CHAPTER NO. 1 : INTRODUCTION 15

1.1. Report Description 15

1.1.1. Purpose of the Report 15

1.1.2. USP & Key Offerings 15

1.2. Key Benefits for Stakeholders 15

1.3. Target Audience 16

1.4. Report Scope 16

CHAPTER NO. 2 : EXECUTIVE SUMMARY 20

2.1. Folding Furniture Market Snapshot 20

2.2. Global Folding Furniture Market, 2017 – 2030 (USD Million) 22

2.1. Insights from Primary Respondents 22

CHAPTER NO. 3 : COVID 19 IMPACT ANALYSIS 23

3.1. Impact Assessment of COVID-19 Pandemic, By Region 23

CHAPTER NO. 4 : FOLDING FURNITURE MARKET – INDUSTRY ANALYSIS 24

4.1. Introduction 24

4.2. Market Drivers 25

4.2.1. Space Optimization 25

4.2.2. Portability and Convenience 26

4.3. Market Restraints 26

4.3.1. Restraining Factor Analysis 26

4.4. Market Opportunities 27

4.4.1. Market Opportunity Analysis 27

4.5. Porter’s Five Forces Analysis 27

4.6. Value Chain Analysis 28

CHAPTER NO. 5 : KEY INVESTMENT POCKETS ANALYSIS 29

5.1. Top Investment Pockets 29

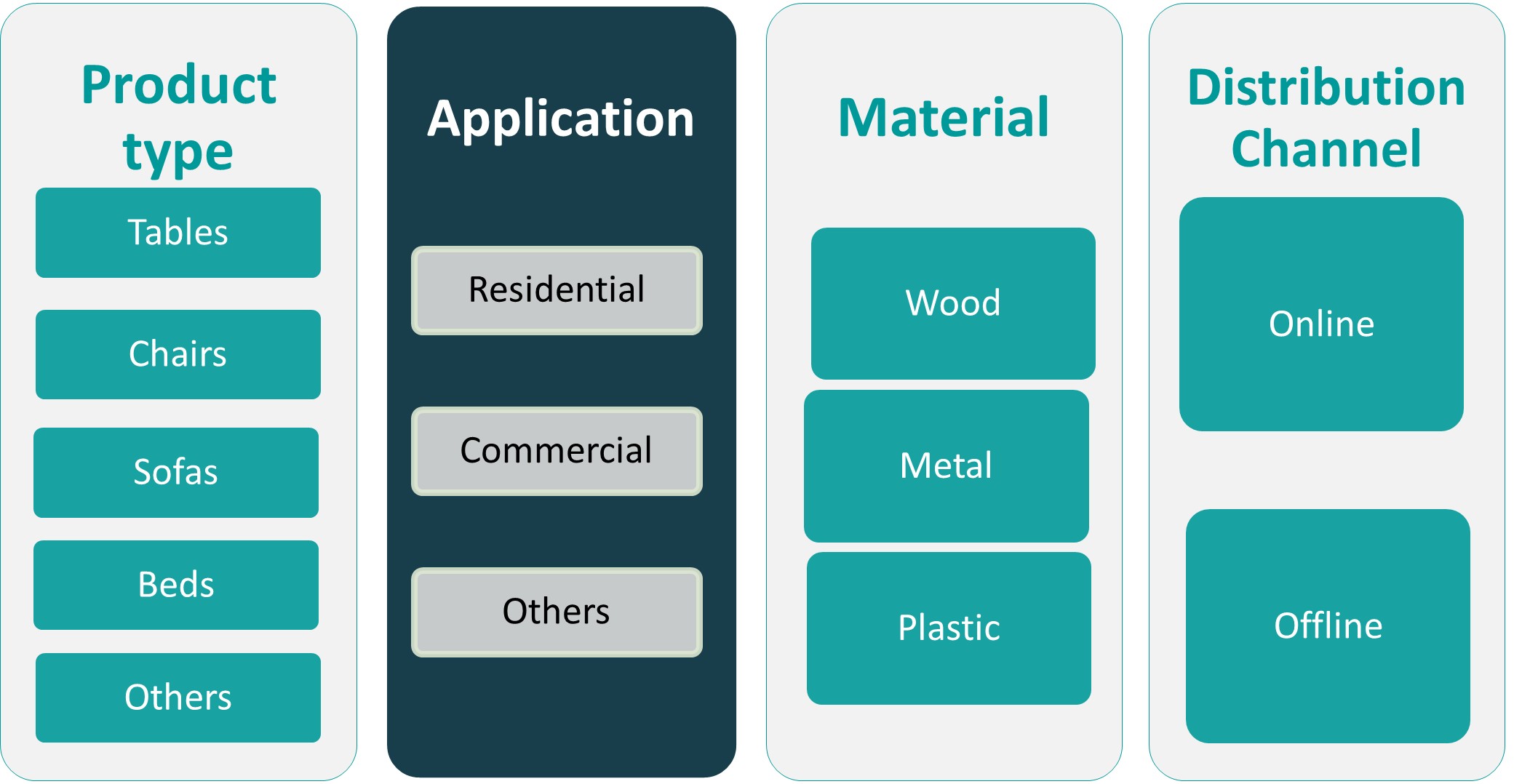

5.1.1.1. Folding Furniture Market Attractiveness Analysis, By Type 29

5.1.1.2. Folding Furniture Market Attractiveness Analysis, By Application 29

5.1.1.3. Folding Furniture Market Attractiveness Analysis, By Material 30

5.1.1.4. Folding Furniture Market Attractiveness Analysis, By Distribution Channel 30

5.2. Product Life Cycle Analysis 31

5.3. Incremental Revenue Growth Opportunity, 2023 – 2030 32

5.3.1. Type 32

5.3.2. Application 32

5.3.3. Material 33

5.3.4. Distribution Channel 33

CHAPTER NO. 6 : MARKET POSITIONING OF KEY PLAYERS 34

6.1. Company Market Share Analysis –2020 and 2022 34

6.1.1. Global Folding Furniture Market: Company Market Share, 2022 34

6.1.2. Global Folding Furniture Market: Company Market Share, 2022 34

6.1. Global Folding Furniture Market Company Volume Market Share, 2022 35

6.2. Global Folding Furniture Market Company Revenue Market Share, 2022 36

6.3. Market Position of Key Players 2022 37

6.3.1. Market Position of Key Players, 2022 37

6.4. Strategic Developments 38

6.4.1. Acquisitions & Mergers 38

6.4.2. New Product Launch 38

6.4.3. Regional Expansion 38

CHAPTER NO. 7 : FOLDING FURNITURE MARKET – BY TYPE SEGMENT ANALYSIS 39

7.1. Folding Furniture Market Overview, by Type Segment 39

7.1.1. Global Folding Furniture Market Revenue Share, By Type, 2022 & 2030 40

7.2. Table & Chair 41

7.2.1. Global Table & Chair Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 41

7.3. Sofa 42

7.3.1. Global Table & Chair Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 42

7.4. Bed 43

7.4.1. Global Bed Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 43

7.5. Storage units 44

7.5.1. Global Storage units Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 44

7.6. Others 45

7.6.1. Global Others Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 45

CHAPTER NO. 8 : FOLDING FURNITURE MARKET – BY APPLICATION SEGMENT ANALYSIS 46

8.1. Folding Furniture Market Overview, by Application Segment 46

8.1.1. Global Folding Furniture Market Revenue Share, By Application, 2022 & 2030 47

8.2. Residential 48

8.2.1. Global Folding Furniture for Residential Market Revenue, By Region, 2017 – 2022 (USD Million) 48

8.3. Commercial 49

8.3.1. Global Folding Furniture for Commercial Market Revenue, By Region, 2017 – 2022 (USD Million) 49

8.4. Institutional 50

8.4.1. Global Folding Furniture for Institutional Market Revenue, By Region, 2017 – 2022 (USD Million) 50

8.5. Application 4 51

8.5.1. Global Folding Furniture for Application 4 Market Revenue, By Region, 2017 – 2022 (USD Million) 51

8.6. Application 5 52

8.6.1. Global Folding Furniture for Application 5 Market Revenue, By Region, 2017 – 2022 (USD Million) 52

CHAPTER NO. 9 : FOLDING FURNITURE MARKET – BY MATERIAL SEGMENT ANALYSIS 53

9.1. Folding Furniture Market Overview, by Material Segment 53

9.1.1. Global Folding Furniture Market Revenue Share, By Material, 2022 & 2030 54

9.2. Wood 55

9.2.1. Global Wood Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 55

9.3. Plastic 56

9.3.1. Global Plastic Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 56

9.4. Metal 57

9.4.1. Global Metal Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 57

9.5. Glass 58

9.5.1. Global Glass Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 58

9.6. Others 59

9.6.1. Global Others Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 59

CHAPTER NO. 10 : FOLDING FURNITURE MARKET – BY DISTRIBUTION CHANNEL SEGMENT ANALYSIS 60

10.1. Folding Furniture Market Overview, by Distribution Channel Segment 60

10.1.1. Global Folding Furniture Market Revenue Share, By Distribution Channel, 2022 & 2030 61

10.2. E-commerce websites 62

10.2.1. Global E-commerce websites Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 62

10.3. Company-Owned Websites 63

10.3.1. Global Company-Owned Websites Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 63

10.4. Specialty Stores 64

10.4.1. Global Specialty Stores Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 64

10.5. Furniture Marts 65

10.5.1. Global Furniture Marts Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 65

10.6. Others 66

10.6.1. Global Others Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 66

CHAPTER NO. 11 : FOLDING FURNITURE MARKET – REGIONAL ANALYSIS 67

11.1. Folding Furniture Market Overview, by Region Segment 67

11.1.1. Global Folding Furniture Market Revenue Share, By Region, 2022 & 2030 68

11.1.2. Global Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 69

11.1.3. Global Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 70

11.1.4. Global Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 71

11.1.5. Global Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 72

11.1.6. Global Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 73

11.2. North America 74

11.2.1. North America Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 75

11.2.2. North America Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 76

11.2.3. North America Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 77

11.2.4. North America Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 78

11.2.5. North America Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 79

11.2.6. U.S. 80

11.2.7. Canada 80

11.2.8. Mexico 80

11.3. Europe 81

11.3.1. Europe Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 82

11.3.2. Europe Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 83

11.3.3. Europe Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 84

11.3.4. Europe Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 85

11.3.5. Europe Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 86

11.3.6. UK 87

11.3.7. France 87

11.3.8. Germany 87

11.3.9. Italy 87

11.3.10. Spain 87

11.3.11. Russia 87

11.3.12. BENELUX 87

11.3.13. Sweden 87

11.3.14. Denmark 87

11.3.15. Poland 87

11.3.16. Austria 87

11.3.17. Rest of Europe 87

11.4. Asia Pacific 88

11.4.1. Asia Pacific Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 89

11.4.2. Asia Pacific Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 90

11.4.3. Asia Pacific Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 91

11.4.4. Asia Pacific Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 92

11.4.5. Asia Pacific Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 93

11.4.6. China 94

11.4.7. Japan 94

11.4.8. South Korea 94

11.4.9. India 94

11.4.10. Thailand 94

11.4.11. Indonesia 94

11.4.12. Vietnam 94

11.4.13. Malaysia 94

11.4.14. Philippines 94

11.4.15. Taiwan 94

11.4.16. Rest of Asia Pacific 94

11.5. Latin America 95

11.5.1. Latin America Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 96

11.5.2. Latin America Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 97

11.5.3. Latin America Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 98

11.5.4. Latin America Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 99

11.5.5. Latin America Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 100

11.5.6. Brazil 101

11.5.7. Argentina 101

11.5.8. Colombia 101

11.5.9. Chile 101

11.5.10. Peru 101

11.5.11. Rest of Latin America 101

11.6. The Middle-East 102

11.6.1. Middle East Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 103

11.6.2. Middle East Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 104

11.6.3. Middle East Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 105

11.6.4. Middle East Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 106

11.6.5. Middle East Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 107

11.6.6. GCC Countries 108

11.6.7. Israel 108

11.6.8. Turkey 108

11.6.9. Iran 108

11.6.10. Rest of Middle East & Africa 108

11.7. Africa 109

11.7.1. Africa Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 110

11.7.2. Africa Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 111

11.7.3. Africa Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 112

11.7.4. Africa Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 113

11.7.5. Africa Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 114

11.7.6. South Africa 115

11.7.7. Egypt 115

11.7.8. Nigeria 115

11.7.9. Algeria 115

11.7.10. Morocco 115

11.7.11. Rest of Africa 115

CHAPTER NO. 12 : COMPANY PROFILES 116

12.1. IKEA 116

12.1.1. Company Overview 116

12.1.2. Product Portfolio 116

12.1.3. Financial Overview 116

12.2. Ashley Furniture Industries, Inc. 117

12.3. Dorel Industries Inc. 117

12.4. Lifetime Products Inc. 117

12.5. Leggett & Platt, Incorporated 117

12.6. Haworth Inc. 117

12.7. Meco Corporation 117

12.8. Expand Furniture 117

12.9. Resource Furniture 117

12.10. Murphy Wall-Beds Hardware Inc. 117

12.11. Home Depot 117

12.12. Flexsteel Industries 117

12.13. Hooker Furnishings 117

12.14. La-Z-Boy 117

CHAPTER NO. 13 : RESEARCH METHODOLOGY 118

13.1. Research Methodology 118

13.2. Phase I – Secondary Research 119

13.3. Phase II – Data Modeling 119

13.3.1. Company Share Analysis Model 120

13.3.2. Revenue Based Modeling 120

13.4. Phase III – Primary Research 121

13.5. Research Limitations 122

13.5.1. Assumptions 122

List of Figures

FIG NO. 1. Global Folding Furniture Market Volume & Revenue, 2017 – 2030 (USD Million) 22

FIG NO. 2. Porter’s Five Forces Analysis for Global Folding Furniture Market 27

FIG NO. 3. Value Chain Analysis for Global Folding Furniture Market 28

FIG NO. 4. Market Attractiveness Analysis, By Type 29

FIG NO. 5. Market Attractiveness Analysis, By Application 29

FIG NO. 6. Market Attractiveness Analysis, By Material 30

FIG NO. 7. Market Attractiveness Analysis, By Distribution Channel 30

FIG NO. 8. Product Life Cycle Analysis 31

FIG NO. 9. Incremental Revenue Growth Opportunity by Type 32

FIG NO. 10. Incremental Revenue Growth Opportunity by Application 32

FIG NO. 11. Incremental Revenue Growth Opportunity by Material 33

FIG NO. 12. Incremental Revenue Growth Opportunity by Distribution Channel 33

FIG NO. 13. Company Share Analysis, 2020 34

FIG NO. 14. Company Share Analysis, 2022 34

FIG NO. 15. Folding Furniture Market – Company Volume Market Share, 2022 35

FIG NO. 16. Folding Furniture Market – Company Revenue Market Share, 2022 36

FIG NO. 17. Market Position of Key Players, 2022 37

FIG NO. 18. Global Folding Furniture Market Revenue Share, By Type, 2022 & 2030 40

FIG NO. 19. Global Folding Furniture Market for Table & Chair, Volume & Revenue (USD Million) 2017 – 2030 41

FIG NO. 20. Global Folding Furniture Market for Sofa, Volume & Revenue (USD Million) 2017 – 2030 42

FIG NO. 21. Global Folding Furniture Market for Bed, Volume & Revenue (USD Million) 2017 – 2030 43

FIG NO. 22. Global Folding Furniture Market for Storage units, Volume & Revenue (USD Million) 2017 – 2030 44

FIG NO. 23. Global Folding Furniture Market for Others, Volume & Revenue (USD Million) 2017 – 2030 45

FIG NO. 24. Global Folding Furniture Market Revenue Share, By Application, 2022 & 2030 47

FIG NO. 25. Global Folding Furniture Market for Residential, Volume & Revenue (USD Million) 2017 – 2030 48

FIG NO. 26. Global Folding Furniture Market for Commercial, Volume & Revenue (USD Million) 2017 – 2030 49

FIG NO. 27. Global Folding Furniture Market for Institutional, Volume & Revenue (USD Million) 2017 – 2030 50

FIG NO. 28. Global Folding Furniture Market for Application 4, Volume & Revenue (USD Million) 2017 – 2030 51

FIG NO. 29. Global Folding Furniture Market for Application 5, Volume & Revenue (USD Million) 2017 – 2030 52

FIG NO. 30. Global Folding Furniture Market Revenue Share, By Material, 2022 & 2030 54

FIG NO. 31. Global Folding Furniture Market for Wood, Volume & Revenue (USD Million) 2017 – 2030 55

FIG NO. 32. Global Folding Furniture Market for Plastic, Volume & Revenue (USD Million) 2017 – 2030 56

FIG NO. 33. Global Folding Furniture Market for Metal, Volume & Revenue (USD Million) 2017 – 2030 57

FIG NO. 34. Global Folding Furniture Market for Glass, Volume & Revenue (USD Million) 2017 – 2030 58

FIG NO. 35. Global Folding Furniture Market for Others, Volume & Revenue (USD Million) 2017 – 2030 59

FIG NO. 36. Global Folding Furniture Market Revenue Share, By Distribution Channel, 2022 & 2030 61

FIG NO. 37. Global Folding Furniture Market for E-commerce websites, Volume & Revenue (USD Million) 2017 – 2030 62

FIG NO. 38. Global Folding Furniture Market for Company-Owned Websites, Volume & Revenue (USD Million) 2017 – 2030 63

FIG NO. 39. Global Folding Furniture Market for Specialty Stores, Volume & Revenue (USD Million) 2017 – 2030 64

FIG NO. 40. Global Folding Furniture Market for Furniture Marts, Volume & Revenue (USD Million) 2017 – 2030 65

FIG NO. 41. Global Folding Furniture Market for Others, Volume & Revenue (USD Million) 2017 – 2030 66

FIG NO. 42. Global Folding Furniture Market Revenue Share, By Region, 2022 & 2030 68

FIG NO. 43. North America Folding Furniture Market Volume & Revenue, 2017 – 2022 (USD Million) 74

FIG NO. 44. Europe Folding Furniture Market Volume & Revenue, 2017 – 2022 (USD Million) 81

FIG NO. 45. Asia Pacific Folding Furniture Market Volume & Revenue, 2017 – 2022 (USD Million) 88

FIG NO. 46. Latin America Folding Furniture Market Volume & Revenue, 2017 – 2022 (USD Million) 95

FIG NO. 47. The Middle-East Folding Furniture Market Volume & Revenue, 2017 – 2022 (USD Million) 102

FIG NO. 48. Africa Folding Furniture Market Volume & Revenue, 2017 – 2022 (USD Million) 109

FIG NO. 49. Research Methodology – Detailed View 118

FIG NO. 50. Research Methodology 119

List of Tables

TABLE NO. 1. : Global Folding Furniture Market: Snapshot 20

TABLE NO. 2. : Drivers for the Folding Furniture Market: Impact Analysis 25

TABLE NO. 3. : Restraints for the Folding Furniture Market: Impact Analysis 26

TABLE NO. 4. : Global Table & Chair Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 41

TABLE NO. 5. : Global Table & Chair Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 41

TABLE NO. 6. : Global Table & Chair Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 42

TABLE NO. 7. : Global Table & Chair Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 42

TABLE NO. 8. : Global Bed Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 43

TABLE NO. 9. : Global Bed Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 43

TABLE NO. 10. : Global Storage units Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 44

TABLE NO. 11. : Global Storage units Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 44

TABLE NO. 12. : Global Others Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 45

TABLE NO. 13. : Global Others Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 45

TABLE NO. 14. : Global Folding Furniture for Residential Market Revenue, By Region, 2017 – 2022 (USD Million) 48

TABLE NO. 15. : Global Folding Furniture for Residential Market Revenue, By Region, 2023– 2030 (USD Million) 48

TABLE NO. 16. : Global Folding Furniture for Commercial Market Revenue, By Region, 2017 – 2022 (USD Million) 49

TABLE NO. 17. : Global Folding Furniture for Commercial Market Revenue, By Region, 2023– 2030 (USD Million) 49

TABLE NO. 18. : Global Folding Furniture for Institutional Market Revenue, By Region, 2017 – 2022 (USD Million) 50

TABLE NO. 19. : Global Folding Furniture for Institutional Market Revenue, By Region, 2023– 2030 (USD Million) 50

TABLE NO. 20. : Global Folding Furniture for Application 4 Market Revenue, By Region, 2017 – 2022 (USD Million) 51

TABLE NO. 21. : Global Folding Furniture for Application 4 Market Revenue, By Region, 2023– 2030 (USD Million) 51

TABLE NO. 22. : Global Folding Furniture for Application 5 Market Revenue, By Region, 2017 – 2022 (USD Million) 52

TABLE NO. 23. : Global Folding Furniture for Application 5 Market Revenue, By Region, 2023– 2030 (USD Million) 52

TABLE NO. 24. : Global Wood Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 55

TABLE NO. 25. : Global Wood Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 55

TABLE NO. 26. : Global Plastic Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 56

TABLE NO. 27. : Global Plastic Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 56

TABLE NO. 28. : Global Metal Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 57

TABLE NO. 29. : Global Metal Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 57

TABLE NO. 30. : Global Glass Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 58

TABLE NO. 31. : Global Glass Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 58

TABLE NO. 32. : Global Others Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 59

TABLE NO. 33. : Global Others Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 59

TABLE NO. 34. : Global E-commerce websites Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 62

TABLE NO. 35. : Global E-commerce websites Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 62

TABLE NO. 36. : Global Company-Owned Websites Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 63

TABLE NO. 37. : Global Company-Owned Websites Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 63

TABLE NO. 38. : Global Specialty Stores Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 64

TABLE NO. 39. : Global Specialty Stores Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 64

TABLE NO. 40. : Global Furniture Marts Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 65

TABLE NO. 41. : Global Furniture Marts Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 65

TABLE NO. 42. : Global Others Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 66

TABLE NO. 43. : Global Others Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 66

TABLE NO. 44. : Global Folding Furniture Market Revenue, By Region, 2017 – 2022 (USD Million) 69

TABLE NO. 45. : Global Folding Furniture Market Revenue, By Region, 2023– 2030 (USD Million) 69

TABLE NO. 46. : Global Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 70

TABLE NO. 47. : Global Folding Furniture Market Revenue, By Type, 2023– 2030 (USD Million) 70

TABLE NO. 48. : Global Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 71

TABLE NO. 49. : Global Folding Furniture Market Revenue, By Application, 2023– 2030 (USD Million) 71

TABLE NO. 50. : Global Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 72

TABLE NO. 51. : Global Folding Furniture Market Revenue, By Material, 2023– 2030 (USD Million) 72

TABLE NO. 52. : Global Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 73

TABLE NO. 53. : Global Folding Furniture Market Revenue, By Distribution Channel, 2023– 2030 (USD Million) 73

TABLE NO. 54. : North America Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 75

TABLE NO. 55. : North America Folding Furniture Market Revenue, By Country, 2023– 2030 (USD Million) 75

TABLE NO. 56. : North America Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 76

TABLE NO. 57. : North America Folding Furniture Market Revenue, By Type, 2023– 2030 (USD Million) 76

TABLE NO. 58. : North America Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 77

TABLE NO. 59. : North America Folding Furniture Market Revenue, By Application, 2023– 2030 (USD Million) 77

TABLE NO. 60. : North America Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 78

TABLE NO. 61. : North America Folding Furniture Market Revenue, By Material, 2023– 2030 (USD Million) 78

TABLE NO. 62. : North America Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 79

TABLE NO. 63. : North America Folding Furniture Market Revenue, By Distribution Channel, 2023– 2030 (USD Million) 79

TABLE NO. 64. : Europe Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 82

TABLE NO. 65. : Europe Folding Furniture Market Revenue, By Country, 2023– 2030 (USD Million) 82

TABLE NO. 66. : Europe Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 83

TABLE NO. 67. : Europe Folding Furniture Market Revenue, By Type, 2023– 2030 (USD Million) 83

TABLE NO. 68. : Europe Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 84

TABLE NO. 69. : Europe Folding Furniture Market Revenue, By Application, 2023– 2030 (USD Million) 84

TABLE NO. 70. : Europe Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 85

TABLE NO. 71. : Europe Folding Furniture Market Revenue, By Material, 2023– 2030 (USD Million) 85

TABLE NO. 72. : Europe Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 86

TABLE NO. 73. : Europe Folding Furniture Market Revenue, By Distribution Channel, 2023– 2030 (USD Million) 86

TABLE NO. 74. : Asia Pacific Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 89

TABLE NO. 75. : Asia Pacific Folding Furniture Market Revenue, By Country, 2023– 2030 (USD Million) 89

TABLE NO. 76. : Asia Pacific Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 90

TABLE NO. 77. : Asia Pacific Folding Furniture Market Revenue, By Type, 2023– 2030 (USD Million) 90

TABLE NO. 78. : Asia Pacific Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 91

TABLE NO. 79. : Asia Pacific Folding Furniture Market Revenue, By Application, 2023– 2030 (USD Million) 91

TABLE NO. 80. : Asia Pacific Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 92

TABLE NO. 81. : Asia Pacific Folding Furniture Market Revenue, By Material, 2023– 2030 (USD Million) 92

TABLE NO. 82. : Asia Pacific Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 93

TABLE NO. 83. : Asia Pacific Folding Furniture Market Revenue, By Distribution Channel, 2023– 2030 (USD Million) 93

TABLE NO. 84. : Latin America Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 96

TABLE NO. 85. : Latin America Folding Furniture Market Revenue, By Country, 2023– 2030 (USD Million) 96

TABLE NO. 86. : Latin America Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 97

TABLE NO. 87. : Latin America Folding Furniture Market Revenue, By Type, 2023– 2030 (USD Million) 97

TABLE NO. 88. : Latin America Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 98

TABLE NO. 89. : Latin America Folding Furniture Market Revenue, By Application, 2023– 2030 (USD Million) 98

TABLE NO. 90. : Latin America Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 99

TABLE NO. 91. : Latin America Folding Furniture Market Revenue, By Material, 2023– 2030 (USD Million) 99

TABLE NO. 92. : Latin America Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 100

TABLE NO. 93. : Latin America Folding Furniture Market Revenue, By Distribution Channel, 2023– 2030 (USD Million) 100

TABLE NO. 94. : Middle East Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 103

TABLE NO. 95. : Middle East Folding Furniture Market Revenue, By Country, 2023– 2030 (USD Million) 103

TABLE NO. 96. : Middle East Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 104

TABLE NO. 97. : Middle East Folding Furniture Market Revenue, By Type, 2023– 2030 (USD Million) 104

TABLE NO. 98. : Middle East Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 105

TABLE NO. 99. : Middle East Folding Furniture Market Revenue, By Application, 2023– 2030 (USD Million) 105

TABLE NO. 100. : Middle East Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 106

TABLE NO. 101. : Middle East Folding Furniture Market Revenue, By Material, 2023– 2030 (USD Million) 106

TABLE NO. 102. : Middle East Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 107

TABLE NO. 103. : Middle East Folding Furniture Market Revenue, By Distribution Channel, 2023– 2030 (USD Million) 107

TABLE NO. 104. : Africa Folding Furniture Market Revenue, By Country, 2017 – 2022 (USD Million) 110

TABLE NO. 105. : Africa Folding Furniture Market Revenue, By Country, 2023– 2030 (USD Million) 110

TABLE NO. 106. : Africa Folding Furniture Market Revenue, By Type, 2017 – 2022 (USD Million) 111

TABLE NO. 107. : Africa Folding Furniture Market Revenue, By Type, 2023– 2030 (USD Million) 111

TABLE NO. 108. : Africa Folding Furniture Market Revenue, By Application, 2017 – 2022 (USD Million) 112

TABLE NO. 109. : Africa Folding Furniture Market Revenue, By Application, 2023– 2030 (USD Million) 112

TABLE NO. 110. : Africa Folding Furniture Market Revenue, By Material, 2017 – 2022 (USD Million) 113

TABLE NO. 111. : Africa Folding Furniture Market Revenue, By Material, 2023– 2030 (USD Million) 113

TABLE NO. 112. : Africa Folding Furniture Market Revenue, By Distribution Channel, 2017 – 2022 (USD Million) 114

TABLE NO. 113. : Africa Folding Furniture Market Revenue, By Distribution Channel, 2023– 2030 (USD Million) 114