| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Data Centre Market Size 2024 |

USD 91,184.38 Million |

| Europe Data Centre Market, CAGR |

5.95% |

| Europe Data Centre Market Size 2032 |

USD 1,44,823.30 Million |

Market Overview

Europe Data Centre Market size was valued at USD 91,184.38 million in 2024 and is anticipated to reach USD 1,44,823.30 million by 2032, at a CAGR of 5.95% during the forecast period (2024-2032).

The Europe data centre market is witnessing significant growth, driven by the rising demand for cloud services, edge computing, and data-intensive technologies such as artificial intelligence and the Internet of Things (IoT). Enterprises across sectors are increasingly investing in digital transformation, leading to higher data storage and processing needs. Additionally, the growing adoption of 5G networks and the shift towards hybrid and multi-cloud environments are accelerating the deployment of advanced data centre infrastructure. Government initiatives supporting data sovereignty, energy efficiency, and green data centres are further contributing to market expansion. Moreover, increased investments from hyperscale providers and colocation service providers are reshaping the competitive landscape. These trends, combined with advancements in cooling technologies and modular data centre designs, are enabling scalable and sustainable growth. As businesses prioritize data security and compliance with regional regulations like GDPR, the demand for robust and secure data centre solutions continues to strengthen across the European region.

The Europe data centre market demonstrates a dynamic geographical distribution, with major hubs concentrated in countries such as the United Kingdom, Germany, France, and the Netherlands due to their advanced digital infrastructure, strong connectivity, and supportive regulatory environments. These regions continue to attract significant investments from hyperscale cloud providers and colocation service operators. In addition, emerging markets in Eastern and Northern Europe, including Poland, Sweden, and Denmark, are gaining traction owing to rising demand for edge computing, sustainable energy sources, and expanding enterprise digital transformation. Key players actively shaping the market include CyrusOne Inc., Data4, Equinix Inc., Global Switch Holdings Limited, and Leaseweb Global BV. These companies are focused on expanding their footprint across the region through new facility launches, strategic partnerships, and energy-efficient infrastructure investments. As data sovereignty, security, and operational efficiency become top priorities, these market leaders are driving innovation and setting new standards for performance and sustainability in the European data centre industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe data centre market was valued at USD 91,184.38 million in 2024 and is projected to reach USD 144,823.30 million by 2032, growing at a CAGR of 5.95% during the forecast period.

- Rising demand for cloud computing, AI, and IoT across industries is significantly driving data centre expansion in Europe.

- The growing emphasis on green data centres and energy-efficient technologies is shaping sustainable infrastructure development.

- Increasing adoption of hybrid and multi-cloud strategies is boosting demand for colocation and managed hosting services.

- High capital investment, rising energy costs, and data security concerns continue to pose challenges to market growth.

- The UK, Germany, France, and the Netherlands are leading regions due to robust connectivity and digital infrastructure.

- Key players such as CyrusOne Inc., Equinix Inc., and Global Switch Holdings Limited are expanding through strategic partnerships and advanced facility launches.

Report Scope

This report segments the Europe Data Centre Market as follows:

Market Drivers

Rising Demand for Cloud Services and Digital Transformation

The accelerating pace of digital transformation across Europe is a major driver of the data centre market. Organizations in both the public and private sectors are increasingly adopting cloud-based services to enhance operational efficiency, scalability, and agility. For instance, the European Commission has emphasized the importance of cloud infrastructure in supporting digital transformation initiatives across member states. Additionally, the European Data Centre Association (EUDCA) has highlighted the growing reliance on hybrid and multi-cloud strategies to meet expanding data processing and storage needs.

Adoption of Emerging Technologies like AI, IoT, and 5G

The widespread adoption of advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and 5G connectivity is significantly contributing to the growth of the European data centre market. For instance, the European Commission has supported the deployment of edge data centres to accommodate the data influx generated by smart cities and connected devices. Similarly, the European Telecommunications Standards Institute (ETSI) has emphasized the role of 5G in enhancing data transfer speeds and reducing latency, driving demand for high-performance computing infrastructure.

Expansion of Hyperscale and Colocation Facilities

The rising demand for scalable and cost-efficient data storage solutions is fueling the expansion of hyperscale and colocation data centres across Europe. Major cloud service providers and hyperscalers are investing in large-scale facilities to cater to the growing needs of enterprises and consumers. Colocation services offer flexibility, cost savings, and enhanced security for businesses that prefer not to manage their own data infrastructure. This trend is especially prominent in urban hubs and technology corridors where the demand for high-density computing is concentrated. Furthermore, increased capital inflow from real estate investment trusts (REITs) and infrastructure funds is supporting the construction and modernization of data centre facilities.

Government Regulations and Focus on Sustainability

Supportive regulatory frameworks and sustainability initiatives are playing a crucial role in shaping the data centre landscape in Europe. The implementation of data protection regulations such as the General Data Protection Regulation (GDPR) has compelled organizations to host data within national or regional boundaries, boosting the need for local data centres. Additionally, growing environmental concerns are driving demand for green data centres that utilize renewable energy sources and energy-efficient technologies. European governments are encouraging eco-friendly infrastructure development through incentives and partnerships, which aligns with the broader goals of reducing carbon emissions. This emphasis on compliance and sustainability not only enhances operational efficiency but also strengthens customer trust and market competitiveness.

Market Trends

Surge in Edge Data Centres and Decentralized Infrastructure

One of the most prominent trends in the European data centre market is the rapid rise of edge data centres. As latency-sensitive applications like autonomous vehicles, smart manufacturing, and augmented reality gain traction, businesses are shifting toward decentralized computing models. For instance, the European Telecommunications Standards Institute (ETSI) has emphasized the importance of edge data centres in supporting real-time data handling for autonomous vehicles and smart city applications. Additionally, the European Commission has supported investments in micro data centres and modular solutions to improve localized digital service delivery in urban and remote regions.

Growing Focus on Green and Sustainable Data Centres

Environmental sustainability is becoming a central focus for data centre operators in Europe. With increasing scrutiny over energy consumption and carbon emissions, there is a marked shift toward green data centres powered by renewable energy sources such as wind, solar, and hydroelectric power. For instance, the European Union’s climate goals have driven initiatives to adopt energy-efficient cooling technologies and AI-based monitoring systems to minimize environmental footprints. Similarly, the European Data Centre Association (EUDCA) has highlighted the role of green certifications and energy performance metrics as competitive differentiators in the market.

Increased Investment by Hyperscalers and Tech Giants

The Europe data centre market is witnessing substantial investment inflows from hyperscale cloud providers and global technology companies. Firms such as Amazon Web Services, Microsoft, Google, and Meta are expanding their regional presence by establishing large-scale data centre campuses across strategic locations in Northern and Western Europe. These investments are driven by the growing demand for public and hybrid cloud services among European enterprises, as well as regulatory requirements for data localization. Countries like Ireland, the Netherlands, Germany, and Sweden have emerged as hotspots for hyperscale data centre development due to their strong connectivity, stable political environments, and access to renewable energy.

Emergence of Data Centre-as-a-Service (DCaaS) Models

The rising complexity of IT infrastructure management has led to increased adoption of Data Centre-as-a-Service (DCaaS) models across Europe. Businesses are seeking flexible, scalable, and cost-efficient solutions to manage their data storage, computing, and networking requirements without the burden of owning physical infrastructure. DCaaS offers organizations the ability to access data centre resources on demand, making it ideal for dynamic workloads and remote operations. This trend is especially relevant for small and medium-sized enterprises (SMEs) looking to leverage enterprise-grade infrastructure without significant capital expenditure. The continued evolution of service-based models is reshaping the way data centres operate and deliver value.

Market Challenges Analysis

Rising Energy Consumption and Infrastructure Strain

One of the primary challenges facing the Europe data centre market is the escalating energy consumption associated with large-scale facilities. As data volumes grow exponentially and high-performance computing becomes more prevalent, data centres require significantly more power to maintain operations and cooling systems. For instance, the European Data Centre Association (EUDCA) has reported that the rising energy demand of data centres is placing significant strain on national power grids, particularly in industrialized regions. Additionally, the European Commission has emphasized the need for renewable energy integration to address electricity cost fluctuations and reduce dependence on non-renewable sources. Local governments are also introducing stricter sustainability mandates to minimize the carbon footprint of data centres.

Regulatory Complexity and Data Sovereignty Concerns

Navigating the complex regulatory environment in Europe poses another significant challenge for data centre operators. The General Data Protection Regulation (GDPR) and other regional data sovereignty laws require organizations to store and process data within national or EU boundaries, compelling operators to localize infrastructure and modify their service offerings accordingly. While these regulations aim to protect user data, they also increase operational complexity and compliance costs, particularly for international cloud service providers. Furthermore, the regulatory landscape varies significantly across European countries, creating fragmented compliance requirements that complicate cross-border data centre strategies. Political uncertainties such as Brexit have also introduced additional compliance burdens for operators managing UK and EU data flows. To succeed in this landscape, data centre providers must invest in regulatory expertise, ensure robust data governance frameworks, and maintain transparency with clients regarding data handling practices. Balancing regulatory compliance with operational scalability continues to be a key challenge in the region.

Market Opportunities

The Europe data centre market presents significant growth opportunities driven by the accelerating shift towards digitalization and the widespread adoption of cloud computing, artificial intelligence, and big data analytics. As businesses across industries increasingly migrate their operations to digital platforms, the demand for scalable, secure, and high-performance data infrastructure continues to rise. This transformation creates ample opportunities for data centre providers to expand their service offerings, particularly in edge computing and hybrid cloud environments. Moreover, the growing adoption of IoT and 5G technologies is generating massive volumes of data that require low-latency processing, encouraging the development of edge data centres closer to end-users. This evolution of computing architecture is particularly beneficial for operators who can offer localized data solutions that comply with region-specific data residency requirements.

In addition, the increasing emphasis on sustainability and green infrastructure in Europe is paving the way for innovations in energy-efficient data centre design. Governments and regulatory bodies are supporting the transition to renewable energy sources, offering incentives and policy support for eco-friendly data centre development. Operators who integrate clean energy, advanced cooling systems, and carbon-neutral strategies are likely to gain competitive advantage in the market. Furthermore, emerging markets in Eastern and Southern Europe present untapped potential due to increasing internet penetration, growing enterprise IT spending, and the need for modern digital infrastructure. These regions offer attractive investment opportunities for colocation, hyperscale, and modular data centres, especially as local businesses and governments prioritize data sovereignty and digital resilience. As enterprises seek flexible and cost-effective data management solutions, models such as Data Centre-as-a-Service (DCaaS) and colocation services are expected to experience strong demand, creating further avenues for growth across the European data centre landscape.

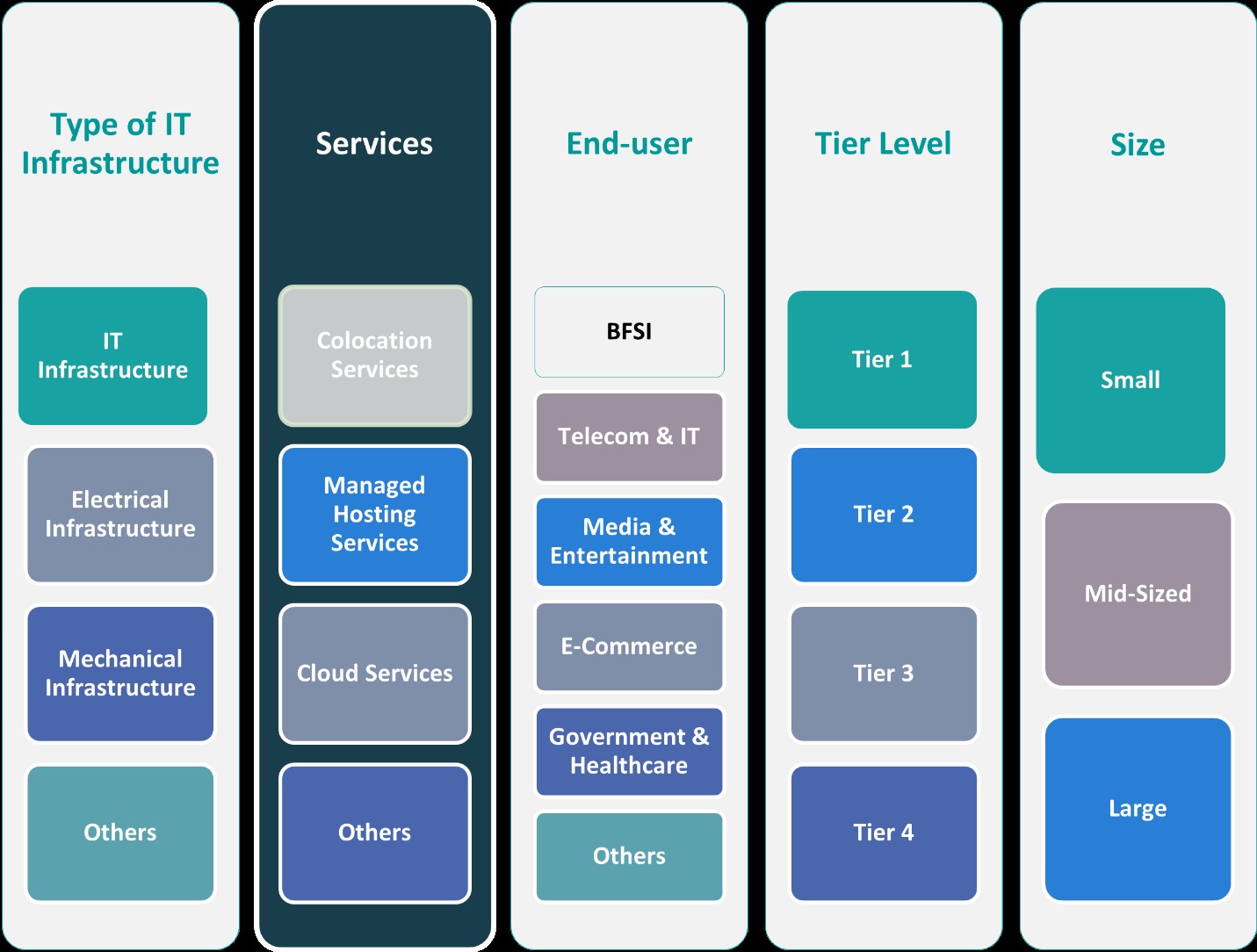

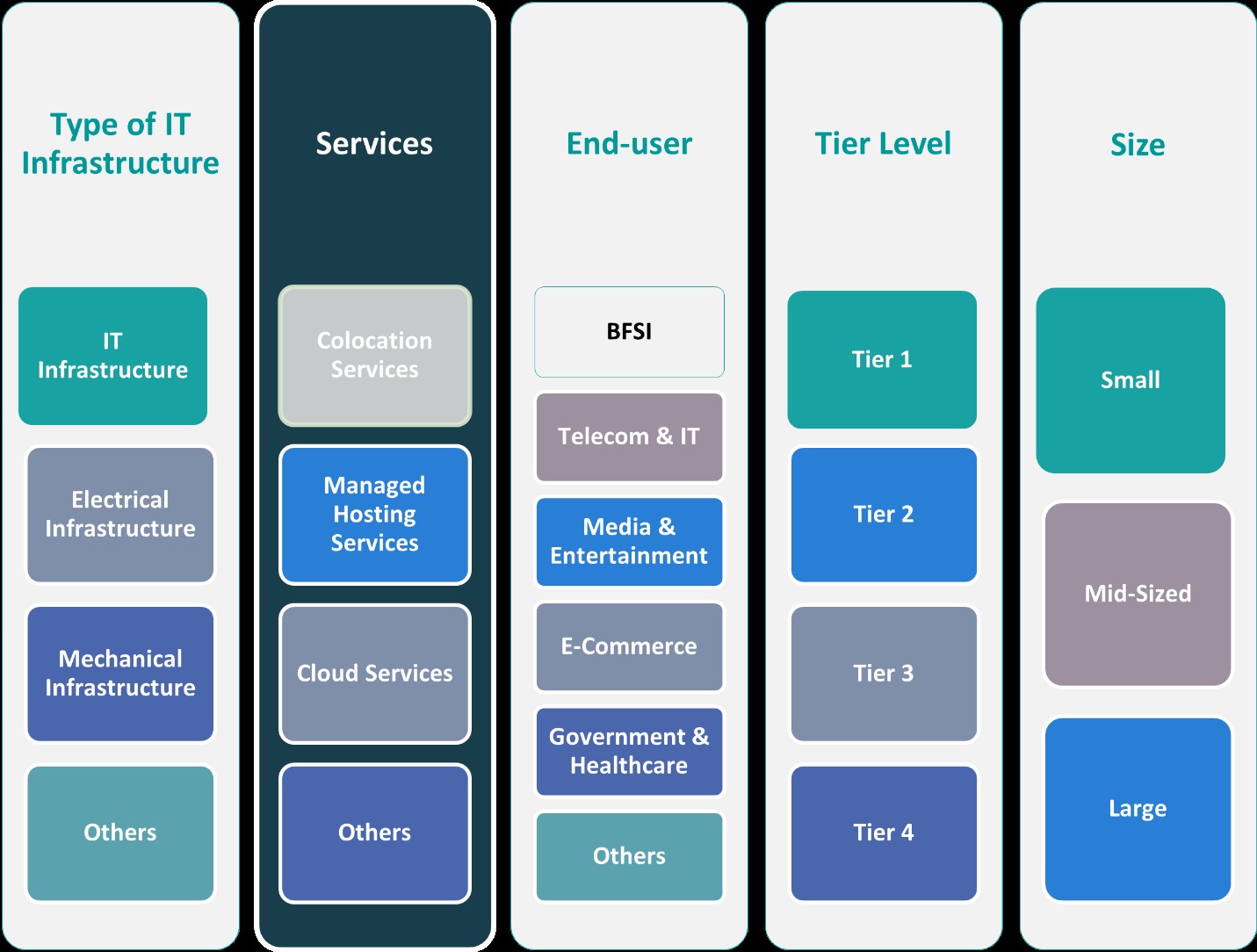

Market Segmentation Analysis:

By Type:

The Europe data centre market, when segmented by type, comprises IT infrastructure, electrical infrastructure, mechanical infrastructure, and others. Among these, IT infrastructure holds a significant share due to the rising demand for high-performance computing systems, storage solutions, and networking equipment. As data volumes continue to surge across industries, businesses are heavily investing in advanced IT infrastructure to support real-time processing, analytics, and secure data management. Electrical infrastructure, which includes UPS systems, generators, and power distribution units, plays a critical role in ensuring uninterrupted operations and remains essential in data centre design. The growing emphasis on energy efficiency and sustainability has also spurred innovation in power supply solutions. Mechanical infrastructure, including cooling systems, racks, and airflow management technologies, is witnessing rising demand as operators strive to maintain optimal performance while minimizing energy consumption. The “Others” segment, encompassing building design, security systems, and monitoring equipment, adds to the comprehensive infrastructure needed for modern, scalable, and environmentally responsible data centre operations.

By Service Type:

Based on service type, the Europe data centre market is segmented into colocation services, managed hosting services, cloud services, and others. Colocation services dominate this segment, as they offer enterprises flexibility, cost-efficiency, and secure physical space without the need to build their own infrastructure. This model is particularly attractive to small and medium-sized enterprises (SMEs) seeking to scale operations quickly while maintaining compliance with data sovereignty regulations. Managed hosting services are gaining traction among companies that prefer to outsource the administration of servers and IT infrastructure, allowing them to focus on core business functions. Cloud services represent another rapidly expanding segment, driven by the widespread adoption of hybrid and multi-cloud strategies, which provide on-demand scalability and support for advanced technologies such as AI, IoT, and big data analytics. The “Others” category, which may include disaster recovery, data backup, and consulting services, further strengthens the service ecosystem, offering comprehensive support to organizations navigating digital transformation across Europe.

Segments:

Based on Type:

- IT Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- Others

Based on Service Type:

- Colocation Services

- Managed Hosting Services

- Cloud Services

- Others

Based on End- User:

- BFSI

- IT & Telecom

- Media & Entertainment

- E-Commerce

- Government & Healthcare

- Others

Based on Tier Level of Infrastructure:

- Tier 1

- Tier 2

- Tier 3

- Tier 4

Based on Size:

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

United Kingdom

The United Kingdom holds the largest share of the Europe data centre market, accounting for approximately 22% of the total regional revenue in 2024. The country’s mature digital economy, combined with the presence of major tech companies, hyperscale cloud providers, and a robust financial services sector, continues to drive demand for high-capacity data centres. London, in particular, serves as a key data centre hub due to its strong connectivity infrastructure, global business presence, and access to renewable energy. Furthermore, the UK government’s push for smart cities and digital transformation initiatives across public services has further accelerated infrastructure investments. The rising need for edge computing and localized data storage post-Brexit is also compelling firms to expand or establish data centres within the country to ensure data sovereignty and regulatory compliance.

Germany

Germany follows as a significant contributor to the Europe data centre market, commanding a market share of 17% in 2024. As Europe’s largest economy, Germany benefits from strong enterprise IT spending and a growing demand for cloud services, colocation, and managed hosting. Frankfurt has emerged as a leading data centre destination due to its status as a financial hub and its strategic location at the heart of Europe’s internet backbone. The country’s focus on digitalization, supported by the industry 4.0 revolution, has boosted the need for advanced data processing capabilities, driving growth in hyperscale and edge data centres. Additionally, Germany’s commitment to renewable energy aligns well with the green data centre movement, making it a preferred location for environmentally responsible operations.

France

France, with a market share of approximately 13%, represents another key region within the European data centre landscape. The country is witnessing steady growth in demand due to rising digital infrastructure development, the proliferation of cloud-based services, and ongoing digital transformation across sectors such as BFSI, healthcare, and manufacturing. Paris serves as a central hub for data traffic and connectivity, supported by extensive fibre networks and international subsea cables. Moreover, the French government’s initiatives to promote data sovereignty and strengthen cybersecurity are encouraging businesses to host data domestically, creating more opportunities for local data centre expansion and development.

Rest of Europe

The Rest of Europe, which includes countries such as Sweden, the Netherlands, Poland, Austria, and Denmark, collectively contributes around 32% of the regional market. These countries are gaining prominence due to their strategic geographic positions, access to renewable energy, and supportive regulatory frameworks. The Netherlands, particularly Amsterdam, is well-known for its data centre density and connectivity. Sweden and Denmark are capitalizing on their cool climates and renewable energy resources to attract green data centre investments. Poland and Austria are also emerging as favorable destinations for expanding edge data centre networks in Eastern and Central Europe. These developments are strengthening regional competitiveness and contributing to a more balanced growth landscape across Europe.

Key Player Analysis

- CyrusOne Inc.

- Data4

- Equinix Inc.

- Global Switch Holdings Limited

- Leaseweb Global BV

Competitive Analysis

The Europe data centre market features a competitive landscape marked by the presence of leading global and regional players focused on expanding capacity, enhancing service offerings, and prioritizing sustainability. Key companies such as CyrusOne Inc., Data4, Equinix Inc., Global Switch Holdings Limited, and Leaseweb Global BV are playing a pivotal role in shaping market dynamics through continuous innovation and strategic investments. These firms are leveraging cutting-edge technologies to offer scalable and energy-efficient solutions that cater to the growing demand for cloud services, colocation, and hybrid IT environments across Europe. Market leaders are also expanding their geographical presence by establishing new data centre facilities in key hubs like London, Frankfurt, Amsterdam, and Paris while exploring opportunities in emerging markets such as Sweden, Poland, and Denmark. Sustainability remains a core focus, with companies integrating renewable energy sources, advanced cooling systems, and green building practices to meet stringent EU energy efficiency standards. Additionally, partnerships with hyperscale cloud providers and enterprises are enhancing service portfolios and boosting competitiveness. As digital transformation accelerates across sectors, these key players are expected to maintain their leadership by adapting to regulatory changes, enhancing security frameworks, and providing high-performance, low-latency infrastructure that aligns with evolving enterprise and end-user requirements.

Recent Developments

- In April 2025, CyrusOne announced plans to develop its second data center in Milan, named MIL2. The facility will offer 54MW IT capacity across 18,000 sqm and feature sustainable designs such as heat reuse and solar panels. It is located near the MIL1 data center, which is under development.

- In March 2025, Data4 signed an MoU with Westinghouse to explore deploying smaller modular nuclear reactors (SMRs) to power future data centers, reducing reliance on fossil fuels.

- In March 2025, Leaseweb launched its European Cloud Campus initiative as part of the IPCEI-CIS project to build sovereign cloud infrastructure for Europe. This includes scalable compute platforms and container integration expected by late 2025

- In February 2025, Equinix inaugurated PA13x, its 11th French data center, with a €350 million investment. The facility integrates heat recovery systems and sustainable features to support AI-driven workloads.

Market Concentration & Characteristics

The Europe data centre market exhibits a moderately high level of market concentration, characterized by the dominance of a few major players that hold significant influence over infrastructure development, technological innovation, and service delivery. These companies primarily operate across strategic metropolitan hubs, leveraging advanced connectivity, regulatory compliance, and access to renewable energy. The market is marked by a strong focus on scalability, sustainability, and energy efficiency, driven by rising enterprise demand for cloud-based services, data sovereignty, and edge computing capabilities. High barriers to entry, including substantial capital investment and regulatory complexity, further contribute to the consolidated nature of the market. However, regional diversity allows emerging players to enter through niche service offerings or by targeting underdeveloped markets in Eastern and Northern Europe. The market’s dynamic nature is reinforced by continual advancements in virtualization, automation, and hybrid IT models, which are reshaping the competitive landscape and enabling service providers to address evolving enterprise needs efficiently.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Tier Level of Infrastructure, Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe data centre market is expected to witness steady growth due to rising demand for cloud computing and digital transformation initiatives.

- Increasing adoption of AI, big data analytics, and IoT technologies will drive higher data storage and processing requirements.

- Colocation services will continue gaining traction as enterprises seek scalable and cost-efficient infrastructure solutions.

- Sustainability will remain a major focus, with operators investing in energy-efficient technologies and renewable power sources.

- Edge data centres will grow in prominence to support low-latency services across diverse European regions.

- Government regulations and data sovereignty concerns will influence market dynamics and infrastructure investments.

- Hyperscale data centres will expand rapidly to meet the growing demand from cloud service providers and digital platforms.

- Strategic partnerships and mergers among telecoms, cloud providers, and data centre operators will shape market consolidation.

- Rising cybersecurity threats will drive increased investment in robust physical and network security solutions.

- Demand for smart cooling and automation systems will surge as operators focus on operational efficiency and cost reduction.