Market Overview:

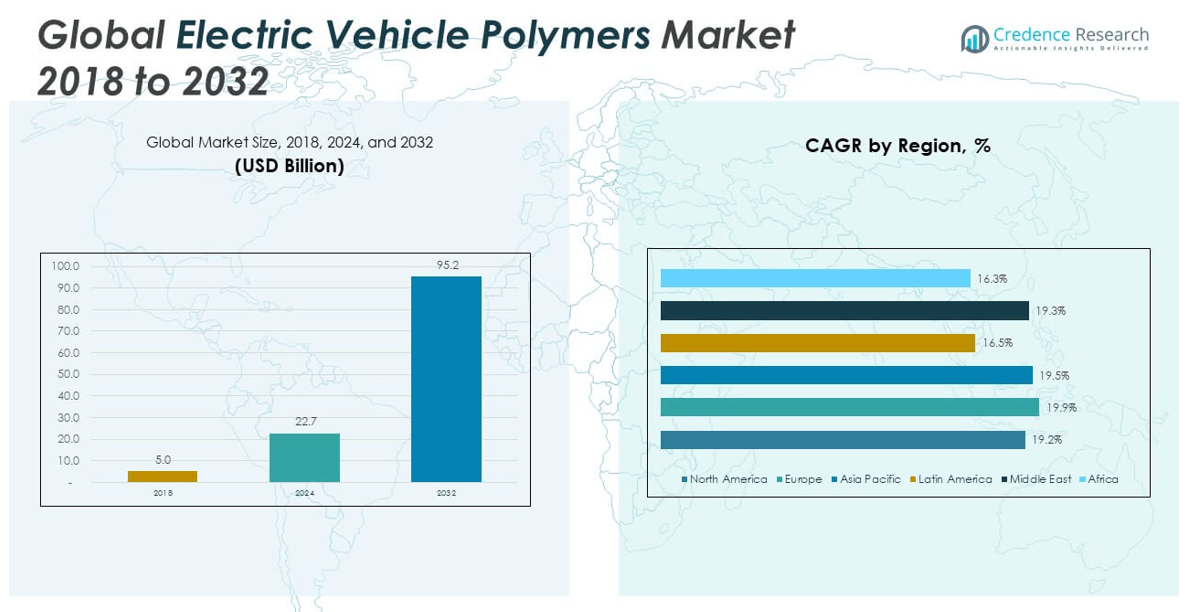

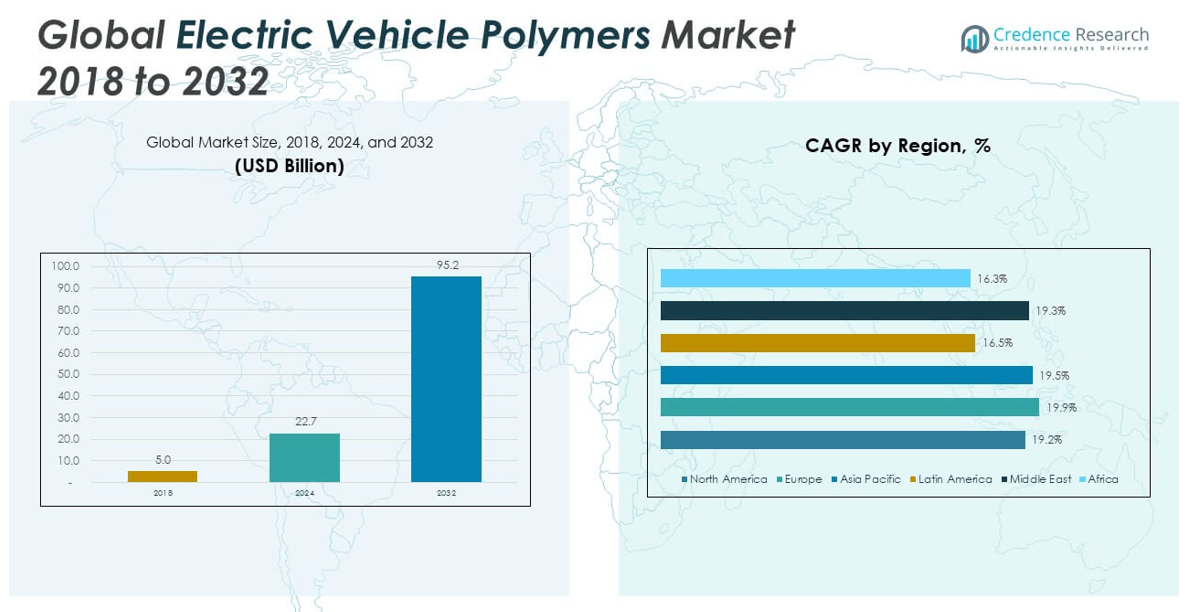

The Electric Vehicle Polymers Market size was valued at USD 5.0 million in 2018 to USD 22.7 million in 2024 and is anticipated to reach USD 95.2 million by 2032, at a CAGR of 19.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Polymers Market Size 2024 |

USD 22.7 million |

| Electric Vehicle Polymers Market, CAGR |

19.30% |

| Electric Vehicle Polymers Market Size 2032 |

USD 95.2 million |

One of the primary drivers fueling the Electric Vehicle Polymers Market is the global push for reducing vehicle weight to enhance energy efficiency and battery performance. Polymers offer a lightweight yet durable alternative to metal components, contributing directly to improved vehicle range and reduced energy consumption. In addition, growing environmental concerns and stricter emission regulations have accelerated the adoption of electric vehicles, which in turn is increasing demand for advanced polymer materials in battery enclosures, interior systems, and powertrain components. Technological advancements in polymer chemistry, such as the development of flame-retardant and heat-resistant materials, are expanding the application scope of polymers in high-voltage electrical systems and thermal management. Furthermore, the need for improved insulation, safety, and recyclability in EV components is prompting automakers to collaborate with polymer producers to innovate new materials tailored to the evolving specifications of electric mobility.

Regionally, Asia-Pacific holds the largest share of the Electric Vehicle Polymers Market. China dominates this region with its vast EV manufacturing base, strong government support, and integrated supply chain, contributing more than half of the global EV output. The country’s aggressive electrification targets, combined with investments in lightweight and high-performance materials, are propelling the demand for EV polymers across all vehicle classes. Europe stands as the second-largest market, backed by stringent emissions regulations, incentives for sustainable transportation, and increasing EV adoption in countries such as Germany, France, and the Netherlands. Automakers in the region are actively replacing metal parts with recyclable polymer solutions to meet EU environmental standards. North America is also witnessing substantial growth, supported by government initiatives like tax credits, infrastructure funding, and domestic manufacturing investments. While Latin America, the Middle East, and Africa currently hold smaller market shares, these regions are expected to experience gradual growth as policy frameworks and infrastructure for electric mobility mature.

Market Insights:

- The Electric Vehicle Polymers Market grew from USD 5.0 million in 2018 to USD 22.7 million in 2024 and is projected to reach USD 95.2 million by 2032, registering a strong CAGR of 19.30%.

- Lightweight polymers are replacing metal components to improve energy efficiency and vehicle range, supporting the shift toward high-performance, low-emission electric vehicles.

- Stringent emission regulations and government electrification mandates across the U.S., EU, and China are pushing OEMs to adopt recyclable and advanced polymer materials.

- Technological advancements in polymer chemistry—such as flame-retardant, thermally stable, and bio-based formulations—are expanding applications in EV batteries, interiors, and electronics.

- Challenges such as high material and processing costs and performance limitations under extreme conditions continue to affect widespread adoption, especially in cost-sensitive markets.

- Asia-Pacific holds approximately 46% of the market share, led by China’s dominant EV production and material supply chain, followed by strong growth in Europe and North America.

- Rising EV production, battery gigafactory expansion, and localized polymer manufacturing are set to fuel global demand across all vehicle types and component categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Lightweight Materials to Improve Vehicle Efficiency

The Electric Vehicle Polymers Market is gaining momentum due to the growing emphasis on lightweight vehicle construction. Reducing vehicle weight directly improves energy efficiency and extends driving range, which are critical factors in electric vehicle performance. Polymers, particularly thermoplastics and elastomers, offer a high strength-to-weight ratio, making them ideal substitutes for conventional metal components. Automakers are increasingly replacing steel and aluminum with polymers in exterior body panels, battery housings, and structural parts to achieve better mileage and lower energy consumption. This weight reduction also contributes to lowering battery load, thereby optimizing battery capacity and lifespan. The shift toward fuel-efficient, low-emission vehicles continues to elevate the strategic importance of polymers in automotive design.

- For example, BASF’s Ultramid® Advanced N polyphthalamide (PPA) is now used in battery housings and structural parts, offering a density of 1.3 g/cm³ compared to aluminum’s 2.7 g/cm³, resulting in up to 50% weight reduction for specific components.

Stringent Government Regulations and Electrification Mandates

Global efforts to curb greenhouse gas emissions are prompting governments to enforce stricter vehicle emission norms and support the transition toward electric mobility. These policies are pushing automotive manufacturers to accelerate the development of electric vehicles, which in turn boosts the demand for high-performance polymer components. The Electric Vehicle Polymers Market is benefiting from regulations such as the EU’s CO₂ reduction targets, the U.S. Inflation Reduction Act, and China’s New Energy Vehicle (NEV) quotas. These mandates create a direct incentive for OEMs to adopt materials that improve vehicle efficiency and safety while aligning with environmental goals. Polymers, with their recyclability and lower carbon footprint during production, meet many of these requirements effectively. Government support for R&D and material innovation further fuels market growth.

- For instance, Solvay’s Xydar LCP G-330 HH was developed in response to the EU’s CO₂ reduction targets and stricter battery safety standards, ensuring compliance with regulations for thermal runaway protection in high-voltage EVs.

Advancements in Polymer Technologies for EV Applications

Technological progress in material science is expanding the use of polymers across various EV subsystems, including battery packs, motor assemblies, interiors, and under-the-hood applications. Manufacturers are developing next-generation polymers with improved thermal stability, flame resistance, and electrical insulation properties. These materials are essential for high-voltage environments and thermal management systems used in electric vehicles. The Electric Vehicle Polymers Market is experiencing a shift toward engineering plastics and specialty polymers designed specifically for safety-critical and high-performance applications. Innovations such as thermally conductive plastics and bio-based polymers are also opening new possibilities for sustainable and efficient vehicle production. The customization potential of polymers gives automakers greater design flexibility and integration advantages.

Growth in EV Production and Battery Manufacturing Capacity

The rapid expansion of global EV production capacity is directly linked to increased demand for advanced polymer materials. Leading automotive markets, including China, the U.S., and Germany, are investing heavily in electric vehicle manufacturing and battery gigafactories. These developments require scalable, durable, and cost-efficient materials, placing polymers at the center of supply chain planning. The Electric Vehicle Polymers Market benefits from rising investments in localized polymer production and the establishment of EV-focused industrial clusters. Growing battery demand also drives the use of polymers in separators, insulators, and cooling modules. As EV platforms diversify into various segments from compact cars to commercial fleets the need for application-specific polymer solutions continues to expand.

Market Trends:

Increased Integration of Smart and Functional Polymers in EV Systems

The Electric Vehicle Polymers Market is witnessing a shift toward smart and functional polymers that offer more than structural support. These materials are being engineered to possess enhanced properties such as self-healing capabilities, conductivity, and sensor integration. Automakers are exploring polymers embedded with smart functionalities to enable real-time diagnostics, energy harvesting, and adaptive responses to environmental conditions. This trend supports the broader move toward connected and intelligent vehicle systems. It also enables new design paradigms that prioritize user experience and predictive maintenance. Smart polymers are particularly relevant in next-generation EV interiors and control systems where material intelligence can support digital interfaces and autonomous features.

Adoption of 3D Printing and Additive Manufacturing Techniques

The adoption of additive manufacturing in automotive production is influencing material choices and encouraging the use of polymers in new applications. In the Electric Vehicle Polymers Market, 3D printing allows for rapid prototyping, customization, and small-batch production of complex polymer components. This flexibility helps manufacturers reduce development cycles and respond faster to design changes and market demands. Lightweight parts with intricate geometries, previously difficult or costly to produce, are now feasible with advanced printing techniques. It also supports low-waste manufacturing processes, aligning with sustainability goals. This trend is expanding the role of polymers in EV development beyond traditional molding and extrusion methods.

- For instance, Extolutilized polypropylene-based 3D printing to reduce prototyping and validation time for critical automotive components from 7 weeks to just 6 days. This 90% reduction in development time enables faster iterations and supports rapid EV platform launches.

Rising Use of Recycled and Bio-Based Polymers in EV Manufacturing

Sustainability remains a central theme in the automotive industry, prompting a significant rise in the use of recycled and bio-based polymers. The Electric Vehicle Polymers Market is responding to this trend by shifting material development toward renewable sources such as bio-polyamides, polylactic acid, and recycled polypropylene. Automakers are integrating these eco-friendly alternatives into vehicle interiors, dashboards, and insulation components to lower overall environmental impact. Regulatory pressure and consumer awareness are driving this transition toward circular material flows. It also supports brand positioning for EV manufacturers looking to strengthen their sustainability credentials. This shift is expected to reshape supply chains and material sourcing strategies in the coming years.

- For example, Syensqo’s Echo rangefeatures bio-based and recycled-content polymers, including Ryton® PPS Supreme resins produced with 100% renewable electricity. The Udel® PSU ECHO RP and Radel® PPSU ECHO RP are the first ISCC-PLUS mass balance compliant sulfone materials for automotive use, meeting global sustainability certifications while maintaining high mechanical performance.

Focus on Aesthetic Customization and Design Flexibility

Demand for personalized EV experiences is leading to increased focus on design flexibility, where polymers offer superior aesthetic and tactile qualities. The Electric Vehicle Polymers Market is evolving to meet consumer preferences for stylish interiors, sleek surfaces, and vibrant color options. Polymer materials are being formulated to provide a range of textures, finishes, and color stability under UV exposure. This trend enhances brand differentiation and user appeal in a competitive EV landscape. It is particularly evident in premium electric vehicles where interior ambiance and customization influence buyer decisions. The use of polymers in this context also supports integrated design solutions with fewer components and simplified assembly.

Market Challenges Analysis:

High Cost of Advanced Polymers and Processing Techniques

One of the major challenges facing the Electric Vehicle Polymers Market is the high cost associated with specialty polymers and their complex processing requirements. Advanced materials such as high-performance thermoplastics, flame-retardant polymers, and conductive composites often come with significant price premiums compared to conventional alternatives. This cost barrier can deter widespread adoption, particularly among cost-sensitive manufacturers and in emerging economies. It also impacts the overall affordability of electric vehicles, which remains a key concern in promoting EV adoption at scale. Specialized processing techniques such as injection molding, co-extrusion, and post-treatment add further expenses to the production chain. Managing these costs while maintaining performance and regulatory compliance presents a continuous challenge for both polymer suppliers and EV manufacturers.

Technical Limitations in Thermal and Mechanical Properties Under Extreme Conditions

While polymers offer many advantages, their performance under extreme thermal and mechanical conditions can limit their use in critical EV components. The Electric Vehicle Polymers Market must overcome concerns related to material degradation, heat distortion, and limited mechanical strength when exposed to high temperatures, electrical stress, or harsh environments. Battery enclosures, power electronics, and under-the-hood applications demand materials with exceptional thermal stability and structural integrity. In some cases, polymers may not yet fully meet the stringent safety and durability standards required for these applications, prompting reliance on metal hybrids or composite reinforcements. Ensuring long-term reliability, resistance to thermal cycling, and chemical compatibility remains a technical barrier. Addressing these limitations through innovation and testing will be key to expanding the application scope of polymers in electric vehicles.

Market Opportunities:

Expansion of Battery Electric Vehicle Production Across Emerging Economies

The Electric Vehicle Polymers Market has strong growth potential in emerging economies where EV adoption is gaining momentum. Countries such as India, Brazil, and Indonesia are investing in electric mobility infrastructure and offering incentives to attract manufacturers. This expansion creates new opportunities for polymer suppliers to enter untapped markets and collaborate with local OEMs. It opens avenues for introducing cost-effective and locally sourced polymers tailored to regional requirements. Growth in two-wheeler and compact EV segments in these regions further drives demand for lightweight and affordable polymer-based components. Localization strategies and supportive trade policies enhance the scalability of polymer solutions across diverse automotive platforms.

Development of Polymer Solutions for Next-Generation EV Architectures

Shifting trends toward solid-state batteries, high-voltage platforms, and modular EV designs are creating new material demands that polymers are well-positioned to fulfill. The Electric Vehicle Polymers Market can capitalize on these trends by developing application-specific materials with superior insulation, heat resistance, and design flexibility. Innovations in polymer blends and composites enable integration into power electronics, charging systems, and thermal management structures. OEMs are seeking materials that reduce complexity and enhance performance, which opens doors for polymer-based multifunctional components. As vehicle platforms evolve, the need for lightweight, durable, and scalable materials increases, offering polymer producers long-term strategic opportunities.

Market Segmentation Analysis:

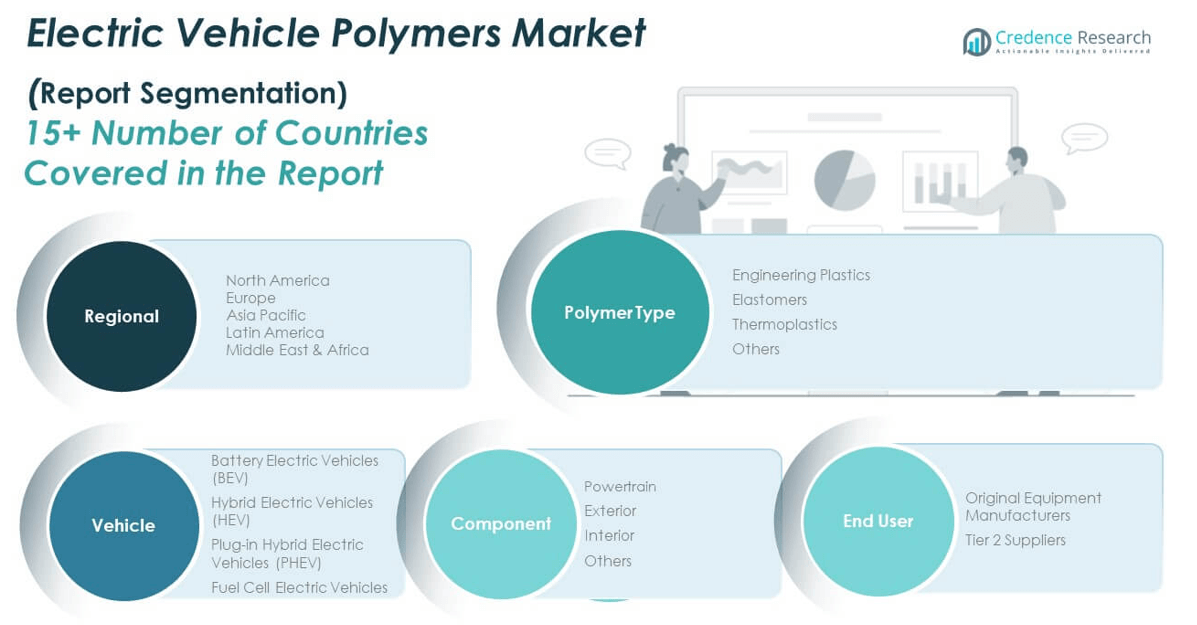

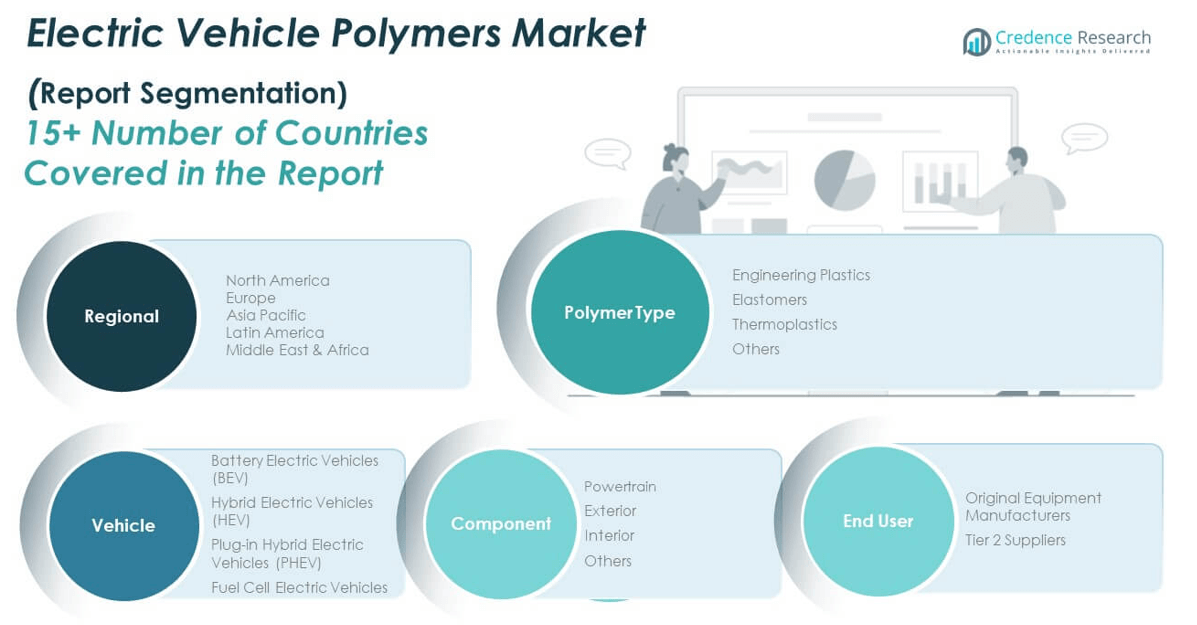

The Electric Vehicle Polymers Market is segmented by polymer type, vehicle type, component, and end user, reflecting the diverse applications and evolving material demands across the electric mobility landscape.

By polymer type, engineering plastics dominate the segment due to their superior mechanical strength and thermal stability, followed by elastomers, which are widely used for sealing and vibration damping. Thermoplastics are gaining traction for their moldability and lightweight properties, while other specialized polymers support niche applications.

- For example, Freudenberg Sealing Technologies developed thermally conductive silicone elastomers for battery control units in electric vehicles.

By vehicle type, Battery Electric Vehicles (BEVs) hold the largest share, driven by increasing production volumes and the need for high-performance materials across structural and electrical systems. Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) contribute steadily to polymer demand, while Fuel Cell Electric Vehicles are emerging with growing investments in hydrogen mobility.

By component, powertrain leads in polymer usage, followed by interior and exterior parts where lightweighting and design flexibility are critical.

- For instance, Carbon fiber-reinforced plastics (CFRP) are used in exterior body panels, as seen in the BMW i3, providing superior strength and rigidity while being extremely lightweight.

By end users, Original Equipment Manufacturers (OEMs) represent the primary consumers of EV polymers, while Tier 2 suppliers contribute through the production of specialized components.

Segmentation:

By Polymer Type

- Engineering Plastics

- Elastomers

- Thermoplastics

- Others

By Vehicle Type

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles

By Component

- Powertrain

- Exterior

- Interior

- Others

By End User

- Original Equipment Manufacturers (OEMs)

- Tier 2 Suppliers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Electric Vehicle Polymers Market size was valued at USD 1.46 million in 2018 to USD 6.58 million in 2024 and is anticipated to reach USD 27.30 million by 2032, at a CAGR of 19.2% during the forecast period. North America accounts for nearly 18% share of the global Electric Vehicle Polymers Market. The region is driven by strong policy support, infrastructure investments, and rising electric vehicle production, particularly in the United States. Federal and state-level incentives are accelerating EV adoption, which is increasing demand for lightweight and durable polymer components. Automakers are collaborating with material suppliers to integrate advanced polymers into battery systems, powertrain assemblies, and interior components. The region also benefits from growing investments in localized polymer manufacturing and recycling facilities. It is positioning itself as a key contributor to sustainable EV material innovation through public-private partnerships and research initiatives.

The Europe Electric Vehicle Polymers Market size was valued at USD 1.20 million in 2018 to USD 5.60 million in 2024 and is anticipated to reach USD 24.43 million by 2032, at a CAGR of 19.9% during the forecast period. Europe holds around 16% share of the global Electric Vehicle Polymers Market, supported by strict emission regulations and advanced automotive engineering. Countries such as Germany, France, and the Netherlands are leading polymer adoption across EV platforms due to environmental targets and incentives. Automakers are increasingly replacing metals with recyclable polymers to meet EU sustainability directives. The European market favors high-performance thermoplastics and bio-based composites for interiors, battery enclosures, and structural applications. Technological innovation and eco-labeling requirements encourage polymer suppliers to focus on quality, recyclability, and compliance. It continues to attract investment in next-generation material R&D and circular economy initiatives.

The Asia Pacific Electric Vehicle Polymers Market size was valued at USD 1.74 million in 2018 to USD 7.98 million in 2024 and is anticipated to reach USD 33.95 million by 2032, at a CAGR of 19.5% during the forecast period. Asia Pacific dominates the global Electric Vehicle Polymers Market with a 48% market share, driven primarily by China’s leadership in EV production and battery technology. The region benefits from strong government support, large-scale manufacturing ecosystems, and aggressive electrification policies. China, Japan, and South Korea are leading in the integration of advanced polymers in high-volume EV segments. Regional OEMs are adopting lightweight materials to boost energy efficiency and meet growing domestic and export demand. Supply chain integration, cost competitiveness, and innovation hubs are helping Asia Pacific maintain its dominant position. It continues to scale production capacity to meet global EV material demand.

The Latin America Electric Vehicle Polymers Market size was valued at USD 0.34 million in 2018 to USD 1.37 million in 2024 and is anticipated to reach USD 4.76 million by 2032, at a CAGR of 16.5% during the forecast period. Latin America holds a smaller share of the Electric Vehicle Polymers Market, accounting for just under 3%. However, it presents emerging opportunities due to urban mobility programs and national EV policies in countries such as Brazil, Mexico, and Chile. The region is witnessing gradual adoption of electric vehicles, particularly in public transport and fleet operations. Growing environmental awareness and vehicle modernization efforts are encouraging local OEMs to explore polymer-based components. The availability of raw materials and investments in processing infrastructure support regional polymer applications. It is poised for moderate but steady growth as electrification strategies mature.

The Middle East Electric Vehicle Polymers Market size was valued at USD 0.17 million in 2018 to USD 0.79 million in 2024 and is anticipated to reach USD 3.30 million by 2032, at a CAGR of 19.3% during the forecast period. The Middle East contributes roughly 2% to the global Electric Vehicle Polymers Market and is slowly expanding due to green mobility targets set by countries like the UAE and Saudi Arabia. Governments are promoting EVs to diversify their energy portfolio and reduce dependence on oil. This policy direction is encouraging investments in EV manufacturing and charging networks, indirectly boosting demand for advanced polymers. The region’s high temperatures create demand for thermally stable, UV-resistant materials in EV design. Automotive suppliers are introducing polymer solutions that meet these environmental challenges. It is building strategic partnerships to accelerate material technology transfer and local production.

The Africa Electric Vehicle Polymers Market size was valued at USD 0.11 million in 2018 to USD 0.42 million in 2024 and is anticipated to reach USD 1.44 million by 2032, at a CAGR of 16.3% during the forecast period. Africa accounts for less than 1% of the Electric Vehicle Polymers Market, but shows potential as governments begin supporting green mobility transitions. Countries like South Africa, Kenya, and Rwanda are implementing policies to promote EV imports, assembly, and local manufacturing. Growth in urban centers and sustainable transport initiatives is gradually driving interest in lightweight, affordable materials. Polymers are emerging as key components for basic EV models and electric buses operating in high-density corridors. The region faces challenges related to infrastructure and supply chain development. It is slowly building capacity through pilot projects and international collaboration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Arlanxeo

- BASF SE

- SABIC

- DuPont de Nemours, Inc.

- LG Chem

- Covestro AG

- Solvay S.A.

- Lanxess AG

- Dow Inc.

- Celanese Corporation

- Mitsui Chemicals, Inc.

- Evonik Industries AG

- Toray Industries, Inc.

- Arkema S.A.

- Asahi Kasei Corporation

Competitive Analysis:

The Electric Vehicle Polymers Market features a competitive landscape marked by the presence of leading chemical and material science companies focused on innovation, scale, and customization. Key players include BASF SE, SABIC, Covestro AG, Solvay S.A., and DuPont, each offering a diverse portfolio of high-performance polymers tailored for electric vehicles. These companies are investing in research to enhance material strength, heat resistance, and recyclability while maintaining lightweight properties. Strategic collaborations with automotive OEMs help them co-develop application-specific solutions. New entrants and regional players are expanding capacity to meet growing demand across Asia Pacific and Europe. The market is witnessing consolidation and vertical integration, particularly in supply chain management and compounding capabilities. It remains technology-driven, with manufacturers competing on performance metrics, regulatory compliance, and cost efficiency. Continuous product innovation and expansion into emerging markets strengthen the position of major players and intensify competition across all vehicle segments.

Recent Developments:

- In June 2025, LG Chem finalized the sale of its water treatment filter business to Glenwood Private Equity for $1 billion. This move is part of LG Chem’s strategy to focus more on battery materials and eco-friendly materials, both of which are central to electric vehicle development.

- In May 2025, BASF announced its intention to acquire the remaining 49% shares of the Alsachimie joint venture from DOMO Chemicals, making BASF the sole owner. This strategic move is expected to strengthen BASF’s position in the polyamide 6.6 value chain, which is critical for automotive and electric vehicle applications.

- In March 2023, Solvay, a leading Belgium-based chemical company, introduced Xydar LCP G-330 HH, a novel liquid crystal polymer designed specifically for high-heat insulation in electric vehicle battery modules. This new grade enhances passenger safety by preventing battery thermal runaway, meeting rigorous thermal and insulation requirements for high-voltage EV systems.

Market Concentration & Characteristics:

The Electric Vehicle Polymers Market is moderately concentrated, with a few global players holding a significant share due to their advanced manufacturing capabilities and strong partnerships with automotive OEMs. It is characterized by rapid innovation, high-performance material requirements, and growing demand for sustainability. The market favors companies with expertise in lightweight polymers, thermal management, and regulatory compliance. Product differentiation and customization play a key role in competitive positioning. It requires consistent investment in R&D to meet evolving safety, efficiency, and design standards in electric vehicles. The presence of regional players is increasing, especially in Asia Pacific, driven by localized production and cost advantages. The market structure reflects a blend of multinational leadership and regional expansion strategies.

Report Coverage:

The research report offers an in-depth analysis based on polymer type, vehicle type, component, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-performance polymers will accelerate as EV manufacturers prioritize weight reduction and efficiency.

- Advancements in flame-retardant and thermally stable materials will support growth in battery and powertrain applications.

- The shift toward solid-state batteries will open new opportunities for specialized polymer components.

- Asia Pacific will continue to dominate global volume, driven by large-scale EV production in China and India.

- Europe will see increased adoption of recyclable and bio-based polymers due to strict sustainability regulations.

- North American players will expand localized polymer manufacturing to reduce reliance on imports.

- Polymer suppliers will invest in R&D for multifunctional materials with improved conductivity and durability.

- 3D printing and additive manufacturing will enable cost-effective customization of EV polymer parts.

- Strategic collaborations between OEMs and material producers will accelerate the development of integrated polymer solutions.

- Emerging markets in Latin America, Middle East, and Africa will gradually contribute to market expansion through public mobility initiatives.