| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Industrial Pumps Market Size 2024 |

USD 15642.02 Million |

| North America Industrial Pumps Market, CAGR |

4.15% |

| North America Industrial Pumps Market Size 2032 |

USD 21,661.40 Million |

Market Overview:

The North America Industrial Pumps Market is projected to grow from USD 15642.02 million in 2024 to an estimated USD 21,661.40 million by 2032, with a compound annual growth rate (CAGR) of 4.15% from 2024 to 2032.

The North American industrial pumps market is driven by several key factors that contribute to its steady growth. The region’s growing oil and gas sector plays a significant role, with the United States being one of the largest oil producers globally, thus increasing the demand for pumps used in exploration, extraction, and refining processes. Additionally, the continuous infrastructure development across North America, particularly in construction and transportation projects, is driving the need for efficient fluid handling solutions. Canada’s investment in infrastructure projects, including public transportation, further contributes to market growth. The increasing focus on water and wastewater management due to rising environmental concerns also supports the demand for industrial pumps, which are essential for water distribution and treatment processes. Moreover, technological advancements such as IoT-enabled pumps and AI-based monitoring systems are enhancing operational efficiency, thus spurring market expansion.

Regionally, North America is a key market for industrial pumps, with the United States accounting for a significant share. The country’s advanced technological infrastructure and diversified industrial base, including oil and gas, power generation, and manufacturing, support the growing demand for pumps. Canada, with its strong presence in the oil and gas sector, particularly in natural gas production, also represents a crucial part of the market. Both nations are investing in large-scale infrastructure and public utilities projects, which further fuels the demand for industrial pumps in various sectors. Together, these factors contribute to a positive growth outlook for the North American industrial pumps market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North American industrial pumps market is projected to grow from USD 15,642.02 million in 2024 to an estimated USD 21,661.40 million by 2032, driven by demand from key industries such as oil and gas, water treatment, and infrastructure development.

- The global industrial pumps market is projected to grow from USD 45,756.97 million in 2024 to USD 63,738.11 million by 2032, driven by increasing demand across multiple sectors.

- The U.S. is a dominant player, with its advanced technological infrastructure and significant oil and gas production driving high demand for industrial pumps in extraction, refining, and transportation.

- Infrastructure development, including public transportation and energy systems, continues to fuel the market, particularly in water distribution and wastewater treatment applications.

- Growing environmental concerns are increasing demand for efficient water and wastewater management systems, driving the adoption of advanced pumping technologies across North America.

- Technological advancements like IoT-enabled pumps and AI-based monitoring systems are enhancing the operational efficiency and reliability of pumps, supporting market growth.

- The rising cost of raw materials and regulatory compliance issues present challenges, particularly for smaller manufacturers who face financial and operational constraints.

- Increasing competition from alternative pumping technologies such as centrifugal and diaphragm pumps may limit the market share of more complex industrial pumps, presenting a challenge for manufacturers.

Market Drivers:

Expansion of the Oil and Gas Sector

The oil and gas industry is a primary driver of growth in the North American industrial pumps market. The United States, as one of the world’s largest producers of oil and natural gas, is experiencing an increase in exploration, production, and refining activities. As demand for oil and gas rises, so does the need for industrial pumps, which are essential in various processes such as drilling, extraction, and transportation. Pumps are critical for transferring fluids, including crude oil, water, and chemicals, through pipelines, drilling rigs, and other systems. The ongoing expansion of the shale oil industry, coupled with technological advancements in extraction methods, has significantly boosted the demand for efficient and durable pumping systems.

Infrastructure Development and Investment

Infrastructure development continues to be a driving force in the North American industrial pumps market. Both the United States and Canada have committed to large-scale investments in infrastructure, which includes public transportation, water management, and energy systems. The U.S. government’s recent initiatives to invest in infrastructure improvements, such as clean water projects and wastewater treatment facilities, has increased the demand for industrial pumps. For example, over 16,000 publicly owned water resource recovery facilities in the U.S. rely on pumps for wastewater management. Pumps are required in various stages of water distribution and treatment processes to ensure the reliable supply of water. The growth in construction and infrastructure projects also creates a higher demand for pumps in applications like heating, ventilation, and air conditioning (HVAC) systems, further driving market expansion.

Focus on Water and Wastewater Management

Rising concerns over water scarcity, contamination, and environmental sustainability are major drivers of demand for industrial pumps in North America. As urbanization increases and environmental regulations become more stringent, water and wastewater management systems are being modernized. Pumps are integral to these systems, facilitating water distribution and the processing of wastewater to meet environmental standards. Both the United States and Canada are investing in upgrading water treatment infrastructure, which is accelerating the adoption of advanced pump technologies. This trend reflects the increasing importance of water conservation and the need to maintain sustainable water supplies for growing populations and industries.

Technological Advancements in Pump Systems

Technological advancements have played a crucial role in the growth of the North American industrial pumps market. Innovations such as the integration of Internet of Things (IoT) sensors and artificial intelligence (AI) in pump systems are improving operational efficiency and reliability. These advancements enable real-time monitoring, predictive maintenance, and performance optimization, which are essential in reducing downtime and increasing system longevity. For example, electric submersible pumps integrated with AI-driven analytics have enhanced performance in oilfield operations by optimizing fluid flow and minimizing energy consumption. As industries across North America seek more efficient and cost-effective fluid handling solutions, the demand for technologically advanced pumps continues to rise. The growing adoption of smart pumps across sectors like manufacturing, chemicals, and energy is poised to further propel market growth in the coming years.

Market Trends:

Technological Advancements in Pump Systems

The North American industrial pumps market is undergoing a transformation driven by technological advancements. Manufacturers are increasingly incorporating features such as smart sensors, IoT connectivity, and AI into their pump systems. These innovations enable real-time monitoring, predictive maintenance, and optimized performance, helping to reduce operational costs and enhance reliability. For instance, IoT-enabled pump monitoring systems can save up to 30% of energy and reduce maintenance costs by up to 25% by enabling real-time data collection and predictive maintenance. With these technological upgrades, industrial pumps are becoming more efficient, supporting the market’s overall growth by providing more cost-effective and dependable solutions to end-users.

Shift Towards Energy-Efficient Pumps

Energy efficiency has become a critical focus in the industrial pumps market, prompting a shift toward pumps that consume less energy without sacrificing performance. This trend is driven by both environmental concerns and the desire to reduce operational costs. As industries are under pressure to minimize their carbon footprint while maintaining productivity, energy-efficient pumps have become a sought-after solution. The demand for these pumps is increasing as industries strive to meet sustainability goals and lower their long-term operational expenses, contributing to the overall market growth.

Integration of Automation and Digitalization

The integration of automation and digitalization is significantly impacting the industrial pumps market in North America. Companies across various sectors are increasingly adopting automated pump systems with digital controls to improve precision, reduce human error, and optimize efficiency. These advanced systems enable seamless operation within automated industrial processes and improve the overall reliability of pump systems. The trend towards digitalization is poised to accelerate the adoption of these technologies, as industries seek to improve operational efficiency and performance, further driving market demand.

Consolidation and Strategic Acquisitions

The industrial pumps market in North America is seeing a trend of consolidation, with companies pursuing strategic acquisitions to expand their product offerings and strengthen their market positions. This trend reflects the competitive nature of the industry, where companies are actively seeking opportunities to enhance their capabilities and diversify their portfolios. By acquiring complementary businesses, industry players are better positioned to meet evolving customer needs and capitalize on emerging market opportunities. For instance, ABB’s acquisition of Real Tech underscores efforts to integrate advanced technologies like optical sensors for water management solutions. As the market continues to consolidate, larger companies are expected to gain a greater share, intensifying competition within the industry.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

Investing in advanced industrial pumps necessitates substantial initial capital, posing financial challenges for small and medium-sized enterprises (SMEs). Beyond procurement, these pumps require specialized maintenance to ensure optimal performance, leading to increased operational expenses. SMEs, often operating under budget constraints, may find it difficult to allocate funds for such sophisticated equipment and their upkeep.

Competition from Alternative Pumping Technologies

Alternative technologies such as diaphragm and peristaltic pumps are gaining traction due to their cost-effectiveness and lower maintenance needs. For instance, Graco’s QUANTM electric diaphragm pump offers lower operating costs and a longer lifespan compared to peristaltic pumps, with diaphragms lasting up to five times longer than hoses in similar applications. These benefits make alternative pumps appealing for industries seeking economical solutions, thereby challenging the adoption of more complex pump systems.

Regulatory Compliance and Environmental Standards

Manufacturers must navigate complex regulatory landscapes and adhere to stringent environmental standards. Compliance often necessitates design modifications and the use of specialized materials, which can increase production costs and extend time-to-market. These regulations can be particularly challenging for smaller manufacturers who may lack the resources to meet evolving standards.

Fluctuating Raw Material Prices

The cost of raw materials, including metals and specialized polymers, significantly impacts the production expenses of industrial pumps. Price volatility in these materials can lead to unpredictable manufacturing costs, affecting profitability and pricing strategies. Manufacturers must develop robust supply chain strategies to mitigate the risks associated with raw material price fluctuations.

Operational Limitations in Specific Applications

While certain pumps are designed for specific applications, they may face limitations under varying operational conditions. For instance, progressive cavity pumps, though effective for handling viscous fluids, may not perform optimally in high-pressure scenarios, limiting their versatility across different industrial processes.

Market Opportunities:

The North American industrial pumps market presents significant growth opportunities, primarily driven by substantial investments in infrastructure development and a heightened focus on water and wastewater management. In February 2024, the U.S. government announced plans to invest in clean drinking water and wastewater infrastructure, aiming to enhance public health and environmental sustainability. This initiative is expected to increase the demand for industrial pumps used in water treatment and distribution systems.

Additionally, the market is witnessing a trend toward technological innovation, with companies integrating smart technologies such as IoT-enabled sensors and AI-based monitoring into pump systems. These advancements offer real-time monitoring, predictive maintenance, and improved operational efficiency, aligning with the industry’s move toward automation and digitalization. Embracing these technologies presents a lucrative opportunity for manufacturers to meet evolving customer demands and strengthen their market position. Furthermore, the expansion of the oil and gas sector in North America continues to drive the demand for industrial pumps. Increased exploration and production activities necessitate efficient fluid handling solutions, presenting growth prospects for pump manufacturers. Collectively, these factors—strategic infrastructure investments, technological advancements, and sectoral expansions—offer promising opportunities for stakeholders in the North American industrial pumps market.

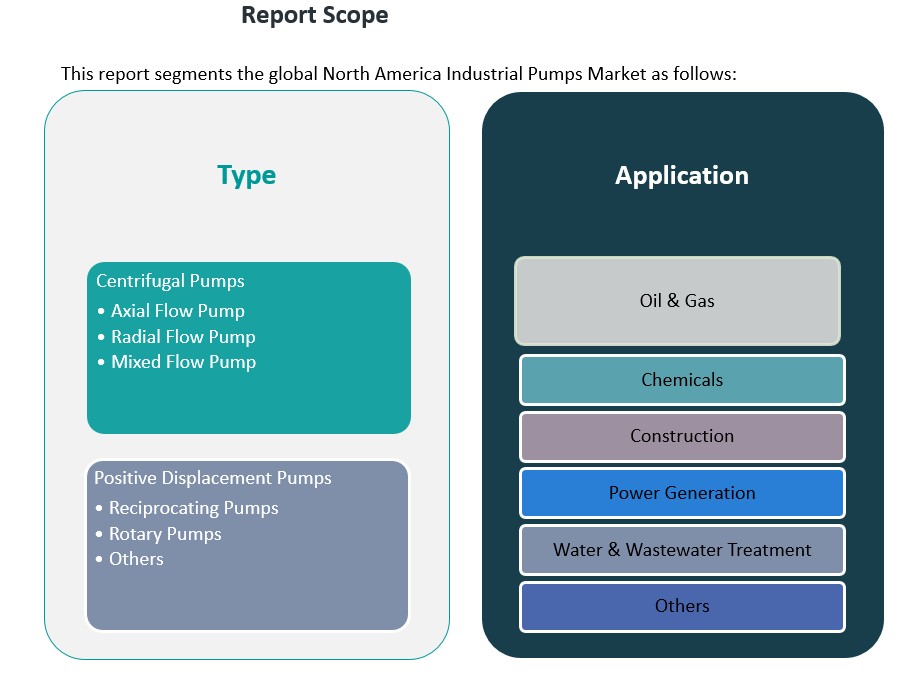

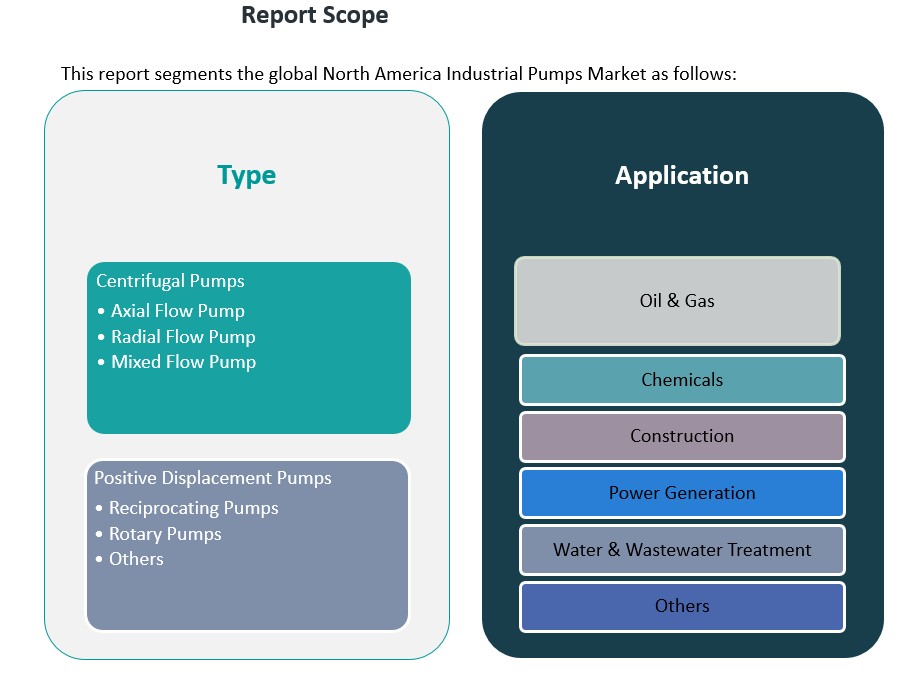

Market Segmentation Analysis:

The North American industrial pumps market is segmented by product type and application, each catering to specific industry needs.

By Product Type, the market is divided into centrifugal and positive displacement pumps. Centrifugal pumps, which include axial flow, radial flow, and mixed flow pumps, dominate the market due to their versatility in handling a wide range of fluids at varying pressures. These pumps are commonly used in applications such as water treatment and power generation. Positive displacement pumps, which include reciprocating and rotary pumps, are preferred for handling viscous fluids and maintaining consistent flow rates. These pumps are commonly found in industries like oil and gas, chemicals, and construction. Other subtypes of pumps also contribute to the market, addressing specialized needs in fluid handling systems.

By Application, the market is led by the oil and gas sector, where pumps are crucial for exploration, extraction, and refining processes. The chemicals industry also represents a significant portion of the market, with pumps used in the transfer of chemicals, oils, and other hazardous materials. The construction sector relies heavily on pumps for dewatering, concrete mixing, and other fluid handling tasks. Water and wastewater treatment applications drive substantial demand for pumps, as efficient fluid distribution and filtration are essential for sustainable water management. The power generation sector also demands high-performance pumps for cooling, fluid circulation, and waste management. Other industries, including food processing and pharmaceuticals, further contribute to the market, adding to the diverse applications of industrial pumps.

Segmentation:

By Product Type:

- Centrifugal Pumps

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pumps

- Reciprocating Pumps

- Rotary Pumps

- Others

By Application:

- Oil & Gas

- Chemicals

- Construction

- Power Generation

- Water & Wastewater Treatment

- Others

Regional Analysis:

The North American industrial pumps market is primarily driven by the United States, which holds a dominant share of the regional market. This is due to the country’s significant advancements in pump technology, robust industrial activities, and increasing demand for efficient water management solutions. The U.S. market spans a wide range of industries, including oil and gas, chemicals, construction, power generation, and water and wastewater treatment. The diverse industrial applications and ongoing investments in infrastructure projects continue to drive demand for industrial pumps in the U.S.

Canada also plays a substantial role in the North American industrial pumps market. The country’s market growth is largely fueled by its strong oil and gas sector, coupled with continuous infrastructure development initiatives. These investments, particularly in public utilities, manufacturing, and energy, contribute to the rising demand for fluid handling solutions. As Canada increasingly focuses on sustainable development and modernizing its infrastructure, the need for advanced pumping systems in sectors like water treatment and construction continues to grow.

Mexico, although a smaller market compared to the U.S. and Canada, is emerging as an important contributor to the regional industrial pumps sector. The country’s expanding manufacturing base, urbanization, and growing need for efficient water and wastewater treatment facilities are driving the demand for industrial pumps. With a focus on improving infrastructure and increasing industrial productivity, Mexico presents significant opportunities for pump manufacturers, particularly in sectors like manufacturing and environmental management.

Key Player Analysis:

- Xylem Inc.

- Flowserve Corporation

- ITT Inc.

- Dover Corporation

- Moyno, Inc.

Competitive Analysis:

The North American industrial pumps market is highly competitive, with several key players leading the industry. Companies like Flowserve Corporation, ITT Inc., Xylem Inc., and Pentair PLC dominate the market by offering a wide range of advanced pump solutions for various applications, including oil and gas, water treatment, and industrial processing. These market leaders invest heavily in research and development to integrate cutting-edge technologies such as IoT, AI, and energy-efficient designs into their products, which gives them a competitive edge in meeting the evolving needs of industries. Smaller and regional players also contribute to the market, often differentiating themselves by offering specialized pump solutions tailored to specific industry requirements. The competitive landscape is further intensified by increasing mergers and acquisitions, as companies seek to expand their product portfolios, enhance their market presence, and gain access to new customer bases. Innovation and strategic partnerships are key factors in maintaining competitiveness in this dynamic market.

Recent Developments:

- In January 2025, Dover Corporation announced the acquisition of Cryogenic Machinery Corp. (Cryo-Mach), a specialized manufacturer of cryogenic centrifugal pumps, mechanical seals, and accessories. This acquisition, integrated into Dover’s PSG business within its Pumps & Process Solutions segment, expands Dover’s presence in cryogenic applications such as liquefied oxygen, argon, and nitrogen.

- In April 2024, Flowserve Corporation received two major project awards from Middle Eastern engineering, procurement, and construction contractors. These contracts, collectively valued at over $150 million, primarily involve original equipment pumps. Flowserve emphasized its robust project pipeline and selective bidding approach to secure these significant deals amidst a regional capital spending upcycle.

- In January 2025, Xylem Inc. expanded its strategic partnerships with Pump Supplies and PDAS in the UK. Pump Supplies will manage the sale of Xylem pumps to 250 UK-based customers, while PDAS secured exclusive distribution rights for Xylem’s packaged pumping station products and Adoptable Pump Station installations.

Market Concentration & Characteristics:

The North American industrial pumps market is moderately consolidated, with several major players, including Flowserve Corporation, ITT Inc., Xylem Inc., and Pentair PLC, leading the industry. These companies dominate the market by offering a diverse range of pump solutions tailored to various applications such as oil and gas, chemicals, water treatment, power generation, and manufacturing. Their extensive product portfolios and established market presence allow them to maintain a significant share of the regional market. The market also witnesses strategic mergers and acquisitions, as companies seek to expand their product offerings and enhance their competitive positions. Such consolidation efforts reflect the dynamic nature of the market, where players aim to strengthen their capabilities in specialized sectors. Additionally, there is a growing focus on research and development, with key players investing in advanced technologies like IoT-enabled sensors and AI-driven monitoring systems to enhance efficiency, reliability, and sustainability across industrial applications. The North American industrial pumps market is characterized by continuous innovation, with both large corporations and smaller players focusing on technological advancements to meet evolving industry needs and maintain competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North American industrial pumps market will continue to grow due to increasing demand for efficient fluid handling systems across industries.

- Technological advancements, such as IoT integration and AI-based monitoring, will drive innovation in pump systems.

- The oil and gas sector’s expansion will remain a major growth driver for pump manufacturers in the region.

- Increasing investments in water and wastewater infrastructure will significantly boost demand for industrial pumps.

- The focus on energy-efficient pumps will intensify as industries aim to reduce costs and meet sustainability goals.

- Automation and digitalization in industrial processes will further elevate the need for advanced pump solutions.

- Strategic mergers and acquisitions will enhance market competition and lead to broader product portfolios.

- The rising trend of environmental regulations will spur the adoption of pumps that comply with stricter standards.

- The growth of the renewable energy sector will create opportunities for pumps used in wind, solar, and geothermal energy applications.

- As manufacturing processes become more complex, the demand for specialized pumps for unique applications will increase.