom to meet regional or seasonal preferences. Customization capabilities now influence capital expenditure planning in packaging lines.

Compact and Energy-Efficient Machines Dominate Equipment Investments in Small Plants

The shift toward decentralized production models prompts small and mid-sized beverage plants to invest in scalable solutions. The Beverage Carton Packaging Machinery Market now prioritizes compact, modular systems that operate efficiently in smaller footprints. It supports businesses operating in rural or space-limited facilities. These machines consume less power, meet local compliance standards, and reduce operating costs. Startups and local brands benefit from affordable, easy-to-maintain solutions. Entry-level systems now come with automation features once limited to large-scale operations. Such investments enable faster regional expansion and brand localization. The market benefits from manufacturers seeking lean, energy-conscious production models.

Market Challenges Analysis:

High Capital Investment and Long Payback Period Create Entry Barriers for Smaller Players

Capital costs for advanced carton packaging machines remain high, limiting accessibility for smaller manufacturers. The Beverage Carton Packaging Machinery Market often requires companies to invest in integrated systems, including filling, sealing, and labeling units. It poses a financial strain on startups and SMEs lacking funding support. Many firms hesitate to upgrade legacy machines due to the uncertain return on investment. Complex installation and training add to the initial cost burden. In some regions, limited access to financing or subsidies further delays modernization. Smaller operators struggle to match the production speed and quality of larger competitors. The cost challenge impedes technology diffusion across low- and middle-income markets.

Technical Skill Gaps and Maintenance Complexity Hinder Efficient Machine Utilization

Operating high-end packaging machinery demands skilled technicians and familiarity with software-based systems. The Beverage Carton Packaging Machinery Market faces workforce challenges, especially in developing economies. It experiences downtime due to insufficient operator training or poor troubleshooting capability. Specialized parts and repair services may not be readily available in remote areas. Machine integration with upstream and downstream processes complicates maintenance. Language and technical documentation barriers slow operator onboarding. Equipment performance declines when users fail to follow calibrated protocols. It slows productivity gains despite automation capabilities. The skill gap poses a bottleneck for seamless adoption and optimal system usage.

Market Opportunities:

Rising Beverage Demand in Emerging Economies Fuels Long-Term Machinery Investments

Emerging economies in Asia, Latin America, and Africa experience strong growth in packaged beverage consumption. The Beverage Carton Packaging Machinery Market stands to benefit from increasing production volumes across these regions. It gains traction where beverage brands establish new manufacturing units or expand capacity. Governments support food processing infrastructure, enhancing market prospects. Urbanization and changing diets also elevate demand for packaged drinks. Local players seek machinery with low operating costs and ease of use. The market captures long-term potential by supporting scalable solutions for high-growth regions.

Sustainable Carton Innovations Open Niche Opportunities in Premium Segments

Consumer interest in sustainable lifestyles encourages brands to adopt bio-based or compostable carton materials. The Beverage Carton Packaging Machinery Market taps into this shift by adapting systems to handle new materials. It enables packaging innovations that align with eco-conscious branding. Luxury beverage categories now seek premium-feel cartons made from FSC-certified sources. This creates demand for machines with advanced handling precision and customizable output. It opens opportunities for machinery suppliers to target premium and niche beverage producers.

Market Segmentation Analysis:

By Type, the Beverage Carton Packaging Machinery Market includes diverse equipment types tailored to specific production needs. Among them, horizontal end side-load cartoners dominate due to their high-speed capability and compatibility with automated lines. Top-load cartoners gain traction in premium packaging applications requiring precise placement. Wraparound cartoners suit large-volume beverage operations focused on structural stability. Vertical leaflet/couponing equipment and vertical sleeve containers address niche branding and promotional strategies, offering added value to packaging formats.

- For example, R.A. Jones’ Criterion® CLI horizontal end side-load cartoner reaches speeds up to 1,000 cartons per minute and supports tool-less size changeovers in under 10 minutes, designed for high-speed beverage lines.

By functional automation, automatic machines lead the market, driven by their ability to reduce labor, improve output consistency, and integrate with smart factory systems. Semi-automatic machines serve small and mid-sized producers seeking affordable, flexible solutions with manual oversight. It sees robust growth in both automation segments, reflecting varied operational capacities across beverage companies.

- For example, Krones’ Contipure AseptBloc DN system received FDA validation for low-acid aseptic beverages, offering automated cleaning and sterilization in under 2.5 hours and maintaining sterile production for 168 hours without interruption.

By application, dairy beverages represent a major segment, benefiting from consistent demand and strict hygiene requirements. Soft drinks and juice categories show significant equipment demand due to wide consumer reach. Alcoholic beverages also contribute steadily, with tailored machines used for different bottle sizes and sealing formats.

By carton material, paperboard holds the largest share due to its recyclability, printability, and regulatory compliance. Plastic and aluminum serve specialized applications requiring moisture or light barriers. Biodegradable and aseptic materials emerge as preferred options for eco-conscious and shelf-stable product lines. The market evolves with each segment playing a critical role in shaping its technological direction.

Segmentation:

By Type

- Horizontal End Side-Load Cartoner

- Top-Load Cartoner

- Wraparound Cartoner

- Vertical Leaflet/Couponing Equipment

- Vertical Sleeve Containers

- Others

By Functional Automation/Mode of Operation

- Automatic Machines

- Semi-Automatic Machines

By Application (End-Use Industry)

- Dairy Beverages (e.g., milk, yogurt)

- Alcoholic Beverages (e.g., beer, wine, spirits)

- Soft Drinks (e.g., carbonated drinks, bottled water, sports drinks)

- Juice and Other Non-Alcoholic Beverages

By Carton Material

- Paperboard

- Plastic

- Aluminum

- Other (Biodegradable, Aseptic)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe holds the largest share of the Beverage Carton Packaging Machinery Market, accounting for 34% of the global revenue. The region benefits from strong environmental regulations and high consumer demand for sustainable packaging formats. Countries like Germany, France, and Italy lead in automation and packaging innovation. It supports advanced food and beverage sectors with high investments in machinery upgrades. Leading manufacturers focus on developing eco-friendly and energy-efficient solutions to align with EU policies. The presence of established packaging equipment companies further strengthens Europe’s dominance in the market.

North America follows closely, holding a 28% share of the Beverage Carton Packaging Machinery Market. The U.S. remains the key contributor due to its large-scale beverage production facilities and emphasis on high-speed automated solutions. Strong demand for dairy, plant-based, and organic beverages drives continuous machinery enhancements. It witnesses growing adoption of digital and aseptic technologies to improve hygiene and operational efficiency. Canada also plays a growing role, with several regional players upgrading their production capabilities. Sustainability goals and innovation in packaging formats further fuel market expansion in this region.

Asia Pacific holds a 24% market share and presents the fastest growth potential for the Beverage Carton Packaging Machinery Market. It gains momentum from increasing packaged beverage consumption in China, India, and Southeast Asia. Rising urbanization and consumer preference for convenient, on-the-go drinks support regional demand. It benefits from foreign direct investment in local food and beverage manufacturing. Governments promote food safety and modernization, which stimulates equipment upgrades. Local and international machine vendors target these markets with cost-effective, modular solutions. Competitive pricing and expanding retail networks accelerate adoption across emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Tetra Pak

- Krones AG

- Sidel

- Bosch Packaging Technology (now part of Syntegon Technology GmbH)

- Syntegon Technology GmbH

- A. Jones

- Bradman Lake Group Ltd.

- Mpac Group plc

- Mitsubishi Electric

- Coesia S.p.A

Competitive Analysis:

The Beverage Carton Packaging Machinery Market features a mix of global giants and regional specialists focused on automation, sustainability, and line flexibility. Companies like Tetra Pak, SIG Combibloc, Krones AG, and Bosch Packaging lead in innovation and hold strong brand reputations. It sees steady investment in R&D to improve operational speed, hygiene, and material adaptability. Competitors differentiate through customized solutions, lifecycle support, and integration of smart technologies. Strategic partnerships, after-sales services, and global distribution networks play critical roles in maintaining market position. Regional players also compete by offering compact, affordable equipment for emerging markets.

Recent Developments:

- In July 2025, Tetra Pak launched its first greenfield project in Libya through a partnership with Zulfa, part of the Alushibe Group. The new facility will feature fully integrated processing and packaging systems, aiming to support growth in the North African market.

- In March 2024, Krones AG successfully completed the acquisition of Netstal Maschinen AG, a leading Swiss supplier of injection molding machines for the beverage market. This strategic acquisition enhances Krones’ capabilities across the full PET bottle production lifecycle, from injection molding and filling to recycling, and supports diversification into medical and personal care packaging

- In June 2024, Syntegon Technology GmbH announced the acquisition of Telstar from Japan’s Azbil Corporation. This deal expands Syntegon’s pharmaceutical processing and packaging business, particularly in freeze-dryer and isolator solutions for pharmaceutical vials, strengthening its global technology portfolio and market position

Market Concentration & Characteristics:

The Beverage Carton Packaging Machinery Market is moderately concentrated, with a few multinational companies dominating global sales and a long tail of regional and niche suppliers. It features high entry barriers due to capital intensity, technical complexity, and regulatory compliance requirements. Companies compete on innovation, machine reliability, customization, and energy efficiency. Product differentiation remains essential for serving diverse beverage categories and production scales. The market shows strong tendencies toward long-term contracts, bundled services, and recurring aftermarket revenues.

Report Coverage:

The research report offers an in-depth analysis based on Type, Functional Automation/Mode of Operation, Application (End-Use Industry) and Carton Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness increased adoption of compact, multi-format machines that enable producers to run various carton sizes and product types on a single line.

- Advanced automation technologies, including AI-driven inspection systems, will enhance operational efficiency, reduce labor dependency, and improve packaging consistency.

- Growth in emerging economies across Asia Pacific, Latin America, and Africa will fuel demand for cost-effective and scalable machinery, supported by expanding beverage consumption.

- Regulatory mandates on sustainable packaging will push manufacturers to adopt machinery that handles recyclable, biodegradable, or bio-based carton materials.

- Rising popularity of functional, organic, and plant-based beverages will accelerate the uptake of aseptic and cold-fill packaging systems to preserve nutritional value.

- Equipment customization will become a key differentiator, enabling brands to experiment with innovative shapes, closures, and printing designs.

- Demand from e-commerce channels and convenience retail formats will create new opportunities for machinery optimized for secondary packaging and shelf-ready solutions.

- Manufacturers will establish regional assembly and service hubs to offer localized support and reduce lead times for installations and spare parts.

- Integration of IoT-enabled systems and smart factory solutions will improve predictive maintenance, traceability, and production data analytics.

- Investment in operator training and digital skill development will become essential to fully leverage high-tech packaging systems and ensure long-term performance.