| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ASIC Verification Market Size 2024 |

USD 4,174.44 million |

| ASIC Verification Market, CAGR |

8.40% |

| ASIC Verification Market Size 2032 |

USD 8,329.77 million |

Market Overview:

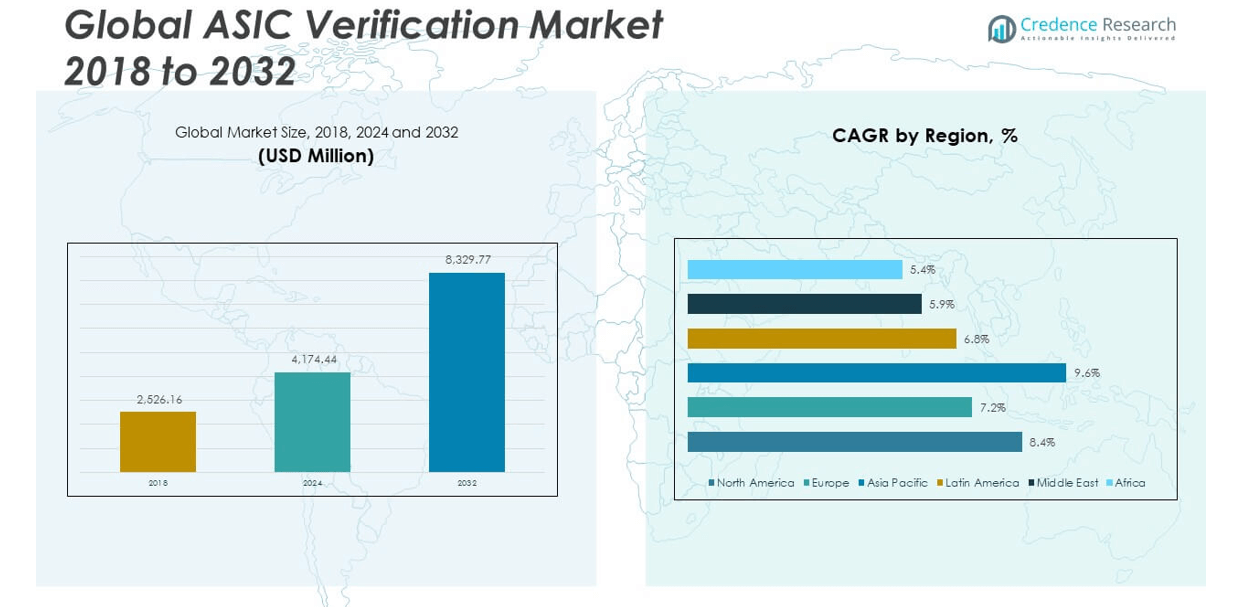

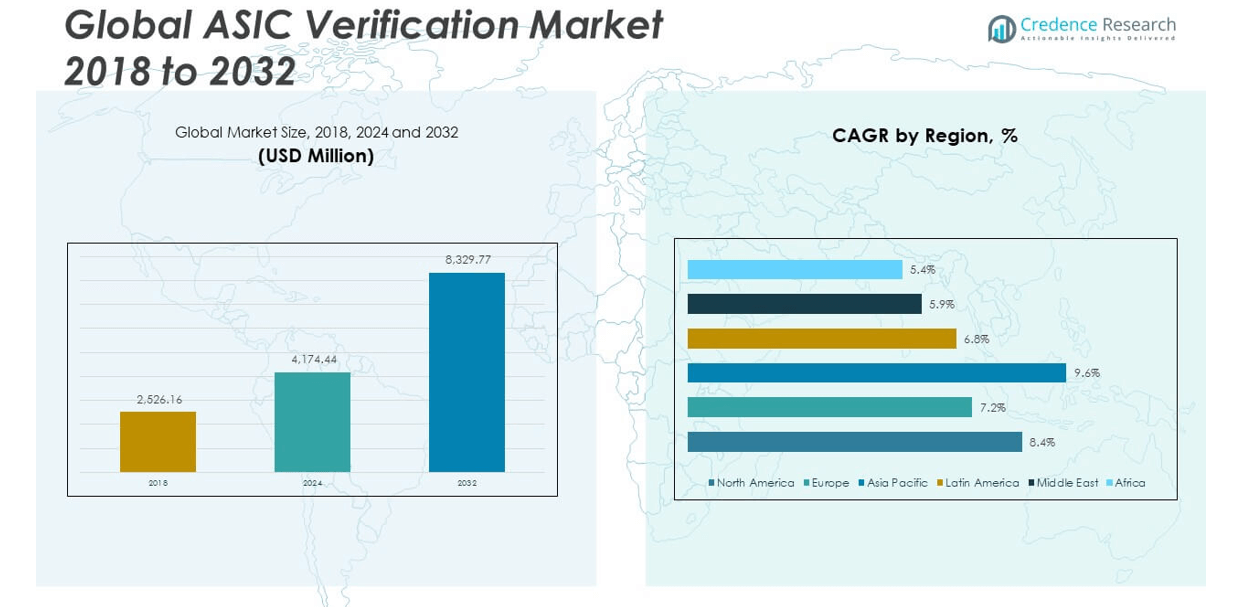

The Global ASIC Verification Market size was valued at USD 2,526.16 million in 2018 to USD 4,174.44 million in 2024 and is anticipated to reach USD 8,329.77 million by 2032, at a CAGR of 8.40% during the forecast period.

The key drivers fueling the growth of the global ASIC Verification Market include escalating design complexity, the growing need for faster product deployment, and the increasing demand for safety, performance, and reliability in semiconductor devices. As ASICs are being used in safety-critical applications such as autonomous vehicles, aerospace, industrial automation, and high-performance computing, rigorous verification becomes indispensable. Time-to-market pressure compels semiconductor companies to adopt advanced simulation, emulation, and formal verification techniques to ensure first-pass success. Additionally, the widespread adoption of AI and machine learning in the verification workflow enables faster and more intelligent detection of design flaws, reducing development cycles and cost. Rising demand for design reuse and IP integration further necessitates comprehensive verification at the system level, especially when multiple IP blocks from various vendors are incorporated into a single chip.

Regionally, Asia-Pacific holds the largest share of the ASIC Verification Market, supported by a strong electronics manufacturing ecosystem in countries such as China, Taiwan, South Korea, Japan, and India. The region’s dominance is fueled by high-volume ASIC production for consumer electronics, networking, and automotive applications, along with increasing government investments in semiconductor self-sufficiency. North America follows closely, driven by the presence of major semiconductor design companies and EDA tool providers in the United States. The U.S. market emphasizes innovation, with a focus on AI-powered verification tools and custom ASIC development for data centers, defense, and autonomous systems. Europe also plays a significant role, particularly in automotive and industrial sectors, where functional safety and regulatory compliance are key priorities. Countries like Germany and France are investing in advanced verification methodologies to meet strict quality standards such as ISO 26262. Although smaller in size, regions such as the Middle East & Africa and Latin America are experiencing gradual adoption of ASIC verification solutions, supported by growing digital infrastructure and increased participation in global semiconductor supply chains.

Market Insights:

- The Global ASIC Verification Market was valued at USD 4,174.44 million in 2024 and is expected to reach USD 8,329.77 million by 2032, growing at a CAGR of 8.40%.

- Rising ASIC design complexity driven by AI, 5G, and edge computing is increasing demand for advanced verification solutions.

- Time-to-market pressure is accelerating the adoption of automation tools like emulation, formal methods, and pre-verified IPs.

- Safety-critical sectors such as automotive, aerospace, and industrial automation require robust verification to meet strict standards like ISO 26262.

- Integration of AI and machine learning in verification workflows is enhancing efficiency, reducing manual intervention, and improving bug detection.

- High verification costs, resource requirements, and evolving design protocols present challenges, especially for smaller firms.

- Asia-Pacific leads the market with strong ASIC production, followed by North America and Europe, while Latin America, the Middle East, and Africa show gradual adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Design Complexity in ASIC Architectures Increases Verification Demand

The rapid evolution of ASIC designs, driven by AI, 5G, and edge computing applications, has led to a dramatic rise in architectural complexity. Modern ASICs now feature billions of transistors and numerous integrated IP blocks, which require extensive validation before tape-out. Verification workflows must adapt to account for heterogeneous computing, hardware-software integration, and high-speed interfaces. This growing intricacy places greater pressure on verification teams to implement advanced simulation, emulation, and formal methods. The Global ASIC Verification Market is experiencing strong demand due to this increased design sophistication. It plays a crucial role in identifying logic flaws, performance bottlenecks, and interoperability issues before manufacturing begins.

Time-to-Market Pressures Accelerate Automation in Verification Processes

Competitive pressures in the semiconductor industry push companies to reduce product development cycles while maintaining quality and performance. Verification often consumes over 60% of ASIC development time, making it a critical area for optimization. Companies are investing in automation to shorten verification timelines and eliminate manual debugging steps. Functional verification platforms that include pre-verified IPs and automated testbenches allow teams to accelerate coverage and achieve faster sign-off. The market is expanding as firms prioritize scalable solutions that support rapid validation across multiple design iterations. It supports design teams aiming to bring products to market ahead of competitors without compromising reliability.

- For example, Arm’s Verification Lab states that their shift to automated, coverage-driven verification frameworks reduced manual test writing by 65% and enabled sign-off for complex Cortex series CPU cores within 12 weeks—compared with a previous average of 20 weeks.

Focus on Reliability, Security, and Functional Safety in Critical Applications

ASICs deployed in automotive, aerospace, and industrial applications must meet rigorous standards for reliability and functional safety. Verification tools are essential for compliance with safety norms such as ISO 26262 and DO-254, especially in mission-critical environments. Hardware security also influences verification priorities, with engineers verifying encryption modules, secure boot mechanisms, and side-channel resistance. The need to detect edge-case errors and system-level failures early in the lifecycle fuels demand for comprehensive verification frameworks. The Global ASIC Verification Market responds to this requirement by offering fault injection, formal proofs, and safety test automation. It ensures validated ASICs meet performance thresholds under all operating conditions.

- For instance, Infineon’s AURIX TC4x microcontroller product line is engineered specifically for automotive safety and security. The AURIX TC4x was developed according to ISO 26262:2018 standards and achieves certification up to Automotive Safety Integrity Level D (ASIL-D), the highest risk classification for road vehicles.

AI and Machine Learning Integration Enhances Verification Efficiency

The integration of AI and machine learning technologies into EDA tools enhances the predictive capability of verification platforms. These technologies help prioritize test cases, detect patterns in bugs, and optimize regression cycles. ML-driven analysis identifies design hotspots and shortens the path to coverage closure by learning from historical verification data. Verification-as-a-service providers also leverage AI to reduce manual intervention and improve tool efficiency. The market benefits from this transformation by reducing verification time and increasing the scalability of solutions for large SoCs. It enables engineers to focus on high-value tasks while automating repetitive validation activities.

Market Trends:

Shift Toward Cloud-Based Verification Platforms Across Semiconductor Workflows

The semiconductor industry is increasingly adopting cloud-based verification solutions to address growing compute demands and design complexity. Cloud-native platforms provide elastic scalability, enabling simulation and emulation tasks to run in parallel and reduce verification bottlenecks. These platforms also improve collaboration among geographically distributed teams by offering centralized access to design data and verification environments. Many EDA vendors now offer verification-as-a-service models that align with shifting enterprise preferences for OpEx over CapEx. The Global ASIC Verification Market is witnessing significant traction for cloud deployments, especially among fabless startups and mid-sized design houses. It supports flexible deployment without requiring heavy upfront investment in hardware infrastructure.

Growing Adoption of System-Level Verification for SoC Integration Challenges

With the rise of complex SoC designs, system-level verification has become an essential focus for development teams. Integrating multiple IP blocks from different vendors increases the risk of compatibility issues and unexpected behavior at the system level. Verification now extends beyond block-level simulation to full-system validation, including firmware and real-world application testing. Tools capable of modeling entire chip architectures and validating them under functional workloads are gaining popularity. The market reflects this trend by offering high-level abstraction tools that support software-driven verification and scenario-based validation. It enables engineers to simulate how the final product will behave across various usage environments.

- For example, Mentor Graphics(now Siemens EDA) demonstrated the technical leap with its Veloce Strato emulation platform, modeling 15+ billion gate SoCs at real-world application speeds enabling early firmware validation and reducing system-level bugs.

Expansion of Verification IP (VIP) Libraries for Protocol Compliance

Design teams increasingly rely on pre-built verification IP (VIP) to accelerate the testing of standard protocols such as PCIe, USB, DDR, and Ethernet. These VIPs help ensure compliance with protocol specifications and reduce the burden of building testbenches from scratch. The growing diversity of protocol interfaces in ASICs drives demand for an expansive range of reusable and customizable VIP offerings. EDA vendors continue to expand their VIP portfolios to support emerging standards in automotive, 5G, and data center applications. The Global ASIC Verification Market benefits from this trend, providing developers with access to validated VIPs that simplify coverage goals. It promotes consistency in verification quality and shortens time to closure.

- For instance, Cadence’s VIP catalog now covers 130+ standard protocols (e.g., PCIe 6.0, 112G Ethernet, LPDDR5X), with automated compliance tests.

Rise in Interest for Digital Twin Models in Pre-Silicon Validation

Digital twin methodologies are emerging as an innovative trend to enable real-time analysis and validation of ASIC behavior prior to fabrication. These models replicate the functional attributes of physical chips, allowing design teams to run simulations that mimic real-world deployment scenarios. Digital twins help verify dynamic power management, thermal behavior, and performance under load before manufacturing begins. This approach reduces risk, improves design confidence, and supports faster iteration cycles for complex ASICs. The market is gradually embracing digital twins as a complement to traditional verification flows. It provides a virtual environment to detect flaws that may otherwise surface post-silicon.

Market Challenges Analysis:

High Cost and Resource Intensiveness of Comprehensive Verification Workflows

Advanced ASIC verification demands significant investment in both capital and engineering resources. The cost of deploying full-scale simulation, emulation, and formal verification environments often strains budgets, particularly for startups and small-to-mid-size semiconductor firms. The need for highly skilled verification engineers adds to operational costs, making it difficult for companies to scale without substantial funding. Maintaining in-house verification infrastructure and tools also presents ongoing expenses in terms of licenses, hardware upgrades, and training. The Global ASIC Verification Market faces these challenges as companies seek to balance verification rigor with project timelines and cost-efficiency. It must deliver scalable and cost-effective solutions without compromising on accuracy or coverage.

Evolving Standards and Design Paradigms Complicate Verification Scope

The fast-changing landscape of semiconductor technologies introduces ongoing challenges in aligning verification methods with evolving design architectures. New application domains such as AI, quantum computing, and automotive autonomy demand specialized verification approaches tailored to unique performance and safety criteria. Verification teams must constantly update their methodologies to account for new protocols, power states, and functional requirements. This dynamic environment increases the complexity of ensuring coverage completeness and verification closure across diverse product lines. The market must respond to these shifts by enabling flexible, forward-compatible solutions. It requires constant innovation to keep pace with emerging technologies while maintaining confidence in pre-silicon validation.

Market Opportunities:

Increased Outsourcing of Verification Services Among Fabless Semiconductor Companies

Fabless semiconductor companies are increasingly outsourcing verification tasks to specialized service providers to reduce internal workload and accelerate product development. This shift creates a strong opportunity for third-party vendors offering verification-as-a-service models tailored to fast-moving design teams. Outsourcing helps firms access expert talent, advanced tools, and scalable infrastructure without building capabilities in-house. The Global ASIC Verification Market can capitalize on this trend by offering customizable, IP-compliant, and secure service packages. It supports design validation across diverse applications, from consumer electronics to high-performance computing. The demand for faster turnaround and reduced verification cycles will continue to drive growth in outsourced services.

Emergence of Verification Tools for Heterogeneous and AI-Driven Chip Designs

New ASIC architectures that combine CPUs, GPUs, FPGAs, and custom accelerators require advanced verification tools capable of handling heterogeneous integration. The rising demand for AI accelerators in edge devices and data centers opens new revenue channels for vendors providing AI-aware verification frameworks. These tools must validate machine learning models embedded in hardware, ensuring deterministic behavior and safety. The market has an opportunity to lead in this space by developing solutions that address the unique needs of dataflow-driven and parallel compute designs. It can expand its reach by aligning with trends in AI, neuromorphic computing, and next-generation SoCs. Innovation in this area will strengthen the market’s long-term value proposition.

Market Segmentation Analysis:

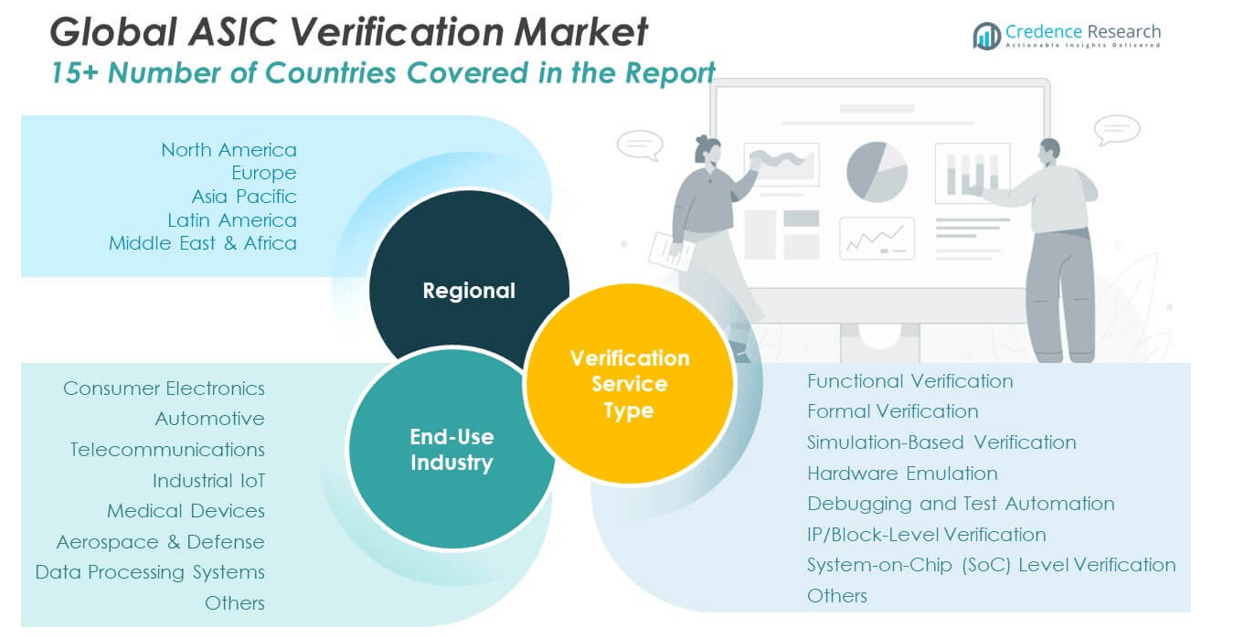

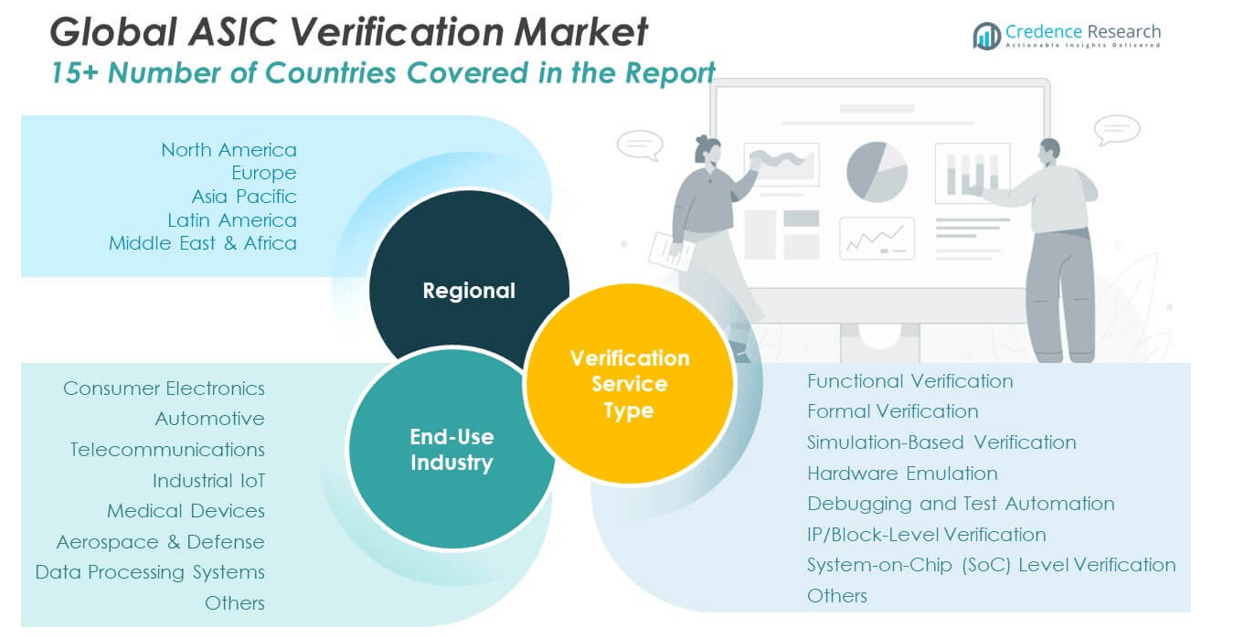

The Global ASIC Verification Market is segmented by verification service type and end-use industry, each reflecting the growing need for precision and reliability in chip development.

By verification service type, functional verification dominates the market, driven by its critical role in ensuring design intent and logic correctness. Formal verification is gaining traction due to its ability to mathematically prove design properties, especially in safety-critical applications. Simulation-based verification remains a widely adopted method for its flexibility and scalability in diverse design environments. Hardware emulation is expanding with the rise of large-scale SoCs, enabling faster pre-silicon validation. Debugging and test automation streamline error detection and accelerate development cycles. IP/block-level and SoC-level verification segments address rising complexity from design reuse and integration, with SoC-level validation becoming essential in modern chip architectures.

- For example, Cadence offers the Jasper FSV (Functional Safety Verification) App, which integrates with ISO 26262 flows, adding formal fault-propagation analysis to improve safety verification and reduce fault simulation time.

By end-use industry, consumer electronics leads demand, followed by the automotive sector where functional safety and ISO 26262 compliance are vital. Telecommunications and industrial IoT segments require high-performance ASICs with robust validation to support connectivity and automation. Medical devices and aerospace & defense demand high-reliability verification workflows. The market also sees steady growth from data processing systems requiring accelerated and power-efficient ASICs. It continues to evolve to meet these industry-specific performance and compliance needs.

- For instance, Philips collaborates with Ansys on digital twin applications in healthcare, such as physiological modeling and imaging device simulation. Ansys promotes digital twin platforms in industries like energy and manufacturing, but does not specifically mention 7nm ASIC thermal verification.

Segmentation:

By Verification Service Type:

- Functional Verification

- Formal Verification

- Simulation-Based Verification

- Hardware Emulation

- Debugging and Test Automation

- IP/Block-Level Verification

- System-on-Chip (SoC) Level Verification

- Others

By End-Use Industry:

- Consumer Electronics

- Automotive

- Telecommunications

- Industrial IoT

- Medical Devices

- Aerospace & Defense

- Data Processing Systems

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America ASIC Verification Market size was valued at USD 1,056.53 million in 2018 to USD 1,726.96 million in 2024 and is anticipated to reach USD 3,456.02 million by 2032, at a CAGR of 8.4% during the forecast period. North America holds the largest market share of the Global ASIC Verification Market, accounting for 31.3% in 2024. It benefits from the strong presence of leading semiconductor companies, EDA tool providers, and a robust R&D ecosystem in the United States. Demand for advanced verification solutions is driven by high-performance computing, autonomous vehicles, aerospace, and defense sectors. Companies in the region are early adopters of AI-driven verification tools and cloud-based simulation environments. Government initiatives focused on strengthening domestic semiconductor capabilities further accelerate market development. It continues to lead in innovation, tool maturity, and verification standards adoption.

Europe

The Europe ASIC Verification Market size was valued at USD 495.72 million in 2018 to USD 776.47 million in 2024 and is anticipated to reach USD 1,416.12 million by 2032, at a CAGR of 7.2% during the forecast period. Europe commands 14.1% of the Global ASIC Verification Market share in 2024, supported by strong demand from the automotive and industrial automation sectors. Germany, France, and the UK are key contributors, driven by compliance with safety standards such as ISO 26262 and IEC 61508. European verification teams focus on functional safety, fault tolerance, and low-power designs across embedded applications. The growing integration of ASICs in electric vehicles and smart factories fuels the need for rigorous verification frameworks. It benefits from academic-industry collaborations and the region’s emphasis on regulatory compliance. Strategic investments in R&D continue to strengthen Europe’s verification capabilities.

Asia Pacific

The Asia Pacific ASIC Verification Market size was valued at USD 746.09 million in 2018 to USD 1,300.25 million in 2024 and is anticipated to reach USD 2,824.79 million by 2032, at a CAGR of 9.6% during the forecast period. Asia Pacific holds a 23.6% share of the Global ASIC Verification Market in 2024, with significant contributions from China, Taiwan, South Korea, Japan, and India. It supports a vast electronics manufacturing base, making it a central hub for ASIC design and production. Companies in the region increasingly adopt third-party verification services to meet aggressive tape-out schedules. Government-backed semiconductor initiatives further stimulate demand for verification technologies. Regional players are expanding capabilities in simulation, IP validation, and system-level testing. It remains a critical engine for global ASIC production and pre-silicon validation growth.

Latin America

The Latin America ASIC Verification Market size was valued at USD 121.57 million in 2018 to USD 198.44 million in 2024 and is anticipated to reach USD 351.31 million by 2032, at a CAGR of 6.8% during the forecast period. Latin America accounts for 3.6% of the Global ASIC Verification Market in 2024. Brazil and Mexico lead regional activity, supported by growth in consumer electronics and industrial electronics sectors. Demand for verification solutions is emerging, as local companies aim to modernize their IC development pipelines. Academic partnerships and regional research centers contribute to growing interest in ASIC verification practices. Market penetration remains moderate due to limited infrastructure and technical expertise. It shows steady progress, with potential for growth through international collaborations and digital infrastructure investments.

Middle East

The Middle East ASIC Verification Market size was valued at USD 65.99 million in 2018 to USD 99.00 million in 2024 and is anticipated to reach USD 164.23 million by 2032, at a CAGR of 5.9% during the forecast period. The Middle East contributes 1.8% to the Global ASIC Verification Market in 2024. The region sees growing demand for verification in sectors such as defense, telecom, and industrial automation. Countries like the UAE and Saudi Arabia are investing in digital transformation and semiconductor design education. Regional design centers are slowly adopting formal verification methods and IP validation workflows. Limited local EDA tool providers and talent shortages remain challenges. It has potential to expand through public-private initiatives and increased access to global verification ecosystems.

Africa

The Africa ASIC Verification Market size was valued at USD 40.27 million in 2018 to USD 73.31 million in 2024 and is anticipated to reach USD 117.30 million by 2032, at a CAGR of 5.4% during the forecast period. Africa represents just 1.3% of the Global ASIC Verification Market share in 2024. The region is still in the early stages of ASIC design and verification adoption, with minimal commercial activity in semiconductor development. South Africa leads regional efforts with limited university-led research and pilot programs. Lack of infrastructure, verification expertise, and funding limit rapid expansion. The growing focus on digital skills and education in engineering presents future opportunities. It holds long-term potential, contingent on capacity building and international support for semiconductor innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cadence Design Systems

- Synopsys Inc.

- Mentor Graphics (Siemens EDA)

- Ansys

- Aldec

- OneSpin Solutions

- Imperas Software

- Verilab

- Xilinx (AMD)

- Microsemi (Microchip Technology)

Competitive Analysis:

The Global ASIC Verification Market features a competitive landscape dominated by established EDA vendors and specialized verification service providers. Key players such as Synopsys, Cadence Design Systems, Siemens EDA, and Mentor Graphics lead the market with comprehensive tool suites covering simulation, emulation, formal verification, and VIP. These companies continuously enhance their platforms by integrating AI and cloud capabilities to address increasing design complexity. Emerging players focus on niche areas such as system-level verification, low-power validation, and verification-as-a-service. The market also includes strategic partnerships between fabless semiconductor firms and verification service vendors to accelerate time-to-market. It relies heavily on innovation, IP ecosystem integration, and customer support to retain competitive advantage. As the demand for complex ASICs grows, competition intensifies around tool performance, scalability, and flexibility. Global players invest in R&D and training to expand their service offerings and address evolving verification requirements across diverse end-use industries.

Recent Developments:

- In May 2025, Cadence Design Systems unveiled its Millennium M2000 Supercomputer, which is powered by NVIDIA Blackwell chips. The system significantly accelerates AI-driven simulation workloads, providing up to 80 times higher performance and 20 times lower power consumption compared to CPU-based setups.

- In May 13, 2025, Siemens EDA launched Questa One, a smart verification suite powered by AI. It integrates functional, fault, and formal verification engines and leverages predictive analytics, delivering up to 50× coverage acceleration, 48× faster fault simulation, and stimulus‑free checking. Questa One targets complex 3D‑ICs, chiplets, and software-defined architectures, enabling seamless IP‑to‑SoC workflows.

- In February 2025, Synopsys expanded its hardware-assisted verification portfolio with the launch of the next-generation HAPS-200 prototyping and ZeBu-200 emulation systems, aimed at accelerating semiconductor and design innovation.

Market Concentration & Characteristics:

The Global ASIC Verification Market is moderately concentrated, with a few dominant players controlling a significant share of the overall revenue. It is characterized by high entry barriers due to the complexity of tool development, long sales cycles, and the need for strong domain expertise. Leading companies maintain competitive positions through integrated toolchains, proprietary verification IPs, and strong client relationships. The market demands constant innovation, driven by rapidly evolving ASIC architectures and the need for efficient, scalable verification solutions. It favors vendors that offer end-to-end support across simulation, formal, and emulation environments. Customization, speed, and accuracy remain core competitive attributes, especially for applications in AI, automotive, and high-performance computing. Emerging vendors focus on specialized offerings, but often face challenges in scaling due to resource intensity and ecosystem integration requirements.

Report Coverage:

The research report offers an in-depth analysis based on Verification Service Type and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for ASIC verification will grow steadily due to increasing complexity in chip design across AI, 5G, and autonomous systems.

- Adoption of AI-driven verification tools will improve speed, accuracy, and test coverage in large SoC environments.

- Cloud-based verification platforms will gain traction, offering scalability and cost efficiency to fabless and mid-sized firms.

- Verification-as-a-service models will expand as companies outsource critical functions to reduce time-to-market.

- Growth in IP-based design will drive the need for robust VIP libraries and protocol compliance validation.

- System-level verification will become standard practice to address integration risks in heterogeneous chip architectures.

- Functional safety and security requirements will push adoption of formal verification in automotive and aerospace sectors.

- Regional investments in semiconductor infrastructure will increase demand for local verification talent and services.

- Emerging markets in Latin America and Africa will see gradual uptake driven by academic and industrial collaboration.

- Continuous innovation in digital twin models and low-power verification tools will shape future workflows.