Market Overview

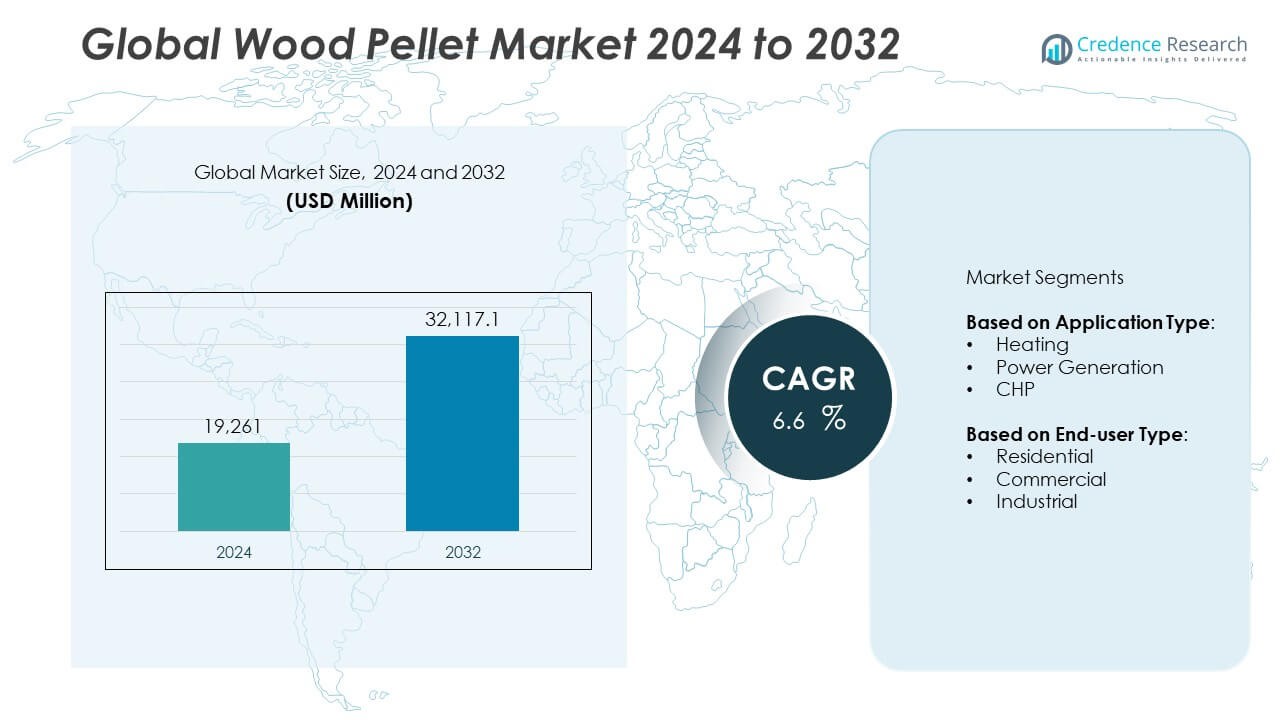

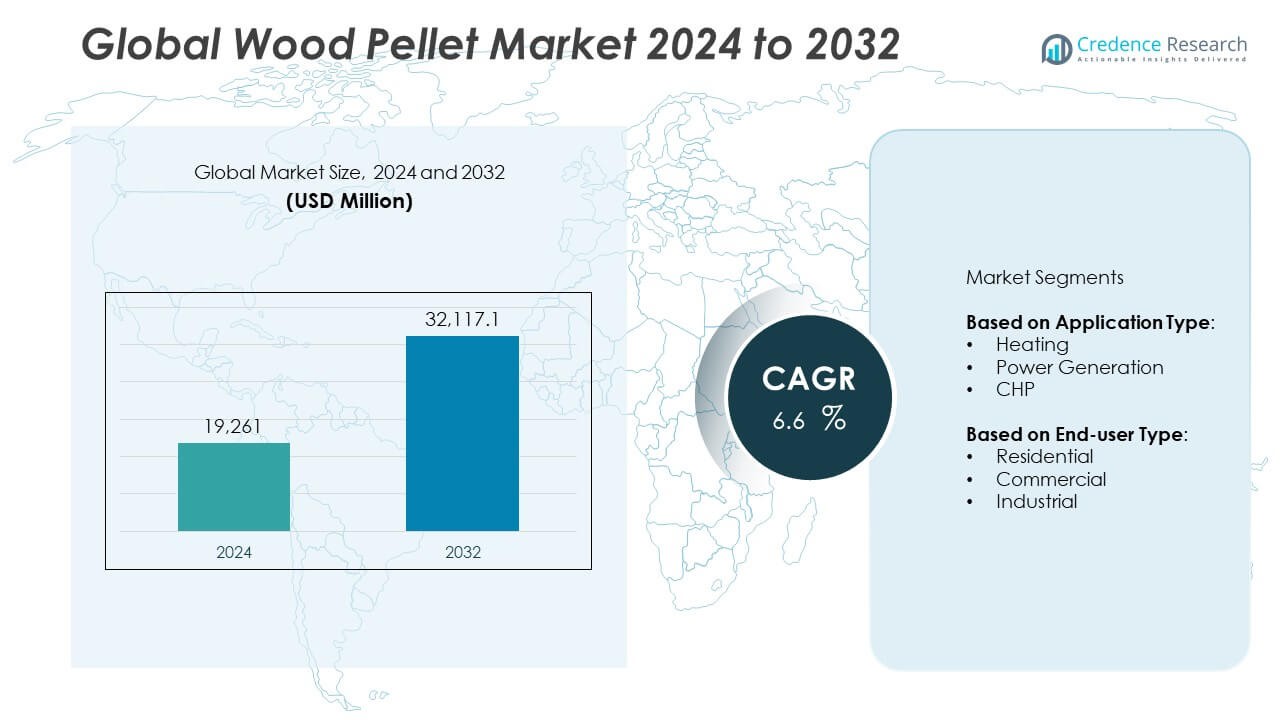

The wood pellet market was valued at USD 19,261 million in 2024 and is projected to reach USD 32,117.1 million by 2032, growing at a compound annual growth rate (CAGR) of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wood Pellets Market Size 2024 |

USD 19,261 Million |

| Wood Pellets Market, CAGR |

6.6% |

| Wood Pellets Market Size 2032 |

USD 32,117.1 Million |

The wood pellet market is driven by increasing demand for renewable energy sources, stringent emissions regulations, and a global shift toward sustainable heating solutions. It supports decarbonization efforts in power generation through cofiring and offers clean alternatives for residential and industrial heating. Growing urbanization and supportive government policies fuel adoption across regions.

The Wood Pellet Market spans across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Europe leads in demand due to strict environmental policies and focus on renewable energy, while North America plays a key role in production and export activities. Asia-Pacific shows rising interest driven by industrial growth and supportive government initiatives promoting clean energy. Latin America and the Middle East & Africa are steadily adopting biomass energy, offering future growth potential. Major companies in the Wood Pellet Market include Enviva LP, a global leader in biomass fuel production, and Drax Group Plc, recognized for its large-scale biomass power generation. Pinnacle Renewable Energy Inc. has a solid presence in North America, focusing on consistent pellet quality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wood pellet market was valued at USD 19,261 million in 2024 and is projected to reach USD 32,117.1 million by 2032, growing at a CAGR of 6.6% during the forecast period.

- Rising energy demand, coupled with the global shift toward renewable and low-carbon fuels, drives the growth of the wood pellet market.

- Increasing adoption of wood pellets for heating and power generation in residential and industrial sectors highlights a strong sustainability trend.

- The market features intense competition with players like Enviva LP, Drax Group Plc, and Groupe Savoie Inc. investing in production capacity and international trade routes.

- Fluctuating raw material availability, high initial investment, and logistic limitations act as key restraints for industry expansion in certain regions.

- Europe leads the market due to strict emission regulations and strong renewable energy policies, followed by North America and Asia-Pacific with growing demand from industrial users.

- Ongoing innovation in pellet manufacturing, coupled with rising investment in biomass infrastructure, continues to support the long-term outlook for this market.

Market Drivers

Rising Demand for Renewable Energy Drives Biofuel Adoption Globally

The growing global focus on renewable energy sources has significantly boosted demand for biomass-based fuels. The wood pellet market benefits from its ability to offer a low-carbon alternative to fossil fuels, particularly in residential heating and industrial energy generation. Governments across Europe, North America, and Asia-Pacific have introduced incentives to promote biomass consumption. It helps reduce greenhouse gas emissions and aligns with international climate commitments. The market sees consistent growth due to policy support, emission targets, and carbon-neutral goals. Energy diversification strategies in developed economies continue to prioritize wood pellets in their sustainable energy mix.

- For instance, Enviva Inc. exported over 6.2 million metric tons of wood pellets in 2023 to global markets, supported by long-term supply contracts for renewable heat and power generation in the UK, Japan, and the EU.

Supportive Government Policies and Subsidies Encourage Market Expansion

Policy frameworks and financial subsidies play a key role in strengthening the wood pellet market. Regulatory bodies provide incentives for biomass-based power plants, heating systems, and export infrastructure. It creates a favorable investment climate and stimulates domestic and international trade in wood pellets. Several countries offer tax credits or feed-in tariffs for renewable energy generation using pellets. These policies reduce operational costs and encourage the shift from coal and oil to sustainable fuels. This structured support system significantly increases wood pellet adoption in both public and private sectors.

- For instance, Drax Group Plc converted four of its six generating units to biomass at its UK power station, using approximately 7.9 million tons of wood pellets annually to supply reliable renewable power to millions of homes.

Rising Global Trade and Export Opportunities Strengthen Supply Networks

The global wood pellet trade has expanded rapidly with increasing export volumes to energy-dependent regions. Countries with abundant forestry resources, such as the United States, Canada, and Vietnam, are key exporters. The wood pellet market benefits from long-term contracts with power utilities in Europe and Asia. It ensures steady demand and promotes infrastructure development across ports, storage, and handling systems. Growth in international trade enhances market resilience and supports competitive pricing. Stable supply chains also help meet seasonal fluctuations in heating demand.

Technological Advancements Improve Pellet Quality and Processing Efficiency

Innovations in pellet manufacturing and processing technology continue to enhance product quality and operational efficiency. Modern equipment allows for better moisture control, uniform density, and lower emissions during combustion. It improves the performance of wood pellets in residential boilers, industrial furnaces, and power plants. Automation and smart monitoring systems also reduce waste and energy consumption during production. These advancements strengthen customer confidence and expand application scope. The wood pellet market benefits from higher output quality and growing compatibility with advanced combustion systems.

Market Trends

Surge in Cofiring Practices Across Power Generation Facilities

Cofiring of biomass with coal in thermal power plants has gained significant traction, offering a transitional pathway toward cleaner energy. Power producers integrate wood pellets into existing infrastructure to reduce emissions without major retrofitting. The wood pellet market benefits from this scalable adoption model in both developed and emerging economies. Utilities achieve lower carbon intensity while maintaining power output reliability. It aligns with national and regional emission reduction goals. Cofiring also extends the lifespan of coal-fired plants while supporting sustainability mandates.

- For instance, Japan’s Electric Power Development Co. (J-Power) introduced biomass cofiring at its Takehara Thermal Power Plant Unit 2, burning 200,000 tons of wood pellets annually alongside coal to meet its low-emission generation targets.

Rapid Urbanization Spurs Demand for Clean Residential Heating Solutions

Urban centers increasingly prioritize low-emission heating systems to address air quality concerns and reduce dependency on fossil fuels. The wood pellet market supports this transition by offering clean-burning alternatives for residential and district heating. It enables households and municipalities to switch to biomass boilers that emit fewer pollutants. Rising adoption in countries like Germany, Austria, and South Korea strengthens this trend. Local policies promote pellet-based heating through incentives and installation support. Wood pellets offer consistent combustion quality and ease of storage, making them a practical solution for urban environments.

- For instance, ÖkoFEN installed more than 100,000 pellet heating systems across Europe, with its Pellematic Condens boiler system achieving ultra-low emissions and thermal output capacities ranging from 10 kW to 32 kW for urban households.

Expansion of Export Infrastructure Improves Global Trade Efficiency

Export-focused countries are investing in specialized infrastructure to handle large-scale pellet shipments efficiently. Ports are upgrading handling facilities to ensure faster loading, reduced loss, and improved storage conditions. The wood pellet market benefits from improved logistics, which lower overall delivery costs and increase international competitiveness. Export hubs in the United States, Canada, and Southeast Asia see rising outbound volumes. It supports uninterrupted supply to energy-hungry regions like Europe and East Asia. These improvements also contribute to the stability of long-term offtake agreements.

Technological Innovation Enhances Pellet Manufacturing and Sustainability

Modern pellet production facilities adopt advanced technologies to improve efficiency and environmental compliance. Equipment upgrades allow precise control over pellet density, size, and moisture content, enhancing combustion efficiency. The wood pellet market responds with innovations that reduce production emissions and energy input. Integration of real-time monitoring systems ensures consistent product quality. Automation further optimizes throughput and minimizes operational downtime. These technological trends help producers meet stringent regulatory standards and expand capacity sustainably.

Market Challenges Analysis

High Production Costs and Supply Chain Complexity Limit Market Scalability

The wood pellet market faces considerable challenges due to high production costs and complex supply chains. It relies on consistent access to raw materials like sawdust and wood chips, which are subject to regional availability and price volatility. Energy-intensive manufacturing processes and capital investments in specialized equipment further inflate operational costs. Transportation and storage require controlled environments to maintain pellet quality, increasing logistical expenses. These factors reduce the market’s price competitiveness against traditional fuels. Companies must optimize efficiency to sustain profitability without compromising product integrity.

Regulatory Uncertainty and Environmental Concerns Impact Long-Term Viability

Evolving regulatory landscapes and environmental concerns present barriers to the long-term growth of the wood pellet market. It operates under scrutiny due to debates around deforestation, land use, and carbon accounting practices linked to biomass. Policy shifts in key regions, especially in the EU and North America, can disrupt demand forecasts and investment planning. Certification requirements and compliance with sustainability standards demand continuous monitoring and documentation. Public pressure for cleaner, verifiable renewable sources may divert focus toward solar, wind, or hydrogen energy. These uncertainties challenge stakeholder confidence and complicate strategic decision-making.

Market Opportunities

Rising Global Demand for Renewable Heating Fuels Creates Growth Potential

The wood pellet market benefits from increasing demand for low-carbon heating alternatives across residential, commercial, and industrial sectors. Countries in Europe and Asia are investing in biomass heating systems to reduce dependency on fossil fuels. It supports policy-driven energy transitions by offering a scalable, renewable solution for heating applications. Growing adoption of pellet stoves and boilers in colder regions expands consumer-level consumption. Government incentives and carbon reduction targets continue to drive procurement of wood-based energy products. The market finds significant opportunities in countries prioritizing energy security and emission control.

Industrial Co-Firing and Emerging Power Generation Markets Drive Expansion

Power utilities are integrating wood pellets into their fuel mix through co-firing with coal, creating new industrial-scale opportunities for the wood pellet market. It enables plants to lower emissions without full infrastructure replacement, aligning with regulatory targets. Markets in Japan and South Korea are expanding imports to meet biomass power generation goals. This demand creates long-term contracts and stable revenue streams for producers. Technological improvements in pellet combustion and energy efficiency support wider industrial applications. The market gains further potential in developing regions investing in bioenergy capacity for grid stability and diversification.

Market Segmentation Analysis:

By ApplicationType:

The wood pellet market is segmented into heating, power generation, and combined heat and power (CHP). Heating remains the dominant application, driven by residential and commercial adoption of pellet stoves and boilers in colder climates. It provides an affordable and renewable alternative to fossil fuels for space heating. Power generation is gaining momentum, especially in industrial co-firing operations where wood pellets are used alongside coal. The combined heat and power segment sees steady growth in Europe, where integrated energy systems are promoted under clean energy policies.

- For instance, Drax Power Station in the United Kingdom has converted four of its six units to biomass, using approximately 7.5 million metric tons of wood pellets annually for power generation, and also operates a 129 MW biomass-powered CHP plant that supplies both electricity and steam to nearby industries.

By End-user Type:

The wood pellet market serves residential, commercial, and industrial consumers. Residential end users lead demand in Europe and North America, where wood pellets fuel efficient heating systems. The commercial segment includes institutional buildings and small-scale energy users seeking carbon-neutral solutions. Industrial users, particularly in the utility sector, drive high-volume consumption through co-firing and dedicated biomass power plants. It benefits from long-term procurement contracts and government-backed energy transition goals. The market continues to evolve with rising interest in sustainable energy across all end-user categories.

- For instance, Ørsted’s Avedøre Power Station in Denmark uses approximately 1.2 million metric tons of wood pellets annually in its biomass unit, which supports industrial-scale energy production while meeting the region’s renewable energy goals.

Segments:

Based on Application Type:

- Heating

- Power Generation

- CHP

Based on End-user Type:

- Residential

- Commercial

- Industrial

Based on the Geography:

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa

Regional Analysis

Europe:

Europe holds the leading position in the global wood pellet market, accounting for approximately 42% of the total market share in 2024. The region has established a mature biomass infrastructure supported by strong government policies, carbon emission reduction goals, and renewable energy directives. Countries such as the United Kingdom, Germany, Italy, and Sweden are major consumers of wood pellets for both heating and power generation. The European Union’s Renewable Energy Directive (RED II) plays a critical role in promoting biomass energy. Demand for wood pellets remains high in residential heating and large-scale industrial applications, particularly in district heating and combined heat and power (CHP) plants. It benefits from a stable regulatory framework, subsidies for biomass heating, and consistent public awareness regarding sustainable energy. Manufacturers across Eastern and Central Europe support the supply chain by producing high-quality pellets for both local consumption and export.

North America:

North America represents around 28% of the global wood pellet market share, driven largely by its strong role in production and export. The United States and Canada possess vast forest resources, advanced processing facilities, and efficient transportation networks. The region produces high-grade industrial pellets that meet European sustainability certifications, with exports primarily directed to the UK, the Netherlands, and Belgium. Domestic consumption, although lower than exports, is increasing due to rising demand for residential heating in colder northern states and rural Canada. Policy support at the federal and state levels enhances the appeal of wood pellets as a cleaner alternative to oil and coal. North American manufacturers invest in high-capacity plants and logistics systems, maintaining the region’s competitiveness in international markets.

Asia Pacific:

Asia Pacific captures approximately 18% of the global wood pellet market share and is the fastest-growing regional segment. Japan and South Korea lead demand, primarily using imported pellets for biomass power generation. These countries rely heavily on energy imports and are actively seeking carbon-neutral alternatives to coal. Both have introduced incentive schemes and renewable portfolio standards that support pellet usage in utilities. Domestic pellet production remains limited, pushing dependence on suppliers from North America and Southeast Asia. China also shows potential growth due to rural heating needs and efforts to reduce coal reliance. The region is expected to increase its market share over the next decade as more countries adopt biomass energy solutions to meet their climate goals.

Latin America:

Latin America holds about 7% of the wood pellet market, with Brazil, Chile, and Argentina leading production and consumption. The region benefits from rich forest resources and lower operational costs. Brazil has become a notable exporter, particularly to Europe and Asia. Domestic usage is rising slowly due to limited infrastructure and policy support, but interest is growing in renewable energy and rural electrification. It faces challenges in logistics, certification, and awareness but shows potential for market development through investment and international partnerships. Regional governments are beginning to explore biomass strategies as part of national energy planning.

Middle East & Africa:

The Middle East and Africa collectively account for around 5% of the global wood pellet market. The market remains nascent, with limited production capacity and low consumer awareness. South Africa and Morocco show early signs of adoption, mainly in industrial and institutional heating. Wood pellets are being explored as alternatives for charcoal and coal in rural and off-grid communities. Energy diversification efforts, especially in North Africa, are slowly creating opportunities for biomass integration. The region requires infrastructure, investment, and policy alignment to unlock its full potential in the global wood pellet supply chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Vermont Wood Pellet Co.

- United Company

- Groupe Savoie Inc.

- Wood Pellet Energy (UK) Ltd.

- Pacific BioEnergy

- Lauzon Recycled Wood Energy

- Georgia Biomass, LLC

- Energex

- Pinnacle Renewable Energy Inc.

- The Westervelt Company, Inc.

- Enviva LP

- Premium Pellet Ltd.

- Drax Group Plc

- C.S. (Lacroix) Lumber Inc.

- SINGPELLET Pte. Ltd.

Competitive Analysis

The wood pellet market is highly competitive, with leading players such as Enviva LP, Drax Group Plc, Pinnacle Renewable Energy Inc., Georgia Biomass, LLC, Pacific BioEnergy, Groupe Savoie Inc., and The Westervelt Company, Inc. driving growth through capacity expansion, strategic partnerships, and global supply chain optimization. Enviva LP leads with its strong export infrastructure and long-term contracts, while Drax Group continues expanding its biomass operations through vertical integration. Pinnacle Renewable Energy leverages its Canadian base to serve global markets, and Georgia Biomass along with Pacific BioEnergy focuses on sustainable scaling. The Westervelt Company and Groupe Savoie emphasize advanced pellet technologies for higher efficiency and lower emissions. These companies compete by innovating in production, aligning with regulatory standards, and securing certified sustainable feedstock. The market environment continues to push players toward regional expansion, supply chain efficiency, and consolidation to maintain a competitive edge in the evolving renewable energy landscape.

Recent Developments

- In April 2025, Drax Group Plc completed its acquisition of Pinnacle Renewable Energy Inc., integrating Pinnacle’s 17 pellet plants across Western Canada and the US South into its network, with a combined capacity of 4.9 million tonnes per year. This reinforced Drax’s position as a global biomass leader.

- In December 2024, Drax and Pathway Energy agreed to a deal for Drax to supply over 1 million tonnes of sustainable biomass pellets annually to Pathway’s proposed sustainable aviation fuel (SAF) facility on the US Gulf Coast.

- In September 2024, Georgia Power received certification for approximately 78MW of biomass resources. This certification is part of their 2025 Integrated Resource Plan and could significantly impact the biomass market in Georgia. The certification was a result of the 2023 Biomass Request for Proposals (RFP).

Market Concentration & Characteristics

The Wood Pellet Market shows moderate to high concentration, with a few key players dominating global production and trade. It features vertically integrated operations, where companies manage sourcing, manufacturing, and distribution under a single structure to ensure quality control and supply chain efficiency. The market favors firms with access to certified sustainable raw materials, large-scale production capabilities, and established export infrastructure. It operates in a cost-sensitive and regulation-driven environment, where fuel quality standards and emissions requirements influence production methods. It benefits from long-term supply contracts, especially in Europe and Asia, where renewable energy targets remain strong. Technological advancement in pellet manufacturing and logistics plays a crucial role in shaping competitive positioning. The Wood Pellet Market continues to display characteristics of consolidation, capital intensity, and compliance-driven innovation, encouraging firms to adopt sustainable practices while maintaining operational scalability.

Report Coverage

The research report offers an in-depth analysis based on Application Type, End-user Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for wood pellets will grow steadily due to rising preference for renewable and low-carbon energy sources.

- Governments across Europe and Asia will continue to promote biomass as part of national energy strategies.

- The market will see increasing investment in pellet production infrastructure and technology.

- Industrial use of wood pellets for power generation will remain a primary driver of consumption.

- Residential heating applications will gain traction in colder regions due to cost-efficiency and cleaner combustion.

- Sustainability certifications and traceability will become essential for global market access.

- North America will expand its role as a leading exporter due to abundant raw material availability.

- Asia-Pacific markets, especially Japan and South Korea, will boost import volumes under long-term contracts.

- Innovation in pellet quality and logistics will help reduce transportation costs and improve fuel efficiency.

- Market players will focus on strategic mergers and acquisitions to strengthen supply chains and expand global reach.