Market Overview

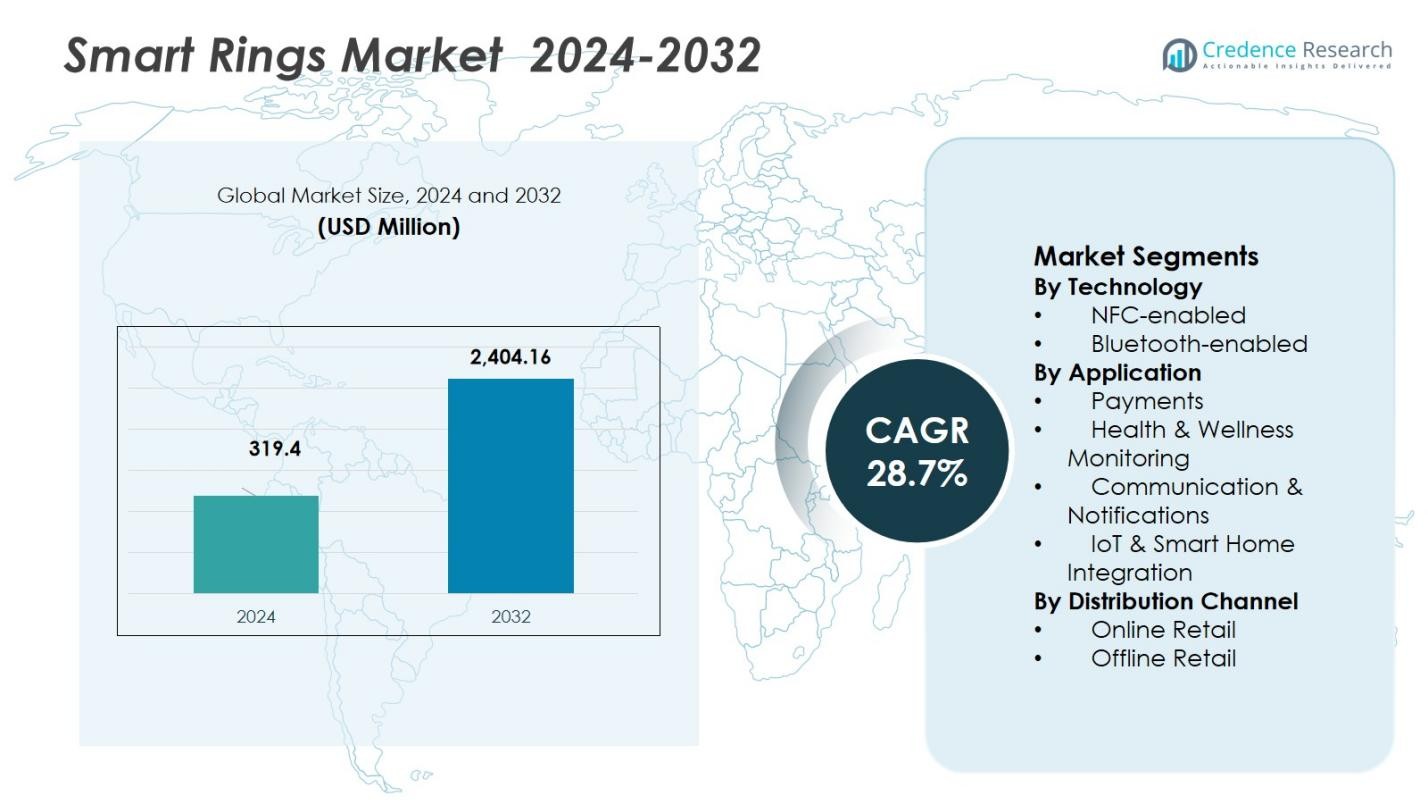

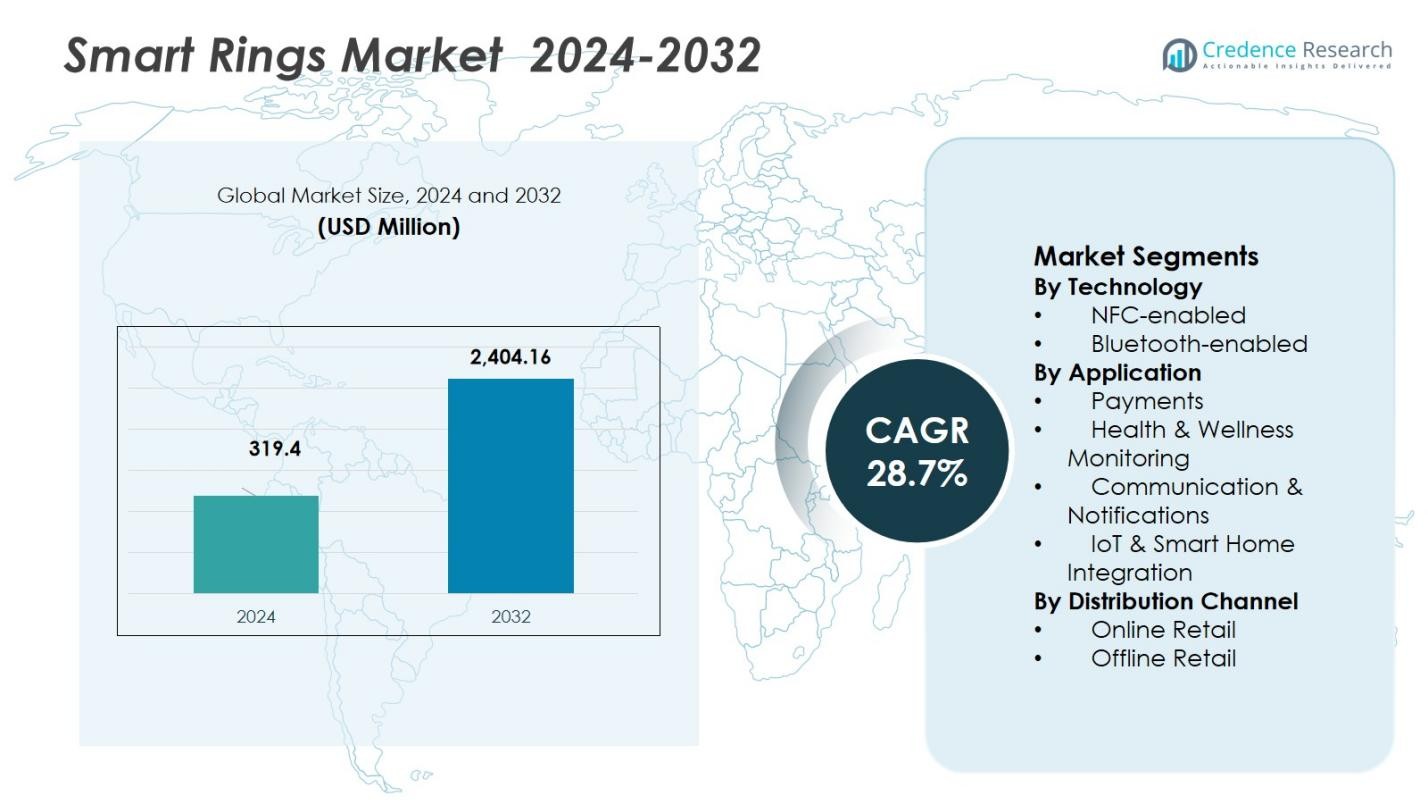

The Smart Rings Market size was valued at USD 319.4 million in 2024 and is anticipated to reach USD 2,404.16 million by 2032, at a CAGR of 28.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Rings Market Size 2024 |

USD 319.4 Million |

| Smart Rings Market, CAGR |

28.7% |

| Smart Rings Market Size 2032 |

USD 2,404.16 Million |

Smart Rings Market exhibits strong presence of leading players such as Oura Health Ltd., Motiv Inc., McLear Ltd., NFC Ring, Ringly Inc., Jakcom Technology Co., Ltd., Kerv Wearables, Tokenize Inc., Prevention Circul+ and Sleepon. These companies drive the market through diverse offerings from advanced health‑tracking rings to NFC‑enabled payment and security devices aiming at different consumer segments and use cases. The market’s leading region is North America, which held a 44.18% share in 2024. High consumer awareness of wearable technology, strong disposable incomes, and robust digital infrastructure in this region continue to support adoption of smart rings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Smart Rings Market size was valued at USD 319.4 million in 2024 and is anticipated to reach USD 2,404.16 million by 2032, growing at a CAGR of 28.7% during the forecast period (2024-2032).

- Rising consumer demand for wearable technology, especially health and fitness monitoring devices, is a major driver for market growth.

- Key trends include the growing integration of smart rings with IoT and smart home devices, offering more functionality such as home automation and secure access control.

- The market faces challenges such as data privacy concerns and battery life limitations, which could hinder growth if not addressed by manufacturers.

- North America leads the market with a 44.18% share in 2024, followed by Europe and Asia Pacific, with Health & Wellness Monitoring being the dominant application, representing 37.2% of the market share in 2024.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Technology:

The Smart Rings market is primarily segmented by technology into NFC-enabled and Bluetooth-enabled rings. Bluetooth-enabled smart rings dominate this segment, holding a substantial market share of 68.5% in 2024. The growth of Bluetooth technology is driven by its widespread adoption in consumer electronics, offering reliable connectivity, low power consumption, and ease of use. Bluetooth-enabled rings are increasingly used for communication, notifications, and health tracking, which has contributed to their strong market position. NFC-enabled rings, though emerging, account for the remaining 31.5% share, primarily driven by secure payment applications.

- For instance, Oura’s third-generation smart ring leverages Bluetooth Low Energy (BLE) for continuous sleep and heart rate monitoring while maintaining a battery life of up to seven days.

By Application:

The Smart Rings market’s applications are divided into Payments, Health & Wellness Monitoring, Communication & Notifications, and IoT & Smart Home Integration. Among these, Health & Wellness Monitoring holds the largest share, representing 37.2% in 2024. The growing consumer focus on personal health and fitness has driven demand for wearable health tech, such as smart rings capable of tracking vital signs and sleep patterns. Payments follow closely, contributing 29.4% to the market, spurred by the increasing adoption of contactless payment solutions. Communication & Notifications, along with IoT & Smart Home Integration, also contribute significantly to the market.

- For instance, Oura Ring Gen 3 monitors heart rate, SpO₂, temperature, and sleep cycles, and has been adopted by organizations like the NBA for player health tracking.

By Distribution Channel:

The Smart Rings market is distributed through Online Retail and Offline Retail channels. Online Retail leads the distribution landscape, capturing 58.7% of the market share in 2024. The ease of access to a wide range of smart rings through e-commerce platforms and growing consumer preference for online shopping fuel this dominance. Offline Retail holds a 41.3% share, benefiting from consumers’ desire to physically examine and test the products before purchase. Both channels are expected to grow steadily, with online sales continuing to outpace offline sales due to the convenience and broader product selection available online.

Key Growth Drivers

Rising Consumer Demand for Wearable Technology

The increasing adoption of wearable technology is a significant growth driver for the Smart Rings market. As consumers seek more discreet and stylish alternatives to traditional wearables like smartwatches, smart rings offer a compact and convenient solution. With advancements in technology, smart rings are becoming capable of tracking fitness, health metrics, and facilitating communication, all while maintaining a sleek design. This growing interest in wearable health and wellness products contributes significantly to the market’s expansion, appealing particularly to tech-savvy and health-conscious consumers.

- For instance, Circular Ring Pro 2, FDA-cleared for atrial fibrillation detection, provides detailed ECG monitoring and AI-powered sleep analysis, with digital sizing ensuring a perfect fit.

Expansion of Contactless Payments

The adoption of contactless payments is a major factor propelling the growth of the Smart Rings market. As consumers and businesses increasingly shift toward cashless transactions, NFC-enabled smart rings are gaining popularity for secure and convenient payments. These rings provide a seamless experience by allowing users to make purchases with just a tap, eliminating the need for physical cards or smartphones. The growing acceptance of digital payments, along with enhanced security features, is expected to drive the demand for smart rings, particularly in retail and financial sectors.

- For instance, India’s 7 Ring is an NFC-enabled smart ring certified by RuPay, offering fast, secure payment by simply placing a closed fist with the ring near a POS terminal, with payment approval in less than 4 seconds.

Technological Advancements in Smart Rings

Technological innovations in smart ring functionality are fueling market growth by enhancing the overall user experience. Advancements in Bluetooth and NFC technologies enable smart rings to offer reliable connectivity, lower power consumption, and greater compatibility with various devices. Additionally, improved sensor capabilities in smart rings allow for better health monitoring, including heart rate tracking, sleep analysis, and even stress management. These innovations make smart rings more attractive to a broader range of consumers, from fitness enthusiasts to tech-savvy individuals seeking cutting-edge wearables.

Key Trends & Opportunities

Integration with IoT and Smart Home Devices

Smart rings are increasingly being integrated into the broader Internet of Things (IoT) ecosystem, creating new opportunities for growth. As smart homes become more prevalent, the ability to control devices like lights, thermostats, and security systems directly from a smart ring presents a significant trend. Consumers are looking for more intuitive and seamless ways to interact with their smart home devices, and smart rings offer a convenient and discreet solution. This integration is likely to expand the functionality of smart rings, making them a key component in the IoT market.

- For instance, McLear a pioneer in NFC smart ring technology, allows users to make contactless payments and control smart home devices with just a tap, expanding smart ring functionality beyond fitness tracking.

Focus on Personalized Health Monitoring

As health-conscious consumers demand more personalized and accurate health tracking, smart rings present a significant opportunity. The growing trend of health and wellness wearables is fueling demand for rings that can monitor a wide range of metrics, including sleep patterns, stress levels, and even blood oxygen saturation. Smart rings equipped with advanced sensors are becoming increasingly capable of offering real-time health insights, which can be personalized to meet individual needs. This trend aligns with the growing interest in preventive healthcare and fitness, creating opportunities for brands to develop tailored solutions.

- For instance, Samsung’s Galaxy Ring launched in 2024 integrates AI-powered features to monitor sleep patterns, heart rate, and fitness activities, all within a sleek titanium frame offering up to seven days of battery life.

Key Challenges

Privacy and Data Security Concerns

One of the major challenges facing the Smart Rings market is the growing concern around privacy and data security. As smart rings collect sensitive data, such as health metrics and payment information, there is an increased risk of cyberattacks and unauthorized access to personal data. Consumers are becoming more cautious about sharing their private information with wearable devices, and manufacturers must prioritize robust encryption and data protection measures to ensure user trust. Addressing these concerns is essential to the market’s continued growth, particularly as the integration of smart rings with other IoT devices increases.

Battery Life Limitations

Despite significant advancements in smart ring technology, battery life remains a challenge. The compact size of smart rings restricts the capacity for large batteries, limiting how long the device can function on a single charge. As consumers increasingly demand more powerful and feature-rich devices, manufacturers are struggling to balance performance with battery longevity. Improving the battery life of smart rings without compromising size, functionality, and comfort will be critical for their continued success in the market. This challenge requires ongoing innovation in power-efficient technologies and energy management solutions.

Regional Analysis

North America

North America commands a strong position in the smart rings market, holding a 37.69% share in 2024. This dominance stems from a tech-savvy population, high disposable income, and mature adoption of wearable devices. Consumers in the region increasingly embrace smart rings for health monitoring, contactless payments, and daily convenience. Robust infrastructure supporting IoT ecosystems and the presence of leading smart-ring manufacturers further reinforce North America’s leading role in the market.

Asia Pacific

Asia Pacific leads as the largest regional market with a 27.03% share in 2024. Rapid urbanization, rising disposable incomes, and growing smartphone penetration in countries such as China and India drive the uptake of smart rings. Increasing awareness about health and wellness, combined with a large youthful population open to wearable technology, fuels demand. Government initiatives promoting digitalization and improving connectivity also support regional growth, contributing to the overall market share.

Europe

Europe exhibits a significant presence in the smart rings market, with a 22.5% market share in 2024. The region benefits from tech-aware consumers and rising interest in health tracking and contactless payment solutions. Regulatory support for data privacy and consumer protection, along with robust retail and e-commerce frameworks, further encourage adoption. Continued investment in wearable-friendly ecosystems sustains Europe’s market relevance, positioning it as a strong contender in the global market.

Latin America

Latin America represents a growing, albeit smaller, share of the global smart rings market, holding 7.1% of the market in 2024. Market growth in this region is driven by increasing smartphone penetration, rising consumer awareness of wearable health and payment convenience, and gradual improvements in digital infrastructure. As contactless payments gain traction and affordability improves, smart rings gradually gain acceptance among tech-savvy and urban consumers, further expanding the regional market share.

Middle East & Africa

The Middle East & Africa region captures a modest but rising portion of global smart rings demand, holding a 5.7% share in 2024. Growing adoption of contactless payments, urbanization, and increasing interest in health and wellness wearables underpin growth. Expansion of e-commerce platforms and improving internet connectivity also support market penetration. As disposable income rises among certain urban segments, smart rings emerge as attractive lifestyle and utility devices, contributing to the region’s increasing market share.

Market Segmentations:

By Technology

- NFC-enabled

- Bluetooth-enabled

By Application

- Payments

- Health & Wellness Monitoring

- Communication & Notifications

- IoT & Smart Home Integration

By Distribution Channel

- Online Retail

- Offline Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Smart Rings Market centers on key players Oura Health Ltd., Motiv Inc., McLear Ltd. and NFC Ring. These firms lead the market by offering differentiated products that focus variously on health‑tracking, contactless payments, and seamless connectivity. Oura Health maintains leadership through its advanced health‑monitoring smart rings, widely recognized for sleep, heart rate, and physiological tracking. McLear Ltd. and NFC Ring dominate the payment and security segment, leveraging NFC technology for contactless payments and smart‑device access. Motiv Inc. contributes by targeting users who prefer minimalist design with core fitness‑tracking features. Together, their strong product portfolios and brand equity shape market expectations and push innovation. Other firms compete by addressing niche applications such as specialized security, IoT integration, or cost‑effective alternatives but the dominance of these leading players defines competitive dynamics.

Key Player Analysis

- Motiv Inc.

- NFC Ring

- Sleepon

- Jakcom Technology Co., Ltd.

- McLear Ltd.

- Tokenize Inc.

- Ringly Inc.

- Prevention Circul+

- Oura Health Ltd.

- Kerv Wearables

Recent Developments

- In November 2025, Oura launched a new premium version of its smart ring the Oura Ring 4 Ceramic and introduced a USB‑C charging case able to recharge the ring up to five times, enhancing user convenience and product appeal.

- In July 2024, Samsung unveiled the Samsung Galaxy Ring, its first smart ring with biometric health‑monitoring features, marking a major entry of a leading smartphone OEM into the smart‑ring category.

- In May 2025, Oura rolled out an algorithm update for the Oura Ring that improves step‑count accuracy and refines activity and calorie‑burn metrics via machine learning improving reliability of fitness tracking.

- In October 2025, Reebok released its first smart ring at USD 249, offering heart‑rate, blood oxygen, sleep and stress tracking marking its debut in wearable wellness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The smart rings market is poised to benefit from ongoing miniaturization of sensors and electronics, enabling ever‑smaller, more comfortable devices that can deliver accurate health, activity, and biometric tracking without compromising aesthetics.

- Rising integration with broader IoT and smart‑home ecosystems will allow smart rings to act as universal controllers for home automation, access control, and secure authentication expanding their utility beyond health tracking and payments.

- Increasing consumer emphasis on preventive health and wellness will drive rising demand for smart rings that offer continuous monitoring of vitals, sleep, stress, and recovery especially among fitness‑conscious and health‑aware populations.

- Smart rings will increasingly become preferred wearables for consumers seeking discretion and minimalism offering similar or complementary functionality to smartwatches but with more subtle design and 24/7 wear comfort.

- As contactless payment infrastructure and digital wallet adoption expand globally, NFC‑enabled smart rings will gain traction as convenient, secure alternatives to cards and smartphones for transactions and identity verification.

- Market expansion into emerging economies and high‑growth regions such as Asia‑Pacific and parts of Middle East & Africa will broaden the user base, driven by increasing smartphone penetration and rising disposable incomes.

- Manufacturers will increasingly adopt subscription‑based services and added‑value health analytics (e.g. sleep optimization, stress management, recovery recommendations) to drive recurring revenue and deepen user engagement.

- Design diversification including different materials (metal, ceramic, etc.), styles (fashion‑forward, unisex, gender‑specific) and functionalities will help smart rings appeal to broader demographics, from fashion‑oriented users to health‑conscious professionals.

- Advances in sensor and battery technologies including lower‑power processing, efficient charging, and possibly passive or hybrid power solutions will address existing pain points like battery life and device durability, boosting adoption.

- Competition and innovation from technology incumbents and new entrants will accelerate feature development, push down prices, and enhance global availability making smart rings more accessible to mainstream consumers.

Market Segmentation Analysis:

Market Segmentation Analysis: