Market Overview:

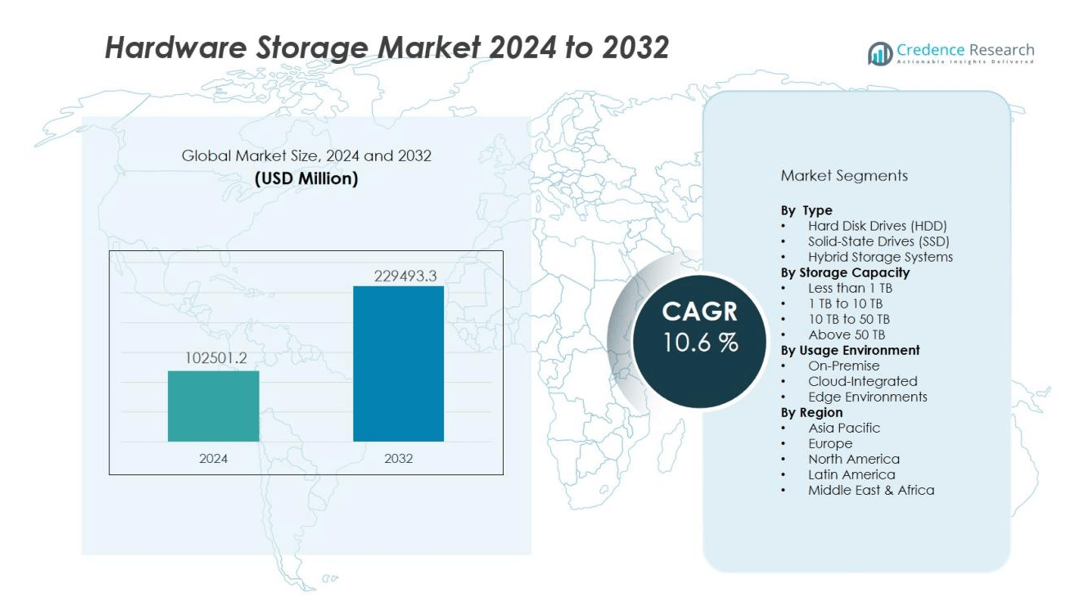

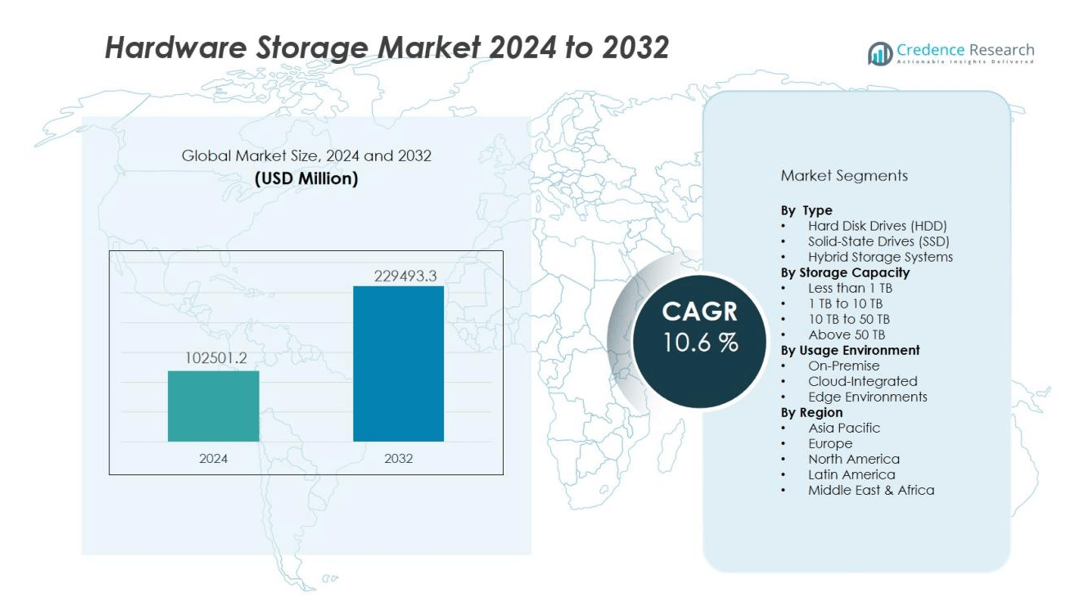

The hardware storage market size was valued at USD 102501.2 million in 2024 and is anticipated to reach USD 229493.3 million by 2032, at a CAGR of 10.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hardware Storage Market Size 2024 |

USD 102501.2 million |

| Hardware Storage Market, CAGR |

10.6% |

| Hardware Storage Market Size 2032 |

USD 229493.3 million |

Several key drivers propel the hardware storage market forward. First, the surging demand for high-speed, high-capacity storage solutions to support artificial intelligence, big data analytics, and real-time processing accelerates investment in SSD and NVMe technologies. Second, stringent data sovereignty and security regulations compel organizations to modernize and localize their storage infrastructure. Third, the rising prevalence of hybrid and multi-cloud environments stimulates demand for interoperable, scalable storage hardware that ensures seamless data mobility and resilience.

Regionally, North America leads the market due to mature IT infrastructure, strong enterprise spending, and robust presence of major storage OEMs. Asia-Pacific follows closely, driven by rapid digitalization, expanding manufacturing, and growing investments in data center infrastructure across China, India, and Southeast Asia. In Europe, demand remains steady as businesses upgrade legacy storage systems to comply with evolving GDPR and cybersecurity mandates.

Market Insights:

- The hardware storage market was valued at USD 102,501.2 million in 2024 and is projected to reach USD 229,493.3 million by 2032, registering a CAGR of 10.6% during the forecast period.

- Rising demand for high-speed, high-capacity storage to support AI, big data, and real-time analytics is accelerating adoption of SSD and NVMe solutions.

- Significant investments in hyperscale data centers and enterprise IT modernization are driving demand for modular, scalable, and high-capacity storage hardware.

- Increasing regulatory compliance and data sovereignty requirements are prompting enterprises to adopt secure, localized, and auditable storage systems.

- Expansion of edge computing and IoT ecosystems is boosting the need for compact, ruggedized, and energy-efficient storage designed for diverse environments.

- North America holds 38% market share, Asia-Pacific 30%, and Europe 22%, each driven by distinct technological, regulatory, and industrial factors.

- Vendors are focusing on AI-driven management tools, hybrid storage models, and sustainability-focused designs to enhance performance, compliance, and environmental responsibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High-Performance Data Solutions:

The hardware storage market is expanding due to the surge in high-performance computing, AI workloads, and real-time data analytics. Enterprises require faster, more efficient storage architectures to support mission-critical applications and reduce latency. It is driving the adoption of solid-state drives (SSDs) and NVMe-based solutions that offer superior speed and reliability compared to traditional HDDs. Organizations are upgrading infrastructure to meet growing performance expectations in both cloud and on-premise environments. This shift is fueling competitive innovation among leading storage hardware providers.

- For instance, Western Digital’s WD_BLACK SN850 NVMe SSD delivers random read performance up to 1,000,000 IOPS and sequential read speeds up to 7,000MB/s on its 2TB model, supporting rapid processing of vast data sets for gaming and enterprise analytics.

Growth in Data Center Investments and Digital Transformation:

The hardware storage market benefits from significant investment in hyperscale data centers and enterprise IT modernization. Businesses are implementing digital transformation strategies that demand scalable, secure, and cost-effective storage systems. It is creating opportunities for vendors offering modular and high-capacity solutions capable of integrating with diverse IT environments. Large-scale adoption of hybrid and multi-cloud architectures is reinforcing the need for flexible storage infrastructure. Service providers are leveraging these solutions to enhance capacity planning and operational efficiency.

- For instance, Equinix expanded its global data center portfolio to over $8 billion in April 2024, with a $600 million joint venture for hyperscale expansion, surpassing 35 data centers globally and delivering more than 725MW of power capacity for customers.

Regulatory Compliance and Data Sovereignty Requirements;

The hardware storage market experiences steady growth due to rising global data privacy regulations and data sovereignty laws. Organizations are required to store and manage sensitive information within specific jurisdictions, which is increasing demand for localized storage infrastructure. It is encouraging enterprises to invest in secure, compliant, and auditable storage systems. Vendors are incorporating encryption, access control, and advanced monitoring capabilities to address these needs. Compliance-driven procurement is becoming a decisive factor in storage hardware purchasing decisions.

Expansion of Edge Computing and IoT Ecosystems:

The hardware storage market is gaining momentum from the rapid expansion of edge computing and IoT applications. These environments generate vast amounts of distributed data that must be processed and stored closer to the source. It is prompting demand for compact, energy-efficient, and ruggedized storage solutions capable of operating in diverse conditions. Businesses in manufacturing, telecommunications, and transportation are deploying edge storage to enable faster decision-making. The trend is reshaping product design priorities for hardware storage manufacturers.

Market Trends:

Shift Toward Flash-Based and Hybrid Storage Architectures:

The hardware storage market is witnessing a decisive shift toward flash-based and hybrid storage architectures to meet rising performance demands. Enterprises are replacing legacy HDD systems with SSD and NVMe technologies to achieve faster data access and lower latency. It is driving adoption in sectors where speed and reliability directly influence business outcomes, including finance, healthcare, and e-commerce. Hybrid storage solutions are also gaining traction by combining the performance benefits of flash with the cost efficiency of HDDs. Vendors are focusing on optimizing storage tiering to balance performance, scalability, and cost. This transition is reshaping procurement strategies, with organizations prioritizing performance-oriented infrastructure upgrades.

- For instance, the Dell EMC PowerMax 8000 NVMe array delivers up to 15 million IOPS at sub-100 µs latency.

Integration of AI-Driven Management and Automation Capabilities:

The hardware storage market is experiencing increased integration of AI and automation in storage management. AI-driven analytics enable predictive maintenance, performance optimization, and intelligent resource allocation. It is helping organizations reduce operational complexity while improving storage utilization rates. Automation tools are enabling seamless provisioning, replication, and backup processes across hybrid and multi-cloud environments. Vendors are embedding machine learning algorithms into storage controllers to enhance efficiency and reliability. This trend is reinforcing the value of storage systems as active contributors to overall IT performance rather than passive infrastructure components.

- For instance, HPE InfoSight utilizes peer-trained ML models to predict performance issues, offering interpreted metrics like Latency Severity Scores derived from over 60 latency measurements.

Market Challenges Analysis:

High Capital Costs and Rapid Technology Obsolescence:

The hardware storage market faces the challenge of high capital expenditure for advanced storage systems. Enterprises often struggle to justify large upfront investments when technology cycles are shortening. It creates pressure to balance immediate performance needs with long-term cost efficiency. Rapid innovation in SSD, NVMe, and AI-driven storage solutions can make recent purchases outdated within a short period. Organizations must carefully assess scalability and upgrade paths before committing to new infrastructure. This challenge impacts both large enterprises and small to mid-sized businesses aiming to remain competitive.

Data Security Risks and Increasing Regulatory Complexity:

The hardware storage market is impacted by growing cybersecurity threats and evolving regulatory requirements. Enterprises must safeguard sensitive data against breaches, ransomware, and unauthorized access. It demands robust encryption, access controls, and real-time monitoring, which can increase deployment complexity. Compliance with diverse regional regulations on data storage and sovereignty adds further operational challenges. Businesses risk financial penalties and reputational damage if systems fail to meet security and legal standards. Vendors are under pressure to deliver secure, compliant, and flexible solutions without compromising performance.

Market Opportunities:

Rising Demand for Edge and Decentralized Storage Solutions:

The hardware storage market offers significant opportunities through the growing adoption of edge computing and decentralized data architectures. Industries such as manufacturing, transportation, and telecommunications require localized storage to process data closer to its source. It enables faster decision-making, reduced latency, and improved operational efficiency. Compact, ruggedized, and energy-efficient storage systems are in high demand for these environments. Vendors can capture growth by designing solutions tailored for harsh conditions and remote deployments. The expansion of IoT ecosystems will further amplify the need for distributed storage capacity.

Expansion of AI-Optimized and Cloud-Integrated Storage Platforms:

The hardware storage market is positioned to benefit from AI-optimized and cloud-integrated storage platforms. AI-driven features can enhance data management, automate performance tuning, and predict hardware failures. It supports businesses seeking to reduce downtime and optimize resource utilization. Cloud integration creates opportunities for hybrid storage models that combine on-premise control with cloud scalability. Enterprises are increasingly prioritizing solutions that enable seamless data mobility across environments. Vendors that deliver intelligent, flexible, and interoperable storage platforms will be well-placed to capture emerging demand.

Market Segmentation Analysis:

By Type:

The hardware storage market is segmented into hard disk drives (HDD), solid-state drives (SSD), and hybrid storage systems. HDDs continue to serve large-capacity, cost-sensitive applications, while SSDs dominate performance-driven environments due to faster data access and reliability. It sees rising adoption of hybrid systems that integrate HDD capacity with SSD speed to optimize workloads. Enterprises choose storage type based on workload intensity, budget, and scalability needs. Vendors are innovating across all categories to enhance efficiency and durability.

- For instance, Seagate launched its Mozaic 3+ platform with 30TB+ hard drives powered by HAMR technology in Q1 2024, doubling capacity in the same footprint compared to typical data center drives.

By Storage Capacity:

Storage capacity segments range from less than 1 TB to more than 50 TB. Low- and mid-capacity solutions cater to personal, small business, and edge deployments, while high-capacity systems serve data centers, cloud providers, and enterprises handling massive datasets. It experiences strong demand in the high-capacity segment due to growth in AI, analytics, and multimedia content. Scalability and performance remain key decision factors.

- For instance, Seagate’s HAMR (Heat-Assisted Magnetic Recording) technology has enabled its Exos hard drives to reach capacities exceeding 30TB per drive, powering hyperscale data centers and supporting advanced AI workloads with expanded storage density.

By Usage Environment:

The hardware storage market addresses usage in on-premise, cloud-integrated, and edge environments. On-premise systems remain relevant for sensitive and regulated data storage, while cloud-integrated solutions dominate hybrid IT strategies. It benefits from rising edge deployments in manufacturing, telecom, and transportation to process data closer to the source. Vendors design environment-specific solutions to meet performance, security, and energy efficiency requirements.

Segmentations:

By Type:

- Hard Disk Drives (HDD)

- Solid-State Drives (SSD)

- Hybrid Storage Systems

By Storage Capacity:

- Less than 1 TB

- 1 TB to 10 TB

- 10 TB to 50 TB

- Above 50 TB

By Usage Environment:

- On-Premise

- Cloud-Integrated

- Edge Environments

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America holds a market share of 38% in the hardware storage market, supported by advanced IT infrastructure and high enterprise technology adoption. The presence of major OEMs and hyperscale data center operators drives continuous innovation in storage solutions. It benefits from strong demand in sectors such as finance, healthcare, and e-commerce, where data-intensive operations require high-performance storage systems. Government initiatives on cybersecurity and data protection further boost investment in secure and compliant storage infrastructure. Hybrid and multi-cloud adoption rates are high, creating strong demand for interoperable hardware storage platforms. Vendors in the region focus on integrating AI-driven management tools to enhance efficiency.

Asia-Pacific :

Asia-Pacific accounts for a market share of 30% in the hardware storage market, driven by rapid digitalization and industrial expansion in China, India, and Southeast Asia. Large-scale investments in data centers, 5G infrastructure, and smart manufacturing stimulate demand for advanced storage hardware. It benefits from the expansion of e-commerce and streaming services, which require scalable and high-capacity storage solutions. Governments in the region are promoting data localization policies, encouraging enterprises to invest in localized storage infrastructure. Competitive pricing strategies from regional manufacturers increase accessibility for small and mid-sized businesses. The growth momentum is supported by rising adoption of edge computing and IoT deployments.

Europe :

Europe holds a market share of 22% in the hardware storage market, supported by stringent data protection regulations such as GDPR. Enterprises prioritize secure, compliant, and energy-efficient storage systems to meet evolving legal requirements. It benefits from steady investment in hybrid cloud and colocation facilities, especially in Germany, the UK, and France. The modernization of legacy IT infrastructure is a key driver for storage hardware upgrades. Vendors focus on sustainability, introducing low-power and recyclable components to align with green technology goals. Strong demand is also emerging from the manufacturing, automotive, and public sector domains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SanDisk

- IBM

- Hitachi Storage Technologies

- Western Digital

- ADATA Technology

- Kingston Technology

- Transcend Information

- Seagate Technology

- Oracle

- Hewlett Packard Enterprise

- Toshiba

Competitive Analysis:

The hardware storage market is characterized by strong competition among global technology leaders and specialized vendors. Key players include SanDisk, IBM, Hitachi Storage Technologies, Western Digital, ADATA Technology, Kingston Technology, and Transcend Information. It is defined by continuous innovation in SSD, HDD, and hybrid storage solutions to meet evolving enterprise and consumer demands. Companies focus on performance optimization, energy efficiency, and advanced data management capabilities to differentiate their offerings. Strategic partnerships with cloud providers, OEMs, and data center operators help expand market reach and strengthen product integration. Vendors invest heavily in R&D to develop AI-driven management tools, improve security features, and enhance scalability. Competitive dynamics are further shaped by rapid technology shifts, price competition, and the need to comply with global data protection regulations.

Recent Developments:

- In August 2025, SanDisk announced a collaboration with SK hynix to support standardization of high-bandwidth flash memory technology.

- In July 2025, Hitachi Vantara announced enhancements to Virtual Storage Platform One Software-Defined Storage, including asynchronous replication, thin provisioning, and advanced compression, now available via Google Cloud Marketplace.

- In March 2025, Seagate completed its acquisition of Intevac Inc., a supplier of thin-film processing systems important for hard drives.

Market Concentration & Characteristics:

The hardware storage market is moderately concentrated, with a mix of global technology leaders and regional specialists competing for market share. Leading players focus on innovation in SSD, NVMe, and hybrid storage solutions to address rising performance and scalability demands. It is characterized by high barriers to entry due to significant R&D investment requirements and the need for strong distribution networks. Strategic partnerships with cloud service providers and data center operators are common to expand reach and enhance product integration. Vendors differentiate through advanced data management features, AI-driven optimization, and energy-efficient designs. Competitive dynamics are shaped by rapid technology cycles, regulatory compliance needs, and growing demand for hybrid and edge storage solutions.

Report Coverage:

The research report offers an in-depth analysis based on Type, Storage Capacity, Usage Environment and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The hardware storage market will witness sustained demand for high-performance SSD and NVMe solutions driven by AI, big data analytics, and cloud computing adoption.

- Enterprises will prioritize hybrid storage architectures to balance speed, scalability, and cost efficiency across diverse workloads.

- Edge computing expansion will create strong demand for compact, durable, and energy-efficient storage systems in remote and industrial environments.

- Vendors will integrate AI-driven management capabilities to enhance storage optimization, predictive maintenance, and automated resource allocation.

- Regulatory compliance and data sovereignty requirements will drive localized storage infrastructure investments across multiple regions.

- Cloud integration will fuel growth of interoperable hardware storage platforms supporting seamless data mobility between on-premise and cloud environments.

- Sustainability goals will encourage the development of low-power, recyclable, and environmentally responsible storage solutions.

- Competitive pressure will intensify as new entrants introduce innovative, cost-effective solutions targeting small and mid-sized enterprises.

- Cybersecurity advancements will become a core component of storage hardware design to mitigate risks from evolving digital threats.

- Continued investment in data center infrastructure worldwide will reinforce long-term growth prospects for hardware storage vendors.