| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 5G in Defense Market Size 2024 |

USD 1,751.75 million |

| 5G in Defense Market, CAGR |

18.58% |

| 5G in Defense Market Size 2032 |

USD 7,493.84 million |

Market Overview:

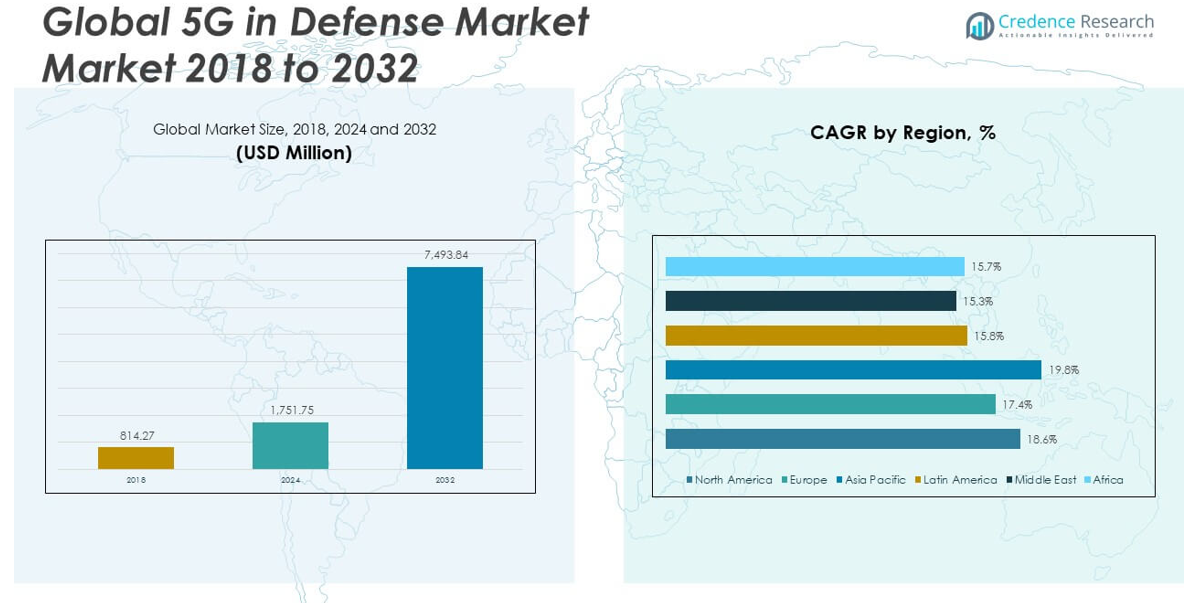

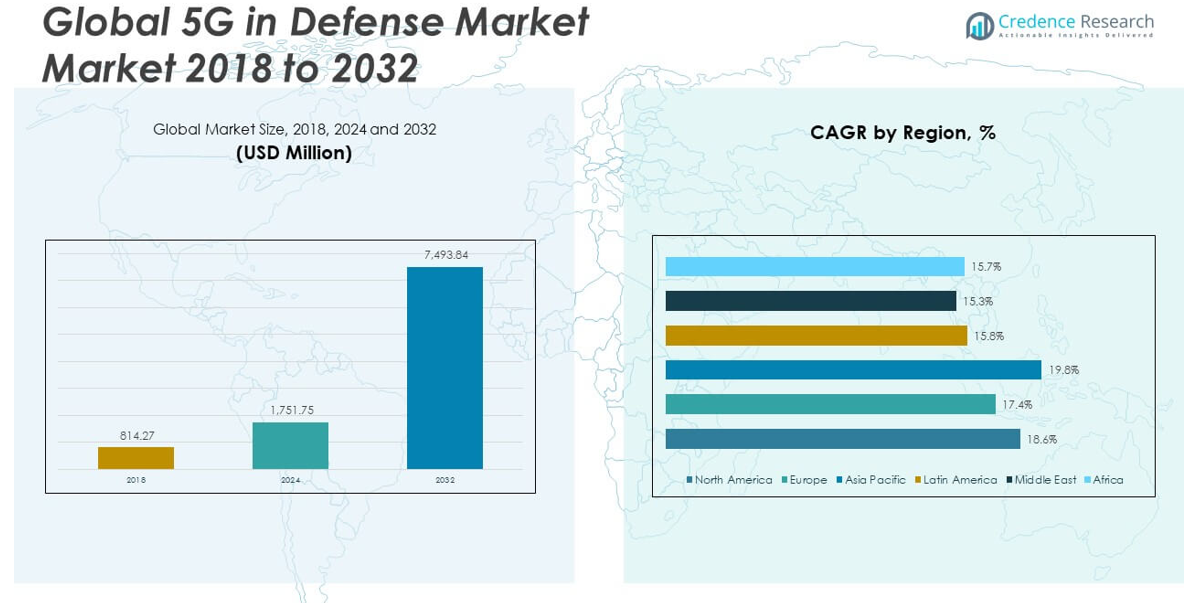

The Global 5G in Defense Market size was valued at USD 814.27 million in 2018 to USD 1,751.75 million in 2024 and is anticipated to reach USD 7,493.84 million by 2032, at a CAGR of 18.58% during the forecast period.

The growth of the global 5G in Defense market is fueled by a convergence of technological advancements and evolving military requirements. The increasing demand for ultra-reliable, low-latency communication is a key driver, as modern defense operations rely heavily on real-time data transmission for command, control, surveillance, and reconnaissance. The adoption of autonomous systems, including drones, unmanned ground vehicles, and robotic platforms, requires seamless and secure connectivity—an area where 5G’s high bandwidth and minimal latency offer strategic advantages. Furthermore, the integration of multi-access edge computing (MEC) enables faster decision-making and enhanced operational efficiency on the battlefield. Rising geopolitical tensions and the emphasis on national security are prompting governments to prioritize digital transformation in defense, leading to increased investments in secure communication infrastructure.

North America currently dominates the 5G in Defense market, driven by substantial government funding, robust military R&D infrastructure, and early adoption of advanced communication systems. The United States Department of Defense has been particularly proactive, initiating several pilot projects and forming public-private partnerships to explore secure 5G applications on military bases. Europe holds the second-largest share, supported by NATO-aligned nations such as the UK, Germany, and France, which are integrating 5G to enhance interoperability and cybersecurity across defense operations. Sweden’s recent participation in 5G defense innovation projects signals growing regional interest in secure, sovereign telecom infrastructure. Asia-Pacific is expected to witness the fastest growth rate, fueled by rising defense budgets, strategic focus on autonomous warfare technologies, and rapid 5G infrastructure expansion in countries such as China, India, Japan, and South Korea. Meanwhile, the Middle East and Africa are gradually adopting 5G in defense through selective modernization programs, particularly in countries like Israel, the UAE, and Saudi Arabia.

Market Insights:

- The Global 5G in Defense Market is projected to grow from USD 1,751.75 million in 2024 to USD 7,493.84 million by 2032, registering a strong CAGR of 18.58%.

- Real-time, low-latency communication is becoming essential for modern defense operations, driving large-scale 5G network deployments.

- The rise of autonomous systems such as drones and robotic units is fueling demand for high-speed, secure 5G connectivity.

- Edge computing and AI integration are enhancing battlefield decision-making and operational efficiency.

- Cybersecurity risks and the complexity of integrating 5G with legacy systems remain key challenges for defense agencies.

- North America holds the largest market share due to proactive military R&D and early 5G adoption, while Asia-Pacific is poised for the fastest growth.

- Governments worldwide are investing in 5G infrastructure to support digital transformation, improve command systems, and strengthen national security.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Real-Time, Low-Latency Communication in Defense Operations

Modern warfare requires instantaneous transmission of data for decision-making, surveillance, and tactical coordination. The Global 5G in Defense Market is experiencing growth due to the increasing emphasis on real-time, low-latency communication systems. Legacy networks often fall short in supporting time-sensitive military applications such as situational awareness, battlefield monitoring, and autonomous vehicle control. 5G offers ultra-reliable low-latency communication (URLLC), high bandwidth, and dense connectivity—key attributes essential for seamless coordination across land, air, and sea forces. These capabilities make 5G indispensable for next-generation mission-critical communication infrastructure. Defense agencies are now prioritizing the replacement of outdated systems with 5G networks to support faster and more secure communication.

Integration of Autonomous Platforms and AI-Driven Systems in Military Applications

The adoption of autonomous platforms such as UAVs, UGVs, and robotic systems has significantly accelerated the demand for advanced connectivity solutions. 5G enables these platforms to operate with greater precision through its support for machine-to-machine communication and edge computing. The Global 5G in Defense Market is expanding as armed forces seek to deploy unmanned systems capable of executing tasks in hostile environments with minimal human intervention. AI-powered applications for threat detection, predictive maintenance, and target identification rely on high-speed, stable networks to process data in real time. 5G’s support for edge analytics ensures mission-critical insights are available without delays. It creates the backbone for intelligent defense systems operating under complex and dynamic conditions.

- For instance, the U.S. Army’s C5ISR Center has adapted 5G technology to connect soldiers, vehicles, and equipment across vast distances, ensuring real-time collaboration and situational awareness. The Center’s enhanced 5G wireless network offers high spectral efficiency and supports up to 1 million devices per square kilometer, enabling seamless integration of robotics and autonomous platforms in congested environments.

Strategic Focus on Modernizing Defense Infrastructure Through 5G Deployment

Global defense organizations are shifting their focus toward modernizing communication infrastructure to meet future operational demands. It aligns with strategic defense objectives such as enhanced interoperability, cyber resilience, and mission readiness. The Global 5G in Defense Market is witnessing substantial funding and pilot projects aimed at creating secure 5G ecosystems on military bases and command centers. These initiatives support defense transformation goals while fostering public-private collaboration between telecom vendors and military technology developers. Government programs across North America, Europe, and Asia-Pacific are supporting 5G research, testbeds, and joint ventures with defense contractors. These investments ensure seamless technology integration and help strengthen national defense capabilities.

- For example, the U.S. Department of Defense (DoD) has initiated several 5G pilot projects across military installations, focusing on applications such as smart warehouses, augmented and virtual reality (AR/VR) training, and advanced mission planning systems. These efforts are part of a broader modernization initiative to integrate high-speed, low-latency communications into operational environments. In support of continued innovation, the Office of the Secretary of Defense requested $55.1 million in fiscal year 2024 for “Beyond 5G” research and development.

Growing Need to Counter Evolving Threats with Secure, Scalable Networks

Rising geopolitical tensions and the increasing complexity of security threats are compelling governments to invest in secure and scalable communication frameworks. 5G offers the scalability and encryption capabilities required to address cyber, electronic warfare, and hybrid threat environments. The market is expanding due to its potential to support distributed command-and-control systems, resilient battlefield networks, and encrypted mobile communications. It also enables secure communication across multiple theaters of operation, even in electronically contested environments. National security agencies are demanding robust network infrastructure that ensures continuity of operations under extreme conditions. The Global 5G in Defense Market is positioned as a critical enabler of strategic defense communication modernization.

Market Trends:

Emergence of Private 5G Networks for Secure Military Environments

Defense agencies are increasingly deploying private 5G networks to ensure complete control over security, data flow, and access management. These networks are isolated from public infrastructure and designed specifically for military-grade use cases, including base operations, secure communication, and sensitive data transfers. The Global 5G in Defense Market is witnessing steady adoption of private 5G frameworks that support tailored network slicing and customizable encryption protocols. These dedicated networks allow militaries to meet strict regulatory and operational standards without relying on commercial carriers. Defense organizations are engaging with telecom equipment providers to establish on-premise 5G capabilities within command facilities and operational zones. It enhances operational independence and reinforces data sovereignty in critical missions.

- For example, Spain invested €50 million in private 5G for military operations, focusing on real-time monitoring and secure communications, while Norway partnered with Telia to integrate private 5G with national defense infrastructure.

Integration of 5G with Satellite Communication for Global Military Connectivity

Global armed forces are exploring the integration of 5G technology with satellite communication systems to extend network coverage beyond terrestrial limits. The convergence of satellite and 5G networks ensures uninterrupted connectivity across remote and maritime regions, supporting global force projection. The Global 5G in Defense Market is benefiting from multi-orbit satellite constellations that work in tandem with 5G networks to offer seamless handovers and robust communication capabilities. Governments are partnering with satellite operators to develop hybrid systems capable of maintaining secure links in geographically dispersed theaters. This trend is particularly significant for naval fleets, forward operating bases, and expeditionary units. It enables always-on connectivity, even in areas with minimal or no terrestrial network infrastructure.

- For instance, in a 2025 demonstration, Lockheed Martin, Nokia, and Verizon successfully integrated Nokia’s military-grade 5G with Lockheed’s 5G.MIL Hybrid Base Station, enabling uninterrupted handover between commercial 5G, tactical low-probability-of-intercept waveforms, and satellite links.

Deployment of 5G-Powered Immersive Training and Simulation Technologies

Militaries are leveraging 5G to power immersive technologies such as augmented reality (AR), virtual reality (VR), and mixed reality (MR) for training and simulation. These systems require high-speed, low-latency networks to support real-time interaction and multi-user participation in virtual environments. The Global 5G in Defense Market is expanding through increased investment in 5G-enabled combat simulations, mission rehearsals, and tactical decision-making exercises. Training modules using 5G enhance soldier preparedness, reduce operational risk, and optimize resource allocation. Defense academies and training centers are adopting this technology to simulate real-world scenarios with enhanced visual fidelity and real-time feedback. It improves learning outcomes and reduces reliance on live field exercises.

Development of Smart Military Bases with Integrated 5G Infrastructure

Defense agencies are building smart military installations that incorporate advanced technologies supported by 5G infrastructure. These bases integrate IoT sensors, surveillance systems, energy management tools, and automated logistics platforms within a unified digital ecosystem. The Global 5G in Defense Market is seeing a shift toward constructing connected environments where real-time data enhances base security, operational efficiency, and resource management. Smart bases use 5G to connect everything from perimeter monitoring to autonomous patrol vehicles and emergency response systems. Governments are investing in these intelligent facilities to boost readiness and reduce human intervention in routine tasks. It reflects a broader trend of digital transformation across defense infrastructure worldwide.

Market Challenges Analysis:

Cybersecurity Vulnerabilities and Risks Associated with Complex 5G Architectures

The implementation of 5G networks in military operations introduces new cybersecurity challenges that require advanced risk mitigation strategies. With its distributed architecture, reliance on edge computing, and massive device connectivity, 5G increases the potential attack surface for adversaries. The Global 5G in Defense Market faces significant concerns over network integrity, data interception, and cyber sabotage, particularly when integrated with third-party components or commercial infrastructure. National defense agencies must ensure that 5G systems comply with strict security protocols and are resilient against both external and internal threats. It demands end-to-end encryption, trusted supply chains, and real-time threat monitoring, all of which require continuous investment. Cybersecurity lapses in such mission-critical networks could jeopardize operational readiness and national security.

High Capital Requirements and Integration Complexity with Legacy Defense Systems

Deploying 5G in defense environments involves high upfront costs for infrastructure development, spectrum allocation, and system customization. Many governments face budgetary constraints and must carefully evaluate the return on investment before scaling deployments. The Global 5G in Defense Market is also challenged by the complexity of integrating new 5G systems with existing legacy platforms, which may not be designed for interoperability or digital transformation. Military communication protocols, sensor platforms, and command systems require extensive upgrades to align with 5G capabilities. It places a strain on procurement cycles and requires coordinated efforts between telecom providers, defense contractors, and regulatory bodies. Without seamless integration, the full potential of 5G-enabled defense capabilities remains difficult to realize.

Market Opportunities:

Expansion of Tactical Edge Capabilities Through Mobile and Deployable 5G Units

The development of mobile and deployable 5G units presents a major opportunity for defense forces seeking to enhance battlefield agility. These compact, rapidly deployable systems can establish high-speed, secure communication networks in remote or hostile environments. The Global 5G in Defense Market can leverage this innovation to support real-time situational awareness, mission coordination, and autonomous operations at the tactical edge. It creates new possibilities for field units operating without traditional infrastructure, enabling faster response and decision-making. Defense suppliers investing in ruggedized, field-tested 5G solutions can meet growing demand from expeditionary forces and special operations.

Partnerships Between Defense Agencies and Telecom Innovators to Accelerate 5G Adoption

Public-private partnerships offer a pathway to accelerate 5G adoption in defense through co-developed solutions and joint testing initiatives. Governments are encouraging collaboration with telecom providers, system integrators, and cybersecurity firms to design tailored 5G platforms for military use. The Global 5G in Defense Market benefits from this ecosystem by gaining access to commercial innovations while meeting defense-specific performance and security standards. It fosters rapid prototyping, technology validation, and scalable deployment across service branches. Companies that align with national defense strategies and offer secure, modular 5G solutions will find strong opportunities for long-term growth.

Market Segmentation Analysis:

The Global 5G in Defense Market is segmented

By communication infrastructure, where small cells account for a major share due to their deployment flexibility, low power requirements, and ability to support high-speed, low-latency communication in confined operational zones. Macro cells are widely used for broader area coverage and base-level connectivity, especially in remote and rural defense zones. Radio Access Network (RAN) forms the critical interface between user equipment and the core network, enabling seamless integration of new 5G capabilities into existing military frameworks.

- For example, Boldyn Networks and Verizon deployed nearly 60 millimeter-wave 5G small cells at Fort Cavazos, Texas, to provide high-capacity, low-latency coverage for over 60,000 soldiers and families, supporting mission-critical and daily activities in high-density areas.

By core network technology segment, Mobile Edge Computing (MEC) leads due to its role in enabling real-time processing, autonomous operations, and decision-making near the battlefield. Software-Defined Networking (SDN) provides centralized control and dynamic bandwidth allocation, while Fog Computing (FC) and Network Functions Virtualization (NFV) offer enhanced data security, agility, and operational efficiency for distributed defense systems.

By chipset segment includes Radio Frequency Integrated Circuit (RFIC) chipsets, which dominate the market owing to their fundamental role in signal transmission and processing across communication devices. Millimetre wave (mm-Wave) chipsets are gaining traction for applications requiring high bandwidth and ultra-low latency, especially in advanced radar and drone systems.

- For example, the U.S. Army uses Wi-Gig (IEEE 802.11ay), operating at 60 GHz, for secure, high-bandwidth communication between command posts and autonomous systems. Researchers have also developed 39 GHz Doppler radar front-ends for precise targeting and surveillance.

By installation, new installations form the majority share, driven by large-scale modernization projects and smart base deployments across developed nations. Upgrades are also gaining importance as military agencies look to retrofit legacy systems with 5G capability without full infrastructure replacement.

By end users, the military segment holds the largest market share, propelled by growing demand for secure communication, autonomous systems, and smart surveillance. Homeland security agencies are emerging as key users, deploying 5G for real-time monitoring, emergency response coordination, and national threat management. The Global 5G in Defense Market aligns its offerings with the distinct needs of each segment to deliver mission-critical performance.

Segmentation:

By Communication Infrastructure

- Small Cell

- Macro Cell

- Radio Access Network (RAN)

By Core Network Technology

- Software-Defined Networking (SDN)

- Fog Computing (FC)

- Mobile Edge Computing (MEC)

- Network Functions Virtualization (NFV)

By Chipset

- Radio Frequency Integrated Circuit (RFIC) Chipset

- Millimetre Wave (mm-Wave) Chipset

By Installation

By End User

- Military

- Homeland Security

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America 5G in Defense Market size was valued at USD 325.26 million in 2018 to USD 691.80 million in 2024 and is anticipated to reach USD 2,968.47 million by 2032, at a CAGR of 18.6% during the forecast period. North America holds the largest share of the Global 5G in Defense Market, accounting for 34% of the total revenue in 2024. The United States leads regional growth due to significant investments from the Department of Defense in advanced communication infrastructure. It benefits from a robust defense industrial base, early pilot programs, and strong collaboration between government and private telecom companies. The region has actively deployed 5G testbeds on military installations to evaluate operational efficiency and cybersecurity protocols. Canada also contributes through focused modernization programs and cross-border technology partnerships. The market continues to expand as military agencies prioritize interoperability and secure battlefield connectivity.

The Europe 5G in Defense Market size was valued at USD 172.09 million in 2018 to USD 352.30 million in 2024 and is anticipated to reach USD 1,387.20 million by 2032, at a CAGR of 17.4% during the forecast period. Europe accounts for 17% of the Global 5G in Defense Market in 2024, driven by increasing defense integration among EU and NATO member states. Countries such as the United Kingdom, France, and Germany are leading regional adoption, investing in private 5G networks for secure military communications. It is witnessing strong momentum from collaborative defense initiatives, including joint procurement and standardization efforts. Regional governments are actively supporting test programs to validate 5G use in drone command, base security, and communication redundancy. The demand for autonomous defense capabilities and cyber-resilient infrastructure is shaping Europe’s strategic approach. Vendors in this region focus on localized manufacturing to reduce dependency on external supply chains.

The Asia Pacific 5G in Defense Market size was valued at USD 257.63 million in 2018 to USD 582.52 million in 2024 and is anticipated to reach USD 2,699.09 million by 2032, at a CAGR of 19.8% during the forecast period. Asia Pacific represents 29% of the Global 5G in Defense Market and is the fastest-growing region. China, India, Japan, South Korea, and Australia are heavily investing in 5G-enabled defense platforms to strengthen national security and technological self-sufficiency. It is rapidly deploying autonomous surveillance systems, smart bases, and next-generation communication technologies. Regional tensions and the need for cross-border situational awareness are accelerating military modernization. China leads in infrastructure deployment, while India focuses on domestic innovation and testing in high-altitude defense zones. Japan and South Korea are integrating 5G into cyber-defense and unmanned systems. The region is also expanding public-private partnerships to enhance indigenous defense capabilities.

The Latin America 5G in Defense Market size was valued at USD 26.33 million in 2018 to USD 55.62 million in 2024 and is anticipated to reach USD 197.78 million by 2032, at a CAGR of 15.8% during the forecast period. Latin America contributes 3% to the Global 5G in Defense Market, with Brazil, Mexico, and Colombia initiating pilot programs focused on border security and military logistics. It is in an early adoption phase, with limited infrastructure and low defense expenditure compared to other regions. Governments are exploring low-cost 5G solutions for smart surveillance and secure mobile communications. Budget limitations and procurement delays restrict large-scale deployment. Despite challenges, the region shows potential through gradual digital transformation in military operations. International collaborations and donor-funded initiatives are helping to build foundational 5G capabilities.

The Middle East 5G in Defense Market size was valued at USD 18.19 million in 2018 to USD 34.92 million in 2024 and is anticipated to reach USD 119.40 million by 2032, at a CAGR of 15.3% during the forecast period. The Middle East accounts for 2% of the Global 5G in Defense Market, driven by growing interest in high-tech defense systems across the UAE, Saudi Arabia, and Israel. It is adopting 5G to support advanced surveillance, unmanned operations, and integrated command systems. National security programs increasingly rely on smart base infrastructure and real-time situational awareness. Governments are partnering with global defense and telecom providers to accelerate rollout in strategic zones. Despite political instability in parts of the region, stable economies are investing in 5G-enabled military modernization. Smart city defense convergence is also encouraging dual-use infrastructure development.

The Africa 5G in Defense Market size was valued at USD 14.76 million in 2018 to USD 34.59 million in 2024 and is anticipated to reach USD 121.89 million by 2032, at a CAGR of 15.7% during the forecast period. Africa holds a 2% share in the Global 5G in Defense Market, with nations like South Africa, Nigeria, and Egypt beginning to explore secure 5G communication for defense purposes. It faces challenges such as limited infrastructure, low spectrum availability, and high implementation costs. Regional efforts focus on upgrading border control, anti-terrorism operations, and emergency response systems. The market is slowly emerging, supported by foreign aid, peacekeeping mandates, and joint training initiatives. Governments are evaluating pilot deployments to assess feasibility in defense settings. It remains a nascent but promising market with long-term potential for digital defense transformation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ericsson

- Huawei

- Nokia Networks

- Samsung Electronics

- NEC Corporation

- AT&T

- Qualcomm Technologies

- Ligado Networks

- Wind River Systems

- Lockheed Martin Corporation

Competitive Analysis:

The Global 5G in Defense Market features a moderately concentrated competitive landscape, with leading companies focusing on strategic partnerships, government contracts, and technological innovation. Key players include Ericsson, Nokia, Huawei, Lockheed Martin, Thales Group, BAE Systems, Raytheon Technologies, Samsung, L3Harris Technologies, and NEC Corporation. It reflects active collaboration between telecom giants and defense contractors to co-develop secure, mission-ready 5G solutions. Companies are investing in private 5G networks, edge computing, and integrated communication platforms tailored for military applications. The market rewards firms that demonstrate cybersecurity compliance, scalability, and field-tested reliability. Regional players are emerging in Asia and the Middle East to support localized deployments and reduce dependency on global vendors. Competitive differentiation hinges on interoperability, low-latency performance, and strong technical support capabilities. Firms that align their offerings with defense modernization priorities are positioned to secure multi-year defense procurement contracts and long-term technological leadership.

Recent Developments:

- In June 2025, Ericsson and Telia Sweden partnered with the Swedish Armed Forces to test advanced 5G Standalone technologies tailored for national defense and NATO operations. This collaboration, under the NorthStar 5G innovation program, focuses on evaluating secure connectivity for critical military services such as real-time tracking of vehicles, personnel, and equipment, as well as providing temporary coverage in remote areas.

- In May 2025, L3Harris Technologies announced it had received a contract from the U.S. government to develop a next-generation security processor for global military communications. This new processor is designed to enhance the security and performance of communication hardware, safeguarding weapon systems against evolving cyber threats.

- In March 2025, Lockheed Martin, Nokia, and Verizon revealed the successful integration of Nokia’s military-grade 5G solutions into Lockheed Martin’s 5G.MIL® Hybrid Base Station. This achievement, demonstrated at MWC25, advances the interoperability of commercial 5G connections with military communication systems.

Market Concentration & Characteristics:

The Global 5G in Defense Market demonstrates moderate market concentration, with a mix of established defense contractors and leading telecom providers shaping the competitive dynamics. It is characterized by high entry barriers due to stringent security requirements, long procurement cycles, and the need for trusted government certifications. The market favors players with advanced R&D capabilities, strong cybersecurity infrastructure, and proven defense partnerships. It operates under strict regulatory oversight, with emphasis on network sovereignty, interoperability, and real-time performance. Vendor selection often prioritizes strategic alignment with national defense objectives and compliance with military-grade specifications. The presence of regional players is growing, but global firms maintain a dominant position through technology leadership and long-term government frameworks.

Report Coverage:

The research report offers an in-depth analysis based on Communication Infrastructure, Core Network Technology, Chipset, Installation, End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of private 5G networks will expand across military bases to support secure, high-speed communication.

- Integration of 5G with AI and autonomous systems will enhance battlefield intelligence and operational efficiency.

- Defense budgets will increasingly allocate funds for 5G infrastructure modernization and R&D.

- Hybrid 5G-satellite systems will improve connectivity in remote and maritime defense operations.

- Governments will prioritize local manufacturing to reduce dependency on foreign telecom equipment.

- Smart military bases equipped with 5G-powered IoT systems will become more prevalent.

- Real-time AR/VR-based training using 5G will improve simulation accuracy and combat readiness.

- Cybersecurity technologies tailored to 5G architectures will see higher investment and adoption.

- Public-private collaborations will accelerate innovation and shorten deployment timelines.

- Emerging markets in Asia-Pacific, Middle East, and Africa will drive future demand through defense digitalization.